Future Predictions and Speculation (avoid definitive predictions)

Predicting Bitcoin’s price after the 2025 halving is inherently speculative. While historical data suggests a correlation between halvings and subsequent price increases, numerous other factors influence market dynamics, making precise forecasting impossible. This section explores potential scenarios, emphasizing the limitations of prediction and the importance of diversified analysis.

The impact of the 2025 halving on Bitcoin’s price remains uncertain. Several scenarios are possible, each with varying degrees of likelihood.

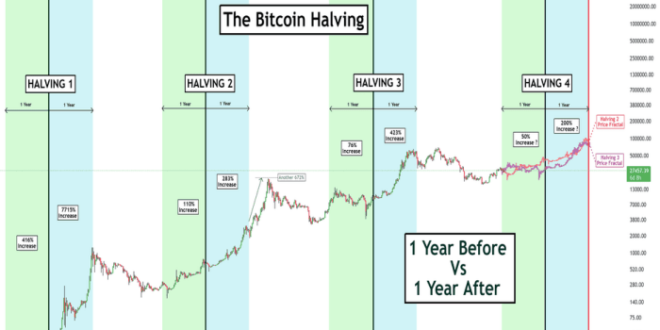

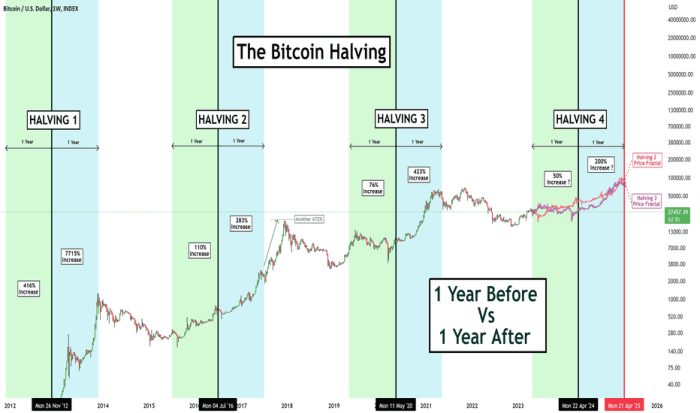

Potential Price Scenarios Following the 2025 Halving, History Bitcoin Halving Chart 2025

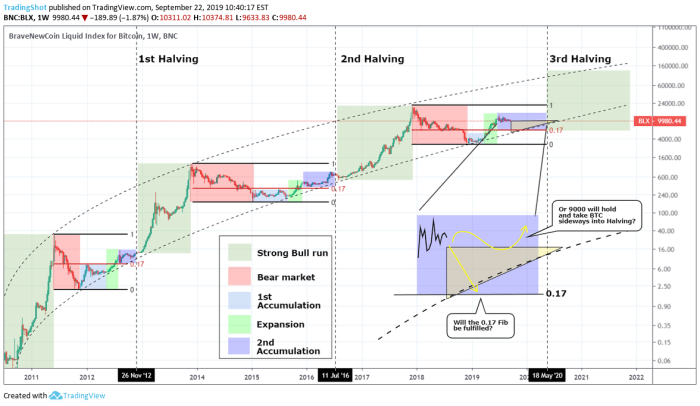

Several factors could influence Bitcoin’s price trajectory post-halving. A bullish scenario might see a gradual increase leading up to the event, followed by a significant surge driven by reduced supply and increased demand. Conversely, a bearish scenario could involve a prolonged period of sideways trading or even a price decline, potentially influenced by macroeconomic factors or regulatory uncertainty. A more moderate scenario could see a modest price increase following the halving, with volatility remaining a key characteristic of the market. These scenarios are not mutually exclusive and the actual outcome could be a blend of these possibilities. For example, a sharp initial price increase could be followed by a period of consolidation or even a correction. Conversely, a slow build-up could lead to a more sustained, longer-term increase.

Limitations of Price Prediction Models

Numerous models attempt to forecast Bitcoin’s price, but their accuracy is often limited. These models typically rely on historical data, technical indicators, or fundamental analysis, but they frequently fail to account for unforeseen events, such as regulatory changes, technological advancements, or shifts in investor sentiment. For instance, a model relying solely on past halving cycles might overlook the impact of increased institutional adoption or the emergence of competing cryptocurrencies. Similarly, models based on technical indicators can be susceptible to manipulation or inaccurate interpretations.

Factors Influencing Investment Decisions

Before making any investment decisions, it’s crucial to consider a range of factors beyond just price predictions. These include your personal risk tolerance, investment timeline, and understanding of the underlying technology and market dynamics. Macroeconomic conditions, regulatory landscape, and technological developments all play a significant role. Diversification across various asset classes is also a prudent strategy to mitigate risk. For example, an investor with a high-risk tolerance and a long-term horizon might be more comfortable with a larger Bitcoin allocation than someone with a shorter timeline and lower risk tolerance.

Illustrative Price Prediction Models and Outcomes

Consider two simplified models: Model A, a purely historical extrapolation based on previous halvings, might predict a significant price increase following the 2025 halving. A visual representation would show an upward-trending line, mirroring past price movements after halvings. However, this model ignores potential negative influences. Model B, a more cautious model incorporating macroeconomic factors and regulatory risks, might project a more moderate price increase or even a period of consolidation. Its visual representation could be a flatter line, showing less dramatic price movement. It is crucial to remember that these are simplified illustrations and real-world outcomes are far more complex and unpredictable. Neither model offers a definitive prediction, but they highlight the range of potential outcomes and the importance of considering multiple perspectives.

Frequently Asked Questions: History Bitcoin Halving Chart 2025

This section addresses some common questions regarding Bitcoin halvings, their impact on price, and the associated risks and rewards of investing in Bitcoin. Understanding these aspects is crucial for anyone considering involvement in the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism cuts the block reward in half, meaning miners receive fewer Bitcoins for verifying transactions and adding new blocks to the blockchain. This is a key component of Bitcoin’s deflationary design, intended to control its supply and potentially influence its value over time.

Bitcoin Halving’s Effect on Price

The relationship between Bitcoin halvings and price fluctuations is complex and not entirely predictable. While halvings historically have been followed by periods of price appreciation, this is not guaranteed. The reduced supply of new Bitcoins entering the market can create scarcity, potentially driving up demand and price. However, other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also play significant roles. For example, the halving in 2012 was followed by a substantial price increase, while the 2016 halving saw a more gradual price rise. The 2020 halving saw a significant price increase, though it was later followed by a substantial correction. These examples illustrate the complex interplay of factors influencing Bitcoin’s price.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in 2024. The precise date depends on the block mining rate, but it is anticipated to be sometime in the Spring or Summer of 2024.

Risks and Rewards of Investing in Bitcoin After a Halving

Investing in Bitcoin after a halving, like any investment in cryptocurrency, carries significant risks. The cryptocurrency market is highly volatile, and Bitcoin’s price can experience dramatic swings. Potential rewards include the possibility of substantial capital appreciation if the price increases, but losses can also be significant if the price declines. Factors influencing price include regulatory changes, adoption rates, technological developments, and overall market sentiment. Before investing, it’s essential to conduct thorough research, understand your risk tolerance, and only invest what you can afford to lose. Diversification of your investment portfolio is also a prudent strategy to mitigate risk.

History Bitcoin Halving Chart 2025 – Analyzing the history of Bitcoin halving events reveals a fascinating pattern of price increases following each halving. To understand the potential impact of the next halving, pinpointing the exact date is crucial. You can find the projected date by checking this resource: What Date Is Bitcoin Halving 2025. Knowing this date allows for a more accurate prediction when constructing a comprehensive Bitcoin halving chart for 2025 and beyond.

Understanding the history of Bitcoin halving is crucial for predicting future price movements. A key event in this history is the 2025 halving; to understand its precise timing, you can check this resource: When Was The 2025 Bitcoin Halving. This date is a significant data point when constructing a comprehensive History Bitcoin Halving Chart 2025, allowing for more accurate forecasting models.

Understanding the history of Bitcoin halving is crucial for predicting future price movements. A visual representation, like a History Bitcoin Halving Chart 2025, can be incredibly helpful. To accurately plot this chart, however, we first need to know the precise date of the next halving; you can find that information by checking this resource: When Was The Bitcoin Halving In 2025.

Once that date is established, we can then complete the History Bitcoin Halving Chart 2025 and analyze the historical data more effectively.

Analyzing the historical Bitcoin halving chart for 2025 requires understanding the cyclical nature of Bitcoin’s reward reduction. It’s interesting to compare this to other cryptocurrencies with similar mechanisms, such as the anticipated impact of the Bitcoin Cash Halving 2025 , which could offer insights into potential market reactions. Ultimately, however, the Bitcoin halving chart remains the primary focus for predicting future Bitcoin price movements.

Analyzing the historical Bitcoin Halving Chart 2025 requires understanding past halving events. The impact of these events on Bitcoin’s price is a key area of study, and to properly contextualize this, it’s beneficial to look ahead to the next halving. For detailed information on this upcoming event, check out this resource on the Next Bitcoin Halving 2025 , which provides valuable insights for interpreting the historical chart and predicting future trends.

Ultimately, a comprehensive understanding of both past and future halvings is crucial for informed analysis of the Bitcoin Halving Chart 2025.

Understanding the history of Bitcoin halving is crucial for predicting future price movements. Analyzing past halving events, as depicted in a Bitcoin halving chart, helps illustrate the impact on supply and demand. To accurately predict the next halving’s effects, it’s important to know precisely when it will occur; you can find that information by checking this resource: When Is The Bitcoin Halving 2025?

. This knowledge, combined with historical data, allows for a more informed assessment of the 2025 Bitcoin halving’s potential influence on the market.