Bitcoin Halving 2025: Que Es El Halving De Bitcoin 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, cutting the block reward in half. Understanding this event is crucial for anyone interested in Bitcoin’s long-term price trajectory and its impact on the cryptocurrency market.

Bitcoin Halving Explained, Que Es El Halving De Bitcoin 2025

The Bitcoin halving is a fundamental mechanism designed to control inflation. Every 210,000 blocks mined, the reward given to miners for verifying transactions is halved. This process inherently limits the total number of Bitcoins that can ever exist to 21 million. The reduced supply, coupled with (potentially) sustained or increased demand, is expected to influence the price. This controlled scarcity is a core element of Bitcoin’s value proposition.

Historical Halving Events and Price Effects

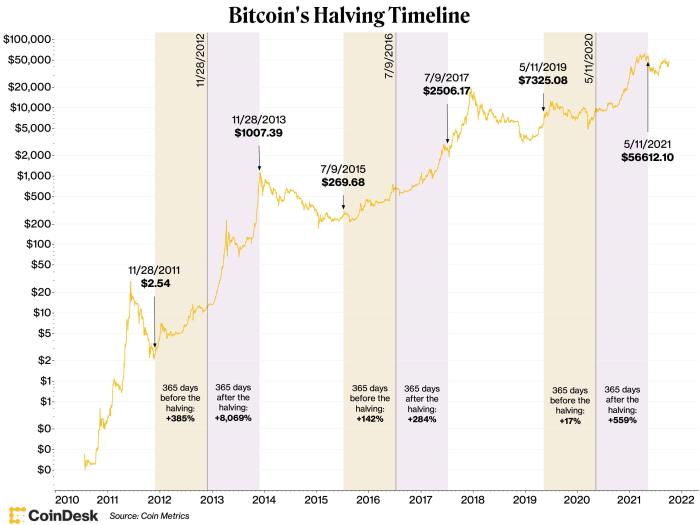

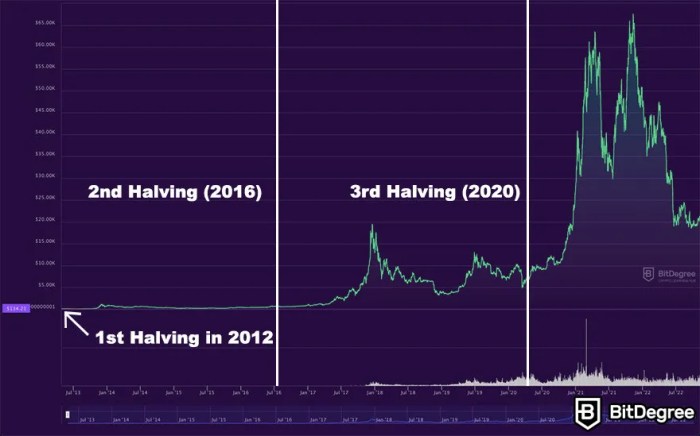

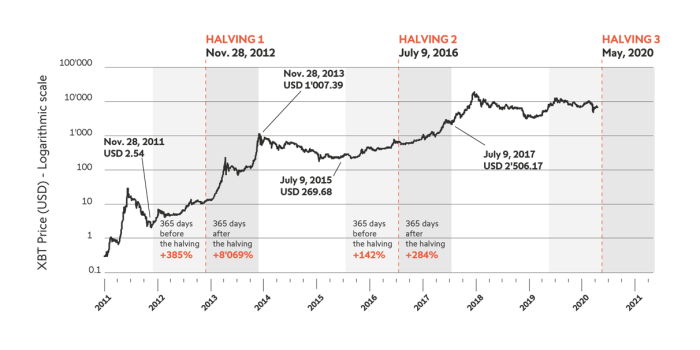

Analyzing past halving events provides valuable insight into potential future price movements. While past performance is not indicative of future results, the historical data can inform our understanding of market reactions.

Timeline of Past Halvings and Price Movements

Que Es El Halving De Bitcoin 2025 – It’s important to note that attributing price movements solely to the halving is an oversimplification. Many other factors, including macroeconomic conditions, regulatory changes, and overall market sentiment, influence Bitcoin’s price. However, the halving consistently introduces a period of decreased supply, which often correlates with subsequent price increases.

Understanding the “Que Es El Halving De Bitcoin 2025” requires grasping the cyclical nature of Bitcoin’s reward reduction. This reduction, a key element of Bitcoin’s design, is visually represented in a helpful way by examining Bitcoin Halving Cycle Chart 2025. The chart clearly illustrates how the halving impacts the rate of new Bitcoin entering circulation, ultimately influencing its price and scarcity, thus providing further context to the “Que Es El Halving De Bitcoin 2025” question.

| Halving Date | Block Reward Before Halving | Block Reward After Halving | Approximate Price Before Halving (USD) | Approximate Price After Halving (USD) (Peak) | Time to Peak Price (approx.) |

|---|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | $13 | $1,147 | ~1 year |

| July 9, 2016 | 25 BTC | 12.5 BTC | $650 | ~$20,000 | ~2 years |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | ~$9,000 | ~$64,000 | ~1 year |

Comparison of the Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is inherently speculative. However, by examining the previous trends, we can formulate some informed expectations. The reduced supply of newly mined Bitcoin will likely contribute to upward price pressure. However, the extent of this pressure will depend on several interacting factors, including the overall state of the global economy, the regulatory landscape for cryptocurrencies, and the level of investor confidence. The 2025 halving is expected to be different from previous ones, as the cryptocurrency market is far more mature and widely recognized than in previous cycles. The increased institutional adoption and regulatory scrutiny could moderate price volatility compared to previous cycles. Conversely, increased adoption could also amplify the price effects. It is crucial to remember that these are merely informed estimations and not guarantees.

Understanding the Mechanics of the Halving

The Bitcoin halving is a significant event that fundamentally alters the rate at which new Bitcoins are created. Understanding its mechanics requires examining the process of Bitcoin mining and its direct impact on the network’s security and economic incentives.

Bitcoin mining is the process by which transactions are verified and added to the blockchain, the public ledger recording all Bitcoin transactions. Miners use powerful computers to solve complex cryptographic puzzles. The first miner to solve the puzzle adds the next block of transactions to the blockchain and receives a reward in Bitcoin. This reward, along with transaction fees, constitutes the miner’s income.

Bitcoin Mining and the Halving

The halving mechanism is programmed into the Bitcoin protocol. Approximately every four years, the reward given to miners for successfully adding a block to the blockchain is cut in half. This reduction in the block reward is the core of the halving event. Before the first halving in 2012, the block reward was 50 BTC. After the halving, it became 25 BTC. Subsequent halvings reduced the reward to 12.5 BTC and then to 6.25 BTC. The next halving in 2025 will reduce it further to 3.125 BTC. This programmed scarcity is a key feature designed to control Bitcoin’s inflation.

The Role of Miners in Securing the Bitcoin Network

Miners play a crucial role in maintaining the security and integrity of the Bitcoin network. By competing to solve complex cryptographic puzzles, they contribute to a distributed consensus mechanism known as Proof-of-Work (PoW). This process ensures that the blockchain remains tamper-proof and prevents fraudulent transactions. The more computational power miners dedicate to the network, the more secure it becomes. The difficulty of the cryptographic puzzles automatically adjusts to maintain a consistent block creation time of approximately 10 minutes, regardless of the total network hash rate.

Impact of Reduced Block Rewards on Miner Profitability

The halving directly impacts miner profitability. As the block reward decreases, miners’ income from block rewards is reduced. To maintain profitability, miners must either increase their efficiency (e.g., by upgrading their mining hardware) or rely more heavily on transaction fees. This creates a competitive pressure within the mining industry, leading to consolidation and the exit of less efficient miners. The profitability of mining is also significantly affected by the price of Bitcoin; a higher Bitcoin price compensates for the reduced block reward.

Consequences of Decreased Miner Profitability on Network Security

A decrease in miner profitability could potentially affect network security. If a significant number of miners become unprofitable and leave the network, the total hash rate could decrease. A lower hash rate could theoretically make the network more vulnerable to attacks, such as 51% attacks, where a malicious actor controls more than half of the network’s computing power. However, the Bitcoin network has historically demonstrated resilience, and the impact of halvings on security has been limited. The price of Bitcoin usually increases after a halving, counteracting the reduced block reward. The market’s response to these events is complex and influenced by multiple factors. For example, the 2020 halving saw a significant increase in Bitcoin’s price in the following months.

The Impact of the Halving on Bitcoin’s Price

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically been associated with significant price movements. While not a guaranteed predictor of future price action, analyzing past halvings offers valuable insights into potential market reactions and the factors influencing them. Understanding these trends helps in formulating informed perspectives on the anticipated impact of the 2025 halving.

Historical Price Trends After Previous Halvings

Examining the price behavior of Bitcoin following the previous halvings reveals a recurring pattern of increased price volatility followed by periods of substantial price appreciation. However, the timeframes and magnitudes of these price changes vary considerably. The initial price surge often occurs in the months leading up to the halving, driven by anticipation and speculation. Post-halving, the price generally experiences a period of consolidation before resuming its upward trend. However, external market forces and macroeconomic conditions significantly influence the overall price trajectory.

Factors Contributing to Price Volatility Around Halvings

Several factors contribute to the heightened volatility surrounding Bitcoin halvings. Firstly, the reduced supply of newly minted Bitcoin creates a deflationary pressure, potentially driving up demand and price. Secondly, the event attracts significant media attention and speculation, leading to increased trading activity and price fluctuations. Thirdly, macroeconomic conditions, such as inflation, regulatory changes, and overall market sentiment, also play a crucial role in influencing the price. Lastly, the actions of large institutional investors and whales can significantly impact the market during periods of heightened volatility.

Expert Opinions on the Potential Price Impact of the 2025 Halving

Expert opinions on the 2025 halving’s price impact are diverse, reflecting the inherent uncertainty of the cryptocurrency market. Some analysts predict a significant price surge, citing the historical precedent and the anticipated scarcity of Bitcoin. Others express caution, emphasizing the influence of macroeconomic factors and potential regulatory headwinds. For example, some experts point to the previous halvings where the price increase wasn’t immediate or as dramatic as some predicted, highlighting the importance of considering other market forces. The divergence in opinions underscores the complexity of predicting cryptocurrency price movements.

Bullish and Bearish Predictions for Bitcoin’s Price Post-2025 Halving

Bullish predictions for the post-2025 halving often center on the reduced supply of Bitcoin leading to increased scarcity and demand, potentially driving the price to new all-time highs. These predictions often incorporate projections based on historical price performance and adoption rates. Conversely, bearish predictions highlight the potential for negative macroeconomic conditions, regulatory uncertainty, or a general market downturn to overshadow the halving’s impact, potentially leading to price stagnation or even a decline. For instance, some analysts argue that the current regulatory scrutiny might dampen the bullish impact typically seen after a halving.

Price Movements After Previous Halvings

| Year | Price Before (USD) | Price After (6 months) (USD) | Price After (1 year) (USD) |

|---|---|---|---|

| 2012 | ~12 | ~14 | ~13 |

| 2016 | ~650 | ~770 | ~1900 |

| 2020 | ~9000 | ~11500 | ~29000 |

Frequently Asked Questions (FAQs)

This section addresses common queries surrounding the Bitcoin halving, a significant event in the Bitcoin network’s lifecycle. Understanding these key aspects is crucial for anyone interested in Bitcoin’s future.

Bitcoin Halving Explained, Que Es El Halving De Bitcoin 2025

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward given to Bitcoin miners for verifying transactions on the blockchain is cut in half. This mechanism is built into the Bitcoin protocol to control inflation and maintain the scarcity of Bitcoin. The initial reward was 50 BTC per block, and it has been halved three times already.

The 2025 Bitcoin Halving Date

The 2025 Bitcoin halving is estimated to occur around April 2025. The exact date depends on the block time, which fluctuates slightly. It’s determined by counting the blocks mined since the previous halving. Because block creation isn’t perfectly consistent, a precise date can only be predicted with a reasonable degree of accuracy as the event approaches. Past halvings have provided a useful benchmark for prediction.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving. This is primarily attributed to the reduced supply of new Bitcoins entering the market. Reduced supply, coupled with consistent or increased demand, often leads to price appreciation. However, it’s important to note that other market factors, such as overall economic conditions and regulatory changes, also significantly influence Bitcoin’s price. The price increase isn’t guaranteed and past performance is not indicative of future results. For example, the 2012 halving preceded a period of significant price growth, while the 2016 halving saw a more gradual price increase.

Investing in Bitcoin During a Halving

Investing in Bitcoin around a halving presents both opportunities and risks. The potential for price appreciation is a significant draw, but the cryptocurrency market is inherently volatile. Investing in Bitcoin should align with your individual risk tolerance and financial goals. Diversification of your investment portfolio is crucial to mitigate risk. Never invest more than you can afford to lose. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Long-Term Implications of the Halving

The halving contributes to Bitcoin’s long-term sustainability by controlling inflation. The reduced supply of new Bitcoins helps to maintain its scarcity, a key factor in its perceived value. This, in turn, could strengthen Bitcoin’s position as a store of value and a potential hedge against inflation in the broader financial landscape. However, the long-term success of Bitcoin also depends on factors such as widespread adoption, technological advancements, and regulatory clarity. The halving is a significant factor, but not the sole determinant of Bitcoin’s future.

Beyond the Price

The Bitcoin halving of 2025, while significantly impacting price speculation, presents broader implications extending far beyond short-term market fluctuations. Understanding these long-term effects is crucial for a comprehensive grasp of Bitcoin’s future and its role in the global financial landscape. This section explores the halving’s influence on decentralization, energy consumption, environmental sustainability, and regulatory responses.

Bitcoin’s Decentralization

The halving’s effect on decentralization is complex. Reduced miner rewards might lead to a consolidation of mining power among larger, more well-funded operations, potentially centralizing the network. However, this could be countered by increased participation from smaller miners utilizing more energy-efficient hardware and geographically diverse locations. The overall impact depends on the interplay of technological advancements, regulatory changes, and the economic incentives for miners. A more decentralized network is generally considered more resilient and resistant to censorship or control by any single entity.

Energy Consumption and Mining

The halving indirectly affects Bitcoin’s energy consumption. Lower block rewards might force less profitable miners to exit the network, leading to a reduction in overall hash rate and energy consumption. Conversely, the increasing price of Bitcoin (often associated with halvings) could incentivize the entry of new, potentially less efficient miners, offsetting any initial reduction. The long-term energy consumption trajectory depends on the balance between these opposing forces and the adoption of more energy-efficient mining technologies. For example, the shift towards renewable energy sources for mining could mitigate environmental concerns.

Environmental Sustainability

The environmental impact of Bitcoin mining remains a significant concern. While the halving may lead to a temporary decrease in energy consumption, the long-term sustainability of Bitcoin depends on the industry’s transition to renewable energy sources. The ongoing development and adoption of more energy-efficient mining hardware, coupled with a strategic shift towards sustainable energy sources, are crucial for mitigating the environmental footprint of the Bitcoin network. Initiatives like carbon offsetting programs and the increased use of hydro, solar, and wind power in mining operations are examples of progress in this area. However, continued monitoring and transparency are necessary to track the overall environmental impact effectively.

Regulatory Responses to the Halving

Governments worldwide are closely monitoring the Bitcoin halving and its potential consequences. A significant price increase following a halving might trigger renewed regulatory scrutiny, potentially leading to stricter regulations on cryptocurrency trading, mining activities, and taxation. Conversely, a less dramatic price response might lead to a more relaxed regulatory approach. The specific regulatory responses will vary across jurisdictions, depending on their individual approaches to cryptocurrency and their assessment of the risks and benefits associated with Bitcoin. Examples include stricter KYC/AML compliance requirements for exchanges or the introduction of specific taxes on cryptocurrency transactions.

Long-Term Impact on Supply and Demand

Imagine a graph charting Bitcoin’s supply over time. It shows a steadily increasing, yet gradually slowing, upward curve representing the fixed supply limit of 21 million coins. Now, overlay a separate line representing demand. Before a halving, demand may outpace the slower-increasing supply, potentially driving prices upward. After the halving, the supply curve flattens further, and depending on sustained demand, the price could continue to rise. However, if demand weakens, the price might stagnate or even decrease. The interplay between these two factors—the fixed, slowly increasing supply and fluctuating demand—determines the long-term price trajectory. The halving acts as a significant catalyst in this dynamic, influencing the balance between supply and demand over the long term.

Understanding the “Que Es El Halving De Bitcoin 2025” involves grasping the halving’s impact on Bitcoin’s inflation rate. This significant event, reducing the rate at which new Bitcoins are created, is easily tracked using a helpful resource like the Bitcoin Halving 2025 Countdown Clock , which provides a real-time countdown. Knowing the exact date helps anticipate potential market shifts related to the “Que Es El Halving De Bitcoin 2025” phenomenon and its consequences for Bitcoin’s value.

Understanding the Bitcoin halving in 2025 involves recognizing the reduction in Bitcoin’s block reward. This significant event impacts the inflation rate of the cryptocurrency. To further understand the cyclical nature of these halvings, it’s helpful to consider when the next one will occur, which you can find information on at When Is The Next Bitcoin Halving After 2025.

Knowing this future date allows for better predictions regarding the long-term effects of the 2025 halving on Bitcoin’s value and overall market dynamics.

Understanding the “Que Es El Halving De Bitcoin 2025” requires knowing the precise timing of the event. To determine this, you’ll need to consult a reliable source detailing the halving schedule, such as this helpful resource: When Is 2025 Bitcoin Halving. Once you know the date, you can better grasp the implications of the 2025 Bitcoin halving on the cryptocurrency’s future inflation rate and overall market dynamics.

Understanding “Que Es El Halving De Bitcoin 2025” involves grasping the halving mechanism, where Bitcoin’s block reward is cut in half. Precisely predicting this event requires careful analysis, and for detailed predictions you can check out this resource on Bitcoin Halving Date 2025 Prediction. Ultimately, understanding the halving’s impact on Bitcoin’s inflation rate is key to comprehending “Que Es El Halving De Bitcoin 2025.”

Understanding the Bitcoin halving of 2025, “Que Es El Halving De Bitcoin 2025,” involves grasping its impact on Bitcoin’s inflation rate. A key aspect is pinpointing the exact date, which you can find by checking this resource: When Was The Bitcoin Halving In 2025. Knowing this date allows for better prediction of potential market reactions surrounding the halving event and its effect on the overall “Que Es El Halving De Bitcoin 2025” discussion.