Economic Factors Influencing the 2025 Halving

The 2025 Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, will undoubtedly be influenced by prevailing macroeconomic conditions. Understanding the interplay between global economic trends and Bitcoin’s price is crucial for predicting its potential trajectory post-halving. The economic landscape in 2025 will significantly shape investor sentiment and market dynamics, ultimately affecting Bitcoin’s value.

Macroeconomic Environment’s Impact on Bitcoin’s Price

The macroeconomic environment exerts considerable influence on Bitcoin’s price. Periods of economic uncertainty, such as high inflation or recessionary fears, often drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation or a safe haven. Conversely, a robust and stable economy might lead investors to favor traditional assets, potentially reducing demand for Bitcoin. The overall global economic health, encompassing factors like GDP growth, employment rates, and geopolitical stability, will play a vital role in determining Bitcoin’s appeal. For example, the 2020 halving coincided with the early stages of the COVID-19 pandemic and subsequent economic stimulus packages, contributing to a significant price surge. However, the following years saw price corrections influenced by macroeconomic factors like rising inflation and interest rates.

Key Economic Indicators Influencing Bitcoin’s Value

Several key economic indicators will likely influence Bitcoin’s price around the 2025 halving. Inflation rates, directly impacting purchasing power, are critical. High inflation could bolster Bitcoin’s appeal as an inflation hedge, driving up demand. Interest rates, set by central banks, also play a significant role. Higher interest rates typically increase the opportunity cost of holding Bitcoin, potentially reducing its price as investors shift to higher-yielding assets. Additionally, indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and Gross Domestic Product (GDP) growth will influence investor confidence and overall market sentiment, which in turn impacts Bitcoin’s price. Furthermore, the strength of the US dollar, a dominant global currency, will impact Bitcoin’s value, as Bitcoin is often priced in USD.

Comparison with Previous Halvings’ Economic Climates

Comparing the economic climate leading up to the 2025 halving with those preceding previous halvings offers valuable insights. The 2012 halving occurred during a period of relatively stable economic growth. The 2016 halving followed a period of global economic uncertainty and volatility. The 2020 halving coincided with the COVID-19 pandemic and unprecedented government intervention in the economy. Analyzing these past events helps us understand how different macroeconomic scenarios have impacted Bitcoin’s price trajectory post-halving. This historical context provides a framework for formulating potential scenarios for 2025.

Effects of Inflation, Interest Rates, and Recessionary Pressures

Inflation, interest rates, and recessionary pressures significantly impact Bitcoin’s price. High inflation could drive investors towards Bitcoin as a store of value, potentially increasing its price. However, concurrently high interest rates might counteract this effect, as investors seek higher returns in traditional markets. Recessionary pressures, on the other hand, could lead to increased risk aversion and capital flight into safe-haven assets, potentially benefiting Bitcoin. The interplay of these factors determines the net effect on Bitcoin’s price. The 2022 economic slowdown, characterized by high inflation and rising interest rates, demonstrated this complex interplay.

Hypothetical Scenario: Economic Conditions and Bitcoin’s Price

Let’s consider a hypothetical scenario. Assume a moderate inflationary environment in 2025, with interest rates remaining relatively stable. This scenario suggests a less volatile market, with investors gradually shifting towards Bitcoin due to its perceived inflation-hedging properties. The halving event, reducing the supply of new Bitcoins, could further amplify this effect, potentially leading to a gradual, sustained price increase post-halving. Conversely, a scenario with high inflation and aggressively rising interest rates could suppress Bitcoin’s price as investors prioritize higher-yielding, less volatile assets. The exact outcome depends on the balance between these competing forces. A severe recession could potentially lead to a significant price drop initially, followed by a gradual recovery as Bitcoin’s scarcity becomes more prominent.

Technological Developments and Bitcoin’s Future

The 2025 Bitcoin halving is not merely a reduction in block rewards; it’s a catalyst for potential technological advancements and shifts in the broader cryptocurrency landscape. The period leading up to and following this event will likely be characterized by significant developments impacting Bitcoin’s scalability, adoption, and overall value.

Anticipated Technological Advancements

Several technological advancements are anticipated before and after the 2025 halving. These range from improvements in layer-2 scaling solutions to advancements in mining hardware and network security. For instance, we can expect continued refinement of existing layer-2 solutions like the Lightning Network, potentially leading to increased transaction throughput and reduced fees. Furthermore, research into new consensus mechanisms and more energy-efficient mining technologies could emerge, addressing some of Bitcoin’s current limitations. The development of improved privacy-enhancing technologies could also become more prevalent, attracting a wider range of users concerned about transaction transparency.

Impact of Layer-2 Scaling Solutions

Layer-2 scaling solutions like the Lightning Network aim to alleviate Bitcoin’s scalability challenges by processing transactions off-chain. This reduces the load on the main blockchain, thereby lowering transaction fees and increasing the number of transactions the network can handle per second. Successful implementation and widespread adoption of these solutions could significantly improve Bitcoin’s usability for everyday transactions, potentially making it more competitive with traditional payment systems. The increased efficiency could also contribute to a more robust and resilient network overall. For example, if the Lightning Network’s capacity increases tenfold, we could see a dramatic decrease in transaction fees, making microtransactions feasible and boosting Bitcoin’s utility in everyday commerce.

Comparison of Bitcoin’s Network Across Halvings

Comparing Bitcoin’s network state across previous halvings reveals a pattern of increased network hash rate, growing adoption, and subsequent price appreciation (although correlation does not imply causation). Before the 2012 halving, Bitcoin was largely a niche technology; after the halving, its popularity grew significantly. Similarly, the 2016 halving was followed by another surge in adoption and price. While the specifics differ between halving cycles, a consistent theme is the increase in network security and resilience as the hash rate increases, demonstrating the network’s growing robustness. This increased security and the reduced inflation rate resulting from the halving are often cited as factors contributing to price increases. However, it is important to note that external economic factors and market sentiment also play a significant role.

Institutional Adoption and Regulatory Changes

Institutional adoption and regulatory changes are intertwined factors that significantly impact Bitcoin’s price. Increased institutional investment, such as that from large corporations and investment firms, can drive demand and push the price upwards. Conversely, stringent regulatory frameworks, especially those hindering access or imposing heavy taxation, could dampen investor enthusiasm and potentially suppress price growth. For example, the entry of firms like MicroStrategy and Tesla into the Bitcoin market signaled a shift in institutional perception and drove a considerable price increase. Conversely, regulatory uncertainty in certain jurisdictions can create volatility and discourage investment.

Bitcoin’s Technological Evolution Across Halving Cycles

| Halving Year | Block Reward (BTC) | Average Transaction Fee (USD) | Notable Technological Developments |

|---|---|---|---|

| 2012 | 50 | Data unavailable | Early adoption, limited scaling solutions |

| 2016 | 25 | Data unavailable | SegWit activation, Lightning Network development |

| 2020 | 12.5 | Variable, but generally low | Increased Lightning Network adoption, Taproot upgrade |

| 2024 | 6.25 | Expected to remain relatively low, potentially decreasing with further L2 development | Continued L2 development, potential for further upgrades |

Investing in Bitcoin Before and After the Halving: Next Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically precedes periods of price volatility and potential significant price appreciation. Understanding the risks and rewards associated with investing in Bitcoin, particularly around this event, is crucial for informed decision-making. This section explores various investment strategies, successful and unsuccessful examples from past halvings, comparative returns against other assets, and a step-by-step guide for beginners.

Risks and Rewards of Bitcoin Investment

Investing in Bitcoin carries substantial risks and potential rewards. The cryptocurrency market is notoriously volatile, subject to rapid price swings driven by factors such as regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. The decentralized nature of Bitcoin, while a strength, also means it’s less regulated than traditional assets, increasing its susceptibility to scams and manipulation. However, the potential for high returns, stemming from its scarcity and growing adoption as a store of value and a medium of exchange, attracts many investors. The limited supply of 21 million Bitcoins contributes to its perceived long-term value proposition. Past halving events have often been followed by significant price increases, although this is not guaranteed to repeat. Therefore, a thorough understanding of market dynamics and risk tolerance is paramount before investing.

Investment Strategies Around the Halving

Navigating the market volatility around the halving requires a strategic approach. Some investors adopt a “buy-and-hold” strategy, accumulating Bitcoin over time and weathering short-term fluctuations. Others employ dollar-cost averaging (DCA), investing a fixed amount at regular intervals, mitigating the risk of investing a lump sum at a market peak. More sophisticated strategies include leveraging technical analysis to identify potential entry and exit points, or employing algorithmic trading to automate investment decisions. However, these strategies demand significant market expertise and can be highly risky. Risk management techniques, such as setting stop-loss orders to limit potential losses, are crucial for all strategies.

Examples of Successful and Unsuccessful Bitcoin Investment Strategies

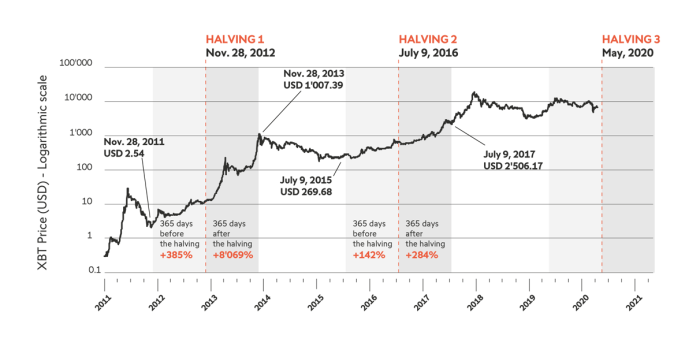

The 2012 and 2016 halvings provide valuable case studies. Investors who held Bitcoin throughout these periods experienced significant gains. For instance, an investment of $100 in Bitcoin before the 2012 halving could have been worth thousands of dollars by the end of 2013. Conversely, investors who bought near the peak of the bull market following a halving and then sold during a subsequent correction experienced significant losses. Those who panic-sold during periods of market downturn missed out on substantial long-term gains. These examples highlight the importance of patience, risk management, and a long-term investment horizon.

Bitcoin Returns Compared to Other Asset Classes

Comparing Bitcoin’s potential returns to other asset classes like stocks, bonds, and gold requires a long-term perspective. While Bitcoin’s volatility makes direct comparison challenging, historical data suggests that its potential returns over extended periods could surpass traditional assets, albeit with substantially higher risk. However, past performance is not indicative of future results. Diversification across asset classes remains a crucial risk management strategy.

A Step-by-Step Guide for Beginners

Investing in Bitcoin involves several steps. Beginners should prioritize security and education.

- Research and Education: Understand the basics of Bitcoin, blockchain technology, and cryptocurrency markets. Utilize reputable sources and avoid misleading information.

- Choose a Reputable Exchange: Select a secure and regulated cryptocurrency exchange to buy and store your Bitcoin. Consider factors like security measures, fees, and user interface.

- Secure Your Bitcoin: Use a hardware wallet or a secure software wallet to store your Bitcoin offline. Never share your private keys with anyone.

- Start Small: Begin with a small investment amount that you can afford to lose. Avoid investing more than you can comfortably risk.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider diversifying your investments across different asset classes.

- Monitor Your Investments: Regularly monitor your Bitcoin holdings and the market conditions. Be prepared to adjust your strategy as needed.

The 2025 Halving

The 2025 Bitcoin halving represents a significant milestone, not just for the cryptocurrency itself, but for the broader landscape of digital assets and global finance. While short-term price volatility is expected, the long-term implications of this event are far-reaching and warrant careful consideration. The reduced supply of newly minted Bitcoin, coupled with potential increased demand, could act as a powerful catalyst for future growth.

The halving mechanism, built into Bitcoin’s core protocol, is designed to control inflation and ensure the long-term sustainability of the network. By reducing the rate at which new Bitcoin enters circulation, the halving event creates a predictable scarcity that can drive up its value over time. This inherent scarcity, combined with growing adoption and institutional interest, could solidify Bitcoin’s position as a store of value and a hedge against inflation.

Bitcoin’s Mainstream Potential

The 2025 halving could accelerate Bitcoin’s journey towards mainstream adoption. Increased media attention surrounding the event, coupled with potential price appreciation, may attract a wider range of investors, from individual retail investors to large institutional players. This influx of capital could further bolster Bitcoin’s price and solidify its position as a viable alternative asset class. We can look at the previous halvings as evidence: each halving has historically been followed by a period of significant price appreciation, suggesting a potential repeat in 2025. However, it’s crucial to remember that external factors, such as regulatory changes and macroeconomic conditions, can also influence Bitcoin’s price trajectory.

Bitcoin’s Long-Term Growth Compared to Other Digital Assets

While Bitcoin enjoys a significant first-mover advantage and established brand recognition, its long-term growth trajectory isn’t guaranteed to outpace all other digital assets. Altcoins, with their varying functionalities and technological advancements, present competition. However, Bitcoin’s established network effect, security, and brand recognition provide a strong foundation for continued growth. The comparison is complex, dependent on the specific altcoin and the evolving technological landscape. Some altcoins might experience periods of rapid growth, driven by innovative features or specific market trends. Yet, Bitcoin’s inherent scarcity and established position in the market provide a significant competitive edge.

The Scarcity Factor and its Impact on Bitcoin’s Value, Next Bitcoin Halving 2025

Bitcoin’s fixed supply of 21 million coins is a cornerstone of its value proposition. This inherent scarcity is a crucial differentiator from fiat currencies, which can be printed at will, potentially leading to inflation. The halving mechanism reinforces this scarcity, reducing the rate of new Bitcoin creation over time. This controlled supply, coupled with growing demand, is a primary driver of Bitcoin’s value. The scarcity principle is well-established in economics; rare and desirable items tend to command higher prices. This fundamental economic principle applies directly to Bitcoin, making its long-term value potential significant.

Projected Growth Trajectory of Bitcoin Post-Halving

A text-based representation of Bitcoin’s projected growth trajectory post-halving would resemble a gradually ascending curve. The curve would be relatively smooth, reflecting the expectation of sustained, albeit not necessarily linear, growth. Immediately following the halving, there might be a period of consolidation or even slight price correction, before the upward trend resumes. The curve would not be a straight line, reflecting the inherent volatility of the cryptocurrency market. Periods of increased adoption and positive market sentiment would likely cause steeper inclines, while periods of uncertainty or negative news might lead to temporary plateaus or minor dips. However, the overall trajectory would remain positive, reflecting the long-term bullish sentiment surrounding Bitcoin’s scarcity and its potential as a store of value. Think of it as a mountain range, with several peaks and valleys, but the overall trend is upward. The height of the peaks and depth of the valleys would depend on various macroeconomic and market factors.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the upcoming Bitcoin halving in 2025, providing clarity on the mechanism, its historical impact, and associated investment considerations. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market.

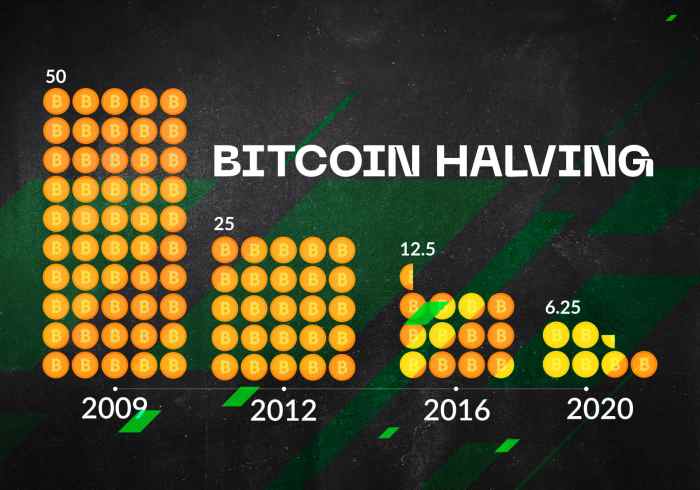

Bitcoin Halving Mechanism and Purpose

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin, mirroring the scarcity of precious metals like gold. The initial reward was 50 BTC per block, and it has been halved three times already, currently standing at 6.25 BTC per block. The halving ensures a predictable and controlled supply of Bitcoin over time.

Expected Timing of the 2025 Halving

While the exact date depends on the block generation time, which can fluctuate slightly, the 2025 Bitcoin halving is anticipated to occur sometime in the spring or early summer of 2025. Precise predictions are difficult due to the variability in block times, but most estimates point to a timeframe around April or May 2025. Tracking the block height approaching the halving threshold provides a more accurate prediction as the event approaches.

Impact of the Halving on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The reduced supply of newly minted Bitcoin, coupled with consistent or increasing demand, can create upward pressure on the price. However, it’s crucial to understand that this correlation isn’t guaranteed. Other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also significantly influence Bitcoin’s price. The 2012 and 2016 halvings, for instance, were followed by substantial price increases, although the timing and magnitude of the price movements varied.

Investment Considerations Before the Halving

Investing in Bitcoin before a halving presents both potential rewards and significant risks. The anticipation of a price increase due to the reduced supply can lead to increased demand and price appreciation. However, the cryptocurrency market is highly volatile, and prices can fluctuate dramatically. Investing before a halving requires careful consideration of your risk tolerance and investment goals. Diversification across various asset classes is a prudent strategy to mitigate potential losses. Thorough research and understanding of the underlying technology and market dynamics are also crucial.

Potential Risks of Investing in Bitcoin

Bitcoin’s price is notoriously volatile, subject to sharp and unpredictable swings. Market manipulation, regulatory uncertainty, security breaches, and technological advancements can all impact its price. Furthermore, Bitcoin is a relatively new asset class, and its long-term performance is uncertain. The lack of intrinsic value, unlike traditional assets like stocks or bonds, adds another layer of risk. Investors should be prepared for the possibility of significant losses and only invest what they can afford to lose.