Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s a crucial element of Bitcoin’s design, intended to control inflation and maintain scarcity. Understanding the halving mechanism and its historical impact is key to comprehending its potential influence on the cryptocurrency’s future price and adoption.

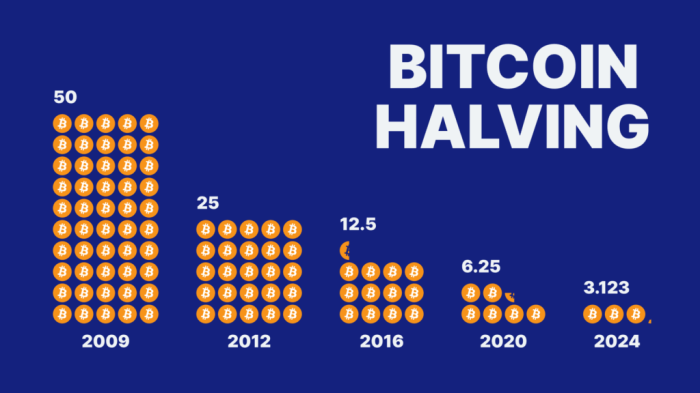

Bitcoin Halving Mechanics: The halving event cuts the block reward in half, the reward miners receive for successfully adding a block of transactions to the blockchain. This reward, initially set at 50 BTC per block, is halved every 210,000 blocks mined. Therefore, the reduction in newly minted Bitcoins directly decreases the rate of Bitcoin inflation. This controlled deflationary mechanism is a core feature distinguishing Bitcoin from traditional fiat currencies.

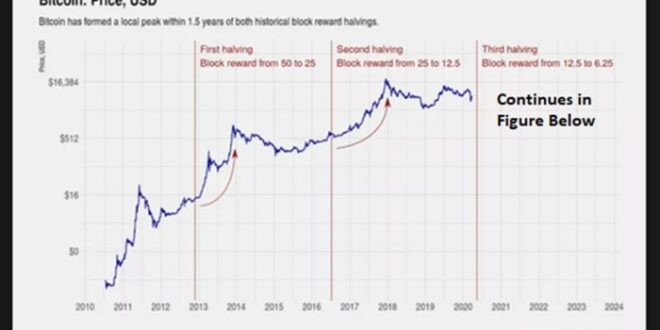

Bitcoin Halving Timeline and Price Effects

The halving events have a documented history, providing data points for analysis. Each halving has been followed by periods of significant price volatility, although the exact impact varies. It’s crucial to remember that while correlations exist, attributing price movements solely to the halving is an oversimplification. Other factors, including market sentiment, regulatory changes, and technological advancements, play substantial roles.

| Halving Date | Block Reward Before | Block Reward After | Subsequent Price Movement (General Trend) |

|---|---|---|---|

| November 2012 | 50 BTC | 25 BTC | Significant price increase over the following year. |

| July 2016 | 25 BTC | 12.5 BTC | Followed by a period of price consolidation, then a significant bull run. |

| May 2020 | 12.5 BTC | 6.25 BTC | A period of price consolidation, followed by a significant bull run that peaked in late 2021. |

Expected Supply Reduction in 2025

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a further decrease in the rate of new Bitcoin entering circulation. The total supply of Bitcoin is capped at 21 million coins. While the halving doesn’t directly impact the total supply, it significantly slows the rate at which this maximum supply is approached. This controlled scarcity is a fundamental aspect of Bitcoin’s value proposition. The reduced inflation rate is expected to contribute to the long-term scarcity of Bitcoin, potentially influencing its price. Predicting the exact price impact is impossible, however, as market forces are complex and multifaceted. The historical data suggests potential for increased price volatility, potentially leading to a significant price appreciation over time, similar to previous cycles. However, this is not guaranteed, and other market factors will undoubtedly play a role.

Market Impact of the 2025 Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically shown a significant correlation with subsequent price increases. Understanding the market impact of the 2025 halving requires examining past trends, current market conditions, and potential influencing factors. This analysis will explore the historical price reactions, compare the pre-2025 market with previous halving periods, and consider factors that may affect the price reaction in 2025.

The impact of previous halvings on Bitcoin’s price has been notable, though not always immediate or uniform. The 2012 halving saw a gradual price increase over the following year, while the 2016 halving was followed by a more dramatic price surge that peaked in late 2017. The 2020 halving also led to a substantial price increase, though the timing and magnitude differed from previous cycles. It’s crucial to note that while a correlation exists, it’s not a guaranteed causal relationship; other market forces significantly influence Bitcoin’s price.

Comparison of Market Conditions Leading to Previous Halvings and 2025

The market conditions leading up to the 2025 halving differ considerably from previous events. The 2012 halving occurred during Bitcoin’s early stages, with limited adoption and regulatory scrutiny. The 2016 halving saw increasing institutional interest and broader market awareness. The 2020 halving took place amid a global pandemic and increasing macroeconomic uncertainty, alongside growing institutional adoption. In contrast, the 2025 halving will occur in a market characterized by greater regulatory scrutiny, increased institutional investment, and significant macroeconomic headwinds, potentially including high inflation and interest rate fluctuations. This more mature and complex market landscape suggests a less predictable price reaction than seen in previous cycles.

Potential Influencing Factors on the 2025 Price Reaction

Several factors beyond the halving itself could significantly impact Bitcoin’s price in 2025. Regulatory developments, particularly in major economies, could dramatically influence investor sentiment and market liquidity. Stringent regulations might suppress price growth, while supportive policies could boost it. Macroeconomic conditions, such as inflation rates, interest rates, and global economic growth, will also play a crucial role. A period of global economic stability might favor Bitcoin as a hedge against inflation, potentially driving up prices. Conversely, a recessionary environment could lead to investors liquidating their holdings, putting downward pressure on prices. Furthermore, the overall sentiment within the cryptocurrency market and the adoption rate of Bitcoin by institutional and retail investors will influence the price response. A surge in institutional adoption could drive significant price increases, while a decrease in investor confidence could lead to a price decline.

Potential for Increased Price Volatility, Halving Bitcoin 2025 Meaning

The period surrounding the 2025 halving is likely to see increased price volatility. The anticipation of the event itself often creates a speculative market, with prices fluctuating wildly based on investor expectations and sentiment. This volatility is exacerbated by the complex interplay of the halving’s impact and the other factors discussed above. Similar to previous halvings, we can expect a period of heightened uncertainty and potential for sharp price swings both before and after the event. For example, the lead-up to the 2020 halving witnessed considerable price fluctuations, reflecting the market’s anticipation and uncertainty regarding the event’s outcome. The actual price reaction post-halving may deviate significantly from predictions due to unforeseen market events or changes in investor sentiment.

Miner’s Perspective on the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward by half, presents a significant challenge to Bitcoin miners. Their profitability hinges directly on the reward received for successfully adding blocks to the blockchain, and this reduction necessitates adaptation and strategic adjustments to remain viable. The impact will be felt across the entire mining landscape, potentially leading to significant changes in the industry’s structure and the network’s security.

The reduced block reward will directly impact miners’ profitability. Currently, miners’ revenue comes from two primary sources: block rewards and transaction fees. With the halving, the block reward component will be cut in half, immediately squeezing profit margins. This pressure will be most keenly felt by miners operating with less efficient hardware or higher electricity costs. For example, a miner previously earning a profit of $100 per day from block rewards alone might see that reduced to $50 after the halving, potentially pushing them into unprofitability.

Impact on Miner Profitability

Miners will experience a decrease in revenue directly proportional to the halving. Those operating at the margin will likely face the most significant challenges, potentially leading to a restructuring of the mining industry. The profitability of mining will become increasingly dependent on factors like energy costs, hardware efficiency, and the price of Bitcoin. For example, a miner with high energy costs might become unprofitable even if the Bitcoin price remains stable or increases slightly.

Adaptation Strategies Employed by Miners

To offset the reduced block rewards, miners will likely employ several strategies. Increased efficiency is paramount; this involves upgrading to newer, more energy-efficient mining hardware, optimizing their operations, and potentially relocating to regions with lower electricity costs. Diversification is another key strategy; some miners might explore additional revenue streams, such as offering hosting services or participating in other cryptocurrency mining activities. Some might also choose to focus on larger mining pools to leverage economies of scale and reduce operational costs. For example, a miner might invest in a more efficient ASIC miner to maintain profitability, or they might explore opportunities in mining other cryptocurrencies alongside Bitcoin.

Miner Exodus and Consolidation

The halving could trigger a miner exodus, with less efficient or less profitable operations shutting down. This could lead to consolidation within the mining industry, with larger, more established players acquiring smaller operations or absorbing their hash rate. This consolidation could potentially centralize mining power, although the decentralized nature of Bitcoin’s network tends to mitigate this risk to some extent. The history of previous halvings provides some evidence for this, with periods of consolidation following each halving event.

Impact on Hash Rate and Network Security

The halving’s impact on the hash rate – the computational power securing the Bitcoin network – is complex. While a miner exodus could initially decrease the hash rate, the resulting increase in Bitcoin’s price (a historically observed effect) might incentivize new miners to enter the market or existing miners to increase their capacity. This could lead to a relatively quick recovery of the hash rate, although the overall impact will depend on several interacting factors including the price of Bitcoin, the cost of energy, and the availability of new mining hardware. A decline in hash rate, even temporarily, would reduce the network’s security, making it potentially more vulnerable to attacks. However, a price increase following the halving often compensates for this, maintaining or even increasing the overall security.

Investor Sentiment and the 2025 Halving: Halving Bitcoin 2025 Meaning

Investor sentiment surrounding the 2025 Bitcoin halving is a complex interplay of historical precedent, current market conditions, and evolving narratives within the cryptocurrency community. While past halvings have generally been followed by periods of price appreciation, the extent and timing of any such increase remain highly debated and uncertain. Several factors contribute to the diverse range of expectations.

The prevailing narratives among investors are largely shaped by the historical performance of Bitcoin following previous halvings. Many believe the reduced supply of newly mined Bitcoin will inevitably drive up demand and, consequently, price. This belief is reinforced by the “scarcity narrative,” which emphasizes Bitcoin’s fixed supply of 21 million coins as a key driver of its long-term value proposition. Conversely, a more cautious segment of investors points to macroeconomic factors, regulatory uncertainty, and the cyclical nature of cryptocurrency markets as potential countervailing forces that could dampen the price impact of the halving.

Prevalent Investor Narratives and Expectations

The dominant narrative focuses on the historical correlation between Bitcoin halvings and subsequent price increases. This is supported by the observation that previous halvings were followed by significant bull runs, albeit with varying timeframes and intensity. However, it’s crucial to acknowledge that correlation does not equal causation. Other factors, such as broader market trends, technological advancements, and regulatory developments, have also significantly influenced Bitcoin’s price. A contrasting narrative emphasizes the potential for a muted response to the 2025 halving, citing the increased institutional adoption of Bitcoin as a potential factor that might reduce the impact of supply shocks on price volatility. The argument here is that large institutional holders are less likely to be driven by short-term supply fluctuations.

Influence of Media Coverage and Social Sentiment

Media coverage plays a significant role in shaping investor sentiment. Positive news coverage, highlighting the potential benefits of Bitcoin and the upcoming halving, can generate excitement and attract new investors, potentially pushing prices higher. Conversely, negative news, such as regulatory crackdowns or security breaches, can trigger sell-offs and negatively impact price. Social media sentiment, amplified through platforms like Twitter and Reddit, also exerts considerable influence. The prevalence of bullish or bearish sentiment on these platforms can significantly impact investor confidence and trading decisions. For instance, a surge in positive social media activity might lead to a buying frenzy, while widespread negativity could trigger a market downturn. The overall tone and narrative within these online communities are often powerful indicators of near-term price movements.

Comparison of Investor Sentiment with Past Halvings

Comparing investor sentiment around the 2025 halving to previous events reveals both similarities and differences. The core expectation of a price increase remains consistent across all halvings. However, the degree of optimism and the perceived certainty of a price surge vary. In the lead-up to the 2012 and 2016 halvings, investor sentiment was arguably more naive and less sophisticated compared to the current environment. The cryptocurrency market was significantly smaller and less regulated, resulting in more pronounced price volatility driven by speculative trading. Today, a greater awareness of macroeconomic factors and regulatory risks tempers expectations, leading to a more nuanced and cautious approach among a segment of investors.

Impact of Investor Behavior on Price Trajectory

Investor behavior is expected to significantly influence Bitcoin’s price trajectory before, during, and after the 2025 halving. In the lead-up to the event, anticipation might drive a gradual price increase as investors accumulate Bitcoin in expectation of future gains. The period immediately surrounding the halving could witness increased volatility as investors react to the actual reduction in block rewards. If the anticipated price surge materializes, a bull market could ensue, characterized by sustained price appreciation. However, if the halving fails to trigger the expected price jump, or if other negative factors intervene, a period of consolidation or even a price decline could follow. The overall trajectory will depend on the interplay of supply and demand, influenced by investor sentiment and broader market conditions. For example, the 2012 halving was followed by a period of relatively slow price growth before a significant bull run began in late 2013. Similarly, the 2016 halving saw a gradual price increase leading up to the bull market of 2017.

Halving Bitcoin 2025 Meaning – Understanding the Bitcoin halving in 2025 means grasping its impact on the cryptocurrency’s inflation rate. This event, where the reward for mining Bitcoin is cut in half, significantly influences its price and scarcity. To know precisely when this pivotal moment will occur, you can consult this helpful resource: When Will Bitcoin Halving Happen In 2025. Ultimately, the 2025 halving’s meaning lies in its potential to reshape the Bitcoin market and its long-term value.

Understanding the Bitcoin halving in 2025 means grasping its impact on the cryptocurrency’s inflation rate. This event, where the reward for Bitcoin miners is cut in half, significantly affects its scarcity and potential price. To know precisely when this pivotal moment occurs, you should check this resource: When Is Bitcoin Halving Date 2025. Ultimately, the 2025 halving’s meaning rests on its influence on Bitcoin’s long-term value and market dynamics.

Understanding the Halving Bitcoin 2025 Meaning requires looking at the reduced reward for miners. This significant event impacts Bitcoin’s inflation rate and overall value. To pinpoint the exact date of this crucial event, you should consult a reliable source such as this page detailing the Bitcoin 2025 Halving Date. Knowing this date allows for better predictions of market behavior surrounding the Halving Bitcoin 2025 Meaning and its potential consequences.

The Bitcoin halving in 2025 signifies a significant reduction in the rate of new Bitcoin creation, impacting the overall supply. Understanding this event is crucial for predicting future price movements, and a key factor to consider is the potential impact on price after the halving. For insightful analysis on this, check out this resource on Bitcoin Price After Halving 2025 to better grasp the implications of the 2025 halving on Bitcoin’s long-term value.

Ultimately, the halving’s meaning hinges on the interplay of supply and demand dynamics in the market.

Understanding the Halving Bitcoin 2025 meaning requires examining the impact on Bitcoin’s supply. This event, where the reward for Bitcoin miners is cut in half, significantly influences the cryptocurrency’s inflation rate. For a detailed analysis of the potential price effects, you should consult resources like this article on Bitcoin Price Halving 2025. Ultimately, understanding the implications of this halving is crucial for predicting future Bitcoin trends and value.

Understanding the Bitcoin Halving 2025 meaning requires knowing the precise timing of the event. To clarify this crucial aspect, you should consult a reliable source detailing exactly when this halving will occur; for instance, check out this resource on When Bitcoin Halving 2025 to get a clear picture. This date is key to forecasting the potential impact of the reduced Bitcoin supply on its price and overall market dynamics.

Therefore, knowing the precise date is vital to understanding the full meaning of the 2025 halving.