What is Bitcoin Halving?

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial part of Bitcoin’s design, intended to control inflation and maintain scarcity.

The halving mechanism works by cutting the block reward—the amount of Bitcoin miners receive for successfully adding a block of transactions to the blockchain—in half. This directly impacts the supply of Bitcoin entering circulation, making it a deflationary asset in the long term.

Bitcoin Halving History and Price Effects

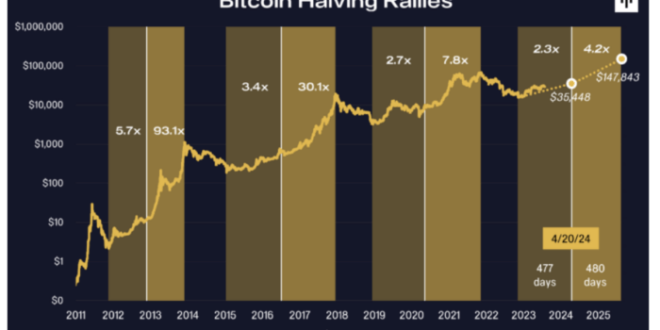

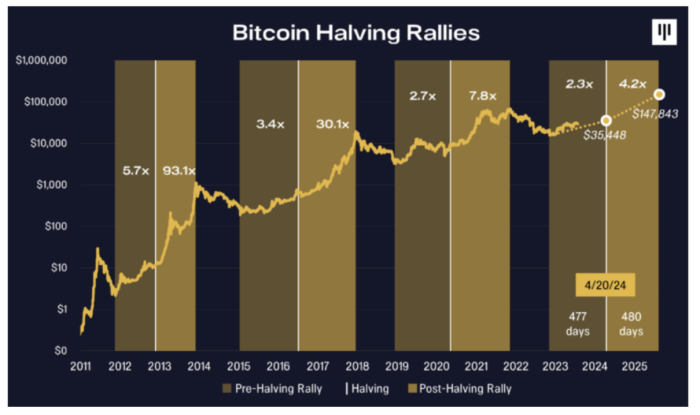

The Bitcoin halving events have occurred three times previously: in November 2012, July 2016, and May 2020. Each halving has been followed by a period of significant price appreciation, although the timing and magnitude of these price increases have varied. The 2012 halving saw a gradual price increase, while the 2016 and 2020 halvings led to more dramatic price surges, although other factors certainly contributed to these price movements. It’s important to note that correlation does not equal causation; while price increases often followed halvings, other market forces play a significant role.

Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is impossible, as numerous factors influence Bitcoin’s price. However, based on previous halvings and current market conditions, many analysts anticipate a potential price increase. The reduced supply of newly mined Bitcoin, combined with potentially increasing demand, could create upward pressure on the price. However, macroeconomic conditions, regulatory changes, and overall market sentiment will all play a crucial role in determining the actual outcome. The 2025 halving might see a more muted price reaction than previous halvings if the overall crypto market sentiment is bearish, or a more pronounced reaction if bullish sentiment prevails.

Bitcoin Halving Timeline

The following timeline illustrates key dates and events related to Bitcoin halvings:

| Date | Event |

|---|---|

| January 3, 2009 | Bitcoin Genesis Block |

| November 28, 2012 | First Halving (Block Reward: 25 BTC → 12.5 BTC) |

| July 9, 2016 | Second Halving (Block Reward: 12.5 BTC → 6.25 BTC) |

| May 11, 2020 | Third Halving (Block Reward: 6.25 BTC → 3.125 BTC) |

| April 2024 (estimated) | Last Block of 6.25 BTC reward mined |

| March/April 2025 (estimated) | Fourth Halving (Block Reward: 3.125 BTC → 1.5625 BTC) |

Bitcoin Block Reward Reduction

The following text describes a visual representation showing the decrease in Bitcoin block rewards over time. Imagine a graph with the x-axis representing time (in years, starting from 2009) and the y-axis representing the block reward (in BTC). The graph would show a step function, with a sharp decrease in the block reward every four years. The steps would be at 50 BTC (initial reward), 25 BTC, 12.5 BTC, 6.25 BTC, 3.125 BTC, and finally 1.5625 BTC after the 2025 halving. The graph clearly illustrates the halving mechanism’s impact on the rate of new Bitcoin creation.

Bitcoin Halving 2025: O Que É O Halving Bitcoin 2025

The Bitcoin halving, a programmed event reducing the block reward for miners by half, is anticipated to occur in 2025. This event has historically been associated with significant price movements in Bitcoin, making its impact in 2025 a subject of intense speculation and analysis within the cryptocurrency community. Understanding the potential consequences requires considering a multitude of factors, from expert opinions to macroeconomic trends and the behavior of key market players.

Bitcoin Price Predictions Post-Halving 2025

Numerous analysts and experts offer varying predictions regarding Bitcoin’s price following the 2025 halving. These predictions often fall into bullish, bearish, or neutral categories, each supported by specific arguments and underlying assumptions. The lack of perfect predictability underscores the inherent volatility of the cryptocurrency market.

- Bullish Predictions: Many believe the halving will create scarcity, driving up demand and subsequently, the price. Some analysts predict prices exceeding $100,000 or even higher, based on historical precedent and the anticipated increase in demand exceeding the reduced supply. This argument is often supported by the analysis of previous halving cycles, where a significant price surge followed each event. For example, the 2012 and 2016 halvings were followed by substantial price increases, albeit with varying timeframes.

- Bearish Predictions: Conversely, some analysts hold a bearish outlook. They argue that macroeconomic factors, such as regulatory uncertainty, global economic downturns, or competition from alternative cryptocurrencies, could overshadow the halving’s impact. These analysts might point to instances where anticipated price increases failed to materialize due to external market forces. For instance, the overall market sentiment during a particular period could negatively affect Bitcoin’s price, irrespective of the halving event.

- Neutral Predictions: A neutral stance suggests that the halving’s impact on price will be less dramatic than often predicted. This perspective emphasizes the complexity of the cryptocurrency market, where multiple factors beyond the halving itself influence price fluctuations. Proponents of this view often highlight the unpredictable nature of market sentiment and the influence of external events, suggesting that the halving might only be one factor among many.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions play a significant role in influencing Bitcoin’s price. Factors such as inflation rates, interest rates, and global economic growth can significantly impact investor sentiment and investment flows into Bitcoin. For example, during periods of high inflation, Bitcoin is often viewed as a hedge against inflation, potentially driving up demand. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin towards more stable, interest-bearing instruments. The overall global economic climate in 2025 and beyond will be a crucial determinant of Bitcoin’s price trajectory.

Institutional Investment and Bitcoin’s Price

The growing participation of institutional investors in the Bitcoin market is another critical factor. Increased institutional adoption could lead to greater price stability and potentially higher valuations. Large-scale investments by institutions can provide a significant boost to demand, particularly if these investments are sustained over time. However, institutional investors are also sensitive to regulatory changes and macroeconomic conditions, which could affect their investment strategies and, consequently, Bitcoin’s price. The level of institutional investment in 2025 will be a key indicator of Bitcoin’s future price trajectory.

Miners’ Response to Reduced Block Reward

The halving directly impacts Bitcoin miners by reducing their block reward. This necessitates adjustments in their operational strategies to maintain profitability. Miners might respond by: increasing their hashing power to maintain their share of block rewards, improving energy efficiency to lower operating costs, or consolidating operations to achieve economies of scale. Some less efficient miners might be forced to exit the market, leading to a decrease in the total hash rate, which could affect network security and potentially impact the price. The industry’s response to this reduced reward will be a significant factor to watch in 2025.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving of 2025, reducing the block reward from 6.25 BTC to 3.125 BTC, presents significant challenges and opportunities for Bitcoin miners. This event fundamentally alters the economics of Bitcoin mining, forcing miners to adapt and innovate to maintain profitability. The consequences extend beyond individual miners, impacting the overall health and decentralization of the Bitcoin network.

The reduced block reward directly impacts miner revenue. This necessitates adjustments in operational strategies to ensure continued profitability, and potentially leads to a reshaping of the mining landscape.

Challenges Faced by Bitcoin Miners

The most immediate challenge is the halved income stream. Miners will receive significantly less Bitcoin for each block they successfully mine. This reduction necessitates either increased efficiency, a rise in the Bitcoin price, or a combination of both to maintain profitability. The profitability of mining is a delicate balance between the cost of electricity, hardware maintenance, and the value of the Bitcoin earned. A drop in Bitcoin’s price alongside the halving could force many less efficient or higher-cost miners out of the market. This could lead to a consolidation of mining power in the hands of larger, more efficient operations.

Strategies for Maintaining Miner Profitability

Miners will likely pursue several strategies to offset the reduced block reward. These include upgrading to more energy-efficient mining hardware, negotiating lower electricity costs, diversifying revenue streams (such as offering hosting services), and focusing on operations in regions with favorable regulatory environments and lower energy prices. Furthermore, strategic collaborations and mergers could allow for economies of scale, increasing efficiency and reducing overhead. Some miners may also explore alternative consensus mechanisms or layer-2 solutions to generate additional revenue.

Energy Consumption Before and After the Halving

While the halving itself doesn’t directly reduce energy consumption per block mined, it may indirectly influence it. The reduced profitability could force less efficient miners to shut down, leading to a decrease in overall network energy consumption. However, this effect depends heavily on the Bitcoin price and the adoption of more energy-efficient hardware. If the Bitcoin price remains high, the incentive to mine with newer, more efficient equipment remains strong, potentially offsetting any reduction from less efficient miners leaving the network. A scenario where the price significantly drops post-halving could see a sharper decrease in energy usage as less profitable operations become unsustainable.

Impact of the Halving on Decentralization

The halving’s impact on decentralization is complex and uncertain. The potential exit of smaller miners due to reduced profitability could lead to a more centralized mining landscape, dominated by larger mining pools with greater hashing power. This could raise concerns about the network’s resilience to attacks and censorship. However, the development and adoption of more energy-efficient mining hardware could potentially counteract this effect by lowering the barrier to entry for smaller miners. Furthermore, the geographical distribution of mining operations will play a significant role in determining the overall decentralization of the network.

Effect of Varying Bitcoin Prices on Miner Profitability

The Bitcoin price is the crucial variable influencing miner profitability after the halving. Let’s consider hypothetical scenarios:

Scenario 1: Bitcoin price remains stable or increases slightly. In this case, the reduced block reward might be offset by the higher value of each Bitcoin earned, maintaining or even improving profitability for efficient miners.

Scenario 2: Bitcoin price drops significantly. This scenario would severely impact miner profitability. Many miners, especially those with higher operational costs, would likely become unprofitable and be forced to shut down. This could lead to a significant reduction in the network’s hash rate and potentially threaten network security.

Scenario 3: Bitcoin price drops moderately. This could result in a shakeout of less efficient miners, leading to a more consolidated mining industry with higher average efficiency.

These scenarios highlight the critical dependence of miner profitability on the Bitcoin price, making accurate prediction extremely challenging. The interplay between the halving’s impact and the price of Bitcoin will determine the ultimate outcome for Bitcoin miners and the network’s overall health.

Bitcoin Halving and its Effect on the Crypto Market

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically exerted a significant influence on the broader cryptocurrency market. The 2025 halving is anticipated to be no different, potentially triggering a cascade of effects across various digital assets and investor sentiment. Understanding these potential impacts is crucial for navigating the market effectively.

Ripple Effects on the Cryptocurrency Market

The 2025 halving’s impact will likely extend beyond Bitcoin itself. Reduced Bitcoin supply, coupled with anticipated increased demand, could lead to price appreciation. This, in turn, could positively influence the overall market sentiment, potentially boosting the prices of altcoins (alternative cryptocurrencies) as investors seek diversification and exposure to the broader crypto space. However, the correlation isn’t always direct; previous halvings have shown periods of both positive and negative correlation between Bitcoin’s price and altcoin performance. The extent of this ripple effect will depend on several factors, including the overall macroeconomic climate, regulatory developments, and prevailing investor confidence. For example, during the 2021 bull market, the altcoin market generally followed Bitcoin’s upward trajectory, but this wasn’t universally true across all altcoins.

Comparison of Market Sentiment Across Halvings

Market sentiment surrounding previous halvings has varied considerably. The 2012 halving occurred during the early days of Bitcoin, with a relatively smaller market capitalization and limited awareness. The 2016 halving saw a more pronounced price increase following the event, but this was also influenced by increasing institutional interest and broader adoption. The 2020 halving coincided with a period of increasing institutional investment and a growing understanding of Bitcoin as a store of value, leading to a significant price surge. Currently, the market is more mature and sophisticated than in previous cycles. While the anticipation for the 2025 halving is palpable, the overall market sentiment is influenced by macroeconomic factors like inflation and interest rates, alongside regulatory uncertainty. This complex interplay makes predicting the precise market reaction challenging.

Opportunities and Risks for Investors, O Que É O Halving Bitcoin 2025

The period leading up to and following the 2025 halving presents both significant opportunities and substantial risks for cryptocurrency investors. Potential opportunities include the possibility of increased Bitcoin price appreciation, leading to gains for holders. Furthermore, the potential for altcoins to experience price increases alongside Bitcoin offers diversification opportunities. However, risks include the potential for market corrections, price volatility, and the inherent risks associated with investing in a relatively nascent and volatile asset class. Investors should carefully assess their risk tolerance and diversify their portfolios accordingly. Past performance is not indicative of future results, and the impact of the halving could be different from previous cycles. For example, a sudden influx of sell orders could counteract the bullish pressure from reduced supply.

Anticipated Impact on Different Crypto Market Segments

| Market Segment | Anticipated Impact (Pre-Halving) | Anticipated Impact (Post-Halving) | Potential Risks | Potential Opportunities |

|—————————–|———————————|———————————–|————————————–|————————————|

| Bitcoin | Price appreciation, increased volatility | Continued price appreciation (potentially), decreased volatility | Market correction, regulatory uncertainty | Significant price gains, long-term store of value |

| Altcoins | Increased volatility, potential price increases correlated with Bitcoin | Variable performance, potential for outperformance or underperformance | Market correction, lack of adoption | High growth potential, diversification benefits |

| DeFi (Decentralized Finance) | Increased trading volume, potential for higher yields | Increased usage, potential for higher yields | Smart contract vulnerabilities, regulatory scrutiny | Growth in decentralized applications and services |

| NFTs (Non-Fungible Tokens) | Increased trading volume, potential for higher prices | Variable performance, potential for increased adoption | Market saturation, regulatory uncertainty | Potential for high returns on unique and desirable assets |

Frequently Asked Questions (FAQs) about Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. Understanding its mechanics and potential impacts is crucial for anyone involved in or observing the Bitcoin ecosystem. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created. This occurs every 210,000 blocks mined, roughly every four years. The halving mechanism is fundamental to Bitcoin’s deflationary nature, limiting the total supply to 21 million coins. Before the first halving in 2012, miners received 50 BTC per block. After the first halving, this reduced to 25 BTC, then to 12.5 BTC in 2020, and will be reduced to 6.25 BTC in 2024.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is anticipated to occur in 2024. The precise date depends on the rate of block creation, which can fluctuate slightly. However, based on historical data and current mining activity, a date sometime in the second half of 2024 is highly probable. Predicting the exact day with certainty is impossible given the variable nature of Bitcoin mining difficulty.

Halving’s Effect on Bitcoin Price

Historically, Bitcoin halvings have been followed by periods of price appreciation. The reduced supply of newly minted Bitcoin, coupled with continued or increased demand, can exert upward pressure on the price. However, it’s crucial to remember that price is influenced by many factors beyond the halving, including market sentiment, regulatory changes, and macroeconomic conditions. The 2012 and 2016 halvings were followed by significant price increases, but this doesn’t guarantee a similar outcome in 2024. Other market forces could easily override the halving’s effect.

Risks and Opportunities of the 2025 Halving

The 2024 halving presents both risks and opportunities. A potential risk is a significant price correction following the halving, if the anticipated price increase fails to materialize due to negative market sentiment or other factors. The opportunity lies in the potential for substantial price appreciation if demand remains strong or increases. Investors should carefully assess their risk tolerance and investment strategy before making any decisions based on the anticipated halving. For example, an investor might choose to accumulate Bitcoin before the halving, anticipating a price increase, or might choose to wait and see the market’s reaction.

Impact on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. The reduced block reward means miners earn less Bitcoin per block mined. This can lead to increased mining difficulty as miners who are less efficient are forced to exit the market, and those who remain increase their hashrate to maintain profitability. Miners may need to adjust their operational costs or seek alternative revenue streams to remain profitable after the halving. The halving could lead to consolidation in the mining sector, with larger, more efficient mining operations gaining market share. For example, miners might invest in more energy-efficient equipment or explore alternative energy sources to reduce their operating costs.

Understanding “O Que É O Halving Bitcoin 2025” requires examining the halving’s impact on Bitcoin’s supply. This reduction in newly mined Bitcoin significantly affects its scarcity and potential price. For detailed figures and predictions, you can consult the comprehensive resource on Halving Bitcoin 2025 Data , which provides valuable insights into this key event. Ultimately, this data helps clarify the expected consequences of the 2025 halving on “O Que É O Halving Bitcoin 2025.”

Understanding “O Que É O Halving Bitcoin 2025” requires knowing the precise timing of the halving event. To clarify this crucial aspect of Bitcoin’s reward reduction schedule, you should consult a reliable source detailing the halving’s date, such as this helpful resource: When Was 2025 Bitcoin Halving. This information is essential for comprehending the impact of the 2025 Bitcoin halving on the cryptocurrency’s future price and overall market dynamics.

Understanding “O Que É O Halving Bitcoin 2025” involves grasping the halving mechanism, where Bitcoin’s block reward is cut in half. This event, anticipated in 2025, significantly impacts the cryptocurrency’s inflation rate. To gain insight into potential market effects, exploring predictions is crucial; for instance, check out this resource on Bitcoin Halving Price Prediction 2025 to better understand the expected price movements following the halving.

Ultimately, comprehending the halving’s implications requires a multifaceted approach, considering both the technical aspects and market speculation surrounding “O Que É O Halving Bitcoin 2025”.

Understanding “O Que É O Halving Bitcoin 2025” requires knowing the precise timing of the event. To clarify this, you should consult a reliable source for the date, such as this helpful resource on When Halving Bitcoin 2025 , which provides a clear answer. This date is crucial because the halving significantly impacts Bitcoin’s inflation rate and, consequently, its overall value, which is a key element in comprehending “O Que É O Halving Bitcoin 2025.”

Understanding the Bitcoin halving in 2025 (“O Que É O Halving Bitcoin 2025”) involves grasping its core mechanism: the reduction of newly mined Bitcoin. This event significantly impacts the cryptocurrency’s inflation rate. To determine the precise date of this crucial event, one needs to consult resources that track the Bitcoin blockchain, such as this helpful page on When Is Bitcoin 2025 Halving.

Knowing this date is key to predicting potential market effects related to “O Que É O Halving Bitcoin 2025”.

Understanding “O Que É O Halving Bitcoin 2025” requires grasping the core mechanism of Bitcoin’s reward system. Essentially, it refers to the scheduled reduction in Bitcoin’s block reward, an event that significantly impacts its supply. To learn more about this specific upcoming event, you can consult this resource on the Bitcoin Halving 2025 , which offers detailed information.

Ultimately, understanding this halving is key to comprehending “O Que É O Halving Bitcoin 2025” and its potential effects on the cryptocurrency’s value and future.