Bitcoin Halving 2025: Exact Date Of Bitcoin Halving 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is anticipated in 2025. This event, programmed into Bitcoin’s code, reduces the rate at which new Bitcoins are created, impacting its supply and potentially its price. Understanding the precise date and its historical context is crucial for navigating the cryptocurrency market.

Bitcoin Halving Mechanism and Supply Impact

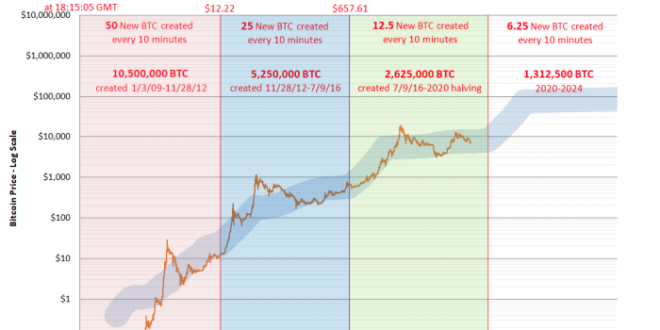

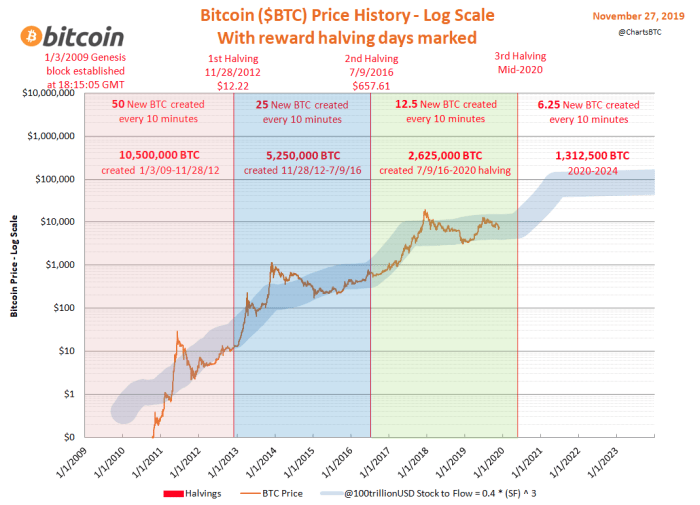

The Bitcoin halving mechanism is a core component of Bitcoin’s deflationary monetary policy. Approximately every four years, the reward given to Bitcoin miners for successfully adding a block to the blockchain is cut in half. This halving directly impacts the rate of new Bitcoin entering circulation. Initially, miners received 50 BTC per block. After the first halving, this dropped to 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled reduction in supply is designed to mimic the scarcity of precious metals like gold. The predictable nature of this halving contributes to Bitcoin’s perceived value proposition as a store of value.

Pinpointing the Exact Date of the 2025 Halving

Determining the precise date requires considering the average block generation time, which is approximately 10 minutes. However, this time isn’t perfectly consistent; it can fluctuate due to network congestion or miner activity. While a precise date cannot be given with absolute certainty until the block is mined, estimations place the 2025 halving around April or May. The exact date will depend on the actual time it takes to mine the specific block triggering the halving. Previous halvings have shown minor variations from predicted dates due to this inherent variability in block times.

Comparison with Previous Halvings and Their Market Impact

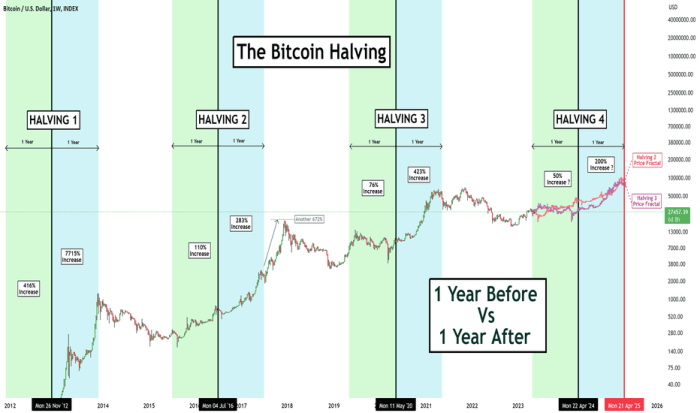

The first Bitcoin halving occurred in November 2012, the second in July 2016, and the third in May 2020. While predicting the precise market impact of a halving is impossible, historical data reveals some trends. The price of Bitcoin often experiences periods of increased volatility both before and after a halving event. Following the 2012 halving, Bitcoin’s price experienced a significant surge, though various other market factors likely contributed. Similarly, the 2016 halving was followed by a substantial price increase, and the 2020 halving, while initially showing a more muted response, ultimately led to significant price appreciation over the following year. However, it’s crucial to remember that correlation doesn’t equal causation, and numerous other economic and technological factors influence Bitcoin’s price.

Timeline of Key Events Surrounding the 2025 Halving

The following table provides a projected timeline of key events. Note that the precise dates are estimates and subject to change based on actual block generation times and market conditions.

| Date | Event | Significance | Market Impact (Projected) |

|---|---|---|---|

| Late 2024 – Early 2025 | Increased Anticipation | Speculative trading increases as the halving approaches. | Increased price volatility, potential price increase |

| April/May 2025 (Estimated) | Bitcoin Halving | Reward for miners halved to 6.25 BTC per block. | Potential short-term price correction followed by long-term price appreciation (historically observed) |

| Post-Halving (2025-2026) | Supply Reduction Impact | Reduced supply of new Bitcoins entering circulation. | Potential increase in Bitcoin’s scarcity value, potentially leading to price appreciation. |

| 2026 Onwards | Long-Term Effects | The full impact of the reduced supply unfolds. | Continued price volatility influenced by various factors, including macroeconomic conditions, regulatory changes, and technological advancements. |

Anticipating Market Reactions to the 2025 Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically precedes periods of significant price volatility. Predicting the exact market response to the 2025 halving remains challenging, but analyzing past trends and considering current market conditions allows for a reasoned assessment of potential bullish and bearish scenarios.

Historical Price Movements Around Halving Events

Examining Bitcoin’s price behavior around the previous halvings reveals some consistent patterns, although the magnitude of the response varies. The 2012 halving saw a gradual price increase in the following months, while the 2016 halving led to a more pronounced surge. The 2020 halving, occurring amidst a broader cryptocurrency market boom, resulted in a substantial price increase, albeit followed by a period of consolidation and subsequent correction. These historical data points highlight the potential for both significant price appreciation and subsequent periods of price adjustment following a halving. The timing and extent of these price movements are not uniform and are influenced by numerous external factors. For example, the 2020 halving occurred during a period of growing institutional interest in Bitcoin, which likely amplified the positive price impact.

Investor Sentiment and Speculation

Investor sentiment plays a crucial role in shaping market reactions to the halving. Anticipation of the event often leads to increased buying pressure in the months preceding the halving, driving up the price. This is fueled by speculation that the reduced supply will create scarcity and drive demand. Conversely, if the broader macroeconomic climate is negative or if there are significant regulatory developments impacting cryptocurrencies, the anticipated bullish effect of the halving might be dampened or even reversed. The level of market confidence, reflected in trading volumes and overall investor enthusiasm, will significantly determine the market’s reaction. A high degree of positive sentiment can amplify the bullish effect, whereas negativity can negate it.

Economic Factors Influencing Bitcoin’s Price, Exact Date Of Bitcoin Halving 2025

Several macroeconomic factors could significantly influence Bitcoin’s price leading up to and following the 2025 halving. Global inflation rates, interest rate adjustments by central banks, geopolitical instability, and overall economic growth prospects all play a part. For instance, high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. Conversely, rising interest rates could divert investment away from riskier assets like Bitcoin, leading to price declines. Furthermore, regulatory clarity or uncertainty within various jurisdictions can dramatically impact investor confidence and thus Bitcoin’s price. The overall health of the global economy will be a significant factor. A robust global economy might see less capital flowing into Bitcoin as investors pursue traditional investments, whereas a recessionary environment could drive investors to safer haven assets like Bitcoin.

Comparison with Previous Halving Events

While past halvings provide valuable insights, directly comparing them to the 2025 event is inherently limited. The cryptocurrency market is constantly evolving, with increased institutional participation, greater regulatory scrutiny, and a broader range of competing cryptocurrencies influencing the market dynamics. The 2025 halving is unlikely to produce an identical market response to previous events. However, analyzing the common threads—such as the impact of reduced supply and investor sentiment—offers a framework for understanding the potential range of outcomes. The degree of institutional investment and regulatory landscape in 2025 will be key differentiators compared to previous halvings. The growing sophistication of the market and the increasing influence of macroeconomic factors necessitate a nuanced approach to predicting the market reaction.

Exact Date Of Bitcoin Halving 2025 – Pinpointing the exact date of the Bitcoin halving in 2025 requires careful consideration of block times. To understand the mechanics behind this event, it’s helpful to first grasp the fundamental concept of what a Bitcoin halving actually entails; for a detailed explanation, check out this resource: What Is The Bitcoin Halving 2025. Ultimately, the precise date will depend on the time it takes to mine the blocks leading up to the event.

Pinpointing the exact date of the Bitcoin halving in 2025 requires careful consideration of block times. However, predicting the precise day remains challenging. For a deeper dive into the mechanics and implications of this significant event, consult this comprehensive resource on Halving 2025 Bitcoin. Understanding this resource will help refine your understanding of the Exact Date Of Bitcoin Halving 2025, although some degree of uncertainty always remains.

Pinpointing the exact date of the 2025 Bitcoin halving requires careful consideration of block times. However, predicting the precise day remains challenging, leading many to explore resources offering insights into potential scenarios. For a comprehensive overview of various predictions, check out this helpful resource on Bitcoin Halving Prediction 2025. Ultimately, the exact date of the 2025 halving will depend on the consistent generation of blocks on the Bitcoin network.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of block times. For a comprehensive overview of the event and its implications, you might find the resource Halving De Bitcoin 2025 helpful. This information will assist you in better understanding the factors that influence the precise timing of the 2025 Bitcoin Halving, ultimately helping to predict the exact date.

Pinpointing the exact date of the Bitcoin halving in 2025 requires careful consideration of block times. To stay updated on the projected timeframe, refer to this resource for comprehensive information on the Halving Bitcoin Date 2025 , which will help you understand the expected date. Ultimately, the precise date of the 2025 Bitcoin halving will depend on the actual block generation time leading up to the event.

Pinpointing the exact date of the Bitcoin halving in 2025 requires careful consideration of block times. However, understanding the broader context of the event is crucial. For a comprehensive overview of the implications, refer to this insightful article on Bitcoin Halving In 2025. Returning to the exact date, further analysis of the blockchain is needed for precise prediction, as the timing hinges on the consistent generation of blocks.