What is Bitcoin Halving?: What Is The Bitcoin Halving 2025

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and is designed to control inflation and maintain the scarcity of Bitcoin. The halving mechanism is a core component of Bitcoin’s deflationary monetary policy.

The Bitcoin Halving Process and Market Impact, What Is The Bitcoin Halving 2025

The Bitcoin halving process involves reducing the block reward—the amount of Bitcoin miners receive for successfully adding a block of transactions to the blockchain—by half. Before the first halving, miners received 50 BTC per block. Each subsequent halving cuts this reward in half. This reduction in the supply of newly minted Bitcoins affects the cryptocurrency market in several ways. Reduced supply can lead to increased scarcity, potentially driving up demand and price. However, the market’s reaction is complex and influenced by various factors beyond the halving itself, including overall market sentiment, regulatory changes, and technological advancements. The impact isn’t always immediate; sometimes, the price increase occurs gradually over time.

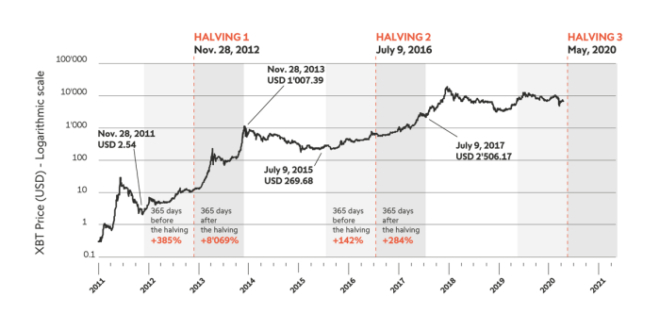

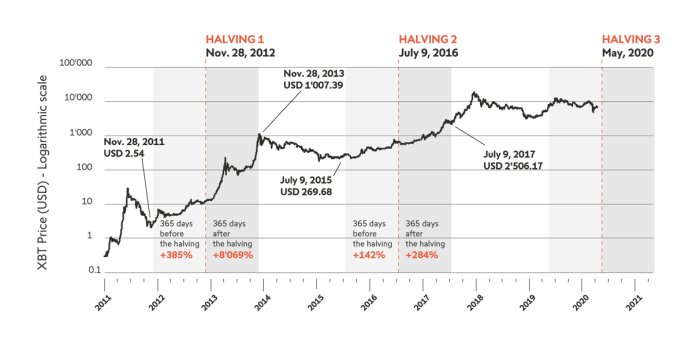

Historical Bitcoin Halving Events and Price Movements

Bitcoin has experienced three halving events so far:

| Date | Block Height | Reward Before | Reward After |

|---|---|---|---|

| November 28, 2012 | 210,000 | 50 BTC | 25 BTC |

| July 9, 2016 | 420,000 | 25 BTC | 12.5 BTC |

| May 11, 2020 | 630,000 | 12.5 BTC | 6.25 BTC |

Following each halving, Bitcoin’s price experienced a significant increase, although the timing and magnitude varied. The 2012 halving saw a gradual price rise, while the 2016 and 2020 halvings were followed by more pronounced increases, though preceded and influenced by other market factors.

Comparison of the Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is challenging. While historical trends suggest a potential price increase due to reduced supply, numerous factors could influence the outcome. These include macroeconomic conditions, regulatory developments, technological innovations within the cryptocurrency space, and overall investor sentiment. The 2025 halving may not mirror previous events exactly; the cryptocurrency market has matured significantly since the earlier halvings, making direct comparisons imperfect.

Mathematical Formula Behind Bitcoin’s Halving Mechanism

The halving mechanism is built into Bitcoin’s code. The block reward is halved at a predetermined block height. The formula isn’t complex, but it’s crucial to understand. The block reward (R) is calculated as follows:

R = 50 * (1/2)h

Where ‘h’ represents the number of halvings that have occurred. For example, after three halvings (h=3), the reward is 50 * (1/2)3 = 6.25 BTC.

The 2025 Bitcoin Halving

The Bitcoin halving, a programmed event reducing the rate of newly mined Bitcoin, is a significant occurrence in the cryptocurrency’s lifecycle. Understanding the projected date and potential impact of the 2025 halving is crucial for investors and enthusiasts alike. This section will explore the anticipated effects on Bitcoin’s scarcity, value, and the influence of macroeconomic factors.

Projected Date and Scarcity

The 2025 Bitcoin halving is projected to occur around April 2025. This date is an approximation, dependent on the precise block generation time. The halving will reduce the block reward for miners from 6.25 BTC to 3.125 BTC. This reduction directly impacts the rate of new Bitcoin entering circulation, thus increasing its scarcity. This inherent scarcity is a core tenet of Bitcoin’s value proposition, suggesting that as fewer new coins are created, the existing supply becomes more valuable, all else being equal.

Impact on Bitcoin’s Value

The halving’s effect on Bitcoin’s price is complex and not guaranteed. Historically, previous halvings have been followed by periods of price appreciation, although the timing and magnitude have varied. The reduced supply often creates upward pressure on price due to increased demand and limited availability. However, other market forces, including regulatory changes, macroeconomic conditions, and investor sentiment, significantly influence the actual price movement. It’s important to remember that past performance is not indicative of future results.

Influence of Macroeconomic Factors

Macroeconomic conditions play a crucial role in determining the impact of the halving. For example, a period of global economic uncertainty or inflation might drive investors towards Bitcoin as a safe haven asset, amplifying the halving’s price effect. Conversely, a robust global economy might reduce the demand for Bitcoin as investors shift their focus to traditional assets. Factors such as interest rates, inflation, and geopolitical events all contribute to the overall market environment and influence Bitcoin’s price trajectory.

Expert Opinions and Market Predictions

Predicting Bitcoin’s price after a halving is inherently speculative. However, various analysts and experts offer their perspectives. Some predict significant price increases, citing the halving’s impact on scarcity and potential increased institutional adoption. Others are more cautious, highlighting the influence of macroeconomic factors and potential regulatory headwinds. It’s vital to approach all predictions with a critical eye and understand the underlying assumptions.

Comparative Analysis of Market Predictions

The following table presents a comparison of different market predictions for Bitcoin’s price after the 2025 halving. It is important to note that these are merely predictions, and the actual price could differ significantly.

| Source | Prediction Date | Predicted Price (USD) | Rationale |

|---|---|---|---|

| Analyst A (Example) | October 2023 | $150,000 | Based on historical halving price increases and anticipated institutional adoption. |

| Analyst B (Example) | November 2023 | $75,000 | Considers potential macroeconomic headwinds and regulatory uncertainty. |

| Research Firm C (Example) | December 2023 | $100,000 | Averages various market indicators and considers both bullish and bearish scenarios. |

| Analyst D (Example) | January 2024 | $200,000 | Focuses on the increasing scarcity of Bitcoin and growing demand from developing economies. |

What is the Bitcoin Halving 2025? It’s a significant event in the Bitcoin network where the reward for miners creating new blocks is cut in half. This scheduled reduction, occurring approximately every four years, impacts Bitcoin’s inflation rate. For precise details on the timing of this halving, specifically focusing on the anticipated April 2025 event, you can consult this helpful resource: Bitcoin Halving April 2025.

Understanding this date is crucial for comprehending the potential effects of the 2025 Bitcoin Halving on the cryptocurrency’s value and overall market dynamics.

What is the Bitcoin Halving 2025? It’s a significant event in the Bitcoin network where the reward for miners creating new blocks is cut in half. This reduction in newly minted Bitcoin influences its supply and potentially its price. We currently anticipate this halving event, as detailed in this article, Bitcoin Halving Is Expected To Occur In April 2025.

Understanding the halving helps in forecasting future Bitcoin trends and its overall market dynamics.

The Bitcoin halving in 2025 is a significant event that reduces the rate at which new Bitcoins are created. This programmed reduction impacts the supply and potentially the price. To understand its impact, knowing the precise date is crucial; you can find that information by checking this resource: When Is The Halving Of Bitcoin 2025. Ultimately, the halving’s effect on Bitcoin’s future remains a topic of much discussion and analysis within the cryptocurrency community.

The Bitcoin Halving 2025 is a significant event where the reward for Bitcoin miners is cut in half. This reduction in newly minted Bitcoin impacts the inflation rate and potentially influences the price. To understand the precise timing of this event, you can check the detailed schedule at Bitcoin Halving 2025 Time. Ultimately, the halving is a core part of Bitcoin’s deflationary programming, shaping its long-term value proposition.

The Bitcoin halving in 2025 is a significant event reducing the rate at which new Bitcoins are created. This programmed reduction, occurring approximately every four years, impacts the inflation rate of Bitcoin. To understand the precise timing of this event, you’ll want to check out this resource: What Day Is Bitcoin Halving 2025. Knowing the exact date helps anticipate potential market reactions associated with the halving’s impact on Bitcoin’s supply and demand dynamics.

Ultimately, the halving is a key element in Bitcoin’s long-term monetary policy.

The Bitcoin Halving 2025 is a significant event where the reward for miners creating new blocks is cut in half. This reduction in newly minted Bitcoin impacts the inflation rate and is often a topic of much discussion regarding its potential effects on price. Predicting the exact date requires careful analysis, and you can find more information on potential timing by checking out this resource: When Is Bitcoin Halving 2025 Prediction.

Ultimately, understanding the Bitcoin Halving 2025 is crucial for anyone interested in the long-term prospects of Bitcoin.