What is Bitcoin Halving?: What Is The 2025 Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and is a crucial mechanism designed to control Bitcoin’s inflation and maintain its scarcity over time. It’s a fundamental aspect of Bitcoin’s design, impacting its long-term value proposition.

Bitcoin Halving Mechanism and Impact on Supply

The halving mechanism is hardcoded into the Bitcoin blockchain. It dictates that the reward given to miners for successfully adding a block of transactions to the blockchain is cut in half. Initially, the block reward was 50 BTC. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The next halving in 2025 will reduce this reward to 3.125 BTC. This reduction in the rate of new Bitcoin creation directly impacts the overall supply, slowing its growth and contributing to its deflationary nature. The total supply of Bitcoin is capped at 21 million coins; the halving ensures this limit is reached gradually over time.

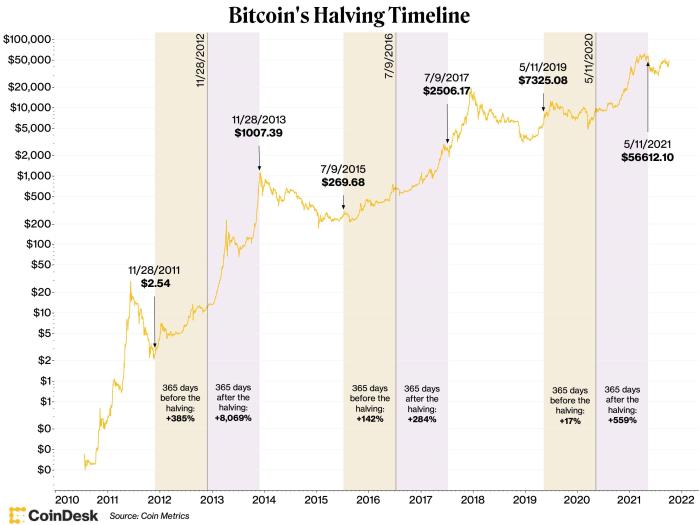

Historical Overview of Bitcoin Halvings and Subsequent Price Movements

Bitcoin has experienced three previous halvings: in November 2012, July 2016, and May 2020. Following each halving, the price of Bitcoin has historically seen a period of significant growth, though the timing and magnitude of these price increases have varied. The 2012 halving was followed by a gradual price increase. The 2016 halving preceded a substantial bull market, and the 2020 halving also led to a significant price surge, although this was followed by a correction. It’s important to note that while historical trends suggest a potential positive correlation between halvings and price increases, this is not guaranteed and other market factors significantly influence Bitcoin’s price.

Comparison of the Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is challenging, as numerous factors influence Bitcoin’s price. However, analysts often compare it to past events, considering the increased adoption and maturity of the cryptocurrency market since the previous halvings. While past halvings have been followed by bull markets, the 2025 halving might see a different response due to macroeconomic conditions, regulatory changes, and the overall sentiment in the crypto market. The reduced supply pressure, however, remains a significant factor potentially contributing to upward price pressure. The anticipation of the halving itself can also influence market behavior, driving price action leading up to the event.

Mathematical Formula and Long-Term Implications for Scarcity

The halving is governed by a simple, yet powerful, formula: the block reward is halved every 210,000 blocks. This creates a predictable, yet gradually decreasing, supply of new Bitcoins. This mathematical certainty contributes significantly to Bitcoin’s perceived scarcity and value proposition. As the supply approaches the 21 million coin limit, the rate of new Bitcoin creation diminishes drastically, enhancing its long-term scarcity and potentially influencing its value. The formula ensures that Bitcoin’s supply remains finite and predictable, unlike fiat currencies which can be printed indefinitely. This inherent scarcity is a key differentiating factor and a major driver of Bitcoin’s appeal.

The halving formula: Block Reward = Initial Block Reward / 2^(n), where ‘n’ is the number of halvings that have occurred.

Visual Representation of Bitcoin’s Supply Reduction

Imagine a line graph. The X-axis represents time (in years), starting from Bitcoin’s inception. The Y-axis represents the number of newly mined Bitcoins per year. The graph starts with a relatively high value representing the initial 50 BTC block reward. With each halving (marked on the X-axis), the line drops sharply by half. This downward trend continues, gradually flattening as the supply approaches its limit. The 2025 halving would be represented by another significant drop in the line, illustrating the continuing reduction in the rate of new Bitcoin creation. The graph would visually demonstrate the decreasing supply of newly mined Bitcoin over time, culminating in the eventual cessation of new Bitcoin mining when the 21 million coin limit is reached.

The 2025 Bitcoin Halving

The 2025 Bitcoin halving, scheduled for approximately April 2025, represents a significant event in the cryptocurrency’s lifecycle. This event, where the reward for Bitcoin miners is cut in half, has historically been followed by periods of price appreciation. However, predicting the precise impact remains a complex undertaking, influenced by a multitude of interacting factors.

Predicted Price Consequences of the 2025 Halving

The halving mechanism, inherent to Bitcoin’s design, reduces the rate of new Bitcoin entering circulation. This decrease in supply, coupled with potentially sustained or increased demand, is often cited as a catalyst for price increases. Historically, previous halvings have been followed by substantial price rallies, although the timing and magnitude of these rallies have varied. For example, the 2012 halving was followed by a significant price increase in 2013, while the 2016 halving preceded the 2017 bull run. However, external market forces, such as regulatory changes or macroeconomic conditions, can significantly influence the price trajectory. It’s crucial to remember that past performance is not indicative of future results.

Impact on Bitcoin Mining Profitability and Hash Rate

The halving directly impacts Bitcoin miners’ profitability. A reduced block reward means miners earn less Bitcoin for each block they successfully mine. This can lead to some miners becoming unprofitable and potentially exiting the network, causing a temporary decrease in the hash rate (the total computational power securing the Bitcoin network). However, this effect is often mitigated by several factors: an increase in Bitcoin’s price (offsetting the reduced reward), technological advancements leading to more efficient mining hardware, and the potential for miners to switch to alternative, more profitable cryptocurrencies. The net effect on hash rate is difficult to predict with certainty, and often depends on the interplay of these factors.

Expert Opinions and Market Analyses Regarding the 2025 Halving

Various analysts and experts offer differing perspectives on the 2025 halving’s impact. Some believe the halving will trigger a substantial price increase, citing the historical precedent and the inherent scarcity of Bitcoin. Others are more cautious, highlighting the influence of macroeconomic factors, regulatory uncertainty, and the potential for market manipulation. These differing viewpoints underscore the inherent uncertainty surrounding price predictions in the volatile cryptocurrency market. For example, some analysts might point to the increasing institutional adoption of Bitcoin as a bullish factor, while others might emphasize the growing energy consumption concerns related to Bitcoin mining.

Potential Risks and Uncertainties Associated with Predicting the Halving’s Outcome, What Is The 2025 Bitcoin Halving

Predicting the precise outcome of the 2025 halving is inherently challenging. Numerous unpredictable factors can influence Bitcoin’s price and mining activity, including global economic conditions, regulatory changes, technological advancements, and the overall sentiment within the cryptocurrency market. Furthermore, the influence of large holders (“whales”) and their trading strategies can significantly impact price movements. These uncertainties make precise predictions extremely difficult, and it’s crucial to approach any forecast with a healthy dose of skepticism.

Timeline of Significant Events Leading Up to and Following the 2025 Halving

A timeline outlining significant events surrounding the 2025 halving would include:

- Pre-Halving (2023-2025): Increasing anticipation in the market, potential price fluctuations based on speculation, technological advancements in mining hardware.

- Halving Event (April 2025): Block reward reduced by 50%.

- Post-Halving (2025-2027): Potential price increase (or decrease depending on market conditions), adjustments in mining profitability and hash rate, continued technological innovation within the Bitcoin ecosystem.

Note that this timeline is a simplified representation and actual events may deviate significantly. The period following the halving is particularly uncertain, as the interplay of various factors will determine the ultimate impact on Bitcoin’s price and network activity.

What Is The 2025 Bitcoin Halving – The 2025 Bitcoin halving is a significant event where the reward for Bitcoin miners is cut in half. This programmed reduction, occurring approximately every four years, impacts the rate of new Bitcoin entering circulation. To learn more about the specific date and its potential market effects, check out the details on Bitcoin Halving Day 2025. Understanding this date is crucial for comprehending the long-term implications of the 2025 Bitcoin halving on its price and overall ecosystem.

The 2025 Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, reducing the rate at which new Bitcoins are mined. Understanding the precise timing is crucial for market analysis, and you can find that information by checking out the projected date at Date Halving Bitcoin 2025. This halving event will undoubtedly impact Bitcoin’s price and overall market dynamics in the coming years, making it a key factor to consider for investors.

The 2025 Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, reducing the rate of newly mined Bitcoin by half. To understand its impact, it’s crucial to know the precise date; you can find that information by checking this resource: When Was The Bitcoin Halving In 2025. This halving event is expected to influence Bitcoin’s price and overall market dynamics, making understanding its timing essential for investors and enthusiasts alike.

The 2025 Bitcoin halving is a significant event where the reward for Bitcoin miners is cut in half. This predictable reduction in new Bitcoin supply often influences the price, leading to speculation about its impact. For insightful predictions on this event, check out this detailed analysis on Bitcoin Halving 2025 Prediction. Understanding these predictions helps contextualize the broader implications of the 2025 Bitcoin halving on the cryptocurrency market.

The 2025 Bitcoin halving is a significant event where the rate of new Bitcoin creation is cut in half, impacting supply. Understanding this reduction is crucial for predicting future price movements, and to help you with that, you can check out this resource on Bitcoin Halving Price Prediction 2025 which offers insightful analysis. Ultimately, the 2025 halving’s effect on Bitcoin’s price remains a topic of much discussion and speculation within the cryptocurrency community.

The 2025 Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, reducing the rate at which new Bitcoins are mined. Understanding the precise timing of this event is crucial for market analysis, and you can find detailed information on the exact date by checking this helpful resource on Bitcoin Halving Time 2025. This reduction in supply often influences Bitcoin’s price, making the 2025 halving a key factor in future price predictions.