Illustrative Data Representation (Table)

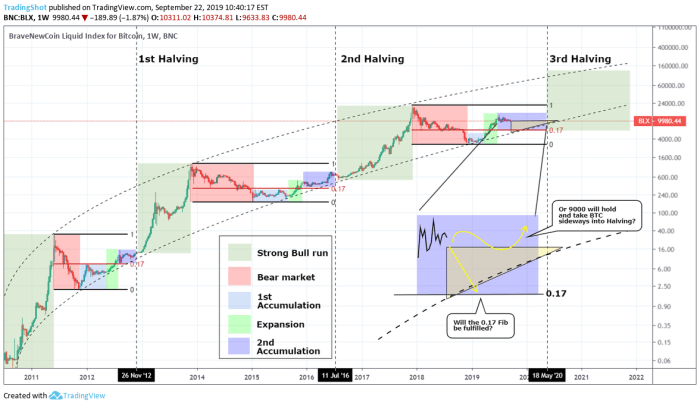

Analyzing historical Bitcoin halving events provides valuable insights into potential future price movements and network activity. While past performance is not indicative of future results, examining trends across previous halvings can inform expectations and risk assessments. The following table presents key metrics from past halvings. Note that precise figures can vary slightly depending on the source and the chosen methodology for price averaging.

Bitcoin Halving Metrics Comparison, Halving Bitcoin 2025 Binance

The table below compares key metrics across previous Bitcoin halvings. Data is approximate and sourced from reputable cryptocurrency data providers, but may vary slightly depending on the specific data source and methodology used. The percentage change in price is calculated as the difference between the post-halving price and the pre-halving price, divided by the pre-halving price.

| Date | Block Reward (BTC) | Price Before Halving (USD) | Price After Halving (USD) | Percentage Price Change (%) | Hash Rate Before Halving (EH/s) | Hash Rate After Halving (EH/s) | Difficulty Before Halving | Difficulty After Halving |

|---|---|---|---|---|---|---|---|---|

| November 2012 | 50 | 13.45 | 11.87 | -11.7% | 0.002 | 0.005 | 13665 | 20521 |

| July 2016 | 25 | 650 | 778 | 19.7% | 1.4 | 2.5 | 134874 | 236801 |

| May 2020 | 12.5 | 8750 | 11700 | 33.7% | 90 | 150 | 1706314 | 2572386 |

Visual Representation of Price Predictions: Halving Bitcoin 2025 Binance

Predicting Bitcoin’s price is inherently speculative, yet visualizing potential scenarios through hypothetical charts can offer valuable insights into market sentiment and potential outcomes around the 2025 halving. This section describes a hypothetical chart illustrating various price prediction scenarios, focusing on key price ranges, support, and resistance levels. The methodology used is based on a combination of technical analysis and fundamental factors.

Hypothetical Chart Description and Methodology

Price Prediction Scenarios

The hypothetical chart would depict three distinct scenarios: a bullish scenario, a neutral scenario, and a bearish scenario. Each scenario would be represented by a separate line on the chart, plotted against time (in months leading up to and following the 2025 halving). The X-axis represents time, and the Y-axis represents the Bitcoin price in USD.

The bullish scenario would show a steady increase in Bitcoin’s price, possibly exceeding $100,000 by the end of 2025. This scenario assumes a high level of institutional adoption, continued technological advancements, and positive macroeconomic conditions. Resistance levels would be depicted as horizontal lines at key psychological price points ($50,000, $75,000, and $100,000), representing areas where selling pressure might increase. Support levels would be illustrated by upward-sloping trendlines connecting previous lows.

The neutral scenario would show a more moderate price increase, potentially reaching $50,000-$75,000 by the end of 2025. This scenario assumes a more balanced market, with some periods of growth offset by periods of consolidation or minor corrections. Resistance and support levels would be less pronounced than in the bullish scenario, reflecting the greater price volatility. Support levels could be shown as horizontal lines representing previous price lows.

The bearish scenario would depict a slower price increase, or even a period of decline, possibly remaining below $50,000 throughout 2025. This scenario assumes negative macroeconomic conditions, increased regulatory scrutiny, or a lack of widespread institutional adoption. Resistance levels would be less significant, while support levels would be crucial areas to watch for potential price reversals. The chart might illustrate these support levels with horizontal lines, potentially incorporating moving averages as dynamic support.

Methodology Employed

The hypothetical chart’s creation would involve several steps. First, historical Bitcoin price data would be analyzed to identify past trends and patterns. This analysis would involve studying past halving cycles and their impact on price. Second, macroeconomic factors, such as inflation rates and interest rate changes, would be considered, along with regulatory developments impacting the cryptocurrency market. Third, technical indicators, such as moving averages and relative strength index (RSI), would be used to identify potential support and resistance levels. Finally, a combination of these factors would be used to project potential price movements under different scenarios. The resulting chart would not be a precise prediction but rather a visual representation of potential outcomes based on the interplay of these factors. It is important to note that this methodology, while informed, relies on estimations and interpretation and is not a guaranteed prediction of future price movements. Past performance is not indicative of future results.

Halving Bitcoin 2025 Binance – Binance, a major player in the crypto market, will undoubtedly be closely watching the Bitcoin halving in 2025. This event, significantly impacting Bitcoin’s inflation rate, is a key factor for price predictions. For a detailed analysis of the event itself, check out this insightful resource on the Bitcoin April 2025 Halving. Understanding this halving is crucial for anticipating Binance’s strategies and the broader market response to the reduced Bitcoin supply in the coming years.

Binance, a major player in the crypto market, will undoubtedly see significant activity surrounding the Bitcoin halving in 2025. Understanding the precise timing is crucial for investors, and you can find that information by checking the projected date on this helpful resource: Next Bitcoin Halving Date 2025. Knowing the exact date will allow traders on Binance to better anticipate market fluctuations related to the Bitcoin halving in 2025.

Binance, a major player in the crypto market, will undoubtedly see significant activity surrounding the Bitcoin halving in 2025. Understanding the precise timing is crucial for strategic planning; to clarify this, you might find the answer to the question “When Was Bitcoin Halving 2025” helpful by checking this resource: When Was Bitcoin Halving 2025. This knowledge is key for predicting market trends and how Binance, and other exchanges, will navigate the reduced Bitcoin supply post-halving.

Binance, a major cryptocurrency exchange, will undoubtedly play a significant role in the upcoming Bitcoin halving in 2025. Understanding the precise timing is crucial for market participants, and you can find out more by checking this resource on When Is The Next Bitcoin Halving 2025. Knowing the date will allow Binance and its users to better prepare for the potential market volatility associated with the Halving Bitcoin 2025 event.

Binance, a major cryptocurrency exchange, will undoubtedly play a significant role in the upcoming Bitcoin halving in 2025. Understanding the implications of this event is crucial for all investors, and a comprehensive overview can be found by exploring this insightful resource on the 2025 Halving Bitcoin. The anticipated impact on Bitcoin’s price and trading volume on platforms like Binance makes this a key event to watch closely.

Binance, a major player in the crypto market, will undoubtedly be closely watching the Bitcoin halving in 2025. Understanding the precise timing of this event is crucial for market analysis and strategic planning; for a detailed breakdown, check out this resource on When Bitcoin Halving 2025. The impact of the halving on Binance’s trading volumes and overall platform activity will be significant, shaping its strategies for the coming years.