Market Sentiment and Investor Behavior

Predicting Bitcoin’s price after the 2025 halving requires understanding how market sentiment and investor behavior will likely evolve. These factors are intertwined and significantly influence price movements, often overriding fundamental analysis in the short term. Analyzing past halving cycles provides valuable insights into potential future trends.

Market sentiment is a collective gauge of investor psychology regarding Bitcoin’s future price. It’s influenced by a multitude of factors, and shifts in sentiment can dramatically impact trading activity and price volatility. Understanding key indicators of market sentiment is crucial for navigating this complex landscape.

Key Indicators of Market Sentiment

Several factors contribute to overall market sentiment. These indicators offer a collective picture, although they should be interpreted cautiously as they are not always perfectly correlated with price movements. For instance, a surge in social media hype might not always translate into sustained price increases.

- Trading Volume: High trading volume often suggests strong conviction and interest, potentially signaling sustained price movement in either direction. Conversely, low volume might indicate a lack of conviction and potential for price stagnation or reversal.

- Social Media Activity: Sentiment analysis of social media platforms like Twitter and Reddit can reveal prevailing opinions. An increase in positive sentiment (e.g., more bullish posts) might indicate growing optimism, while a rise in negative sentiment could foreshadow a price decline. However, it’s important to account for potential manipulation and biases within these platforms.

- Institutional Investment: Large-scale investments by institutions like hedge funds and corporations can significantly influence price. Increased institutional adoption typically signals greater confidence and legitimacy, often leading to price appreciation. Conversely, large-scale selling by institutions can trigger significant price drops.

Comparison of Investor Behavior Before and After Previous Halvings

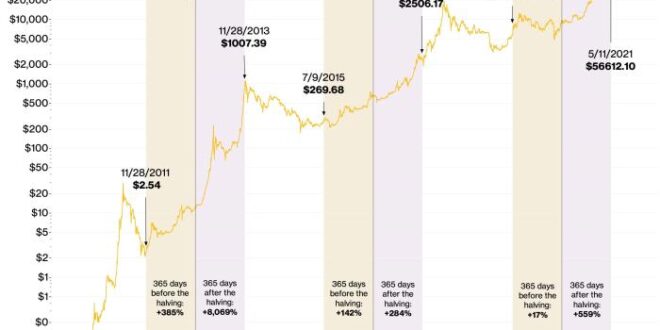

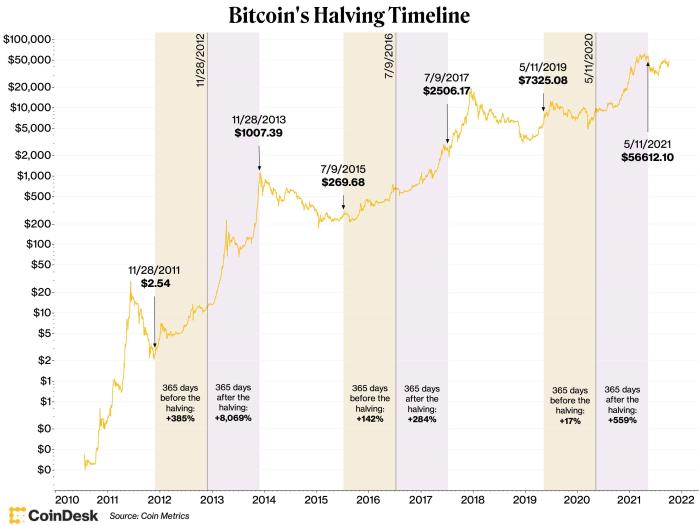

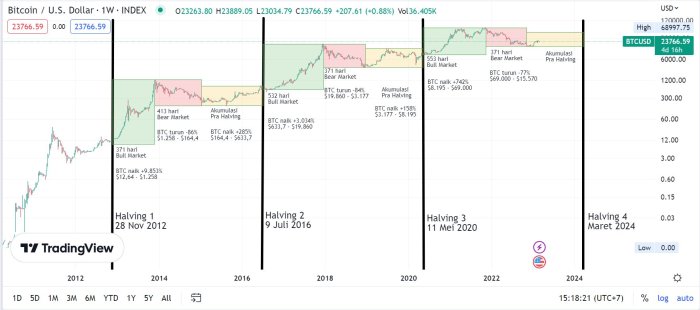

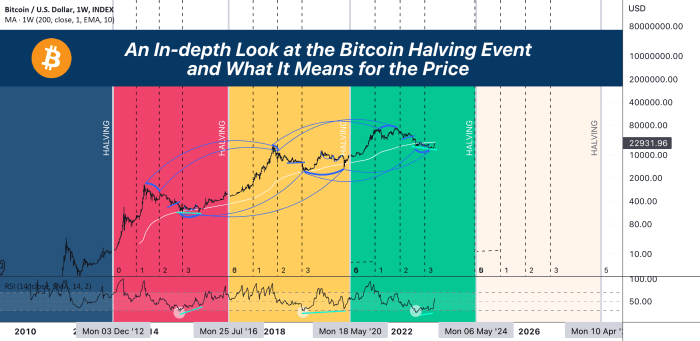

Analyzing investor behavior surrounding previous halvings reveals recurring patterns. Before a halving, anticipation often builds, leading to price increases driven by speculation and the expectation of scarcity. After the halving, the price response varies. Sometimes, there’s a short-term price surge followed by a period of consolidation or correction, as the market assesses the actual impact of the reduced block reward. In other instances, the price may experience a more prolonged period of sideways movement before resuming its upward trajectory.

The 2012 and 2016 halvings showed contrasting post-halving behaviors. The 2012 halving saw a relatively slow price increase in the months following, while the 2016 halving led to a more dramatic price surge that began shortly after the event. The 2020 halving saw a gradual increase that extended over a longer timeframe. These variations highlight the complex interplay of multiple factors beyond the halving itself.

Hypothetical Scenario: Investor Actions and Post-Halving Price Impact

Let’s consider a hypothetical scenario after the 2025 halving. Suppose institutional investors, anticipating continued scarcity and increased demand, accumulate Bitcoin steadily leading up to and immediately after the halving. Simultaneously, retail investors, influenced by positive social media sentiment and news of institutional adoption, increase their buying pressure. This combined buying pressure could lead to a significant price surge.

However, if a major global economic downturn occurs concurrently, this could trigger a sell-off by some investors seeking to liquidate their assets, potentially offsetting the bullish pressure from the halving and institutional buying. The resulting price movement would depend on the relative strength of these opposing forces. If the positive sentiment and institutional buying outweigh the economic concerns, the price might still experience a substantial increase. Conversely, a strong economic downturn might overshadow the halving’s impact, resulting in a price decline or extended period of sideways trading.

Technical Analysis and Price Predictions: Price Of Bitcoin After 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, relying on interpreting historical trends and applying technical analysis tools. However, by examining past halving cycles and employing various indicators, we can formulate potential price scenarios. It’s crucial to remember that these are just educated guesses, and the actual price will depend on numerous unpredictable factors, including regulatory changes, macroeconomic conditions, and overall market sentiment.

Support and Resistance Levels

Identifying key support and resistance levels on Bitcoin’s price chart is a fundamental aspect of technical analysis. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels indicate price points where selling pressure is anticipated to dominate, hindering upward momentum. Historically, previous halving events have shown significant price increases following the event, suggesting that previous resistance levels could become future support levels. For example, the price level reached before the 2021 bull run could potentially act as a support level after the 2025 halving. Analyzing the chart, one might identify key support levels based on previous lows and significant price consolidation areas. Similarly, resistance levels could be identified based on previous highs and psychological price barriers (e.g., $100,000, $200,000).

Technical Indicators for Price Prediction

Several technical indicators can help predict Bitcoin’s price movement. These indicators analyze price and volume data to identify potential trends and turning points. Combining multiple indicators often provides a more robust analysis than relying on a single indicator.

Moving Averages

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and help identify trends. A “golden cross” (50-day MA crossing above the 200-day MA) is often considered a bullish signal, suggesting an upward trend. Conversely, a “death cross” (50-day MA crossing below the 200-day MA) is often interpreted as a bearish signal. For instance, the golden cross preceding the 2021 bull run is a noteworthy example. Analyzing the historical relationship between these moving averages and Bitcoin’s price action after previous halvings could provide insights into potential future movements.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, suggesting a potential price correction. Conversely, an RSI below 30 is often interpreted as oversold, suggesting a potential price rebound. Analyzing RSI levels around previous halving events can help determine whether the market is exhibiting extreme bullish or bearish sentiment, which can inform potential price predictions. For example, observing the RSI during the 2017 bull run can offer insights into potential overbought conditions after the 2025 halving.

MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish crossover (MACD line crossing above the signal line) suggests a potential upward trend, while a bearish crossover suggests a potential downward trend. Analyzing MACD signals around previous halving events could provide clues regarding the potential timing and strength of price movements following the 2025 halving. For example, the MACD divergence observed before the 2019 bear market could provide a comparison point for interpreting future signals.

Interpreting Indicators and Formulating Price Predictions

Interpreting these indicators requires careful consideration of historical data and market context. It’s crucial to avoid relying solely on one indicator, instead using a combination to build a more comprehensive understanding of the market’s sentiment and potential price movements. For example, a golden cross accompanied by an RSI below 50 could suggest a strong bullish trend, whereas a death cross coupled with an RSI above 70 might indicate a significant price correction. By combining these indicators with an analysis of support and resistance levels, a more nuanced price prediction can be formulated. It’s vital to remember that these predictions are not guarantees but rather probabilities based on historical patterns and technical analysis. Past performance is not indicative of future results, and unforeseen events can significantly impact Bitcoin’s price.

Macroeconomic Factors and Their Influence

Bitcoin’s price, while often driven by internal factors like halving events and technological advancements, is significantly influenced by the broader macroeconomic environment. Fluctuations in inflation, interest rates, and geopolitical stability all play a crucial role in shaping investor sentiment and, consequently, Bitcoin’s value. Understanding this interplay is vital for navigating the cryptocurrency market, especially in the lead-up to and aftermath of the 2025 halving.

The relationship between Bitcoin and macroeconomic factors is complex and often indirect. For example, high inflation can drive investors towards alternative assets like Bitcoin, perceived as a hedge against currency devaluation. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors may find higher returns in traditional, interest-bearing assets. Geopolitical uncertainty can also impact Bitcoin’s price, as investors seek safe havens during times of global instability. The influence of these factors, however, is not always consistent and can vary depending on the specific circumstances and the prevailing market sentiment.

Inflation’s Impact on Bitcoin Price

High inflation erodes the purchasing power of fiat currencies. This can lead investors to seek assets that retain or increase their value over time, a phenomenon that often benefits Bitcoin. During periods of high inflation, as seen in several countries in recent years, Bitcoin has frequently experienced price increases as investors look for a store of value outside of traditional financial systems. However, the relationship isn’t always linear. If inflation is perceived as transitory or under control by central banks, the demand for Bitcoin as an inflation hedge might diminish. For instance, the impact of inflation on Bitcoin’s price in 2025 might be different than in previous halving cycles depending on the global inflationary environment at the time. A sustained period of high inflation could significantly boost demand, while a controlled inflationary environment might have a less pronounced effect.

Interest Rate Changes and Bitcoin Investment

Interest rate hikes by central banks often lead to decreased investment in riskier assets, including cryptocurrencies like Bitcoin. Higher interest rates make traditional investments, such as bonds and savings accounts, more attractive due to higher yields. This can lead to capital flowing out of the cryptocurrency market, potentially suppressing Bitcoin’s price. The 2022 market downturn, partly fueled by aggressive interest rate increases by the Federal Reserve, serves as a prime example. The impact of interest rate changes in 2025 will depend on the monetary policies of major central banks and the overall state of the global economy. If interest rates remain high, Bitcoin’s price might face downward pressure. However, if rates stabilize or even decline, it could potentially lead to renewed investor interest in riskier assets.

Geopolitical Events and Bitcoin’s Price Volatility

Geopolitical instability, such as wars, sanctions, or political upheaval, can significantly influence Bitcoin’s price. During periods of uncertainty, investors often seek refuge in assets perceived as less vulnerable to geopolitical risks. Bitcoin, with its decentralized nature and global accessibility, can act as a safe haven asset in such situations, leading to price increases. The 2022 Russian invasion of Ukraine, for example, initially led to a surge in Bitcoin’s price as investors sought alternative investment options. The impact of geopolitical events on Bitcoin’s price in 2025 is difficult to predict, as these events are inherently unpredictable. However, it’s crucial to recognize that significant geopolitical shifts could significantly impact investor sentiment and consequently, Bitcoin’s price.

Regulatory Landscape and its Impact

The regulatory landscape surrounding Bitcoin and cryptocurrencies is rapidly evolving, presenting both opportunities and challenges for the asset’s future price. Governmental actions, from outright bans to comprehensive regulatory frameworks, significantly influence investor confidence, market liquidity, and ultimately, Bitcoin’s price. Understanding these diverse approaches is crucial for navigating the post-2025 halving market.

Different regulatory approaches across jurisdictions have significantly different impacts on Bitcoin’s price and adoption. Some jurisdictions have embraced a more permissive approach, while others have taken a more cautious or restrictive stance. These differences create diverse market dynamics that influence price discovery and overall market sentiment.

Regulatory Developments Affecting Bitcoin’s Price

Several key regulatory developments globally could significantly impact Bitcoin’s price after the 2025 halving. These include the increasing clarity (or lack thereof) regarding taxation of Bitcoin transactions and holdings, the establishment of regulatory frameworks for cryptocurrency exchanges and custodians, and the potential for central bank digital currencies (CBDCs) to compete with Bitcoin. Increased regulatory scrutiny of stablecoins and their underlying reserves is another significant factor. For example, the collapse of TerraUSD highlighted the risks associated with poorly regulated stablecoins and sent shockwaves through the entire cryptocurrency market. This event underscored the importance of robust regulatory oversight in maintaining market stability and investor confidence. Conversely, clear and well-defined regulations could foster greater institutional investment and increase Bitcoin’s legitimacy, potentially driving price appreciation.

Impact of Different Regulatory Scenarios on Bitcoin Adoption and Price

A scenario of globally harmonized and well-defined regulations could lead to increased institutional investment, greater mainstream adoption, and potentially higher Bitcoin prices. This is because clear rules would reduce uncertainty, making Bitcoin a more attractive asset for risk-averse investors. Conversely, a fragmented regulatory landscape with inconsistent rules across different jurisdictions could hinder adoption and depress prices. This is due to the complexities and increased compliance costs for businesses operating across multiple jurisdictions. A completely prohibitive regulatory environment, such as an outright ban in a major economy, could severely impact Bitcoin’s price, reducing liquidity and potentially triggering a significant price drop. The Chinese ban on cryptocurrency trading in 2021 serves as a stark example of how restrictive regulations can negatively impact price.

Comparison of Regulatory Approaches Across Jurisdictions

| Jurisdiction | Regulatory Approach | Potential Influence on Bitcoin Price |

|---|---|---|

| United States | Fragmented, with ongoing debate on regulation of exchanges and stablecoins. | Uncertainty could suppress price; clear regulations could boost it. |

| European Union | Developing a comprehensive regulatory framework (MiCA) for crypto assets. | Increased clarity and standardization could attract investment and increase price. |

| Singapore | Relatively permissive approach with a focus on licensing and investor protection. | Could attract cryptocurrency businesses and potentially support price. |

| El Salvador | Bitcoin is legal tender. | Limited impact on global Bitcoin price, but could influence local adoption. |

This table presents a simplified overview; the actual regulatory landscape is far more nuanced. However, it illustrates the diverse approaches taken by different jurisdictions and their potential influence on Bitcoin’s price. The level of regulatory clarity and the overall regulatory environment significantly influence investor confidence and market stability, ultimately impacting the price of Bitcoin.

Technological Advancements and Their Role

Technological advancements in the blockchain space are crucial factors that could significantly influence Bitcoin’s price trajectory post-2025. These advancements often address Bitcoin’s inherent limitations, such as scalability and transaction speed, thereby increasing its usability and potentially driving demand. The interplay between innovation and market sentiment is complex, but understanding the potential impact of these technologies is vital for accurate price forecasting.

The adoption of improved technologies could lead to a surge in Bitcoin’s adoption, impacting its price positively. Conversely, failure to adapt or unforeseen technological challenges could hinder growth.

Layer-2 Scaling Solutions and Their Impact

Layer-2 scaling solutions aim to alleviate the burden on Bitcoin’s base layer by processing transactions off-chain. This increases transaction throughput and reduces fees, making Bitcoin more practical for everyday use. Examples include the Lightning Network, which allows for near-instant, low-cost transactions. Successful widespread adoption of layer-2 solutions could dramatically increase Bitcoin’s usability, leading to higher demand and potentially pushing its price upward. Conversely, limitations in adoption or security concerns related to layer-2 protocols could limit their effectiveness and dampen the positive price impact. A successful scaling solution could potentially handle millions of transactions per second, compared to Bitcoin’s current capacity of only a few transactions per second. This increased efficiency would make Bitcoin a far more attractive option for businesses and individuals.

Enhanced Privacy Features and Their Influence

Concerns about Bitcoin’s transparency have limited its adoption in certain sectors. Advancements in privacy-enhancing technologies, such as confidential transactions or improved mixing protocols, could address these concerns. These improvements could attract users who previously hesitated due to privacy anxieties, leading to increased demand and a positive price impact. However, regulatory scrutiny surrounding privacy-enhancing technologies could also present challenges. For example, a successful implementation of a privacy-enhancing technology like Mimblewimble could allow for greater anonymity, making Bitcoin more attractive to users who value their privacy. This could lead to increased adoption and a potential rise in Bitcoin’s price.

Hypothetical Scenario: Technological Advancement and Price Trajectory

Imagine a scenario where a highly efficient and widely adopted layer-2 solution, coupled with robust privacy features, is successfully integrated into the Bitcoin ecosystem by 2028. This combination could lead to a significant increase in transaction volume and user base. Increased demand, coupled with a relatively limited supply of Bitcoin (due to the halving events), could create upward pressure on the price. In this hypothetical scenario, we could see a gradual price increase throughout 2026-2027, followed by a more pronounced surge in 2028 and beyond, potentially reaching price levels significantly higher than those predicted by models that do not account for these technological advancements. This surge would be driven by increased utility, broader adoption, and a tightening supply. However, unforeseen challenges in the implementation or adoption of these technologies could significantly alter this optimistic forecast.

Frequently Asked Questions (FAQs)

This section addresses common questions surrounding the Bitcoin halving event of 2025 and its potential impact on the cryptocurrency market. Understanding these key aspects is crucial for informed decision-making regarding Bitcoin investment. We’ll explore the mechanics of the halving, its historical influence on price, potential risks and opportunities, and steps to prepare for this significant event.

Bitcoin Halving Mechanism

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin. Essentially, miners receive half the reward for successfully verifying and adding transactions to the blockchain after a halving. This built-in deflationary pressure is a core element of Bitcoin’s design.

Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the periods following previous halvings. The 2012 halving was followed by a significant price surge, as was the 2016 halving, although market conditions and other factors also play a crucial role. The increased scarcity resulting from the reduced supply of newly mined Bitcoin is often cited as a primary driver of price appreciation after a halving. However, it’s important to remember that past performance is not indicative of future results, and other market forces can significantly influence the price. The 2020 halving, while initially showing price increases, was followed by a period of consolidation and volatility before eventually experiencing a significant bull run.

Risks and Opportunities of Investing After the 2025 Halving

Investing in Bitcoin after the 2025 halving presents both significant opportunities and considerable risks. The potential for price appreciation due to reduced supply remains a compelling opportunity. However, the cryptocurrency market is highly volatile and susceptible to regulatory changes, macroeconomic events, and technological disruptions. A potential risk is a price correction or prolonged period of stagnation following the initial price surge (if any), which could lead to significant losses for investors. Furthermore, the regulatory landscape remains uncertain in many jurisdictions, and unexpected regulatory actions could negatively impact Bitcoin’s price. A balanced approach, involving diversification and careful risk management, is crucial for navigating this potentially rewarding but inherently risky investment.

Preparing for the 2025 Halving

Preparing for the 2025 halving involves a multi-faceted approach: Thorough research is essential to understand the factors influencing Bitcoin’s price and the potential risks and rewards. Developing a well-defined investment strategy that aligns with your risk tolerance is crucial. This strategy should incorporate diversification to mitigate risk. Staying informed about market trends, regulatory developments, and technological advancements through reliable news sources is vital for making informed investment decisions. Finally, only invest what you can afford to lose, recognizing the inherent volatility of the cryptocurrency market. Avoid impulsive decisions driven by hype or fear, and consider seeking advice from a qualified financial advisor before making any investment decisions.

Illustrative Examples and Data Visualization

Visualizing Bitcoin’s price behavior and its relationship with key factors like halving events and supply is crucial for understanding its past performance and potentially informing future expectations. This section presents data visualization techniques to illustrate these relationships.

Bitcoin’s Price Performance Around Previous Halvings

The following table summarizes Bitcoin’s price performance in the periods leading up to and following its previous halving events. Note that past performance is not indicative of future results. Significant external factors beyond halving events influence Bitcoin’s price.

| Halving Date | Price Before Halving (USD) | Price After Halving (USD) | Approximate Percentage Change (1 Year Post-Halving) |

|---|---|---|---|

| November 28, 2012 | ~13 | ~100 | ~650% |

| July 9, 2016 | ~650 | ~20,000 | ~2000% |

| May 11, 2020 | ~8,700 | ~65,000 | ~650% |

Bitcoin Supply and Price Relationship, Price Of Bitcoin After 2025 Halving

This chart would illustrate the relationship between Bitcoin’s circulating supply and its price over time. The x-axis would represent time (e.g., years since inception), and the y-axis would represent both Bitcoin’s price (in USD) and its circulating supply (in millions of coins). Two separate lines would be plotted on the same chart: one for price and one for supply. The supply line would show a steady, upward trend, reflecting the predictable increase in supply due to mining. The price line would demonstrate significant volatility, exhibiting periods of sharp increases and decreases. The chart would visually highlight that while supply increases predictably, price movements are highly influenced by market sentiment, adoption rates, regulatory changes, and macroeconomic conditions. Key halving events could be marked on the chart to demonstrate their apparent influence on price trends. The chart’s overall visual representation would underscore the complex and non-linear relationship between Bitcoin’s supply and its price. It would show that although supply is a fundamental aspect, it’s not the sole determinant of Bitcoin’s value.

Price Of Bitcoin After 2025 Halving – Predicting the price of Bitcoin after the 2025 halving is challenging, but historical trends suggest a potential price surge. To understand the potential impact, it’s crucial to know the exact timing; you can find that information by checking out this resource on When Is Next Bitcoin Halving 2025. Knowing the halving date allows for better forecasting of the subsequent market reaction and potential price fluctuations in Bitcoin after this significant event.

Predicting the price of Bitcoin after the 2025 halving is challenging, as numerous factors influence its value. To gain insight into potential price movements, it’s helpful to examine predictions surrounding the halving itself; for example, check out this resource on Bitcoin Halving 2025 Price Prediction for a comprehensive overview. Ultimately, the post-halving Bitcoin price will depend on market sentiment and overall economic conditions.

Predicting the price of Bitcoin after the 2025 halving is inherently speculative, but historical trends suggest a potential price increase. To accurately assess this, understanding the precise timing is crucial, and you can find details on the Bitcoin Halving 2025 Date to better inform your projections. However, numerous factors beyond the halving itself will influence the ultimate price of Bitcoin following this event.

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, influenced by numerous market factors. A key element in any such prediction involves understanding the historical impact of previous halvings. For detailed analysis on this specific event, you might find the article on Bitcoin Price After Halving 2025 helpful. Ultimately, the price of Bitcoin after the 2025 halving will depend on a confluence of economic conditions and market sentiment.

Predicting the price of Bitcoin after the 2025 halving is inherently speculative, but historical trends suggest a potential price increase. To understand the potential impact, we first need to know the exact date of this halving event; you can find that information by checking this resource: When Is Bitcoin Halving Date 2025. Knowing this date allows for more accurate estimations of the post-halving market dynamics and potential price fluctuations for Bitcoin.

Predicting the price of Bitcoin after the 2025 halving is inherently speculative, but historical trends suggest a potential price surge. Understanding the precise timing of this event is crucial for analysis; you can find details on the exact date at Bitcoin Halving 2025 Time. However, numerous factors beyond the halving itself will ultimately influence the Bitcoin price post-2025, making any prediction inherently uncertain.