Market Sentiment and Investor Behavior

Bitcoin’s price, notoriously volatile, is heavily influenced by the collective sentiment and actions of its investors. Understanding the interplay between market sentiment, institutional activity, and retail investor behavior is crucial for any attempt to predict its future value. Analyzing historical data reveals a strong correlation between positive sentiment and price increases, and vice versa.

Historical Bitcoin Price Trends and Correlation with Market Sentiment

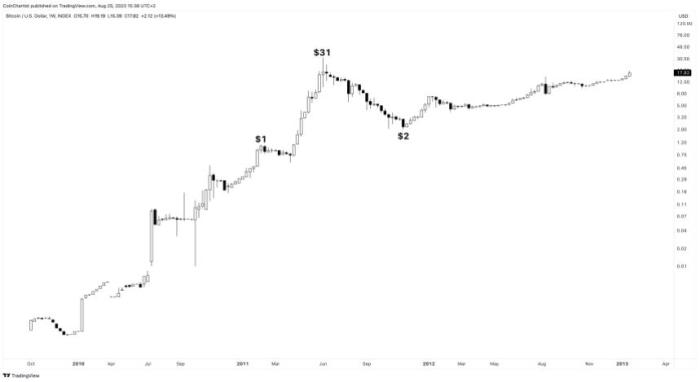

Bitcoin’s price history shows clear patterns linked to prevailing market sentiment. Periods of intense media coverage, positive regulatory developments, or technological advancements often coincide with bull runs, characterized by rapid price appreciation driven by optimistic investor expectations. Conversely, negative news, regulatory uncertainty, or significant market corrections lead to bearish sentiment and price declines. For example, the 2017 bull run was fueled by widespread media hype and increasing institutional interest, while the 2018 bear market was triggered by regulatory crackdowns and concerns about market manipulation. Analyzing sentiment data from social media, news articles, and online forums can provide valuable insights into the prevailing market mood and its potential impact on Bitcoin’s price.

Influence of Institutional Investors and Whale Activity

Large institutional investors and “whales” (individuals or entities holding substantial Bitcoin amounts) exert significant influence on price fluctuations. Their trading activity can trigger substantial price movements, especially in relatively illiquid markets. Institutional adoption, such as Grayscale’s Bitcoin Investment Trust or MicroStrategy’s significant Bitcoin purchases, has historically been associated with periods of price appreciation. Conversely, large-scale selling by whales can trigger sharp price corrections. The impact of these large players is amplified by their ability to move the market through coordinated actions or even by simply creating a perception of buying or selling pressure.

Impact of Retail Investor Behavior

Retail investors, while individually less influential than large institutions, collectively contribute significantly to Bitcoin’s price volatility. Their behavior is often driven by fear and greed, leading to herd mentality and amplified price swings. FOMO (Fear Of Missing Out) can fuel rapid price increases during bull markets, while panic selling during bear markets can exacerbate price declines. The proliferation of retail trading platforms and the accessibility of Bitcoin have increased the influence of this group, making understanding their sentiment crucial. For instance, the surge in retail investor interest in 2020 and 2021 contributed to Bitcoin’s price rally, while subsequent periods of uncertainty saw a significant withdrawal of retail capital.

Hypothetical Scenario: Impact of a Major Market Event

Consider a hypothetical scenario where a major global financial crisis occurs. This event could trigger a flight to safety, potentially leading to increased demand for Bitcoin as a hedge against traditional financial assets. However, concurrently, the crisis might also cause investors to liquidate all assets, including Bitcoin, to meet immediate financial needs. The net effect on Bitcoin’s price would depend on the balance between these competing forces. If the flight-to-safety narrative dominates, we might see a significant price increase; however, if widespread liquidation prevails, a sharp price drop is more likely. The 2008 financial crisis, while not directly comparable, provides some insight into how such events can impact investor behavior and asset prices.

Comparison of Investor Sentiment Indicators

Several indicators attempt to gauge investor sentiment, including the Bitcoin Fear & Greed Index, social media sentiment analysis, and Google Trends data for Bitcoin-related searches. While these indicators offer valuable insights, their predictive power is limited. The Bitcoin Fear & Greed Index, for example, provides a numerical score based on various market metrics, but it doesn’t perfectly predict price movements. Social media sentiment, while often reflecting general market mood, can be easily manipulated or influenced by bots and coordinated campaigns. Therefore, relying solely on any single indicator is risky. A more robust approach involves combining several indicators with fundamental and technical analysis to form a comprehensive view of the market.

Technological Developments and Their Impact

Bitcoin’s future price in 2025 is intricately linked to its technological evolution. Significant advancements in scalability, security, and usability could dramatically alter its adoption rate and, consequently, its value. Conversely, a failure to address current limitations could hinder its growth.

Layer-2 scaling solutions and advancements in cryptography are key factors influencing Bitcoin’s trajectory. The interplay between these technologies and broader market sentiment will determine whether Bitcoin achieves widespread adoption and increased value.

Layer-2 Scaling Solutions and Transaction Fees

The increasing popularity of Bitcoin has led to higher transaction fees and slower confirmation times. Layer-2 scaling solutions aim to alleviate this congestion by processing transactions off the main Bitcoin blockchain. This allows for faster and cheaper transactions, making Bitcoin more suitable for everyday use. Examples include the Lightning Network and the Liquid Network. The successful implementation and widespread adoption of these solutions could significantly reduce transaction costs, making Bitcoin more competitive with other payment systems and potentially driving up demand and price. A successful reduction in transaction fees could increase Bitcoin’s appeal to both individual users and businesses, fostering greater adoption.

The Lightning Network’s Role in Scalability and Efficiency

The Lightning Network is a prime example of a Layer-2 scaling solution. It operates as a network of payment channels built on top of the Bitcoin blockchain. These channels allow for near-instantaneous and low-cost transactions between users without clogging the main blockchain. The more users adopt the Lightning Network, the more efficient and scalable Bitcoin becomes. Its current adoption rate is still relatively low, but significant growth is projected, which could positively influence Bitcoin’s price. For instance, if the Lightning Network facilitates millions of daily transactions, the demand for Bitcoin would likely increase, leading to a potential price surge.

Emerging Technologies and Bitcoin’s Position

Several emerging technologies could impact Bitcoin’s future. Quantum computing, while posing a theoretical threat to Bitcoin’s cryptographic security, also presents opportunities for enhanced security protocols. Advances in privacy-enhancing technologies could also increase Bitcoin’s appeal to users concerned about transaction transparency. Furthermore, developments in decentralized finance (DeFi) could integrate Bitcoin more seamlessly into the broader cryptocurrency ecosystem, potentially boosting its value. The success of these integrations depends on their seamless integration and user adoption.

Advancements in Cryptography and Bitcoin’s Security

Bitcoin’s security relies heavily on its cryptographic algorithms. Advancements in cryptography can both strengthen and weaken its security. While quantum computing poses a long-term threat, the Bitcoin community is actively researching quantum-resistant cryptographic algorithms to mitigate this risk. Improved cryptographic techniques could enhance Bitcoin’s security, increasing investor confidence and potentially driving up its value. Conversely, any significant breakthroughs in cryptography that compromise Bitcoin’s security could negatively impact its price.

Projected Technological Evolution and Price Impact Timeline

| Year | Technological Development | Projected Impact on Price |

|---|---|---|

| 2023-2024 | Widespread adoption of Layer-2 solutions (e.g., Lightning Network) | Moderate price increase due to improved scalability and usability. |

| 2024-2025 | Significant progress in quantum-resistant cryptography | Potential price stabilization or increase due to enhanced security. |

| 2025 | Increased integration with DeFi protocols | Potential price surge driven by increased utility and adoption. |

Note: This timeline represents a potential scenario and actual outcomes may vary depending on several factors, including market sentiment and regulatory developments. The projected price increases are speculative and should not be considered financial advice. Real-world examples, such as the impact of the Lightning Network’s growth on transaction fees, would be needed for more concrete projections.

Regulatory Landscape and Its Influence

The regulatory landscape surrounding Bitcoin is highly fragmented and dynamic, significantly impacting its adoption, price, and accessibility. Different jurisdictions approach the regulation of cryptocurrencies with varying degrees of openness and restrictiveness, leading to a complex and often unpredictable environment. This section will explore how these varying regulatory frameworks influence Bitcoin’s trajectory.

Varying Regulatory Frameworks and Bitcoin Adoption

Different countries have adopted vastly different approaches to regulating Bitcoin. Some, like El Salvador, have embraced Bitcoin as legal tender, while others maintain a more cautious or even hostile stance, implementing strict regulations that limit its use. This divergence creates a patchwork of regulatory environments, affecting both the ease of Bitcoin adoption and the overall market sentiment. Countries with permissive regulations tend to see higher levels of Bitcoin adoption, attracting investors and businesses alike. Conversely, countries with stringent regulations often experience lower adoption rates due to increased barriers to entry and uncertainty. The impact is clearly visible in the contrasting levels of Bitcoin usage and merchant acceptance across different nations. For instance, the widespread adoption in El Salvador contrasts sharply with the restrictive environment in China, which has effectively banned cryptocurrency trading.

Potential Implications of Stricter Regulations

Stricter regulations can significantly impact Bitcoin’s price and accessibility. Increased scrutiny and limitations on trading, custodial services, and mining activities can lead to reduced liquidity and market volatility. This can result in price drops as investors may become hesitant to hold Bitcoin due to the increased regulatory risks. Furthermore, stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations can make it harder for individuals and businesses to access and utilize Bitcoin, hindering its potential for widespread adoption as a medium of exchange. A prime example of this could be observed if a major global economy were to implement a comprehensive ban on cryptocurrency transactions, potentially triggering a significant market downturn.

Potential Regulatory Changes Affecting Bitcoin’s Value

Several potential regulatory changes could significantly affect Bitcoin’s value. The introduction of clear, consistent, and globally harmonized regulatory frameworks could foster greater investor confidence, leading to increased price stability and wider adoption. Conversely, inconsistent or overly restrictive regulations could create uncertainty and negatively impact Bitcoin’s value. For example, the implementation of a global tax on cryptocurrency transactions could significantly reduce trading volume and potentially decrease Bitcoin’s price. Conversely, the development of clear regulatory guidelines for institutional investors could increase institutional participation, potentially driving up the price.

Comparative Regulatory Landscape Across Major Economies

The regulatory landscape for Bitcoin varies significantly across major economies. The United States, for example, has a fragmented regulatory approach with different agencies overseeing different aspects of the cryptocurrency market. The European Union is working towards a more unified regulatory framework, aiming to strike a balance between innovation and consumer protection. Meanwhile, some Asian countries have taken a more restrictive approach, implementing outright bans or severe limitations on cryptocurrency activities. This diversity in regulatory approaches creates a complex and dynamic global environment for Bitcoin.

Regulatory Stances Towards Bitcoin

The following table summarizes the regulatory stances of various countries towards Bitcoin, highlighting the impact on adoption and potential future changes. It’s important to note that the regulatory landscape is constantly evolving, and this information reflects the situation at a specific point in time. Further research is recommended for the most up-to-date information.

| Country | Regulatory Status | Impact on Adoption | Potential Future Changes |

|---|---|---|---|

| United States | Fragmented, evolving | Moderate adoption, significant institutional interest | Increased clarity and harmonization of regulations expected |

| European Union | Developing a unified framework (MiCA) | Growing adoption, driven by regulatory clarity | Implementation of MiCA and further developments within the framework |

| El Salvador | Legal tender | High adoption, significant government support | Further integration into the national financial system |

| China | Banned | Very low adoption, significant government restrictions | Unlikely to see significant changes in the near future |

| Japan | Regulated | Moderate adoption, clear regulatory guidelines | Potential refinements to existing regulations |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and dependence on numerous interconnected factors. However, by considering various economic, technological, and regulatory scenarios, we can construct plausible price ranges. These scenarios are not predictions, but rather illustrative possibilities based on different assumptions.

Price Scenario Analysis: 2025 Bitcoin Price Projections

The following table Artikels three potential price scenarios for Bitcoin in 2025, each built upon distinct assumptions regarding macroeconomic conditions, technological advancements, and regulatory developments. It’s crucial to remember that these are just possibilities, and the actual price could fall outside this range.

| Scenario | Price Range (USD) | Underlying Assumptions | Risks | Opportunities |

|---|---|---|---|---|

| Bullish Scenario | $150,000 – $250,000 | Widespread adoption by institutional investors; significant technological advancements improving scalability and transaction speeds; positive regulatory developments globally fostering increased confidence; continued macroeconomic uncertainty driving safe-haven demand for Bitcoin. This scenario mirrors the rapid growth seen in the early 2020s, albeit at a more mature stage of adoption. For example, the increased use of Bitcoin as a store of value by central banks or large corporations would significantly drive the price upwards. | Overvaluation leading to a sharp correction; increased regulatory scrutiny leading to price volatility; unforeseen technological challenges impacting network stability. | High returns for early investors; potential for Bitcoin to become a dominant store of value and medium of exchange; further technological innovation within the crypto space. |

| Neutral Scenario | $50,000 – $100,000 | Moderate institutional adoption; steady technological improvements; mixed regulatory landscape with some countries embracing Bitcoin while others remain cautious; relatively stable macroeconomic conditions. This scenario assumes a more gradual and less volatile growth trajectory, similar to the growth of established financial assets. For example, this could be compared to the growth of gold over a comparable period. | Slow growth compared to previous cycles; increased competition from alternative cryptocurrencies; potential for negative regulatory changes in key markets. | Sustainable growth with reduced volatility; wider acceptance as a digital asset; continued development of the Bitcoin ecosystem. |

| Bearish Scenario | $20,000 – $40,000 | Limited institutional adoption; significant technological setbacks or security breaches; stricter regulatory frameworks globally leading to decreased accessibility and use; a strong economic recovery reducing the demand for safe-haven assets. This scenario assumes a significant downturn, potentially due to a major regulatory crackdown or a significant security flaw. This would be similar to the bear market seen in 2018-2020. | Significant capital loss for investors; potential for decreased network activity; loss of market share to competing cryptocurrencies. | Opportunity to accumulate Bitcoin at lower prices; potential for technological improvements addressing the issues that led to the downturn. |

Factors Influencing Price Scenarios

The price scenarios Artikeld above are influenced by a complex interplay of factors. Macroeconomic trends, such as inflation and interest rates, directly impact the demand for Bitcoin as a hedge against inflation or a safe-haven asset. Technological advancements, including improvements in scalability and transaction speeds, influence Bitcoin’s usability and adoption. Finally, regulatory actions by governments worldwide significantly shape the legal and operational landscape for Bitcoin, impacting investor confidence and market participation. For example, a significant increase in the adoption of Bitcoin as a payment method in a major economy could drive a bullish scenario, whereas a widespread regulatory ban could trigger a bearish scenario.

Frequently Asked Questions (FAQs)

Predicting Bitcoin’s future price is inherently complex, influenced by a multitude of interacting factors. This section addresses common questions surrounding Bitcoin’s price trajectory, associated risks, and regulatory impact, providing clarity for potential investors.

Major Factors Influencing Bitcoin’s Price

Bitcoin’s price is a dynamic reflection of supply and demand, shaped by macroeconomic conditions, technological advancements, regulatory actions, and investor sentiment. Supply is limited to 21 million coins, creating inherent scarcity. Demand, however, is driven by various factors, including its adoption as a store of value, a medium of exchange, and its role in decentralized finance (DeFi). Global economic events, such as inflation or recessionary periods, can significantly impact investor appetite for Bitcoin as a hedge against traditional assets. Furthermore, positive or negative news concerning technological developments, regulatory changes, or large-scale adoption by institutions can cause dramatic price fluctuations.

Likelihood of Bitcoin Reaching a Specific Price by 2025

Accurately predicting Bitcoin’s price by 2025 is impossible. Numerous analysts offer price projections, but these are based on various models and assumptions, making definitive predictions unreliable. For instance, some models extrapolate past price movements, while others incorporate factors like adoption rates, market capitalization, and technological advancements. However, unforeseen events – such as a major security breach, a significant regulatory crackdown, or a sudden shift in investor sentiment – can dramatically alter the predicted trajectory. Therefore, any price target should be viewed with considerable caution. It’s crucial to remember that past performance is not indicative of future results. Examples of past price predictions, many of which proved wildly inaccurate, serve as a reminder of the inherent uncertainty involved.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price volatility is extreme, meaning substantial gains can be quickly erased by sharp declines. The cryptocurrency market is relatively young and unregulated in many jurisdictions, making it susceptible to manipulation and fraud. Security risks, such as hacking and theft from exchanges or personal wallets, are also considerable. Furthermore, the lack of intrinsic value, unlike traditional assets like gold or real estate, adds to the risk. Investors should thoroughly understand these risks and only invest what they can afford to lose. Diversification across different asset classes is a crucial risk-mitigation strategy.

Regulation’s Impact on Bitcoin’s Price, How Much Will Bitcoin Be Worth 2025

Regulatory actions significantly impact Bitcoin’s price. Favorable regulations, such as clear guidelines for cryptocurrency exchanges and the acceptance of Bitcoin as a legitimate payment method, tend to increase investor confidence and drive up prices. Conversely, stringent regulations, including bans or heavy restrictions, can negatively affect price and liquidity. The regulatory landscape varies considerably across countries, adding another layer of complexity to Bitcoin’s price dynamics. For example, China’s ban on cryptocurrency trading in 2021 led to a significant price drop, highlighting the profound impact of regulatory decisions.

Alternative Cryptocurrencies to Consider

The cryptocurrency market encompasses thousands of alternative cryptocurrencies, each with its unique characteristics and potential. Ethereum, for example, is a leading platform for decentralized applications (dApps) and smart contracts, offering a different investment proposition than Bitcoin. Other cryptocurrencies focus on specific niches, such as privacy (Monero), scalability (Solana), or decentralized finance (Cardano). However, it’s essential to conduct thorough research before investing in any alternative cryptocurrency, as they also carry significant risks and price volatility. The potential for high returns often comes hand-in-hand with a high degree of risk.

Disclaimer and Caveat: How Much Will Bitcoin Be Worth 2025

Predicting the future price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The information presented in this document regarding potential Bitcoin prices in 2025 is for informational and educational purposes only and should not be construed as financial advice. We strongly advise against making investment decisions based solely on these projections.

The models used to predict cryptocurrency prices are subject to numerous limitations. These models often rely on historical data and may not accurately account for unforeseen events, such as regulatory changes, technological breakthroughs, or shifts in market sentiment. Furthermore, the cryptocurrency market is notoriously volatile, characterized by rapid and significant price swings that can be difficult, if not impossible, to predict with any degree of certainty. Remember that past performance is not indicative of future results. For example, Bitcoin’s price in 2017 experienced a meteoric rise followed by a significant correction, illustrating the inherent risks involved. Similarly, the 2022 market downturn showed how quickly sentiment can shift and impact value.

Limitations of Price Prediction Models

Cryptocurrency price prediction models often employ statistical techniques, machine learning algorithms, or fundamental analysis. However, these methods have limitations. Statistical models may struggle to capture the non-linear and unpredictable nature of the cryptocurrency market, particularly in response to unexpected news events or technological disruptions. Machine learning models are only as good as the data they are trained on, and biases in this data can lead to inaccurate predictions. Fundamental analysis, while useful for understanding the underlying technology and adoption rate, often struggles to quantify the influence of speculative trading and market psychology. These factors, coupled with the relative youth of the cryptocurrency market, make accurate long-term price prediction exceptionally challenging.

Inherent Risks of Cryptocurrency Investments

Investing in cryptocurrencies involves a high degree of risk. The market is highly volatile, susceptible to manipulation, and subject to regulatory uncertainty. Security breaches, hacking incidents, and technological failures can lead to significant losses. Moreover, the decentralized nature of cryptocurrencies can make it difficult to recover funds in case of fraud or loss of access to private keys. The lack of regulation in many jurisdictions further increases the risk. Consider the Mt. Gox exchange collapse as a prime example of the potential for significant losses in the cryptocurrency market. The lack of robust regulatory frameworks in the early days of cryptocurrency significantly amplified the risk to investors.

Importance of Thorough Research and Responsible Investing

Before investing in any cryptocurrency, including Bitcoin, it is crucial to conduct thorough due diligence. This includes researching the underlying technology, understanding the risks involved, and assessing your own risk tolerance. Consider diversifying your investment portfolio to mitigate risk and avoid investing more than you can afford to lose. Seeking advice from a qualified financial advisor can also be beneficial, especially for those new to cryptocurrency investments. Responsible investing entails a clear understanding of your investment goals, risk tolerance, and the potential for both substantial gains and significant losses.

Responsible Investing and Risk Management

Responsible cryptocurrency investment necessitates a disciplined approach to risk management. This includes setting realistic investment goals, diversifying your portfolio across different asset classes, and regularly reviewing your investment strategy. Never invest more than you can afford to lose, and always be prepared for the possibility of significant price fluctuations. Utilizing stop-loss orders and setting realistic profit targets can help manage risk effectively. Furthermore, staying informed about market trends and regulatory developments is essential for making informed investment decisions. A well-defined risk management strategy is paramount for navigating the volatile cryptocurrency landscape.

How Much Will Bitcoin Be Worth 2025 – Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its potential value. To gain some insight into possible scenarios, it’s helpful to consult resources dedicated to forecasting, such as this detailed analysis on Bitcoin Price 2025 Prediction. Ultimately, how much Bitcoin will be worth in 2025 remains speculative, depending on market adoption and technological advancements.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its potential value. To gain some insight into possible scenarios, it’s helpful to consult resources dedicated to forecasting, such as this detailed analysis on Bitcoin Price 2025 Prediction. Ultimately, how much Bitcoin will be worth in 2025 remains speculative, depending on market adoption and technological advancements.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its potential value. To gain some insight into possible scenarios, it’s helpful to consult resources dedicated to forecasting, such as this detailed analysis on Bitcoin Price 2025 Prediction. Ultimately, how much Bitcoin will be worth in 2025 remains speculative, depending on market adoption and technological advancements.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its potential value. To gain some insight into possible scenarios, it’s helpful to consult resources dedicated to forecasting, such as this detailed analysis on Bitcoin Price 2025 Prediction. Ultimately, how much Bitcoin will be worth in 2025 remains speculative, depending on market adoption and technological advancements.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its potential value. To gain some insight into possible scenarios, it’s helpful to consult resources dedicated to forecasting, such as this detailed analysis on Bitcoin Price 2025 Prediction. Ultimately, how much Bitcoin will be worth in 2025 remains speculative, depending on market adoption and technological advancements.