Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event occurring approximately every four years, is a significant occurrence in the cryptocurrency’s lifecycle. This event reduces the rate at which new Bitcoins are created, impacting the supply and, historically, influencing its price. The 2025 halving, expected around April, is generating considerable anticipation within the crypto community.

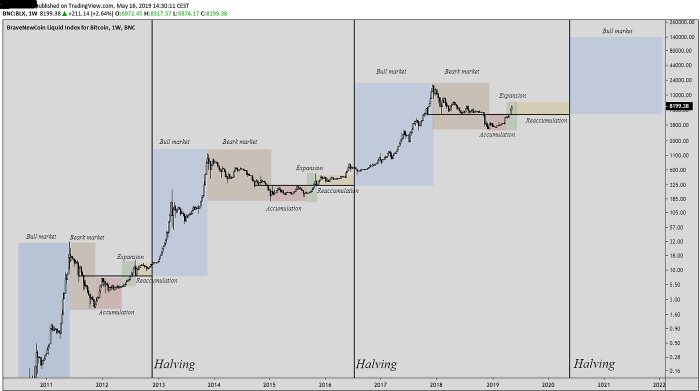

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving mechanism is embedded in the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This halving event directly impacts the rate of Bitcoin inflation. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The scarcity created by reduced supply is often cited as a key driver of these price increases. However, other market factors, such as overall economic conditions and regulatory changes, also play a significant role.

Predicted Effects of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This will further decrease the rate of new Bitcoin entering circulation. This reduction in supply, coupled with potentially sustained or increased demand, is expected to exert upward pressure on the price. The extent of this price increase is highly debated, with predictions ranging from modest gains to exponential growth. The actual outcome will depend on a complex interplay of factors including investor sentiment, macroeconomic conditions, and the adoption rate of Bitcoin. For example, the increased institutional adoption seen in recent years could significantly impact the price trajectory post-halving.

Comparison of the 2025 Halving to Previous Halving Events

While the core mechanism of the halving remains consistent across all events, several factors differentiate the 2025 halving from its predecessors. The overall maturity of the Bitcoin ecosystem, the increased regulatory scrutiny, and the broader adoption of cryptocurrencies are key distinctions. Previous halvings occurred in a less developed and less regulated market environment. The increased institutional investment and participation expected in 2025 could lead to a different price reaction compared to past events. The level of anticipation and public awareness surrounding the 2025 halving is also notably higher than in previous cycles.

Timeline of Significant Events Leading Up to and Following the 2025 Halving

The period leading up to the 2025 halving is characterized by increasing anticipation and speculation within the market. The months prior may see increased volatility as investors position themselves for the event. The halving itself will be a significant event, but its immediate impact on the price might be less dramatic than the subsequent months. The period following the halving is typically marked by a period of price consolidation, followed by potential sustained price appreciation, driven by the reduced supply. However, external market forces can significantly influence this trajectory.

Key Metrics Before, During, and After Previous Halvings

| Metric | Before Halving | During Halving | After Halving |

|---|---|---|---|

| Block Reward (BTC) | 50 (2012), 25 (2016), 12.5 (2020) | Halved | Halved Value |

| Circulating Supply (BTC) | ~10.5M (2012), ~15.8M (2016), ~18.4M (2020) | Continues to increase at a slower rate | Continues to increase at a slower rate |

| Price (USD) | ~$13 (2012), ~$650 (2016), ~$9,000 (2020) | Variable, often volatile | Historically increased significantly over time, but with significant variation |

Market Predictions and Price Volatility: Halving Bitcoin When 2025

The Bitcoin halving event, scheduled for 2025, is anticipated to significantly impact the cryptocurrency’s price, although the extent and direction of this impact remain subjects of considerable debate among market analysts. Predicting the precise price movements is inherently challenging, given the complex interplay of factors influencing Bitcoin’s value. However, by examining historical trends, analyzing current market conditions, and considering various expert opinions, we can explore potential price scenarios and associated risks.

The period leading up to the halving often witnesses a build-up of anticipation, potentially driving price increases as investors position themselves for the expected scarcity-driven price surge. Following the halving, the immediate impact can vary; some analysts predict a sharp, immediate price jump, while others foresee a more gradual increase, influenced by factors beyond the halving itself. The post-halving period can also be characterized by increased volatility as the market adjusts to the reduced supply.

Price Fluctuation Predictions

Several reputable sources offer differing predictions regarding Bitcoin’s price trajectory around the 2025 halving. For instance, some analysts, basing their predictions on historical halving cycles and incorporating macroeconomic indicators, suggest a potential price appreciation to levels significantly exceeding the previous cycle’s peak. Others, emphasizing the uncertainty surrounding regulatory landscapes and potential macroeconomic downturns, offer more conservative estimates, predicting a more modest price increase or even a temporary price dip before eventual appreciation. These differing viewpoints highlight the inherent uncertainties in forecasting cryptocurrency markets. The methodologies employed often involve statistical analysis of past price data, integration of on-chain metrics, and consideration of macroeconomic factors such as inflation and interest rates. Assumptions vary widely, reflecting differing levels of optimism or pessimism regarding Bitcoin’s future adoption and market acceptance.

Factors Influencing Bitcoin’s Price Beyond the Halving

The halving event, while significant, is not the sole determinant of Bitcoin’s price. Regulatory developments, both domestically and internationally, exert a substantial influence. Stringent regulations can suppress price growth, while supportive frameworks can foster wider adoption and price appreciation. Macroeconomic conditions, such as inflation rates, interest rate policies, and global economic growth, also play a crucial role. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation, boosting its price. Conversely, a strong dollar or rising interest rates might divert investment away from riskier assets like Bitcoin, potentially leading to price corrections. Furthermore, technological advancements within the Bitcoin ecosystem, such as the development of the Lightning Network, could also influence its price by improving scalability and transaction efficiency. Lastly, market sentiment and media narratives play a significant, albeit often unpredictable, role.

Visual Representation of Price Prediction Scenarios

Imagine a graph with time on the x-axis and Bitcoin price on the y-axis. Scenario A shows a steady upward trend leading up to the halving, followed by a sharp price jump immediately after, then a gradual, sustained increase. Scenario B illustrates a more volatile pattern, with price fluctuations before the halving, a less dramatic post-halving jump, followed by periods of consolidation and further growth. Scenario C depicts a more pessimistic outlook, showing a price decline before the halving, a modest increase afterward, and then a prolonged period of sideways movement. These scenarios represent only a few of the many possible outcomes, each with its underlying assumptions and justifications.

Potential Risks and Opportunities

Investing in Bitcoin around the 2025 halving presents both significant opportunities and considerable risks.

The potential for substantial price appreciation following the halving represents a key opportunity. However, the market’s volatility and unpredictable nature pose significant risks. A sharp price correction, either before or after the halving, could lead to substantial losses. Regulatory uncertainty remains a major risk factor, as unexpected changes in regulatory frameworks could negatively impact Bitcoin’s price. Furthermore, macroeconomic instability could trigger a broader market downturn, affecting Bitcoin’s price along with other risk assets. Finally, security risks associated with holding Bitcoin, such as exchange hacks or loss of private keys, are ever-present considerations for investors. Diversification of investment portfolios and careful risk management strategies are crucial for mitigating these risks.

Mining and Hashrate Implications

The Bitcoin halving in 2025 will significantly impact the profitability of Bitcoin mining and the overall hashrate of the network. This event, which cuts the block reward in half, will force miners to adapt their operations to remain profitable. Understanding these implications is crucial for assessing the future health and security of the Bitcoin network.

The halving directly reduces the primary revenue stream for miners – the block reward. This decrease in reward necessitates a corresponding increase in Bitcoin’s price to maintain profitability at the existing mining difficulty. If the price doesn’t rise sufficiently, less profitable miners will be forced to shut down, leading to a decrease in the network’s hashrate. This, in turn, could affect the security of the network, making it potentially more vulnerable to attacks.

Miner Adaptation Strategies

Miners will employ several strategies to adapt to the reduced block reward. These include upgrading to more energy-efficient mining hardware, consolidating operations to achieve economies of scale, diversifying revenue streams (such as transaction fees), and seeking out cheaper electricity sources. The success of these strategies will depend heavily on the price of Bitcoin and the overall market conditions. For instance, miners located in regions with high electricity costs might be forced to relocate or shut down entirely, while those with access to cheap, renewable energy sources will likely have a competitive advantage. The 2012 and 2016 halvings saw similar adjustments, with some miners upgrading equipment and others exiting the market. The 2025 halving is expected to follow a similar pattern, albeit with potentially more significant consequences given the current global economic climate.

Energy Consumption Changes, Halving Bitcoin When 2025

While the halving itself doesn’t directly alter the energy efficiency of individual mining rigs, it will indirectly influence the overall energy consumption of the Bitcoin network. A drop in hashrate resulting from less profitable miners exiting the market will likely lead to a reduction in total energy consumption. However, this decrease might be offset by the adoption of newer, more energy-efficient mining hardware by the remaining miners. The net effect on energy consumption is difficult to predict precisely and will depend on the interplay between hashrate reduction and technological advancements in mining hardware. It’s important to note that energy consumption is also influenced by factors beyond the halving, such as the price of Bitcoin and the adoption of renewable energy sources within the mining industry.

Decentralization Impacts

The halving’s effect on the decentralization of Bitcoin mining is complex and multifaceted. While a reduction in hashrate could theoretically lead to greater centralization as larger, more established mining operations survive, it could also encourage the adoption of more decentralized mining pools and the emergence of smaller, independent miners who can leverage cheaper energy sources or specialized hardware. The overall impact will depend on the balance between these competing forces. The increased adoption of more energy-efficient hardware could potentially broaden participation from smaller miners with limited resources, thus potentially counteracting the centralization pressure from the halving.

Bitcoin Price, Mining Profitability, and Hashrate Relationship

We can represent the relationship between Bitcoin’s price, mining profitability, and hashrate using a simplified text-based graph:

“`

Bitcoin Price | High | Medium | Low

—————–|———————————

Mining Profitability | High | Low/Marginal| Negative

—————–|———————————

Hashrate | High | Decreasing | Low

“`

This illustrates that a high Bitcoin price generally leads to high mining profitability and a high hashrate. Conversely, a low Bitcoin price results in low or negative mining profitability, causing a decline in the hashrate. The halving introduces a significant shift in this relationship, as the block reward is reduced, requiring a higher Bitcoin price to maintain profitability at the same hashrate. The market’s reaction to this shift will determine the final outcome. For example, if the price increases sufficiently, the hashrate may remain relatively stable; if the price fails to rise, a significant hashrate drop could follow.

Halving Bitcoin When 2025 – The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding the precise timing is crucial for investors, and you can find a detailed analysis of this at When Is The Next Bitcoin Halving 2025. This event will undoubtedly impact Bitcoin’s price and overall market dynamics in the coming years, making it a key factor to consider when assessing future market trends.

The effects of the 2025 halving on Bitcoin’s price are a subject of much speculation.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the timeline leading up to this event is crucial, and for that, you can check out a detailed countdown resource: Halving Bitcoin 2025 Countdown. This resource provides valuable insights into the factors influencing the halving and its predicted consequences, allowing you to better prepare for the changes expected when Bitcoin undergoes its next halving in 2025.

The Bitcoin halving in 2025 is a significant event, expected to reduce the rate of new Bitcoin creation. Understanding its potential impact on price is crucial, and for detailed analysis, you might find the predictions at Bitcoin 2025 Halving Price Prediction helpful. Ultimately, the 2025 Bitcoin halving’s effect on the market remains a subject of ongoing discussion and speculation within the crypto community.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Precisely pinpointing the date requires understanding the block reward mechanism and mining difficulty adjustments. For a detailed breakdown of the projected date, you can refer to this helpful resource: Halving Bitcoin 2025 Date. Ultimately, the timing of the 2025 Bitcoin halving remains a key factor in predicting future market trends.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its value. Understanding the precise timing and implications requires careful analysis, and a great resource for this is the article on When Halving Bitcoin 2025. This resource provides valuable insights into the halving’s effects on Bitcoin’s long-term trajectory and helps predict what we can expect from the Halving Bitcoin When 2025 event.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future, reducing the rate of new Bitcoin creation. To understand the implications of this event, it’s helpful to learn more about the halving process itself; for a comprehensive explanation, check out this resource: Que Es Halving Bitcoin 2025. Understanding this process is key to anticipating the potential market effects of the 2025 Bitcoin halving.