March 2025 Bitcoin Price Prediction

Bitcoin, since its inception in 2009, has demonstrated remarkable growth alongside extreme volatility. Its journey from a niche digital currency to a globally recognized asset class has been marked by periods of explosive gains and significant price corrections. Understanding its price trajectory requires analyzing a complex interplay of factors, making accurate long-term predictions inherently challenging.

Bitcoin’s price is influenced by a multitude of intertwined elements. Market sentiment, driven by news cycles, technological developments, and investor confidence, plays a crucial role. Positive news, such as widespread adoption by major corporations or positive regulatory developments, tends to boost prices, while negative news, like regulatory crackdowns or security breaches, can trigger sharp declines. Furthermore, technological advancements within the Bitcoin ecosystem, such as scaling solutions or the emergence of new applications, can significantly impact its value proposition and, consequently, its price. Regulatory changes, both at national and international levels, exert considerable influence, shaping the legal framework surrounding Bitcoin and impacting investor participation.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is not determined by a single factor but rather a complex interplay of economic, technological, and regulatory forces. For instance, macroeconomic conditions, such as inflation rates and interest rate changes, can impact investor appetite for riskier assets like Bitcoin. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation, leading to increased demand and higher prices. Conversely, rising interest rates, making traditional investments more attractive, could lead to decreased demand and lower prices for Bitcoin. Similarly, technological developments, such as the implementation of the Lightning Network to improve transaction speeds and reduce fees, can positively influence Bitcoin’s adoption and price. Conversely, significant security breaches or scaling limitations could negatively affect its price. Finally, regulatory decisions, such as the classification of Bitcoin as a security or commodity in different jurisdictions, have a direct impact on its accessibility and trading volume, influencing its price. The example of China’s crackdown on cryptocurrency trading in 2021 led to a significant drop in Bitcoin’s price, highlighting the impact of regulatory actions.

Understanding Price Prediction Limitations

Predicting Bitcoin’s price with certainty is inherently difficult, if not impossible. The cryptocurrency market is notoriously volatile and influenced by unpredictable events. While various analytical models and indicators exist, they offer only probabilistic estimations, not guarantees. Past performance is not indicative of future results, and unforeseen events, such as significant geopolitical shifts or unexpected technological breakthroughs, can drastically alter the price trajectory. Any prediction should be treated with a healthy dose of skepticism, recognizing the inherent uncertainty involved. For example, predictions made in early 2021 anticipating Bitcoin reaching $100,000 by the end of the year proved inaccurate due to unforeseen market corrections. Therefore, focusing on a thorough understanding of the factors influencing Bitcoin’s price and accepting the inherent limitations of prediction models is crucial for informed decision-making.

Analyzing Historical Bitcoin Price Trends: March 2025 Bitcoin Prediction

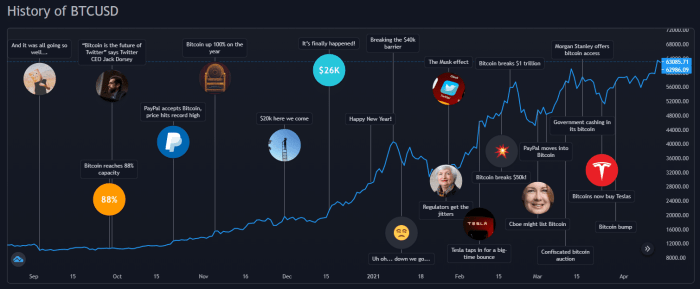

Bitcoin’s price history is characterized by extreme volatility, marked by periods of dramatic growth (“bull runs”) followed by sharp corrections (“bear markets”). Understanding these fluctuations is crucial for any attempt to predict future price movements, even if such predictions remain inherently uncertain. Analyzing past trends, however, allows us to identify potential patterns and inform our understanding of market sentiment and influencing factors.

Analyzing past price movements reveals a pattern of cyclical behavior, though the duration and intensity of these cycles vary. Early Bitcoin adoption saw relatively slow growth, followed by periods of explosive gains punctuated by significant corrections. Major events, such as regulatory announcements, technological upgrades, and macroeconomic shifts, have often acted as catalysts for these price swings.

Bitcoin Price Fluctuations and Significant Events

Several significant events have profoundly impacted Bitcoin’s price. The 2017 bull run, for instance, saw Bitcoin’s price surge to nearly $20,000, driven by increasing mainstream adoption and speculation. This was followed by a prolonged bear market that lasted until late 2019. The 2020-2021 bull run, fueled by institutional investment and the COVID-19 pandemic’s impact on global economies, saw Bitcoin reach an all-time high exceeding $60,000. Subsequent corrections have brought the price down significantly, highlighting the inherent risk associated with Bitcoin investment. Each of these cycles involved a complex interplay of factors, including technological advancements, regulatory developments, macroeconomic conditions, and investor sentiment.

Bitcoin’s Price Performance in Previous March Periods

Examining Bitcoin’s price behavior in previous March periods reveals mixed results. Some Marches have seen significant price increases, while others have witnessed substantial declines or periods of sideways trading. For example, March 2020 saw a significant price drop alongside the initial COVID-19 market crash. Conversely, March 2021 saw a period of significant price growth as the bull market continued. This lack of consistent performance underscores the difficulty in predicting future price movements based solely on past March data. Analyzing the specific economic and market conditions surrounding each March is essential for a more nuanced understanding.

Recurring Patterns or Trends in Bitcoin’s Price Movements, March 2025 Bitcoin Prediction

While precise prediction is impossible, certain recurring patterns emerge from Bitcoin’s price history. One observable pattern is the cyclical nature of bull and bear markets. These cycles typically involve periods of rapid price appreciation followed by significant corrections, often driven by shifts in investor sentiment and market speculation. Another pattern is the influence of major events, such as regulatory changes or technological upgrades, on price volatility. While these events don’t always trigger predictable price movements, they frequently act as catalysts for significant shifts in market sentiment and price action. Identifying these patterns, however, should not be interpreted as a guarantee of future performance; rather, it serves as a tool for understanding the dynamics of the Bitcoin market.

March 2025 Bitcoin Prediction – Predicting Bitcoin’s price in March 2025 is challenging, influenced by numerous factors. A key element impacting this prediction is the anticipated Bitcoin Halving in 2024, which will significantly alter the supply dynamics. For detailed analysis on this crucial event, check out the insightful predictions available at Bitcoin Halving 2025 Predictions. Understanding the halving’s potential consequences is vital for forming a well-informed March 2025 Bitcoin price forecast.

Predicting Bitcoin’s price in March 2025 is inherently speculative, but a key factor influencing the forecast is the upcoming halving event. To understand its potential impact, it’s crucial to first grasp the mechanics of the halving; for a comprehensive explanation, check out this resource: What Is Bitcoin Halving 2025?. Understanding the halving’s effect on Bitcoin supply helps refine any March 2025 price prediction, though external market forces will still play a significant role.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key element to consider is the impact of the upcoming Bitcoin halving, and for insightful discussions on this, check out the lively debate on Bitcoin Halving Prediction 2025 Reddit. Understanding the predicted effects of the halving is crucial for formulating a more comprehensive March 2025 Bitcoin price prediction.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by numerous factors. A key event impacting the prediction is the upcoming Bitcoin halving, significantly affecting the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, you might find this resource helpful: Wann Bitcoin Halving 2025. Therefore, understanding the halving’s date is vital for any accurate March 2025 Bitcoin price prediction.

Predicting Bitcoin’s price in March 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the interplay between Bitcoin and other cryptocurrencies, like Ethereum, is crucial for accurate forecasting. For detailed analysis on the relationship between the Bitcoin halving and Ethereum’s potential influence, check out this insightful resource: Bitcoin Halving 2025 Ethereum.

Ultimately, the March 2025 Bitcoin prediction will depend on various market forces, but the halving’s effect is undeniable.

March 2025 Bitcoin predictions are highly speculative, but many analysts anticipate significant price movements. A key factor influencing these predictions is the anticipated Bitcoin Halving in 2024, which many believe will trigger a bull run as discussed in this insightful article: Bitcoin Halving 2025 Bullrun. Therefore, understanding the potential impact of the halving is crucial for forming a well-rounded March 2025 Bitcoin prediction.