Frequently Asked Questions (FAQ)

This section addresses common queries regarding the upcoming Bitcoin halving in 2025, a significant event in the cryptocurrency’s history. Understanding the mechanics and potential impacts of this halving is crucial for anyone involved in or observing the Bitcoin market.

The Bitcoin Halving and its Significance

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. Specifically, it cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding them to the blockchain, in half. This occurs approximately every four years, or every 210,000 blocks mined. The significance lies in its impact on Bitcoin’s inflation rate. By reducing the supply of newly minted Bitcoin, the halving theoretically contributes to a decrease in inflation and potentially increases scarcity, factors that can influence its price. This built-in deflationary mechanism is a core feature designed into Bitcoin’s architecture from its inception. The halving is not a spontaneous event but a predictable and integral part of Bitcoin’s long-term design.

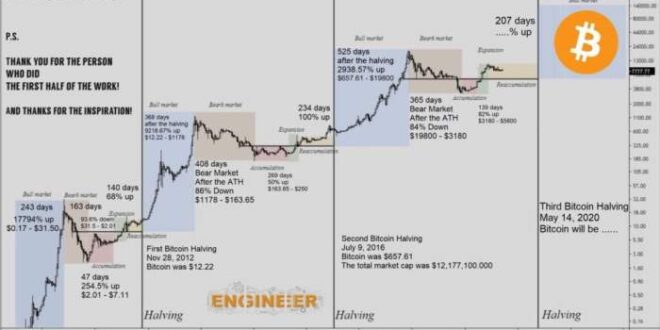

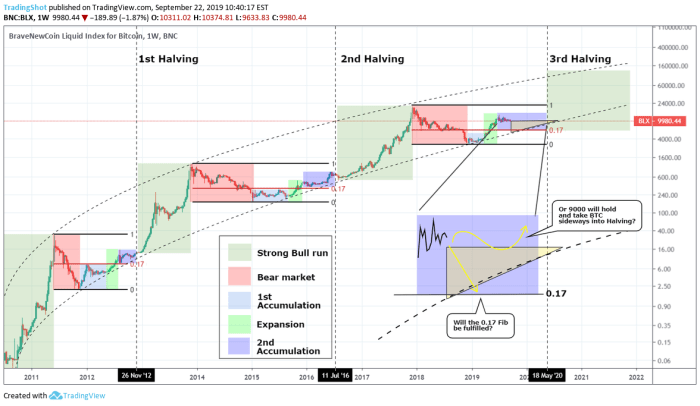

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving event. The 2012 and 2016 halvings were followed by significant price rallies, although other market factors undoubtedly played a role. However, it’s crucial to understand that correlation does not equal causation. While reduced supply can contribute to price increases due to increased demand, other economic factors like broader market sentiment, regulatory changes, and technological advancements also significantly impact Bitcoin’s price. The 2020 halving, for example, saw a price increase, but the subsequent period also experienced considerable volatility. Predicting the exact price impact of the 2025 halving is impossible; it’s a complex interplay of numerous factors.

The Expected Date of the 2025 Bitcoin Halving

While the exact date is difficult to pinpoint with absolute certainty due to variations in block mining times, the 2025 Bitcoin halving is anticipated to occur sometime in the spring or early summer of 2025. The precise date will depend on the actual rate of block mining leading up to the event. Continuous monitoring of the blockchain is necessary for a definitive date closer to the event.

Risks Associated with Investing in Bitcoin Before and After the Halving

Investing in Bitcoin, regardless of the halving, carries inherent risks. Bitcoin’s price is highly volatile, susceptible to significant swings in both directions. Market manipulation, regulatory uncertainty, and technological vulnerabilities are all potential factors that could negatively impact its value. The period leading up to a halving often sees increased speculation, potentially creating “price bubbles” that can burst. Similarly, the post-halving period can see a period of consolidation or even a price correction after an initial rally. Therefore, thorough research, risk assessment, and a long-term investment strategy are crucial before investing in Bitcoin, irrespective of the halving’s timing. It’s essential to only invest what one can afford to lose.

Illustrative Examples: Predictions For Bitcoin Halving 2025

Predicting Bitcoin’s price after a halving is inherently speculative, but visualizing potential scenarios through hypothetical charts can aid understanding. This section presents three distinct price trajectories following the 2025 halving: bullish, bearish, and neutral. These scenarios are not predictions but rather illustrative examples demonstrating the range of possibilities.

Bitcoin Price Scenarios Post-2025 Halving

The following chart depicts three potential price paths for Bitcoin after the 2025 halving. The x-axis represents time (in months, starting from the halving date), and the y-axis represents the Bitcoin price in USD. Each scenario includes a price target 12 months post-halving, along with a rationale for that target. Note that these are purely hypothetical and should not be interpreted as financial advice.

The chart itself would be a line graph. The x-axis would be labeled “Months Since Halving” and range from 0 to 12. The y-axis would be labeled “Bitcoin Price (USD)” and would have a scale appropriate to accommodate the price targets described below. Each scenario would be represented by a differently colored line: Bullish (bright green), Bearish (dark red), and Neutral (light blue). Data points would be plotted monthly, and trend lines would connect these points to visually represent the overall price movement for each scenario. Additional visual cues could include shaded areas representing uncertainty bands around the projected price paths, particularly for the bullish and bearish scenarios, to emphasize the range of possible outcomes.

Bullish Scenario: Exponential Growth

This scenario assumes a highly positive market response to the halving, driven by factors such as increased institutional adoption, positive regulatory developments, and continued mainstream interest. The price could see exponential growth, surpassing previous all-time highs.

* Price Target (12 Months Post-Halving): $150,000

* Rationale: This aggressive target assumes a significant influx of new capital into the market, driven by factors mentioned above. Similar rapid growth was observed following the 2017 halving, although the market conditions and regulatory landscape were significantly different then. This scenario acknowledges a degree of speculative exuberance.

Bearish Scenario: Stagnation and Decline

This scenario assumes a less optimistic market outlook. Factors such as macroeconomic uncertainty, increased regulatory scrutiny, or a lack of significant technological advancements could lead to price stagnation or even a decline.

* Price Target (12 Months Post-Halving): $25,000

* Rationale: This conservative projection accounts for potential headwinds. A prolonged bear market, similar to what was seen in 2018-2019, could easily depress prices to this level or lower. This scenario underscores the risks inherent in cryptocurrency investments.

Neutral Scenario: Gradual Growth, Predictions For Bitcoin Halving 2025

This scenario assumes a more moderate market reaction. The halving event will have a positive impact, but it won’t be as dramatic as the bullish scenario, nor as negative as the bearish one. The price will gradually increase over time, reflecting a steady level of adoption and investor confidence.

* Price Target (12 Months Post-Halving): $50,000

* Rationale: This target represents a balanced approach, acknowledging both the potential benefits and risks associated with the halving. It reflects a steady, organic growth pattern, reflecting a more mature and less volatile market. This scenario serves as a baseline for comparison against the more extreme bullish and bearish possibilities.

Predictions For Bitcoin Halving 2025 – Predictions for the Bitcoin Halving in 2025 are varied, with some analysts anticipating a significant price surge. A key event to consider when forming these predictions is the upcoming halving, specifically detailed in this insightful article on the Bitcoin April 2025 Halving. Understanding the historical impact of previous halvings is crucial for accurately forecasting the potential market reaction to the reduced Bitcoin supply in 2025.

Therefore, analyzing the April 2025 event is vital for shaping comprehensive predictions.

Predictions for the Bitcoin halving in 2025 are varied, with some analysts predicting significant price increases. Understanding these predictions often requires looking ahead to assess potential market reactions; for a detailed outlook, check out this insightful analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 halving’s impact on Bitcoin’s price will depend on a complex interplay of factors beyond just the reduced supply.

Predictions for the Bitcoin halving in 2025 are varied, with some analysts predicting significant price increases. Understanding these predictions often requires looking ahead to assess potential market reactions; for a detailed outlook, check out this insightful analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 halving’s impact on Bitcoin’s price will depend on a complex interplay of factors beyond just the reduced supply.

Predictions for the Bitcoin halving in 2025 are varied, with some analysts predicting significant price increases. Understanding these predictions often requires looking ahead to assess potential market reactions; for a detailed outlook, check out this insightful analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 halving’s impact on Bitcoin’s price will depend on a complex interplay of factors beyond just the reduced supply.

Predictions for the Bitcoin halving in 2025 are varied, with some analysts predicting significant price increases. Understanding these predictions often requires looking ahead to assess potential market reactions; for a detailed outlook, check out this insightful analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 halving’s impact on Bitcoin’s price will depend on a complex interplay of factors beyond just the reduced supply.

Predictions for the Bitcoin halving in 2025 are varied, with some analysts predicting significant price increases. Understanding these predictions often requires looking ahead to assess potential market reactions; for a detailed outlook, check out this insightful analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 halving’s impact on Bitcoin’s price will depend on a complex interplay of factors beyond just the reduced supply.