Illustrative Data Visualization: Halving Bitcoin 2025 Date

Understanding the impact of Bitcoin halvings requires visualizing historical price movements and projected supply. Analyzing these visualizations helps to identify potential trends and inform future expectations, although it’s crucial to remember that past performance is not indicative of future results. The inherent volatility of Bitcoin makes precise predictions challenging.

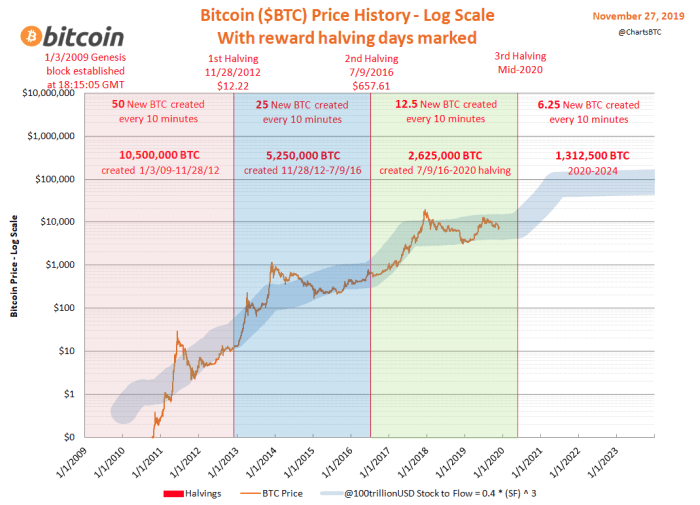

Bitcoin Price Movements Around Previous Halvings

This visualization would depict a line graph showing Bitcoin’s price over time, highlighting the periods surrounding the previous three halving events (2012, 2016, and 2020). The x-axis would represent time, and the y-axis would represent the Bitcoin price in USD. Data points would include the daily closing price of Bitcoin obtained from reputable cryptocurrency exchanges. The graph would clearly mark the dates of each halving event with vertical lines. Observed trends might include a period of price consolidation leading up to the halving, followed by a significant price increase in the months and years after. However, the magnitude and duration of these price increases have varied across halving events, indicating the complexity of influencing factors beyond the halving itself. For instance, macroeconomic conditions, regulatory changes, and overall market sentiment all play a significant role.

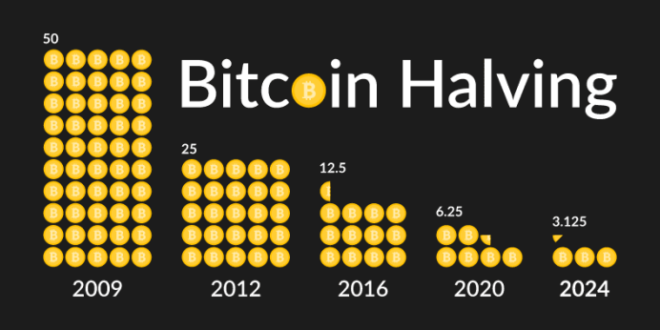

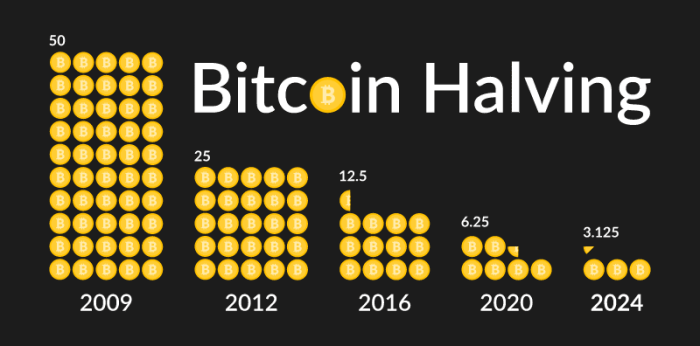

Projected Bitcoin Supply

This chart would be a bar graph illustrating the projected supply of Bitcoin over the next few years. The x-axis would represent the year, and the y-axis would represent the total supply of Bitcoin (in millions). The bars would visually demonstrate the gradual increase in supply, with a noticeable slowdown after each halving event.

The calculations would be based on the known Bitcoin issuance schedule: approximately 6.25 BTC are mined per block after the 2024 halving, and this amount is halved every four years. The assumptions include a consistent block time of approximately 10 minutes and the ongoing operation of the Bitcoin network. The projection would show a gradual increase in supply, with the rate of increase slowing down significantly after each halving. For example, if we assume a constant block time and the halving schedule, we can project the supply for 2025, 2026, and beyond. This projection, however, does not account for potential changes in mining difficulty or unforeseen network disruptions. Real-world examples of supply limitations in other markets, such as precious metals, could be used for comparison, though direct comparison is limited due to the unique nature of Bitcoin. The chart would highlight the asymptotic nature of Bitcoin’s maximum supply of 21 million coins, demonstrating that the rate of new Bitcoin entering circulation will continue to decrease over time.

Bitcoin Halving and its Long-Term Implications

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, has significant implications for the cryptocurrency’s long-term trajectory. Understanding these effects is crucial for anyone interested in Bitcoin’s future as a store of value, medium of exchange, and potential role within the global financial system. The halving’s impact is multifaceted, affecting not only Bitcoin’s price but also its adoption and the sustainability of its underlying infrastructure.

Bitcoin Halving’s Impact on its Role as a Store of Value

Historically, Bitcoin halvings have been followed by periods of price appreciation. This is primarily attributed to the decreased supply of newly minted Bitcoin, potentially increasing scarcity and driving demand. However, this is not a guaranteed outcome. Other market factors, such as regulatory changes, technological advancements, and overall economic conditions, play a significant role. For example, the 2012 and 2016 halvings were followed by substantial price increases, but external factors also contributed to these trends. The 2020 halving saw a less dramatic, yet still notable, price surge, illustrating the complex interplay of factors influencing Bitcoin’s price. The long-term effect on Bitcoin’s store-of-value proposition hinges on maintaining its scarcity and continued adoption as a safe haven asset during times of economic uncertainty.

Bitcoin Halving’s Impact on its Adoption as a Medium of Exchange

While Bitcoin’s price volatility has historically hindered its widespread adoption as a medium of exchange, the halving could indirectly contribute to increased usage. A potential increase in Bitcoin’s value might encourage merchants to accept it as payment, particularly in jurisdictions with unstable fiat currencies. However, transaction fees and processing times remain significant obstacles. The development and adoption of second-layer scaling solutions, such as the Lightning Network, are crucial for addressing these limitations and facilitating broader adoption. The success of Bitcoin as a medium of exchange will depend on its ability to offer a practical and efficient payment system, competing with existing established payment rails.

Bitcoin’s Potential Integration into the Global Financial System, Halving Bitcoin 2025 Date

The halving’s effect on Bitcoin’s integration into the global financial system is indirect but potentially significant. Increased price stability (although not guaranteed) and broader adoption could attract institutional investors and financial institutions, leading to greater legitimacy and integration. However, regulatory uncertainty and concerns about its decentralized nature remain significant hurdles. The evolution of regulatory frameworks and the development of robust compliance solutions will be critical for Bitcoin’s wider acceptance within the traditional financial landscape. Examples of institutional investment in Bitcoin, even before the halving events, already demonstrate a growing interest in its potential as an asset class.

Comparison of Bitcoin’s Long-Term Prospects with Other Cryptocurrencies

Bitcoin’s first-mover advantage, established brand recognition, and established network effect provide a significant competitive edge compared to other cryptocurrencies. However, newer cryptocurrencies often offer improved technology, faster transaction speeds, and lower fees. The long-term dominance of Bitcoin will depend on its ability to adapt and innovate, competing with the features and functionalities offered by other cryptocurrencies. The competition will likely focus on scalability, efficiency, and the development of innovative applications built on top of each blockchain.

Long-Term Sustainability of Bitcoin’s Mining Network

The halving reduces the reward miners receive for validating transactions, potentially impacting the sustainability of the mining network. The long-term viability depends on several factors, including the price of Bitcoin, the efficiency of mining hardware, and the overall energy consumption of the network. A significant decline in Bitcoin’s price could make mining unprofitable, potentially leading to a reduction in the network’s security. However, technological advancements in mining hardware and the emergence of more sustainable energy sources could mitigate this risk. The continued development of more energy-efficient mining operations will be critical for the long-term sustainability of Bitcoin’s mining network.