Realistic Bitcoin Price Prediction 2025

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike since its inception. Its price, however, is notoriously volatile, swinging wildly from record highs to significant lows. Predicting its future value with certainty is an impossible task, a gamble fraught with risk. While no one can definitively say where Bitcoin’s price will be in 2025, a nuanced analysis considering multiple factors can provide a more informed, albeit still uncertain, estimate.

Accurately predicting Bitcoin’s price in 2025 necessitates a multifaceted approach. Several key elements must be considered, including global macroeconomic conditions (inflation, interest rates, recessionary pressures), regulatory developments impacting cryptocurrency adoption, technological advancements within the Bitcoin network itself (like the Lightning Network scaling solutions), and the overall sentiment and adoption rate of Bitcoin amongst investors and the general public. Ignoring any of these factors risks a significantly flawed prediction.

Bitcoin’s Historical Performance and Current Market Position

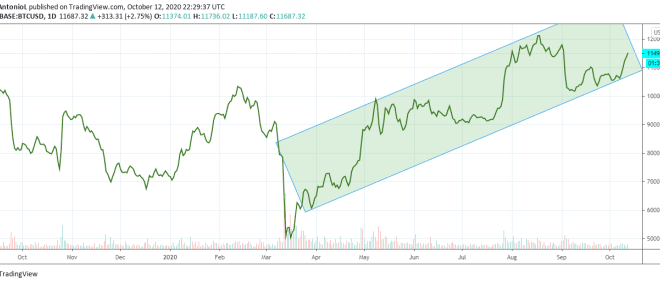

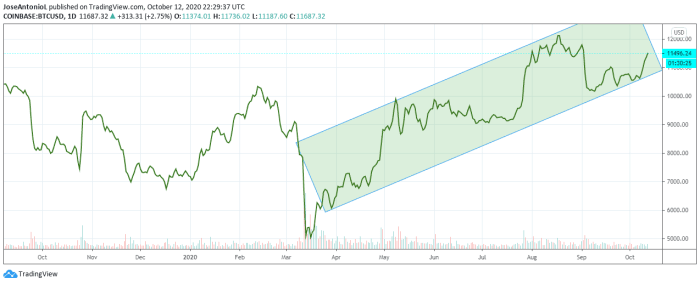

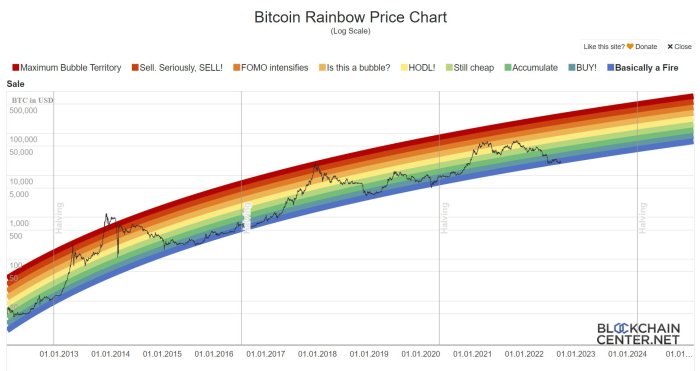

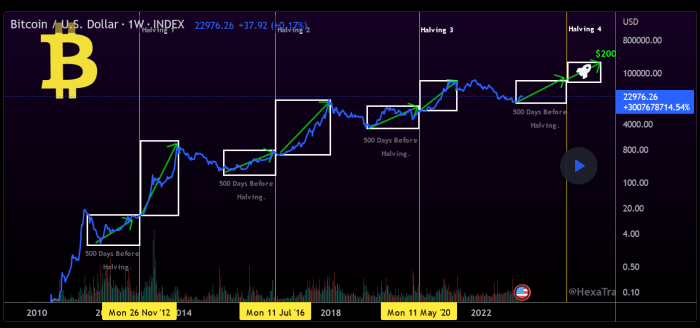

Bitcoin’s journey has been marked by dramatic price swings. From its humble beginnings with a negligible value to its current status as a significant asset class, its history is punctuated by periods of explosive growth and sharp corrections. The 2017 bull run saw Bitcoin reach almost $20,000, followed by a substantial drop. Subsequent years have shown periods of both growth and consolidation, highlighting the inherent volatility. Currently, Bitcoin holds a substantial market capitalization within the cryptocurrency landscape, though its dominance has fluctuated over time, with the emergence of alternative cryptocurrencies (altcoins). Understanding this history, including the various market cycles and influencing factors, is crucial for any realistic price prediction. For example, the halving events, which reduce the rate of new Bitcoin creation, have historically been followed by periods of price appreciation, although the timing and magnitude of this effect are not predictable with precision. Considering past performance, alongside the aforementioned factors, is essential for constructing a realistic price forecast.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and market dynamics. While precise forecasting remains impossible, analyzing these key factors offers valuable insights into potential price trajectories.

Macroeconomic Factors and Bitcoin’s Price, Realistic Bitcoin Price Prediction 2025

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates might reduce investment in riskier assets like Bitcoin, favoring more conservative options. Strong global economic growth could lead to increased investor confidence and potentially higher Bitcoin prices, while economic downturns could trigger sell-offs. The correlation isn’t always direct, however; Bitcoin has demonstrated periods of decoupling from traditional markets. For instance, during the 2022 economic downturn, Bitcoin’s price fell significantly, reflecting investors’ risk aversion, but it also experienced periods of growth despite broader market uncertainty. This highlights the complexity of the relationship and the need for nuanced analysis.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s adoption and price. Clear and supportive regulatory frameworks can foster institutional investment and mainstream acceptance, potentially driving up prices. Conversely, restrictive or unclear regulations can hinder adoption and suppress price growth. The varying approaches taken by different governments worldwide, ranging from outright bans to comprehensive regulatory structures, will continue to influence Bitcoin’s global trajectory. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, demonstrated a government’s willingness to embrace the cryptocurrency, though the long-term economic effects are still being assessed. Conversely, China’s ban on cryptocurrency trading significantly impacted the market.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem are vital for its long-term viability and price appreciation. The Lightning Network, for example, aims to improve scalability and transaction speed, potentially increasing Bitcoin’s usability for everyday payments. The Taproot upgrade enhanced privacy and efficiency. Further innovations in scalability solutions and improved privacy features could attract a wider range of users and investors, leading to increased demand and price appreciation. However, the success of these advancements depends on their widespread adoption and integration.

Institutional vs. Retail Investor Adoption

Institutional investors, such as hedge funds and investment firms, tend to approach Bitcoin with a more long-term, strategic perspective. Their entry into the market can inject significant capital and lend legitimacy, potentially driving up prices. Retail investors, on the other hand, often display more volatile behavior, influenced by market sentiment and short-term price fluctuations. The balance between institutional and retail investor participation significantly shapes Bitcoin’s price volatility and overall trajectory. The increased involvement of institutional investors in recent years has been cited as a factor in Bitcoin’s price increases, though it’s important to note that institutional investment alone doesn’t guarantee sustained price growth.

Competing Cryptocurrencies and Blockchain Technologies

The emergence of competing cryptocurrencies and blockchain technologies presents both challenges and opportunities for Bitcoin. While Bitcoin maintains a strong first-mover advantage and brand recognition, the development of alternative cryptocurrencies with potentially superior functionalities or features could erode Bitcoin’s market dominance. However, competition also spurs innovation and development within the broader crypto space, which could ultimately benefit Bitcoin indirectly. For example, advancements in other blockchain technologies could inspire improvements in Bitcoin’s infrastructure.

Influences on Bitcoin’s Price: A Comparative Overview

| Positive Influence | Negative Influence |

|---|---|

| High inflation (increased demand as a hedge) | Rising interest rates (reduced investment in riskier assets) |

| Supportive government regulations | Restrictive government regulations |

| Technological advancements (e.g., Lightning Network) | Emergence of competing cryptocurrencies |

| Increased institutional investment | Increased retail investor volatility |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and susceptibility to various market forces. However, by analyzing current trends and potential future events, we can construct plausible price scenarios, ranging from optimistic to pessimistic outlooks. These scenarios are not exhaustive, and the actual price may fall outside these ranges.

Bullish Scenario: Bitcoin Surpasses $100,000

This scenario envisions a highly positive outlook for Bitcoin in 2025, driven by widespread adoption, institutional investment, and technological advancements. Increased regulatory clarity in major economies could significantly boost investor confidence. Furthermore, successful scaling solutions and the development of new use cases beyond simple trading could fuel significant growth. The price could potentially exceed $100,000, driven by a combination of factors.

Realistic Bitcoin Price Prediction 2025 – Timeline:

- 2023-2024: Gradual price increase driven by institutional adoption and positive regulatory developments in key markets like the US and EU. Increased demand from institutional investors pushes the price above $50,000.

- 2024-2025: Successful implementation of layer-2 scaling solutions significantly improves transaction speed and reduces fees, attracting a wider range of users. Growing adoption in emerging markets further fuels price appreciation, pushing it past $100,000.

Visual Representation:

The line graph starts at approximately $20,000 (current price, for illustrative purposes) in early 2023. It shows a steady, but relatively slow, upward trend until mid-2024, where it accelerates sharply, crossing the $50,000 mark. From there, the line continues its steep ascent, reaching and surpassing $100,000 by the end of 2025. The overall shape resembles a hockey stick, reflecting the significant price acceleration in the later part of the period.

Bearish Scenario: Bitcoin Falls Below $20,000

This scenario Artikels a less favorable outlook for Bitcoin, characterized by increased regulatory scrutiny, market crashes, and a lack of widespread adoption. Negative news events, such as major security breaches or a significant cryptocurrency market crash, could severely impact investor sentiment. A global economic downturn could also significantly reduce demand.

Timeline:

- 2023-2024: Increased regulatory pressure and negative media coverage lead to decreased investor confidence and a gradual price decline. A major security breach involving a significant cryptocurrency exchange could trigger a sharp price drop.

- 2024-2025: A global economic recession further dampens investor appetite for risky assets, driving Bitcoin’s price below $20,000. A lack of significant technological advancements or positive regulatory developments exacerbates the decline.

Visual Representation:

The graph begins at the same approximate starting point as the bullish scenario. However, instead of rising, the line gradually slopes downwards throughout 2023 and 2024, experiencing a sharper drop in late 2024. By the end of 2025, the line settles significantly below the $20,000 mark, reflecting a sustained bearish trend.

Neutral Scenario: Bitcoin Stabilizes Around $40,000

This scenario assumes a relatively stable market environment, with moderate growth and occasional periods of volatility. Regulatory uncertainty persists, limiting significant price increases, while technological advancements and gradual adoption offset potential downturns. The price would fluctuate around a central point, without experiencing extreme highs or lows.

Timeline:

- 2023-2024: The price fluctuates within a range, experiencing both periods of growth and correction. Regulatory developments have a mixed impact, with some positive and some negative news affecting the market sentiment.

- 2024-2025: The price stabilizes around $40,000, with occasional spikes and dips driven by short-term market events. Technological advancements continue, but their impact on price is less dramatic than in the bullish scenario.

Visual Representation:

The line graph starts similarly to the previous scenarios. However, it shows a relatively flat trajectory with several minor fluctuations around a central line representing the $40,000 price point. There are some upward and downward swings, but these remain contained within a relatively narrow band, indicating price stability and a lack of a clear dominant trend.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. Understanding past trends is crucial, and a key element to consider is the impact of Bitcoin halvings. To gain valuable insight into this, reviewing the historical data on Bitcoin halvings is essential; check out this comprehensive resource on Bitcoin Halving History 2025 for a better understanding.

This historical analysis can help refine our predictions for a realistic Bitcoin price in 2025, considering the scarcity effect.

Predicting the Bitcoin price in 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the Bitcoin halving, which significantly alters the rate of new Bitcoin entering circulation. To understand its potential influence, it’s crucial to know the exact date; you can find this information by checking this resource: Cuándo Es El Halving De Bitcoin 2025.

This date is a critical component when formulating a realistic Bitcoin price prediction for 2025.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. One event that could impact the overall cryptocurrency market, and thus Bitcoin’s price, is the upcoming Halving Bitcoin Cash 2025. This halving will likely affect Bitcoin Cash’s price and potentially ripple outwards, influencing investor sentiment and overall market dynamics, ultimately impacting a realistic Bitcoin price prediction for 2025.

Therefore, considering such events is crucial for informed predictions.

Accurately predicting the Bitcoin price in 2025 is challenging, depending on various market factors. Understanding future price movements requires considering the impact of the next halving event, and for insights into potential post-halving scenarios, you might find this resource helpful: Bitcoin Price Prediction After 2025 Halving. Ultimately, a realistic Bitcoin price prediction for 2025 needs to integrate this post-halving analysis to paint a complete picture.

Accurately predicting the Bitcoin price in 2025 is challenging, influenced by various factors including adoption rates and regulatory changes. A significant event impacting this prediction is the Bitcoin Halving, reducing the rate of new Bitcoin creation. To understand its potential effect, check the precise date of the 2025 Bitcoin Halving on this resource: Bitcoin Halving 2025 Exact Date.

This date is crucial for assessing the potential for price increases due to decreased supply, ultimately refining our understanding of a realistic Bitcoin price prediction for 2025.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the potential timeline for this event and its subsequent effect on price, it’s helpful to consult resources like this prediction: When Is The Bitcoin Halving 2025 Prediction.

Therefore, considering the halving’s timing is crucial for a more realistic Bitcoin price prediction in 2025.