What is Bitcoin Halving?

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial part of Bitcoin’s design, intended to control inflation and maintain the scarcity of the cryptocurrency.

Bitcoin Halving Mechanics

The halving mechanism directly affects the block reward miners receive for successfully adding a new block of transactions to the blockchain. Initially, the reward was 50 BTC per block. With each halving, this reward is cut in half. Therefore, after the first halving, the reward became 25 BTC, then 12.5 BTC, and after the 2020 halving, it settled at 6.25 BTC. The 2025 halving will reduce this reward further to 3.125 BTC per block. This controlled reduction in the supply of new Bitcoins is a key element in maintaining its long-term value proposition.

Historical Impact of Bitcoin Halvings

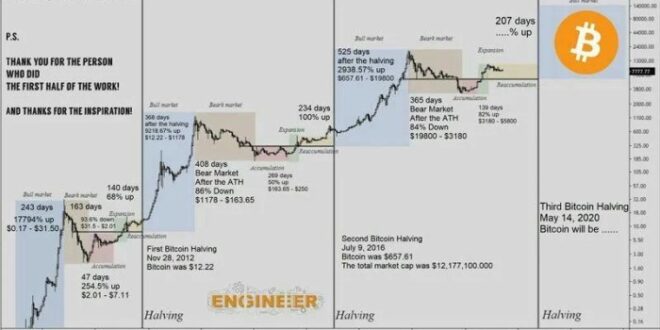

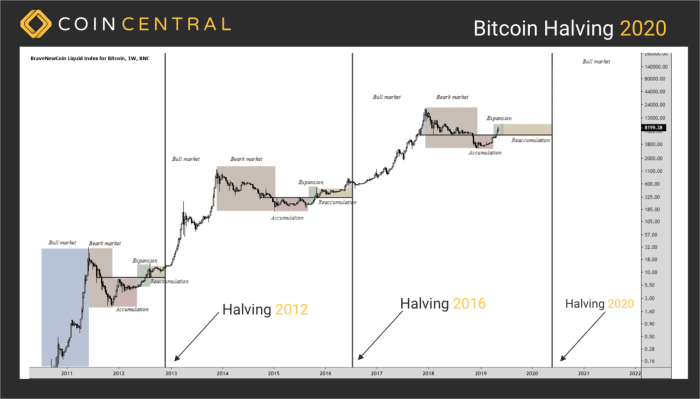

Previous halvings have generally been followed by periods of increased Bitcoin price appreciation. While correlation doesn’t equal causation, the reduced supply coupled with continued or increased demand often leads to upward price pressure. The first halving in 2012 saw a relatively gradual price increase in the following months. The second halving in 2016 preceded a significant bull market that lasted into 2017. The third halving in 2020 was followed by a period of price consolidation before a substantial surge in price during 2021. However, it’s important to note that other market factors, such as regulatory changes, technological advancements, and overall macroeconomic conditions, also significantly influence Bitcoin’s price.

Comparison of the 2025 Halving with Previous Events

Predicting the exact impact of the 2025 halving is inherently speculative. However, we can analyze past trends to form reasonable expectations. The 2025 halving will likely be different from previous ones due to increased institutional involvement, greater regulatory scrutiny, and a more mature cryptocurrency market. The magnitude of the price increase after the 2025 halving might be less dramatic than previous instances, or it might be delayed. Furthermore, the overall economic climate and the general sentiment towards cryptocurrencies will heavily influence the market reaction. The reduced block reward will certainly impact miner profitability, potentially leading to adjustments in mining strategies and hash rate.

Timeline of Key Events Surrounding Bitcoin Halvings

The following table provides a simplified timeline highlighting key events surrounding past Bitcoin halvings:

| Halving Date | Block Reward (BTC) | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) | Notable Market Events |

|---|---|---|---|---|

| November 28, 2012 | 25 | ~13 | ~100 | Gradual price increase; early adoption growth |

| July 9, 2016 | 12.5 | ~650 | ~2000 | Significant price surge; increasing institutional interest |

| May 11, 2020 | 6.25 | ~8700 | ~10000 (though price significantly increased later) | COVID-19 pandemic; increased institutional and retail adoption |

Note: Price data is approximate and subject to various sources and methodologies.

Visual Representation of Halving Events and Bitcoin Price, What Is Bitcoin Halving 2025

Imagine a line graph with the x-axis representing time (years since Bitcoin’s inception) and the y-axis representing Bitcoin’s price in USD. Three distinct vertical lines would mark the three previous halving events. The graph would show a general upward trend in Bitcoin’s price over time, with noticeable price increases occurring after each halving event. The magnitude of the price increase after each halving would vary, with the increase following the 2016 halving being particularly pronounced. The graph would visually demonstrate the correlation between halving events and subsequent price appreciation, although it wouldn’t definitively prove causation. The line representing Bitcoin’s price would likely show periods of volatility both before and after each halving.

The 2025 Bitcoin Halving

The 2025 Bitcoin halving, projected to occur in the spring, marks a significant event in the cryptocurrency’s ongoing evolution. This reduction in the rate of newly minted Bitcoin will, as previous halvings have, impact various aspects of the Bitcoin ecosystem, influencing price, mining profitability, and network security. Understanding the projected date and its potential consequences is crucial for anyone involved in or observing the cryptocurrency market.

Projected Date and Significance of the 2025 Halving

The precise date of the 2025 Bitcoin halving is dependent on the block generation time, which can fluctuate slightly. However, based on current block times and the halving mechanism programmed into the Bitcoin protocol, the event is anticipated to occur sometime in the spring of 2025. This halving, the fourth in Bitcoin’s history, is significant because it reduces the reward for miners who verify transactions on the Bitcoin blockchain by half. This inherent scarcity mechanism is a core tenet of Bitcoin’s design, intended to control inflation and maintain the value of the cryptocurrency over time. The previous halvings, in 2012, 2016, and 2020, have historically been followed by periods of significant price appreciation, although the timing and magnitude of these price increases have varied.

Expert Opinions on the 2025 Halving’s Market Impact

Various experts hold differing opinions on the precise impact of the 2025 halving. Some analysts predict a substantial price surge following the event, mirroring the patterns observed after previous halvings. They point to the reduced supply of new Bitcoin as a primary driver of increased demand and consequently higher prices. Other experts, however, are more cautious, suggesting that other market factors, such as regulatory developments, macroeconomic conditions, and overall investor sentiment, could significantly influence Bitcoin’s price trajectory. These analysts argue that while the halving is a significant event, it’s not the sole determinant of price movement. For example, some argue that the market might have already priced in the anticipated effects of the halving, limiting its immediate impact.

Impact on Bitcoin Mining Profitability and Hash Rate

The 2025 halving will undoubtedly affect the profitability of Bitcoin mining. With the reward halved, miners will need to adjust their operations to remain profitable. This could lead to some miners exiting the market, especially those operating with less efficient equipment or higher electricity costs. This potential decrease in mining activity could, in turn, temporarily reduce the Bitcoin network’s hash rate – a measure of the computational power securing the blockchain. However, the long-term effect on the hash rate is debatable. Some believe that the reduced profitability might lead to a consolidation within the mining industry, with only the most efficient miners remaining, ultimately strengthening the network’s security. Others suggest that the price increase anticipated by some could offset the reduced block reward, maintaining or even increasing profitability for efficient miners.

Comparative Analysis of Market Predictions

Predicting the market’s reaction to the 2025 halving involves analyzing past halving cycles. Following the 2012 halving, Bitcoin’s price saw a gradual increase over the subsequent year. The 2016 halving was followed by a more pronounced price surge, culminating in the 2017 bull market. The 2020 halving resulted in a significant price rally in 2021. However, it’s important to note that these previous cycles occurred under different macroeconomic conditions and levels of market maturity. Therefore, directly extrapolating past performance to predict the future is unreliable. While many anticipate a positive price response, the magnitude and timing remain uncertain, and the impact could be less dramatic than previous cycles, or even delayed due to prevailing market sentiment and regulatory uncertainty.

Impact on Bitcoin Price and Volatility

Bitcoin halvings, events that cut the rate at which new Bitcoins are mined in half, have historically been followed by periods of significant price appreciation. However, the relationship isn’t straightforward, and numerous factors influence the actual price movements. Understanding this complex interplay is crucial for navigating the market around a halving event.

The correlation between Bitcoin halvings and subsequent price increases isn’t a guaranteed law, but rather a pattern observed in the past. The reduced supply of newly mined Bitcoins, coupled with generally increasing demand, has often led to upward pressure on the price. This effect is rooted in basic supply and demand economics: scarcity tends to increase value.

Historical Correlation Between Halvings and Price Movements

The first Bitcoin halving in 2012 saw a relatively modest price increase in the following months. The second halving in 2016 preceded a significant bull run, with the price rising substantially over the next year. The third halving in 2020 also saw a price surge, though the subsequent market behavior was more complex and volatile. Analyzing these past events reveals a trend of increased price after halving, but the magnitude and duration vary considerably. The impact isn’t immediate; it’s often a gradual process influenced by numerous other market factors.

Scenario Analysis of Potential Price Outcomes After the 2025 Halving

Predicting the precise price of Bitcoin after the 2025 halving is impossible. However, we can explore plausible scenarios. A bullish scenario might see a gradual price increase leading up to the halving, followed by a significant surge afterward, potentially mirroring the 2020 event, albeit with its own unique market conditions. A more conservative scenario anticipates a less dramatic price movement, possibly due to factors like macroeconomic conditions or regulatory changes. A bearish scenario, while less likely given the historical pattern, could see a price dip following the halving if overall market sentiment is negative or if significant selling pressure emerges. The actual outcome will depend on a multitude of interacting factors. For example, a scenario similar to 2016 could see a period of sideways trading after the halving before a significant price increase. A scenario more like 2012 would see more modest price increases.

Influence of Supply and Demand on Bitcoin’s Price Around Halvings

The halving directly impacts the supply side of the Bitcoin equation. By reducing the rate of new Bitcoin creation, the halving inherently creates a scarcity effect. This scarcity, when met with sustained or increasing demand, pushes the price upwards. Demand, however, is driven by a complex interplay of factors including investor sentiment, adoption rates, regulatory developments, and macroeconomic conditions. The halving itself doesn’t guarantee increased demand; it simply creates a more favorable environment for price appreciation if demand remains strong or increases.

Price Volatility Before, During, and After Previous Halvings

Bitcoin’s price volatility is inherently high, and this volatility tends to intensify around halving events. Leading up to a halving, anticipation often drives price fluctuations. During the halving itself, the market may experience a period of relative calm or even a slight dip as the event is priced in. The period after a halving is usually characterized by increased volatility as the market reacts to the reduced supply and the resulting price pressure. The extent of this volatility varies from one halving to the next, influenced by the broader market conditions and investor sentiment. For example, comparing the volatility surrounding the 2016 and 2020 halvings highlights the variations in market response.

Short-Term and Long-Term Price Implications of the 2025 Halving

The 2025 halving is likely to have both short-term and long-term implications for Bitcoin’s price. In the short term, we might see increased volatility and potentially a price surge driven by speculation and anticipation. However, the long-term impact will depend heavily on broader market conditions and the continued adoption of Bitcoin. A sustained increase in demand, coupled with the reduced supply, could lead to significant long-term price appreciation. Conversely, if demand weakens or negative market forces prevail, the impact of the halving might be less pronounced or even negated. The extent to which the 2025 halving mirrors past events remains to be seen, as each halving occurs within a unique economic and geopolitical context.

Impact on Bitcoin Mining and Network Security

The Bitcoin halving, a pre-programmed event reducing the block reward miners receive, significantly impacts the profitability of mining operations and, consequently, the security and decentralization of the Bitcoin network. Understanding these impacts is crucial for assessing the long-term health and stability of the cryptocurrency.

The halving directly affects miner profitability by reducing their revenue stream. With fewer newly minted Bitcoins awarded for successfully adding blocks to the blockchain, miners must contend with potentially lower profits, especially if the price of Bitcoin doesn’t rise proportionally to offset the reduced reward. This can lead to miners shutting down less efficient operations, potentially affecting the network’s overall hash rate.

Miner Profitability After Halving

The profitability of Bitcoin mining is a complex interplay of several factors: the Bitcoin price, electricity costs, mining hardware efficiency (hash rate per unit of power), and the block reward. A halving directly impacts the last of these. For example, if the block reward is halved but the Bitcoin price remains constant, miners’ revenue per block will be cut in half. To maintain profitability, miners need to either reduce their operating costs (e.g., finding cheaper electricity) or improve their hardware efficiency. Historically, halvings have often been followed by periods of consolidation within the mining industry, with less efficient miners exiting the market.

Impact on Network Security and Decentralization

The Bitcoin network’s security relies heavily on the collective computational power of its miners, represented by the network’s hash rate. A decline in miner profitability can lead to a decrease in the hash rate, potentially making the network more vulnerable to 51% attacks. However, this isn’t a guaranteed outcome. A sufficiently high Bitcoin price could offset the reduced block reward, maintaining or even increasing the hash rate as new, more efficient mining hardware is deployed. Furthermore, a decrease in the number of miners could lead to a more centralized network, potentially impacting its decentralization. The long-term effects depend on how miners adapt and the overall market dynamics.

Hash Rate Trends Following Previous Halvings

Analyzing previous halvings provides valuable insights. The 2012 and 2016 halvings saw initial dips in the hash rate followed by substantial growth. This growth was largely attributed to improvements in mining hardware and the rising price of Bitcoin. While the initial drop reflected miners temporarily exiting the market due to reduced profitability, the subsequent increase demonstrates the industry’s capacity to adapt and the overall attractiveness of Bitcoin mining, particularly when its price appreciates. The pattern wasn’t identical each time, highlighting the dynamic nature of the market and the interplay of technological advancements, price fluctuations, and regulatory changes.

Miner Adaptation Strategies

Miners employ various strategies to navigate the challenges of halving. These include: upgrading to more energy-efficient hardware, exploring alternative revenue streams like transaction fees, seeking cheaper electricity sources (e.g., relocating to regions with lower energy costs), and forming mining pools to share resources and risks. The successful implementation of these strategies often dictates the overall resilience of the network following a halving. The competitive landscape drives innovation and efficiency improvements within the mining sector.

Long-Term Sustainability of Bitcoin Mining

The long-term sustainability of Bitcoin mining post-halving hinges on several factors, including technological advancements in mining hardware, the price of Bitcoin, and regulatory developments. While halvings reduce the immediate profitability of mining, they also incentivize innovation and efficiency improvements. A sustained increase in the price of Bitcoin, coupled with technological progress, can offset the reduced block reward and ensure the long-term viability of Bitcoin mining, maintaining the security and decentralization of the network. However, significant regulatory hurdles or prolonged periods of low Bitcoin prices could pose substantial challenges to the long-term sustainability of the mining industry.

Market Sentiment and Investor Behavior: What Is Bitcoin Halving 2025

Bitcoin halving events, occurring roughly every four years, significantly impact market sentiment and investor behavior. The predictable reduction in new Bitcoin supply creates a dynamic interplay of anticipation, speculation, and price volatility. Understanding these patterns is crucial for navigating the market around these events.

Investor behavior leading up to a halving typically exhibits increased accumulation. Many investors view the halving as a bullish signal, anticipating a future price increase due to the reduced supply. This often leads to a period of price appreciation in the months preceding the event, fueled by anticipation and speculation. Following the halving, the market reaction is often more complex and less predictable. While some investors may take profits after the price increase, others may continue to hold, believing the price will continue to rise. The actual price movement post-halving is influenced by a multitude of factors beyond just the halving itself, including broader macroeconomic conditions and overall market sentiment.

Historical Impact on Market Sentiment and Investor Confidence

Historically, Bitcoin halving events have been associated with periods of increased market volatility and, often, significant price appreciation in the months following the event. The 2012 halving saw a relatively modest price increase, while the 2016 halving led to a more substantial rally. The 2020 halving resulted in a significant price surge, though this was also influenced by other factors such as increased institutional adoption and the overall growth of the cryptocurrency market. While these events have generally been bullish in the long term, the short-term impact is far less predictable and often involves periods of significant price swings. The sustained upward trend after each halving, however, has reinforced the belief among many investors that the halving acts as a powerful catalyst for price growth.

The Role of Speculation and FOMO

Speculation plays a significant role in shaping Bitcoin’s price movements around halving events. The anticipation of scarcity, driven by the reduced supply of new Bitcoins, fuels speculation, leading to increased buying pressure and price appreciation. FOMO (fear of missing out) amplifies this effect, as investors rush to buy Bitcoin to avoid potentially missing out on significant future gains. This creates a positive feedback loop, where rising prices further incentivize buying, leading to even higher prices. This speculative element, however, also introduces significant risk, as the price can be highly susceptible to sudden corrections if market sentiment shifts. The 2020 halving, for example, saw a period of rapid price increase followed by a correction, illustrating the volatility inherent in this market dynamic.

Comparison of 2025 Halving Sentiment with Past Cycles

The sentiment surrounding the 2025 halving is complex and differs from past cycles in several ways. While the previous halvings occurred in a relatively less regulated and less mature cryptocurrency market, the 2025 halving takes place amidst increased regulatory scrutiny, institutional involvement, and broader macroeconomic uncertainty. While the fundamental scarcity argument remains, the impact of external factors is potentially greater this time around. The overall market sentiment, influenced by factors such as inflation, interest rates, and geopolitical events, will likely play a more significant role in determining the price movements surrounding the 2025 halving compared to previous cycles.

Key Market Indicators to Watch Before and After the 2025 Halving

Several key market indicators can provide valuable insights into the market sentiment and potential price movements before and after the 2025 halving. These include:

- Bitcoin’s on-chain metrics: Analyzing metrics like the number of active addresses, transaction volume, and miner behavior can provide clues about the underlying strength of the network and investor confidence.

- Macroeconomic indicators: Factors such as inflation rates, interest rates, and overall economic growth can significantly impact investor sentiment towards risk assets like Bitcoin.

- Regulatory developments: Changes in regulatory frameworks impacting the cryptocurrency industry can influence investor confidence and market volatility.

- Institutional investment: The level of institutional investment in Bitcoin can serve as a gauge of market maturity and long-term confidence.

- Social media sentiment: While not a definitive indicator, analyzing social media sentiment can provide a sense of overall market sentiment and speculative activity.

Monitoring these indicators can offer a more nuanced understanding of the market dynamics surrounding the 2025 halving, allowing for more informed investment decisions.

What Is Bitcoin Halving 2025 – Bitcoin halving is a programmed event where the reward for miners creating new blocks is cut in half. This impacts the rate of new Bitcoin entering circulation. To understand the implications, knowing precisely when this reduction occurs is crucial; you can find out more by checking this resource on When Does Bitcoin Halving 2025. Understanding the timing of the 2025 halving is vital for predicting potential market effects associated with the reduced supply of newly mined Bitcoin.

Bitcoin halving 2025 refers to the scheduled reduction in the rate of newly mined bitcoins. This event, crucial to Bitcoin’s deflationary model, significantly impacts its supply. To understand the precise timing of this halving, it’s helpful to consult resources such as this article on When Halving Bitcoin 2025 , which provides details on the projected date. Ultimately, the halving’s impact on Bitcoin’s price and market remains a topic of ongoing discussion and speculation.

Bitcoin halving is a programmed event reducing the rate of new Bitcoin creation. This significant event impacts the cryptocurrency’s inflation rate and overall supply. To understand its impact, knowing the precise timing is crucial; you can find out exactly when the Bitcoin halving occurred in 2025 by checking this resource: When Was The Bitcoin Halving In 2025.

Understanding the date of past halvings helps predict future market behavior related to Bitcoin halving events.

Understanding the Bitcoin Halving 2025 event requires knowing the precise date of this significant occurrence. To find out exactly when this reduction in Bitcoin mining rewards will take place, you should consult a reliable source for the confirmed date, such as this helpful resource on the Fecha Halving Bitcoin 2025. This date is crucial for predicting potential market impacts related to the Bitcoin Halving 2025.

What is Bitcoin Halving 2025? Simply put, it’s a scheduled event where the reward for Bitcoin miners is cut in half. This reduction, occurring approximately every four years, impacts the rate of new Bitcoin entering circulation. For detailed information about this significant event, be sure to check out the comprehensive resource on the Bitcoin Halving Event 2025.

Understanding this halving event is crucial to comprehending the long-term implications for Bitcoin’s value and scarcity. What is Bitcoin Halving 2025, therefore, is a pivotal moment in the cryptocurrency’s history.

Understanding the Bitcoin Halving 2025 event requires grasping the mechanics of Bitcoin’s reward system. Essentially, it’s a programmed reduction in the rate of new Bitcoin creation. For those seeking a Spanish-language explanation, a helpful resource is available at Que Es Halving Bitcoin 2025 , which details this significant event. Returning to the English perspective, this halving is expected to impact Bitcoin’s price and overall market dynamics in the coming years.