Plan B Bitcoin Price Prediction 2025

Plan B, a pseudonymous analyst, gained significant attention for his Bitcoin price predictions based on a model primarily utilizing on-chain metrics, specifically focusing on the stock-to-flow (S2F) model. This model posits a relationship between Bitcoin’s scarcity (stock) and its newly mined supply (flow), suggesting that as scarcity increases, so does its price. The model’s simplicity and apparent predictive power in previous cycles have garnered both considerable support and significant criticism.

Plan B’s model has enjoyed periods of accuracy, particularly in predicting Bitcoin’s price during certain phases of its growth. However, his predictions haven’t always been perfectly aligned with market realities. For instance, his predictions for late 2021 significantly overestimated Bitcoin’s price. This discrepancy highlights the limitations of any predictive model, especially in a volatile market like cryptocurrency. The accuracy of Plan B’s predictions is a subject of ongoing debate within the crypto community.

Plan B’s Model Assumptions

Plan B’s S2F model rests on several key assumptions. Primarily, it assumes a consistent relationship between Bitcoin’s scarcity and its price. It also assumes that market participants will consistently value Bitcoin based on its scarcity relative to its newly mined supply. Furthermore, the model simplifies a complex market, neglecting factors like regulatory changes, technological advancements, macroeconomic conditions, and market sentiment, all of which can significantly impact Bitcoin’s price. The model’s success hinges on the validity of these assumptions, which are constantly challenged by evolving market dynamics.

Factors Influencing Bitcoin’s Price

Numerous factors contribute to Bitcoin’s price volatility. These include macroeconomic conditions, such as inflation rates and interest rate adjustments by central banks. Regulatory developments, both positive and negative, significantly influence investor confidence and trading activity. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network, can also impact price through increased usability and transaction efficiency. Finally, market sentiment, driven by news events, social media trends, and overall investor confidence, plays a crucial role in price fluctuations. Understanding the interplay of these factors is essential for any accurate price prediction, a challenge that even sophisticated models like Plan B’s struggle to fully encompass.

Plan B’s Model and Methodology

Plan B’s Bitcoin price prediction model, popularized through his Twitter account and various online publications, relies on stock-to-flow (S2F) analysis. This model attempts to predict Bitcoin’s price based on its scarcity, measured by the ratio of its existing supply to its newly mined supply. It’s a relatively simple model, but its influence on the cryptocurrency community has been significant.

Plan B’s model posits a strong correlation between Bitcoin’s price and its stock-to-flow ratio. The underlying mathematical principle is that scarcer assets generally command higher prices, all else being equal. The S2F ratio quantifies this scarcity, providing a metric for predicting price movements based on the rate at which new Bitcoins are added to the circulating supply. The model uses historical Bitcoin price data to calibrate the relationship between S2F and price, and then extrapolates this relationship to predict future prices.

Model Generation and Prediction Steps

The model’s prediction generation involves several steps. First, the current stock (existing supply) and flow (newly mined supply) of Bitcoin are calculated. This data is readily available from blockchain explorers and other public sources. Next, the S2F ratio is calculated by dividing the stock by the flow. Then, a historical relationship between the S2F ratio and Bitcoin’s price is established using regression analysis. This analysis aims to find a mathematical function (often a power law) that best fits the historical data. Finally, this function is used to predict future prices based on projected future S2F ratios. These projections consider the known halving events, which reduce the rate of new Bitcoin creation. For example, if the model identifies a power law relationship and projects a higher S2F ratio in 2025, it would predict a correspondingly higher Bitcoin price.

Comparison with Other Models

Unlike more complex models incorporating macroeconomic factors, sentiment analysis, or technical indicators, Plan B’s model focuses solely on Bitcoin’s inherent scarcity. Other models might incorporate on-chain metrics such as transaction volume, active addresses, or mining difficulty. Some even attempt to incorporate broader economic factors like inflation rates or regulatory changes. These models often provide more nuanced predictions but are also considerably more complex and prone to greater uncertainty. Plan B’s simplicity is both its strength and its weakness. Its simplicity makes it easily understandable, but its narrow focus might overlook crucial market dynamics that other models consider.

Model Limitations and Biases

Plan B’s model is not without limitations. The most significant is its reliance on historical correlations. Past performance is not necessarily indicative of future results. The model assumes a consistent relationship between S2F and price, which may not hold true in the future. Furthermore, the model does not account for unforeseen events such as significant regulatory changes, major technological breakthroughs, or large-scale market manipulations that could drastically alter Bitcoin’s price trajectory. The model’s reliance on a power law relationship might also be considered a simplification, as the actual relationship between S2F and price could be more complex. Another potential bias stems from the selection of the historical data used for calibration. Different datasets might lead to different model parameters and, consequently, different predictions. Finally, the model’s simplicity overlooks the influence of market sentiment and speculation, which are significant drivers of Bitcoin’s price volatility.

Factors Affecting Bitcoin Price in 2025

Predicting the price of Bitcoin in 2025 is inherently complex, requiring consideration of numerous intertwined factors. While models like Plan B’s offer valuable insights, they are not exhaustive. A comprehensive analysis necessitates understanding the interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and market dynamics.

Macroeconomic Factors and Bitcoin Price

Global economic conditions significantly influence Bitcoin’s price. Periods of high inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and driving up the price. Conversely, periods of economic uncertainty or recession might lead to investors liquidating their Bitcoin holdings to cover losses in other asset classes, resulting in price drops. The strength of the US dollar, a dominant global currency, also plays a crucial role; a stronger dollar generally correlates with a weaker Bitcoin price, as investors might shift to the safer haven of the dollar. For example, the 2022 bear market coincided with rising interest rates and a strengthening dollar, impacting Bitcoin’s value.

Regulatory Developments and Bitcoin Valuation

Government regulations worldwide will profoundly shape Bitcoin’s future. Clear, consistent, and investor-friendly regulations could foster mainstream adoption and increase institutional investment, driving price appreciation. Conversely, overly restrictive or ambiguous regulations could stifle innovation and adoption, potentially suppressing price growth. The varying regulatory approaches across different jurisdictions – from outright bans to regulatory frameworks enabling Bitcoin trading and custody – will create diverse market conditions and influence price dynamics. The example of El Salvador’s adoption of Bitcoin as legal tender illustrates the potential positive impact of supportive government policies, although it is still early to determine the long-term effects on price.

Technological Advancements and Bitcoin’s Future Price

Technological advancements within the Bitcoin ecosystem can significantly influence its price. Improvements in scalability, transaction speed, and security (like the Lightning Network) could make Bitcoin more user-friendly and attractive to a broader audience. Conversely, the emergence of competing cryptocurrencies with superior technology could divert investment away from Bitcoin, potentially impacting its price negatively. The ongoing development of layer-2 solutions, for example, aims to address Bitcoin’s scalability limitations, potentially boosting its appeal and price.

Adoption Rates and Market Sentiment and Bitcoin’s Price Trajectory

The rate of Bitcoin adoption by individuals, businesses, and institutions is a key driver of price. Increased adoption translates to higher demand, potentially pushing prices upwards. Conversely, reduced adoption or negative market sentiment (fueled by news events or regulatory uncertainty) can lead to price declines. Social media sentiment, news coverage, and the overall perception of Bitcoin as an investment asset all play a significant role in shaping market sentiment and influencing price movements. The 2017 Bitcoin price surge, fueled by increased media attention and retail investor enthusiasm, serves as a prime example of how positive market sentiment can drive significant price appreciation.

| Factor | Potential Positive Influence | Potential Negative Influence | Example/Real-Life Case |

|---|---|---|---|

| Macroeconomic Factors | High inflation, economic growth | Recession, strong US dollar | 2022 bear market correlated with rising interest rates and a strengthening dollar. |

| Regulatory Developments | Clear, supportive regulations, institutional adoption | Restrictive or unclear regulations, bans | El Salvador’s adoption of Bitcoin as legal tender. |

| Technological Advancements | Improved scalability, security, user-friendliness | Emergence of competing cryptocurrencies with superior technology | Development of the Lightning Network. |

| Adoption Rates & Market Sentiment | Increased adoption, positive media coverage, investor enthusiasm | Reduced adoption, negative news, regulatory uncertainty | 2017 Bitcoin price surge driven by increased media attention and retail investor enthusiasm. |

Alternative Perspectives and Criticisms

Plan B’s Bitcoin price predictions, while influential, haven’t been without significant debate and criticism. Several analysts and commentators have presented alternative viewpoints, questioning the model’s assumptions and forecasting accuracy. This section explores these dissenting opinions and highlights key criticisms leveled against Plan B’s methodology.

Plan B’s stock-to-flow model, the foundation of his predictions, relies on the premise that Bitcoin’s scarcity, similar to precious metals, will drive its price upward. However, this analogy is far from universally accepted, and several alternative models exist that offer different price projections. These models incorporate factors beyond scarcity, such as adoption rates, regulatory changes, and macroeconomic conditions, leading to significantly divergent predictions.

Differing Viewpoints on Plan B’s Predictions

Many experts believe that relying solely on the stock-to-flow model is an oversimplification of a complex market. They argue that the model fails to account for significant external factors that influence Bitcoin’s price, such as market sentiment, technological advancements, and regulatory interventions. For example, while Plan B’s model predicted a significantly higher price for Bitcoin in 2021 than was ultimately realized, other models that considered market volatility and regulatory uncertainty offered more conservative, and arguably more accurate, forecasts. The divergence highlights the limitations of relying on a single, relatively simplistic model.

Criticisms of Plan B’s Methodology

One major criticism centers on the model’s reliance on historical data. Extrapolating past trends into the future, especially in a rapidly evolving market like cryptocurrencies, is inherently risky. The assumption of a consistent relationship between stock-to-flow and price may not hold true in the future, particularly given the potential for unforeseen technological breakthroughs or regulatory changes that could significantly impact Bitcoin’s trajectory. Furthermore, the model doesn’t inherently account for market manipulation or large-scale sell-offs, which can dramatically affect short-term price movements. For instance, the 2022 bear market significantly deviated from Plan B’s projections, illustrating the model’s limitations in capturing market volatility.

Uncertainties in Plan B’s Assumptions

The stock-to-flow model’s accuracy hinges on several crucial assumptions, some of which are highly debatable. The assumption of a constant halving cycle impacting Bitcoin’s scarcity, for example, ignores potential changes to the Bitcoin protocol itself. Furthermore, the model assumes a relatively stable and predictable adoption rate, which is a considerable simplification. Real-world adoption is influenced by a wide range of factors, including technological advancements, regulatory frameworks, and general economic conditions, making it difficult to accurately predict future adoption rates with certainty. The unpredictable nature of these factors introduces substantial uncertainty into the model’s projections.

Comparison with Other Experts’ Predictions

Other prominent analysts and firms offer significantly different Bitcoin price predictions for 2025. Some predictions are significantly lower than Plan B’s, while others are higher, depending on their chosen methodologies and underlying assumptions. These alternative models often incorporate more sophisticated statistical techniques, macroeconomic factors, and qualitative assessments of market sentiment, leading to a wider range of possible outcomes. For example, some analysts use econometric models that incorporate various economic indicators to forecast Bitcoin’s price, while others rely on technical analysis to identify potential price targets. The discrepancies between these predictions underscore the inherent uncertainty in forecasting cryptocurrency prices.

Potential Price Scenarios for Bitcoin in 2025

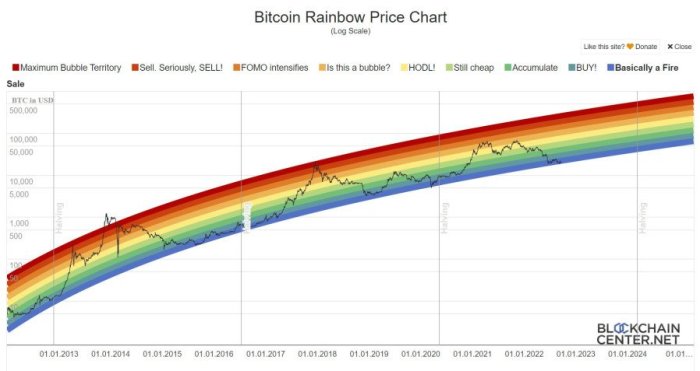

Predicting the price of Bitcoin in 2025 is inherently speculative, but by analyzing Plan B’s stock-to-flow model and considering other macroeconomic factors, we can construct plausible price scenarios. These scenarios are not guarantees, but rather illustrate potential outcomes based on different sets of assumptions. It’s crucial to remember that unforeseen events could significantly alter these projections.

Scenario 1: Bullish Market Continuation

This scenario assumes continued adoption of Bitcoin as a store of value and a medium of exchange, alongside sustained growth in the global economy and a relatively stable regulatory environment. Plan B’s model, while criticized, provides a baseline prediction. We also assume increasing institutional investment and a lack of major negative news events affecting the cryptocurrency market.

The price trajectory would likely see a gradual increase throughout 2024, followed by a more pronounced surge in late 2024 and into 2025, potentially exceeding Plan B’s original predictions due to increased demand. A visual representation would show a steadily rising curve, accelerating towards the end of the period. For instance, the price might reach $100,000 by the middle of 2024 and then climb to $200,000 or more by the end of 2025. This mirrors the general trajectory seen in previous bull markets, albeit on a potentially larger scale.

Scenario 2: Consolidation and Gradual Growth

This scenario anticipates a period of market consolidation following a potential price correction in 2024. Regulatory uncertainty, economic slowdown, or profit-taking could lead to a temporary decline before a more gradual and sustained upward trend emerges. While institutional adoption continues, it might proceed at a slower pace than in the bullish scenario. This scenario aligns with periods of market maturity where price increases are more measured and less volatile.

The price graph would show a period of sideways movement or even a slight decline early in the period, followed by a steady, less dramatic increase. The price might fluctuate around $50,000 – $70,000 for a significant portion of 2024 before gradually climbing to $100,000 – $150,000 by the end of 2025. This reflects a more conservative outlook, acknowledging the possibility of market corrections and a slower rate of adoption. This scenario resembles the price action of established assets undergoing a period of consolidation before further growth.

Scenario 3: Bearish Market Correction

This scenario considers the possibility of a significant bearish correction, driven by factors such as stricter regulations, a global economic recession, or a major security breach impacting Bitcoin’s network. In this case, Plan B’s model might prove inaccurate, as its underlying assumptions of consistent adoption and growth would be invalidated. The price would experience a substantial decline, potentially wiping out a significant portion of its value.

The visual representation would show a sharp downward trend followed by a prolonged period of low prices. For example, a significant correction could see the price fall to $20,000 – $30,000 before a slow and uncertain recovery begins. Reaching even $50,000 by the end of 2025 would be a considerable achievement in this pessimistic scenario. This scenario is comparable to the 2018 bear market, where Bitcoin’s price experienced a significant drop before recovering over time. The recovery, however, could be slower and less dramatic than in previous cycles.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, presents a unique blend of potential rewards and significant risks. Understanding both sides of this equation is crucial before allocating any capital. The volatility inherent in the cryptocurrency market requires careful consideration of your risk tolerance and investment goals.

Bitcoin Investment Risks

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in short periods. Factors influencing this volatility include regulatory changes, market sentiment, technological developments, and macroeconomic conditions. For example, the 2022 cryptocurrency market crash saw Bitcoin’s price plummet significantly, wiping out billions of dollars in market capitalization. Furthermore, the decentralized nature of Bitcoin, while a strength for some, also means there’s less regulatory oversight and protection for investors compared to traditional markets. The risk of theft through hacking or loss of private keys is also substantial; if your private keys are compromised, your Bitcoin is irretrievably lost. Finally, the long-term viability of Bitcoin itself remains uncertain; while it has demonstrated resilience, its future is not guaranteed.

Bitcoin Investment Rewards

Despite the inherent risks, the potential rewards of Bitcoin investment can be substantial. Bitcoin’s limited supply of 21 million coins creates scarcity, potentially driving up its value over time. Historically, Bitcoin has demonstrated periods of significant price appreciation, outpacing many traditional asset classes. For instance, an investment in Bitcoin in 2010 would have yielded extraordinary returns. Moreover, Bitcoin offers diversification benefits; it’s not correlated with traditional assets like stocks and bonds, potentially reducing overall portfolio risk for some investors. The growing adoption of Bitcoin by institutions and individuals further enhances its potential as a store of value and a medium of exchange.

Advice for Bitcoin Investors

Before investing in Bitcoin, conduct thorough research and understand the technology, risks, and potential rewards. Only invest what you can afford to lose, as significant price drops are possible. Diversify your portfolio, don’t put all your eggs in one basket. Consider using a secure hardware wallet to protect your private keys. Stay informed about market trends and regulatory developments. Consult with a qualified financial advisor before making any investment decisions. Remember that past performance is not indicative of future results.

Risks and Rewards Summary

| Risk | Reward |

|---|---|

| High Volatility | Potential for High Returns |

| Security Risks (theft, loss of keys) | Decentralization and censorship resistance |

| Regulatory Uncertainty | Diversification benefits |

| Long-term Viability Uncertainty | Scarcity (limited supply) |

Plan B Bitcoin Price Prediction 2025 – Disclaimer: This information is for educational purposes only and should not be considered financial advice. Investing in Bitcoin involves significant risk and may result in the loss of your entire investment. Consult with a qualified financial advisor before making any investment decisions.

Plan B Bitcoin Price Prediction 2025: Frequently Asked Questions

Plan B, a pseudonymous analyst, has gained notoriety for his Bitcoin price predictions based on a stock-to-flow (S2F) model. This model attempts to predict Bitcoin’s price based on its scarcity, comparing it to precious metals like gold. While his predictions have generated considerable discussion, it’s crucial to understand the model’s limitations and the inherent uncertainties in any market forecast.

Plan B’s Bitcoin Price Prediction for 2025

Plan B’s S2F model, in its various iterations, has suggested potential Bitcoin price ranges for 2025. These ranges are significantly higher than the prices observed in previous years, often projecting values in the hundreds of thousands of dollars per Bitcoin. The precise figures vary depending on the specific version of the model used and the assumptions made about adoption rates and market dynamics. It’s important to note that these are predictions, not guarantees.

Accuracy of Plan B’s Previous Predictions

Plan B’s past predictions have had a mixed track record. Some of his earlier predictions aligned relatively well with the actual Bitcoin price trajectory for a period of time, leading to significant attention within the crypto community. However, subsequent price movements deviated from his projections, highlighting the inherent limitations of any predictive model, especially in the volatile cryptocurrency market. Factors such as unexpected regulatory changes, market sentiment shifts, and technological developments can significantly impact Bitcoin’s price, rendering even sophisticated models less accurate.

Factors Influencing Plan B’s Predictions, Plan B Bitcoin Price Prediction 2025

Plan B’s S2F model primarily focuses on Bitcoin’s scarcity, measured by its stock-to-flow ratio. This ratio compares the existing supply of Bitcoin to the newly mined coins each year. The model also implicitly considers factors such as increasing adoption and institutional investment, although these factors are not explicitly incorporated as quantifiable variables. Halving events, which reduce the rate of new Bitcoin creation, are a key element considered, as they are expected to exert upward pressure on price due to reduced supply.

Risks Associated with Relying on Plan B’s Predictions

Relying solely on Plan B’s, or any other analyst’s, predictions carries significant risk. The cryptocurrency market is exceptionally volatile and influenced by a complex interplay of factors, many of which are unpredictable. Plan B’s model, while intriguing, is a simplification of a complex system and doesn’t account for all relevant variables. Furthermore, confirmation bias can lead to overreliance on predictions that initially seem accurate, potentially leading to poor investment decisions. It’s essential to conduct thorough independent research and consider diverse perspectives before making any investment choices. Past performance is not indicative of future results.