Bitcoin Halving 2025: Is Bitcoin Halving In 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the supply of Bitcoin, a key factor influencing its price. Understanding this mechanism is crucial to comprehending the potential market effects of the 2025 halving.

Bitcoin Halving Mechanism

The Bitcoin halving mechanism is integral to Bitcoin’s deflationary monetary policy. Every 210,000 blocks mined, the reward given to Bitcoin miners for verifying transactions is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The 2025 halving will reduce this reward to 3.125 BTC. This controlled reduction in Bitcoin supply aims to mimic the scarcity of precious metals like gold, potentially increasing its value over time. The halving directly affects the rate of inflation, or rather, the rate of *deflation* within the Bitcoin ecosystem. A reduced supply, assuming demand remains constant or increases, should theoretically lead to price appreciation.

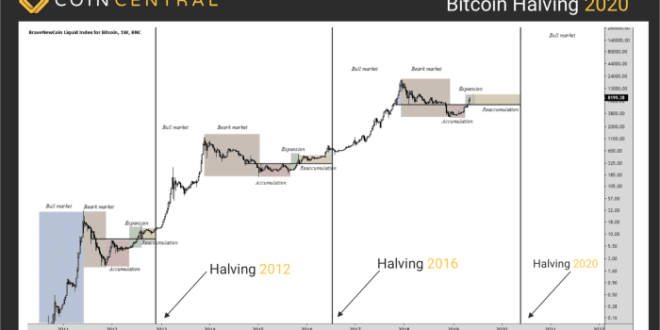

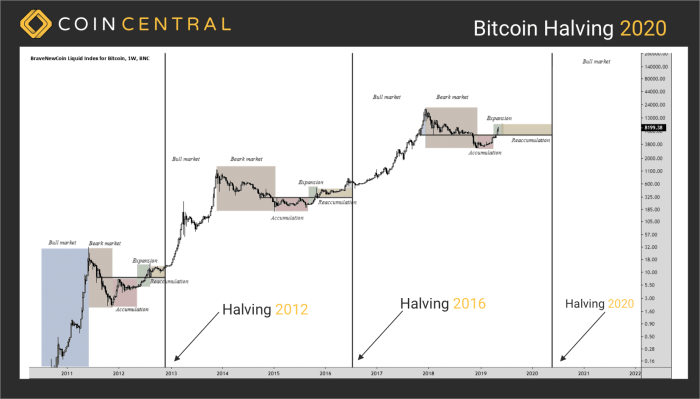

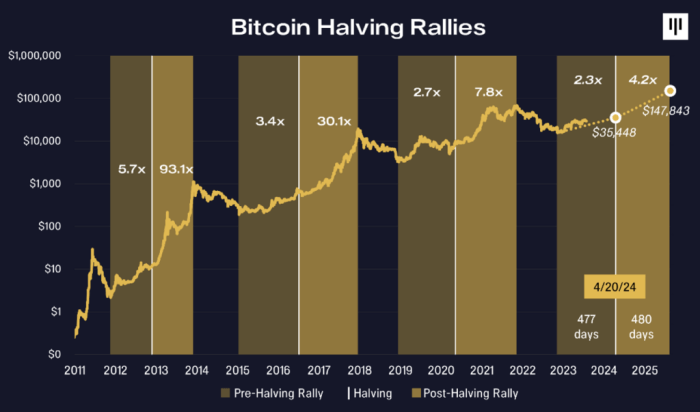

Historical Context of Bitcoin Halvings

The Bitcoin network has undergone three previous halvings: in November 2012, July 2016, and May 2020. Each halving has been followed by a period of significant price appreciation, though the timing and magnitude of these increases have varied. The 2012 halving saw a gradual price increase over the following year. The 2016 halving was followed by a period of consolidation before a significant price surge in 2017. The 2020 halving, occurring amidst the COVID-19 pandemic and increased institutional interest, led to a substantial price increase throughout 2020 and 2021, culminating in an all-time high. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price beyond just the halving, including regulatory changes, macroeconomic conditions, and market sentiment.

Expected Effects of the 2025 Halving, Is Bitcoin Halving In 2025

Predicting the precise impact of the 2025 halving on Bitcoin’s price is inherently speculative. However, based on historical precedent and understanding the mechanism, we can Artikel potential scenarios. A reduced supply of new Bitcoins entering the market could lead to increased scarcity and potentially drive up demand, thus pushing the price higher. This effect is amplified by the fact that the rate of Bitcoin inflation will decrease further, making it even more attractive as a store of value compared to inflationary fiat currencies. However, several countervailing factors could influence the outcome. These include the overall state of the global economy, the regulatory environment surrounding cryptocurrencies, and the level of investor confidence. For instance, a global recession could negatively impact Bitcoin’s price, regardless of the halving. Similarly, increased regulatory scrutiny could dampen investor enthusiasm. Therefore, while a price increase following the 2025 halving is a plausible outcome, it is not guaranteed, and the magnitude of any price movement remains uncertain. The 2025 halving, similar to previous halvings, will likely be a catalyst for price volatility, potentially leading to both significant gains and losses in the short term.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently challenging, as it depends on a complex interplay of factors extending beyond the halving event itself. While the halving reduces the rate of new Bitcoin entering circulation, thereby potentially increasing scarcity and price, other market forces significantly influence the ultimate outcome.

Factors Influencing Bitcoin’s Price Beyond the Halving

Several key factors, beyond the reduced supply from the halving, will play a crucial role in shaping Bitcoin’s price trajectory. Regulatory clarity in various jurisdictions will significantly impact institutional investment and mainstream adoption. Increased adoption, particularly among institutional investors and in developing economies, could drive significant price increases. Conversely, negative regulatory developments or a decrease in adoption could exert downward pressure. Furthermore, macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, will significantly influence investor sentiment and allocation towards Bitcoin as a safe haven or alternative asset. Geopolitical events and unforeseen crises can also introduce volatility and unpredictability into the market. For example, the 2022 bear market was significantly influenced by macroeconomic factors like rising inflation and interest rates, as well as the collapse of several major crypto firms.

Price Prediction Models and Methodologies

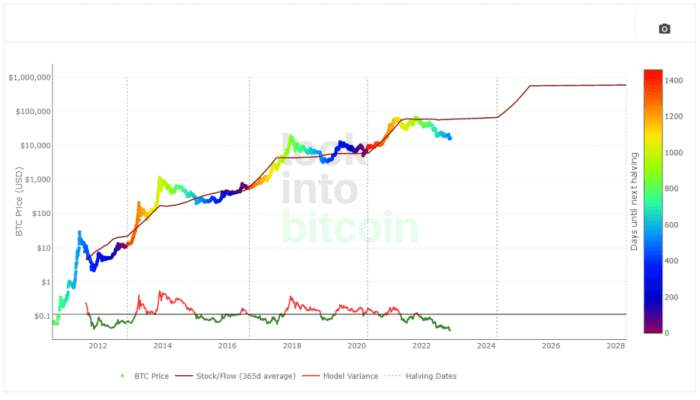

Various models attempt to forecast Bitcoin’s future price. Some employ technical analysis, studying historical price charts and trading volume to identify patterns and predict future movements. Others utilize fundamental analysis, focusing on factors like the halving’s impact on supply, network growth, and adoption rates. Quantitative models, using complex algorithms and historical data, attempt to identify correlations and predict price trends. However, it’s crucial to understand that no model guarantees accuracy. Past performance is not necessarily indicative of future results, and unforeseen events can drastically alter price predictions. For example, a model might accurately predict price based on historical halving cycles, but fail to account for a sudden regulatory crackdown or a major market crash unrelated to Bitcoin itself.

Potential Range of Price Movements

Following the 2025 halving, a wide range of price movements is possible. A bullish scenario, driven by widespread adoption, positive regulatory developments, and sustained macroeconomic stability, could see Bitcoin’s price reaching significantly higher levels. Some analysts have speculated about prices exceeding $100,000 or even higher. Conversely, a bearish scenario, characterized by negative regulatory changes, decreased adoption, or a significant macroeconomic downturn, could result in lower prices than anticipated. This could be exacerbated by events outside the crypto market itself. The actual outcome will likely fall somewhere within this spectrum, shaped by the interplay of all the aforementioned factors. The uncertainty inherent in predicting future price movements highlights the risk associated with investing in Bitcoin.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving event, scheduled for 2025, will significantly impact the profitability and operations of Bitcoin miners. This reduction in block rewards, from 6.25 BTC to 3.125 BTC, will necessitate adjustments within the mining industry, potentially reshaping its geographical landscape and environmental footprint.

The halving directly affects miners’ revenue stream. With fewer Bitcoin rewarded for each successfully mined block, profitability will decrease unless the price of Bitcoin increases proportionally or mining costs significantly decline. This creates pressure on miners to optimize their operations, potentially leading to consolidation within the industry as less efficient miners are forced to shut down or merge with larger operations.

Miner Profitability and Responses

The 2025 halving will undoubtedly challenge the profitability of Bitcoin mining operations. Miners will need to adapt to survive. This could involve strategies like increasing mining efficiency through upgrading hardware, negotiating lower energy costs, or diversifying revenue streams, perhaps through mining other cryptocurrencies alongside Bitcoin. A significant price increase in Bitcoin would also alleviate much of the pressure on miners. For example, if the price of Bitcoin doubles after the halving, the reduced reward per block would be offset by the increased value of those rewards. However, predicting the price of Bitcoin is inherently speculative. We can look at past halvings for insight, but each event occurs within a unique economic and technological context.

Geographical Distribution of Mining Activity

The halving could lead to a shift in the geographical distribution of Bitcoin mining. Regions with lower energy costs and more favorable regulatory environments will become increasingly attractive to miners. Historically, China was a dominant force in Bitcoin mining until regulatory crackdowns led to a significant migration of mining operations to other countries, such as the United States, Kazakhstan, and parts of Central America. The 2025 halving could accelerate this trend, further diversifying the geographical spread of Bitcoin mining activity. Areas with abundant renewable energy sources, such as hydropower or geothermal energy, may also gain a competitive advantage.

Environmental Implications of Bitcoin Mining

The environmental impact of Bitcoin mining remains a significant concern. The energy consumption associated with Bitcoin mining is substantial, and the halving will not necessarily reduce this overall consumption. While the reward per block is halved, the difficulty of mining will adjust to maintain a consistent block generation time. This means that the overall energy consumption of the network will likely remain relatively high unless mining efficiency improves drastically. The halving may accelerate the adoption of more energy-efficient mining hardware and the utilization of renewable energy sources in mining operations. However, the environmental consequences remain a complex issue that requires ongoing monitoring and sustainable solutions within the industry. The potential for environmental damage associated with Bitcoin mining, especially in regions with high reliance on fossil fuels, remains a key consideration.

The question, “Is Bitcoin Halving in 2025?”, is frequently asked. The answer lies in understanding the scheduled Bitcoin Halving events, which reduce the rate of new Bitcoin creation. For a detailed explanation of this significant event, you can refer to this comprehensive resource on the Bitcoin Halving Event 2025. Therefore, the halving’s impact on the future price and supply of Bitcoin in 2025 remains a topic of considerable discussion.

The question of whether Bitcoin will halve in 2025 is a significant one for the cryptocurrency community. Understanding the implications of this event requires researching the specifics of the halving cycle. For a detailed analysis of this pivotal moment, check out this informative resource on 2025 Halving Bitcoin , which provides valuable insights. Ultimately, the 2025 halving will undoubtedly shape the future trajectory of Bitcoin’s price and overall market dynamics.

The question of whether Bitcoin will halve in 2025 is a significant one for the cryptocurrency community. Understanding the implications of this event requires researching the specifics of the halving cycle. For a detailed analysis of this pivotal moment, check out this informative resource on 2025 Halving Bitcoin , which provides valuable insights. Ultimately, the 2025 halving will undoubtedly shape the future trajectory of Bitcoin’s price and overall market dynamics.

The question of whether Bitcoin will halve in 2025 is a significant one for the cryptocurrency community. Understanding the implications of this event requires researching the specifics of the halving cycle. For a detailed analysis of this pivotal moment, check out this informative resource on 2025 Halving Bitcoin , which provides valuable insights. Ultimately, the 2025 halving will undoubtedly shape the future trajectory of Bitcoin’s price and overall market dynamics.

The question of whether Bitcoin will halve in 2025 is a significant one for the cryptocurrency community. Understanding the implications of this event requires researching the specifics of the halving cycle. For a detailed analysis of this pivotal moment, check out this informative resource on 2025 Halving Bitcoin , which provides valuable insights. Ultimately, the 2025 halving will undoubtedly shape the future trajectory of Bitcoin’s price and overall market dynamics.

The question of whether Bitcoin will halve in 2025 is a significant one for the cryptocurrency community. Understanding the implications of this event requires researching the specifics of the halving cycle. For a detailed analysis of this pivotal moment, check out this informative resource on 2025 Halving Bitcoin , which provides valuable insights. Ultimately, the 2025 halving will undoubtedly shape the future trajectory of Bitcoin’s price and overall market dynamics.