Illustrative Examples of Bitcoin Price Predictions

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and the influence of numerous unpredictable factors. However, several reputable sources offer price predictions based on various methodologies, providing a range of potential outcomes. These predictions should be viewed as potential scenarios rather than definitive forecasts.

What Price Bitcoin 2025 – The following examples illustrate the diversity of prediction methodologies and resulting price targets for Bitcoin in 2025. It is crucial to remember that these are just estimations, and the actual price may differ significantly.

Bitcoin Price Prediction Methodologies

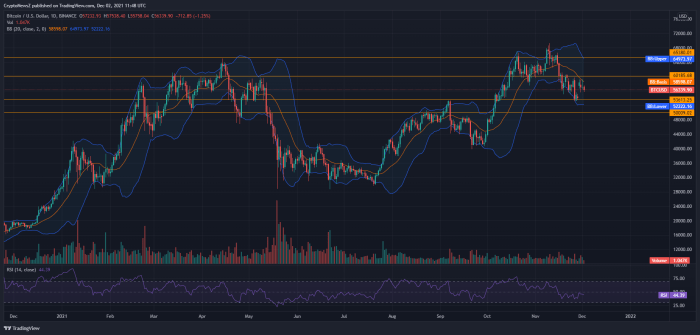

Different sources employ various methodologies when predicting Bitcoin’s future price. Some utilize technical analysis, focusing on chart patterns and historical price movements to identify potential trends. Others employ fundamental analysis, considering factors such as adoption rates, regulatory changes, and technological advancements. Quantitative models, incorporating macroeconomic indicators and statistical analysis, are also frequently used. Finally, some predictions are based on qualitative assessments, incorporating expert opinions and market sentiment. The inherent uncertainty in the cryptocurrency market often leads to a wide range of predictions.

Examples of Bitcoin Price Predictions for 2025

Price Prediction: $100,000 – $150,000

Methodology: Technical analysis, focusing on long-term trends and historical price cycles. The prediction assumes continued adoption and maturation of the Bitcoin ecosystem.

Source: A hypothetical technical analysis firm specializing in cryptocurrencies. (Note: This is a hypothetical example for illustrative purposes.)

Price Prediction: $75,000

Methodology: Fundamental analysis, considering factors such as global macroeconomic conditions, regulatory developments, and the potential impact of competing cryptocurrencies.

Source: A hypothetical financial institution with a dedicated cryptocurrency research team. (Note: This is a hypothetical example for illustrative purposes.)

Price Prediction: $50,000 – $100,000

Methodology: A quantitative model incorporating macroeconomic data, network growth metrics, and historical volatility. The model uses a probabilistic approach to generate a range of possible outcomes.

Source: A hypothetical research group utilizing econometric modeling and machine learning. (Note: This is a hypothetical example for illustrative purposes.)

It’s important to note that these are hypothetical examples. Actual predictions from various sources will vary considerably. The lack of publicly available, consistently formatted data from reliable sources predicting a precise Bitcoin price in 2025 makes creating truly representative examples challenging. The methodology section above Artikels common approaches used in real-world predictions, although the specific details and data employed will vary across sources.

Frequently Asked Questions (FAQ): What Price Bitcoin 2025

This section addresses some of the most common questions surrounding Bitcoin’s price and its future. Understanding these factors is crucial for anyone considering investing in or interacting with this volatile cryptocurrency. We will explore the key drivers of Bitcoin’s price, assess its long-term investment potential, discuss strategies for managing risk, and examine the potential legal and regulatory landscape.

Major Factors Driving Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics are paramount; limited supply (21 million Bitcoin cap) combined with increasing demand from investors, businesses, and individuals directly impacts the price. Furthermore, macroeconomic conditions, such as inflation, interest rates, and global economic uncertainty, significantly influence investor sentiment and Bitcoin’s perceived value as a hedge against inflation or a safe haven asset. Regulatory developments globally also play a crucial role, with positive regulatory frameworks potentially boosting investor confidence and vice versa. Technological advancements, such as the development of layer-2 scaling solutions and improved infrastructure, can also affect the price by increasing efficiency and adoption. Finally, media coverage, market sentiment, and significant events (e.g., halving events) can create short-term price volatility.

Bitcoin as a Long-Term Investment: Pros and Cons

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. On the positive side, its scarcity, decentralized nature, and growing adoption across various sectors suggest potential for long-term growth. Historically, Bitcoin has shown remarkable price appreciation, although with significant periods of volatility. However, the inherent volatility, regulatory uncertainty, and the possibility of technological disruption pose considerable risks. The lack of intrinsic value compared to traditional assets also makes it a riskier investment. Ultimately, the decision of whether or not to invest in Bitcoin long-term depends on individual risk tolerance, investment goals, and a thorough understanding of the associated risks.

Protecting Against Bitcoin Price Volatility

Managing the risk associated with Bitcoin’s price volatility requires a multi-pronged approach. Diversification is crucial; avoid investing all your funds in Bitcoin. Instead, allocate a portion of your investment portfolio to Bitcoin while diversifying into other asset classes (stocks, bonds, real estate) to reduce overall portfolio risk. Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a price peak. Holding Bitcoin for the long term can also help mitigate short-term price swings, as long-term price trends often outweigh short-term volatility. Finally, understanding your risk tolerance and only investing what you can afford to lose is paramount.

Potential Legal and Regulatory Hurdles Facing Bitcoin, What Price Bitcoin 2025

The legal and regulatory landscape surrounding Bitcoin is constantly evolving and varies significantly across jurisdictions. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing the potential benefits of innovation with concerns about money laundering, tax evasion, and market manipulation. Some jurisdictions have embraced a more welcoming approach, establishing clear regulatory frameworks, while others have imposed restrictions or outright bans. The lack of a universally accepted regulatory framework creates uncertainty for investors and businesses operating in the Bitcoin ecosystem. Ongoing regulatory scrutiny and potential changes in regulations pose significant risks to Bitcoin’s price and adoption.

Summary of Key Points

Predicting Bitcoin’s price in 2025 is inherently challenging due to the cryptocurrency’s volatile nature and susceptibility to a wide array of influencing factors. While various analysts offer projections, it’s crucial to understand that these are estimations, not guarantees. The actual price will be determined by the interplay of complex economic, technological, and social forces.

The potential for significant price fluctuations, both upward and downward, is a defining characteristic of Bitcoin. Understanding the factors that contribute to this volatility is key to making informed decisions regarding investment. This summary highlights the key uncertainties and potential outcomes associated with Bitcoin’s future price.

Factors Influencing Bitcoin’s Price

Several key factors will significantly influence Bitcoin’s price in 2025. These include technological advancements within the Bitcoin network itself (such as scaling solutions and improved transaction speeds), regulatory developments from governments worldwide, macroeconomic conditions like inflation and interest rates, and overall investor sentiment and market demand. For example, widespread adoption by major financial institutions could drive prices significantly higher, while increased regulatory scrutiny could lead to price drops. Conversely, a global economic downturn could reduce investor appetite for riskier assets like Bitcoin.

Potential Price Scenarios

A range of price scenarios are plausible for Bitcoin in 2025. Some analysts predict extraordinarily high prices, potentially exceeding $100,000 or even more, based on factors such as increased institutional adoption and growing global demand. Conversely, other predictions suggest significantly lower prices, potentially reflecting negative macroeconomic conditions or regulatory crackdowns. The actual outcome will depend on the combined effect of these various forces. For example, a scenario of sustained global economic growth coupled with positive regulatory developments could support a higher price, whereas a global recession combined with stricter regulations might lead to a much lower price.

Investment Risks and Rewards

Investing in Bitcoin carries substantial risks. Its price volatility can lead to significant losses in short periods. However, the potential rewards are equally substantial. Historical data shows periods of exponential growth, highlighting the potential for high returns. Investors should carefully consider their risk tolerance and only invest what they can afford to lose. It’s crucial to conduct thorough research and diversify investments to mitigate risk. For example, a well-diversified portfolio that includes a small percentage of Bitcoin can help balance risk and potential reward.

Bitcoin’s Future Impact

The long-term impact of Bitcoin on the global financial landscape remains uncertain. Its potential to disrupt traditional financial systems is undeniable, but the extent of this disruption is still unclear. It could become a widely accepted form of digital currency, potentially challenging the dominance of fiat currencies, or it could remain a niche asset primarily used by investors and enthusiasts. The future will depend on technological developments, regulatory actions, and widespread adoption. For instance, if Bitcoin becomes seamlessly integrated into global payment systems, it could significantly alter international finance.