Potential Implications for Investors

Investing in Bitcoin, like any other asset class, presents a unique blend of potential rewards and significant risks. The highly volatile nature of the cryptocurrency market means substantial profits are possible, but equally, significant losses can occur rapidly. Understanding these dynamics is crucial for any investor considering Bitcoin exposure.

Risk and Reward Assessment

Bitcoin’s price history demonstrates extreme volatility. While it has experienced periods of exponential growth, resulting in substantial returns for early investors, it has also undergone dramatic crashes, wiping out considerable wealth for those who invested at market peaks. The lack of regulatory oversight in many jurisdictions adds another layer of complexity and risk. Conversely, the potential for high returns, its decentralized nature, and growing adoption by businesses and institutions present compelling arguments for investment. A balanced approach requires careful consideration of both sides.

Strategies for Mitigating Risks

Effective risk management is paramount when investing in Bitcoin. Diversification is a cornerstone of any robust investment strategy. Avoid putting all your eggs in one basket by allocating only a small percentage of your overall portfolio to Bitcoin. This approach limits potential losses should the price plummet. Furthermore, conducting thorough due diligence before investing, understanding your own risk tolerance, and only investing what you can afford to lose are critical steps. Regularly reviewing your investment strategy and adjusting it based on market conditions is also essential. Consider dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, to mitigate the impact of price volatility.

Bitcoin Price Scenarios and Investor Implications in 2025

The following table illustrates potential outcomes for investors based on different Bitcoin price scenarios in 2025. These scenarios are hypothetical and should not be considered financial advice. They are based on various market analyses and expert opinions, but future price movements are inherently unpredictable. Remember that past performance is not indicative of future results.

| Bitcoin Price in 2025 (USD) | Investor Impact (Example: $10,000 Investment) | Potential Implications |

|---|---|---|

| $100,000 | $90,000 profit (900% ROI) | Massive returns, but high risk of bubble bursting. Potential for early investors to cash out significantly. |

| $50,000 | $40,000 profit (400% ROI) | Strong returns, still potentially lucrative, but with reduced risk compared to the $100,000 scenario. |

| $25,000 | $15,000 profit (150% ROI) | Moderate returns, a more conservative outcome, representing a balanced risk-reward profile. |

| $10,000 | Breakeven | No profit, no loss. Reflects a stagnant market or a scenario where initial investment is recovered. |

| $5,000 | $5,000 loss (50% loss) | Significant loss, highlighting the downside risk associated with Bitcoin investment. |

Frequently Asked Questions (FAQ): Simpsons Bitcoin Prediction 2025

This section addresses common questions regarding the Simpsons’ purported Bitcoin price prediction for 2025 and the broader implications for Bitcoin investment. It’s crucial to remember that fictional media should not be the sole basis for financial decisions.

The Likelihood of Accurate Simpsons Bitcoin Price Prediction, Simpsons Bitcoin Prediction 2025

The likelihood of the Simpsons accurately predicting Bitcoin’s price in 2025 is extremely low. While coincidental similarities between fictional portrayals and real-world events can be striking, attributing predictive power to a satirical cartoon is a fallacy. The Simpsons’ writers, like any creative team, draw inspiration from current events and trends. Any apparent accuracy is likely due to chance or clever writing reflecting existing speculation, not genuine foresight. Relying on such coincidences for investment strategies is inherently risky and unreliable.

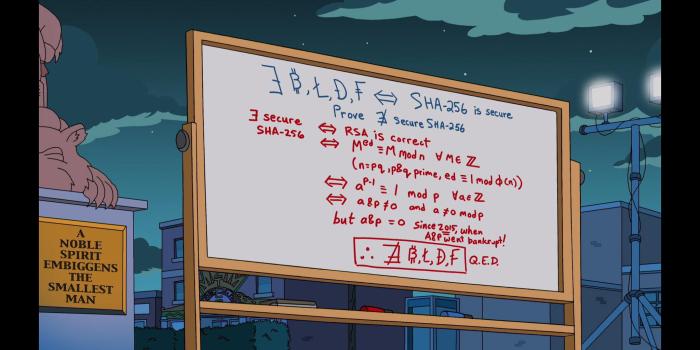

Other Examples of Seemingly Predictive Simpsons Episodes

The Simpsons has gained a reputation for seemingly predicting future events, often attributed to coincidence or astute observation of contemporary trends. For example, the episode predicting the 2000 Bush v. Gore election outcome, while not precisely accurate in detail, captured the contentious nature of the recount and the eventual legal challenges. Similarly, the show depicted a Lisa Simpson presidency, a scenario reflecting broader societal conversations about future leadership. These instances highlight the show’s ability to reflect anxieties and aspirations, rather than possessing genuine predictive capabilities. Another example is the episode depicting a Trump presidency, which aired years before he actually took office, although this again could be attributed to reflecting existing political discourse.

Key Factors Determining Bitcoin’s Price in 2025

Several intertwined factors will significantly influence Bitcoin’s price in 2025. These include:

- Regulatory Landscape: Government regulations globally will play a crucial role. Increased clarity and acceptance could drive adoption and price appreciation, while stricter regulations could dampen enthusiasm.

- Technological Advancements: Improvements in Bitcoin’s underlying technology, such as scaling solutions and increased transaction speed, could positively impact its value and usability.

- Market Adoption and Demand: Widespread adoption by businesses and individuals is vital. Increased demand, coupled with limited supply, could drive prices upward.

- Macroeconomic Factors: Global economic conditions, including inflation, interest rates, and geopolitical events, will inevitably impact Bitcoin’s price, often acting as a safe haven asset during times of economic uncertainty.

- Competition from Altcoins: The emergence and success of competing cryptocurrencies could affect Bitcoin’s market share and price.

Is Investing in Bitcoin a Wise Decision?

Investing in Bitcoin involves significant risk and reward. Bitcoin’s volatility is well-documented, with dramatic price swings occurring frequently. While the potential for substantial returns exists, the possibility of significant losses is equally real. Before investing, individuals should carefully consider their risk tolerance, financial goals, and the potential for complete loss of capital. Thorough research and diversification of investment portfolios are strongly recommended. It’s advisable to consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

Illustrative Examples (Visuals)

Visual aids can effectively communicate the complexities of Bitcoin’s potential future and the disparity between fictional portrayals and real-world market dynamics. The following descriptions offer a clearer understanding of the contrasting viewpoints.

The use of visuals helps to bridge the gap between abstract concepts and concrete understanding, providing a more intuitive grasp of potential Bitcoin price movements and the contrasting views between the Simpsons’ fictional depiction and the actual cryptocurrency market.

Hypothetical Image: Simpsons’ Futuristic Finance vs. 2025 Reality

This image would be a split-screen comparison. The left side would depict a scene reminiscent of a Simpsons episode showcasing a futuristic financial system. Imagine a wildly advanced, possibly chaotic, trading floor filled with characters like Mr. Burns, using holographic interfaces to execute trades in some bizarre, cartoonish cryptocurrency that is clearly not Bitcoin. The scene would be saturated with bright, almost garish, colors and feature exaggerated displays of wealth and technological advancement, perhaps including robots handling transactions or complex algorithms displayed as swirling, abstract patterns. The overall tone would be comedic and fantastical, reflecting the Simpsons’ satirical style.

The right side of the image would show a more realistic representation of the cryptocurrency market in 2025. This would involve a more subdued color palette, featuring graphs displaying Bitcoin’s price fluctuating within a range (perhaps showing both bullish and bearish scenarios). News headlines in the background might indicate real-world events impacting the market, such as regulatory changes or macroeconomic trends. The overall mood would be more serious and data-driven, reflecting the complexities and uncertainties inherent in real-world financial markets. The contrast between the two sides would highlight the gap between comedic, fictional representations and the nuanced realities of the cryptocurrency market.

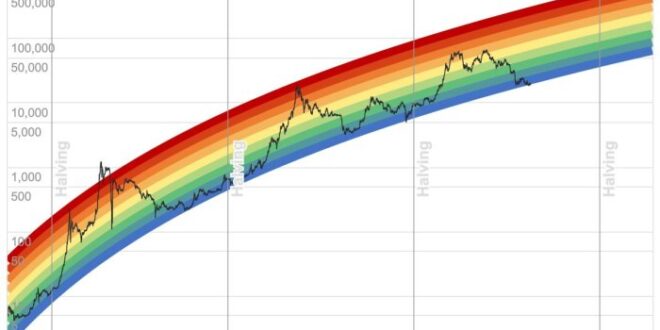

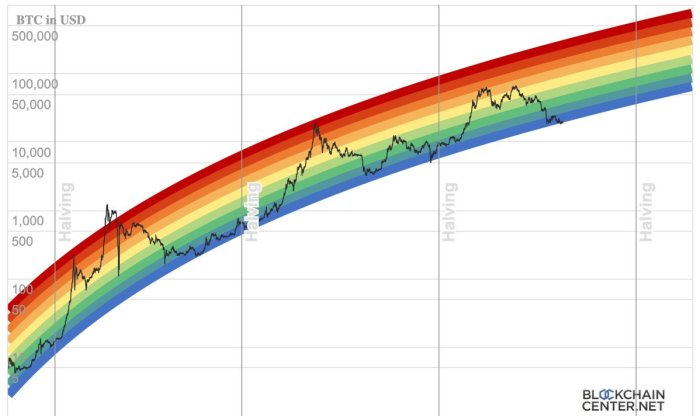

Bitcoin Price Trajectory Graph for 2025

This graph would feature a time axis spanning from January 1st, 2025, to December 31st, 2025. The vertical axis would represent the Bitcoin price in USD. Three distinct lines would represent different potential scenarios:

* Bullish Scenario (Green Line): This line would show a steady, upward trend throughout the year, potentially reaching a significantly higher price than the starting point. This could be based on positive market sentiment, widespread adoption, or institutional investment. For example, a starting price of $30,000 could rise to $70,000 by year-end.

* Bearish Scenario (Red Line): This line would illustrate a downward trend, potentially dipping below the starting price. This scenario might reflect negative regulatory changes, macroeconomic instability, or a general loss of investor confidence. Using the same starting point, the price might fall to $15,000.

* Neutral Scenario (Blue Line): This line would depict a more stable, fluctuating price range throughout the year, with some upward and downward movements but without a significant overall increase or decrease. This scenario reflects a market consolidating after previous volatility. The price might fluctuate between $25,000 and $40,000.

A key would clearly label each line and its corresponding scenario. The graph’s title would be “Potential Bitcoin Price Trajectories – 2025.” The graph would also include a disclaimer stating that these are hypothetical scenarios and actual prices may differ significantly. This disclaimer acknowledges the inherent uncertainty in predicting cryptocurrency prices.