Illustrative Example: Próximo Halving Bitcoin 2025

Predicting Bitcoin’s price after a halving is inherently speculative, but examining hypothetical scenarios based on various influencing factors can provide valuable insights. We will explore two contrasting scenarios: one where the price significantly increases and another where it remains relatively flat or declines. These scenarios are not predictions but illustrative tools to understand potential market dynamics.

Bitcoin Price Surge Post-Halving, Próximo Halving Bitcoin 2025

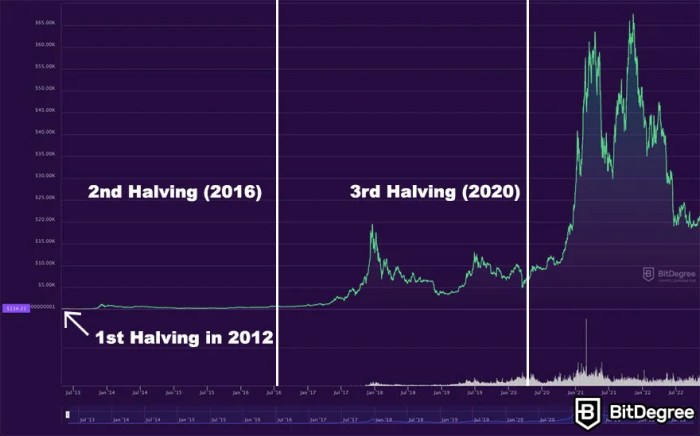

In this scenario, the Bitcoin price experiences a substantial increase following the 2025 halving. Several factors contribute to this positive outcome. Firstly, a sustained increase in institutional adoption, driven by favorable regulatory clarity in key markets like the US and EU, fuels demand. Secondly, growing awareness and adoption of Bitcoin as a store of value, particularly amidst global macroeconomic uncertainty, further propels price appreciation. This is accompanied by positive market sentiment, fueled by successful integration of the Lightning Network and a general increase in Bitcoin’s utility. Finally, a decrease in the supply of newly mined Bitcoin, directly resulting from the halving, creates a scarcity effect, pushing prices upward. This scenario mirrors the price increases observed after previous halvings, albeit with potentially amplified effects due to the increased institutional involvement and broader adoption. For example, imagine a scenario where regulatory clarity leads to several major institutional investors allocating a significant portion of their portfolios to Bitcoin, creating a substantial buying pressure. Simultaneously, a global economic downturn might drive individuals to seek safe haven assets, increasing demand for Bitcoin as a hedge against inflation. This combination of institutional and retail demand, coupled with the reduced supply, could lead to exponential price growth.

Bitcoin Price Stagnation or Decline Post-Halving

Conversely, this scenario explores the possibility of Bitcoin’s price remaining relatively flat or even declining after the 2025 halving. Several factors could contribute to this outcome. Firstly, a prolonged period of regulatory uncertainty or even unfavorable regulatory actions, particularly in major jurisdictions, could dampen investor enthusiasm and limit institutional investment. Secondly, a lack of significant technological advancements or breakthroughs in the Bitcoin ecosystem might hinder its adoption rate and limit its utility beyond its existing functions. This could be coupled with negative market sentiment stemming from factors unrelated to Bitcoin itself, such as a broader cryptocurrency market crash or a significant global economic downturn. Furthermore, even with the halving reducing supply, existing large sell orders or a general lack of new buying pressure could prevent a significant price increase. For instance, imagine a scenario where regulatory bodies implement strict regulations that severely limit the use of cryptocurrencies for financial transactions, thus reducing their overall utility. This, combined with a global economic recovery that reduces the demand for safe-haven assets, could create a downward pressure on the price of Bitcoin, offsetting the effects of the halving. The resulting price stagnation or decline would then be attributed to a combination of regulatory headwinds, lack of technological innovation, and diminished market sentiment.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency market, expected to impact its price volatility. It’s interesting to compare this to other halving events, such as the Bitcoin Cash Halving 2025 , to understand potential market reactions. Analyzing these events in parallel offers valuable insights into the broader cryptocurrency landscape and how halvings generally influence the value of cryptocurrencies, ultimately helping us better predict the effects of the Próximo Halving Bitcoin 2025.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future. Understanding the mechanics of this reduction in Bitcoin’s block reward is crucial, and for a detailed analysis, you can refer to this excellent resource: Halving 2025 Bitcoin. This resource will help you better grasp the implications of the Próximo Halving Bitcoin 2025 and its potential impact on the market.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency. Precisely pinpointing the date requires careful consideration of block times, and for that, a reliable resource like the Bitcoin 2025 Halving Date page is invaluable. Understanding this date is crucial for predicting potential market impacts surrounding the Próximo Halving Bitcoin 2025.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future. Understanding the potential consequences is crucial for investors and enthusiasts alike. To gain insight into the post-halving landscape, it’s helpful to explore resources such as this article: What Will Happen After Bitcoin Halving In 2025. This will help you better prepare for the changes expected after the Próximo Halving Bitcoin 2025.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future. Precisely pinpointing the date requires careful consideration of block times, and for that, a reliable resource is crucial. You can find detailed information regarding the exact date at this helpful website: 2025 Bitcoin Halving Date. Understanding this date is key to anticipating potential market shifts surrounding the Próximo Halving Bitcoin 2025.

The upcoming Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future. This reduction in Bitcoin’s inflation rate is anticipated to impact its price, making accurate predictions challenging. For a detailed countdown and analysis of this pivotal moment, check out the Bitcoin Halving Countdown 2025 resource. Understanding this countdown is crucial for anyone interested in the Próximo Halving Bitcoin 2025 and its potential market effects.