Bitcoin Price Predictions in 2030

Reddit, a vibrant online forum, hosts numerous discussions surrounding Bitcoin’s future price. Analyzing these conversations reveals a diverse range of opinions, encompassing bullish, bearish, and neutral perspectives, often rooted in differing assessments of key factors influencing Bitcoin’s trajectory. These factors, as expressed by Reddit users, are crucial in understanding the rationale behind the wide spectrum of price predictions.

Reddit User Predictions and Underlying Factors

The price predictions on Reddit for Bitcoin in 2030 vary wildly. Bullish predictions often cite increasing mainstream adoption, institutional investment, and the scarcity of Bitcoin as driving forces for significant price appreciation. For instance, some users envision a scenario where Bitcoin becomes a widely accepted global currency, leading to exponential price growth. Conversely, bearish predictions frequently highlight regulatory uncertainty, the potential emergence of competing cryptocurrencies, and the inherent volatility of the cryptocurrency market as reasons for a more pessimistic outlook. Neutral predictions often emphasize the unpredictable nature of the market, highlighting the difficulty in accurately forecasting long-term price movements. Some Reddit users base their predictions on technical analysis, examining historical price trends and chart patterns to extrapolate future price movements. Others rely on fundamental analysis, considering factors like Bitcoin’s market capitalization, transaction volume, and network effects.

Comparison of Reasoning Behind Differing Price Predictions

The disparity in Bitcoin price predictions on Reddit stems from fundamental disagreements about the future of cryptocurrency technology and its adoption. Bullish users often point to Bitcoin’s decentralized nature and its potential to disrupt traditional financial systems as key factors driving its value. They believe that increasing global adoption, fueled by factors such as inflation fears and a growing distrust in traditional institutions, will significantly increase Bitcoin’s demand, pushing prices higher. In contrast, bearish users emphasize the risks associated with Bitcoin’s volatility, regulatory uncertainty, and the possibility of technological disruptions that could render Bitcoin obsolete. They often highlight the potential for government crackdowns or the emergence of more efficient and scalable blockchain technologies as factors that could negatively impact Bitcoin’s price. Neutral users acknowledge the potential for both positive and negative outcomes, emphasizing the inherent uncertainties in the cryptocurrency market. They often advocate for caution and a diversified investment strategy.

Recurring Themes and Concerns Regarding Bitcoin’s Future Value

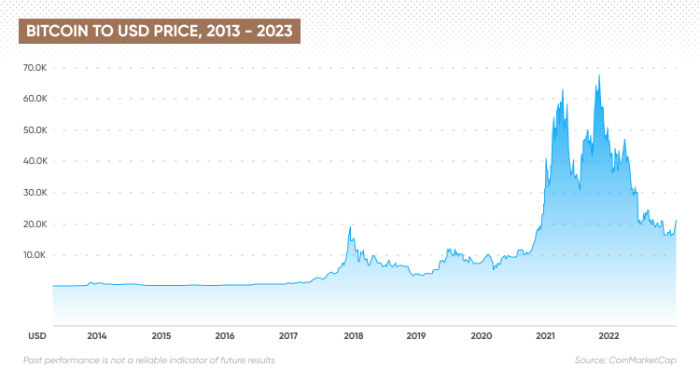

Several recurring themes and concerns consistently emerge in Reddit discussions about Bitcoin’s future value. One prominent concern is regulatory uncertainty. The lack of clear regulatory frameworks in many jurisdictions creates uncertainty for investors and could potentially stifle Bitcoin’s growth. Another major concern is the environmental impact of Bitcoin mining, particularly its energy consumption. This issue raises concerns about Bitcoin’s long-term sustainability and its potential for stricter environmental regulations. Furthermore, the scalability of the Bitcoin network remains a subject of ongoing debate, with concerns about transaction fees and processing times potentially limiting its widespread adoption. Finally, the inherent volatility of Bitcoin’s price is a constant source of discussion and concern among Reddit users, highlighting the significant risks associated with investing in Bitcoin. For example, some users point to the significant price drops Bitcoin has experienced in the past as evidence of its inherent volatility and potential for substantial losses.

Factors Influencing Bitcoin’s Future Value

Predicting Bitcoin’s price in 2030 is inherently complex, depending on a confluence of factors that are difficult to precisely quantify. These factors range from widespread adoption and regulatory shifts to technological advancements and macroeconomic conditions. Understanding their potential impact is crucial for any informed assessment of Bitcoin’s future.

Widespread Cryptocurrency Adoption

The broader adoption of cryptocurrencies will significantly influence Bitcoin’s price. Increased demand from institutional and retail investors, coupled with greater utility in everyday transactions, could drive up Bitcoin’s value. However, the emergence of competing cryptocurrencies could also dilute Bitcoin’s market share, potentially capping its price growth. The success of Bitcoin in maintaining its position as the dominant cryptocurrency will be a key determinant of its future value. For example, if Bitcoin becomes widely accepted as a store of value and a medium of exchange, its price could experience substantial growth. Conversely, if other cryptocurrencies gain significant traction, Bitcoin’s dominance and price could be affected.

Regulatory Changes

Regulatory frameworks surrounding cryptocurrencies will profoundly impact Bitcoin’s value. Positive regulations, such as clear guidelines for trading and taxation, could foster investor confidence and increase liquidity, leading to higher prices. Conversely, restrictive regulations, including outright bans or excessive taxation, could severely dampen investor enthusiasm and depress the price. The regulatory landscape is constantly evolving, and its influence on Bitcoin’s future is unpredictable but undeniably significant. Consider, for example, the contrasting approaches of El Salvador, which adopted Bitcoin as legal tender, and China, which banned cryptocurrency trading. These differing regulatory stances illustrate the wide range of potential outcomes.

Technological Advancements

Technological improvements within the Bitcoin ecosystem will play a vital role in shaping its future. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speeds and reduce fees, potentially increasing Bitcoin’s usability and adoption. Advancements in mining technology and energy efficiency could also affect Bitcoin’s price by influencing its cost of production and environmental impact. The successful implementation and widespread adoption of these technological upgrades could lead to a significant increase in Bitcoin’s utility and desirability.

Macroeconomic Factors

Macroeconomic conditions, such as inflation and interest rates, will influence Bitcoin’s price. High inflation may drive investors towards Bitcoin as a hedge against inflation, increasing demand and driving up its price. Conversely, rising interest rates may make other investment options more attractive, potentially reducing demand for Bitcoin and lowering its price. Global economic uncertainty could also increase Bitcoin’s appeal as a safe-haven asset. The 2022 inflationary environment, for instance, saw a period of increased interest in Bitcoin as a potential inflation hedge, though this was subsequently impacted by other market factors.

Impact of Various Factors on Bitcoin’s Potential Price in 2030

| Factor | Potential Impact (Positive/Negative) | Likelihood | Reasoning |

|---|---|---|---|

| Widespread Adoption | Positive | High | Increased demand and utility would drive price up. |

| Positive Regulation | Positive | Medium | Clear guidelines increase investor confidence and liquidity. |

| Negative Regulation | Negative | Medium | Bans or excessive taxes could dampen investor enthusiasm. |

| Technological Advancements (Layer-2, etc.) | Positive | High | Improved scalability and usability would increase adoption. |

| High Inflation | Positive | Medium | Bitcoin may be seen as a hedge against inflation. |

| High Interest Rates | Negative | Medium | Alternative investments become more attractive. |

Comparing Reddit Predictions to Expert Opinions

Reddit’s cryptocurrency forums, particularly those dedicated to Bitcoin, are rife with price predictions, often ranging from wildly optimistic to deeply pessimistic. These user-generated forecasts, while entertaining and sometimes insightful, must be contrasted with the more measured analyses offered by established financial analysts and experts in the field. A comparison reveals significant discrepancies, highlighting the differences between community sentiment and professional projections.

The divergence between Reddit predictions and expert opinions is striking. Reddit users, often driven by enthusiasm or fear, frequently propose extreme price targets, sometimes reaching into the hundreds of thousands or even millions of dollars per Bitcoin by 2030. These predictions often lack the rigorous quantitative analysis and consideration of macroeconomic factors that underpin professional forecasts. In contrast, established financial institutions and analysts tend to provide more conservative estimates, often factoring in technological advancements, regulatory changes, and overall market trends. Their predictions typically fall within a more moderate range, often reflecting a cautious approach to such a volatile asset.

Discrepancies Between Reddit Sentiment and Professional Forecasts

A primary source of discrepancy lies in the methodologies employed. Reddit predictions are largely based on speculation, community sentiment, and anecdotal evidence. For example, a highly upvoted post might claim Bitcoin will reach $1 million due to increasing adoption in developing nations, without providing concrete data or analysis to support this assertion. Expert opinions, on the other hand, typically rely on sophisticated econometric models, historical data analysis, and a deep understanding of the underlying technology and market dynamics. For instance, a report from a reputable financial institution might project a more moderate price based on factors like network effects, transaction volume, and the potential impact of competing cryptocurrencies. This difference in approach leads to dramatically different price targets. Another example could be the consideration of regulatory uncertainty. While Reddit might focus on positive narratives ignoring potential negative regulatory impacts, expert analysis will typically incorporate various regulatory scenarios into their models, leading to more conservative predictions.

Reasons for Differing Perspectives

Several factors contribute to the contrasting perspectives. Reddit users often represent a self-selected group with a strong inherent bias towards Bitcoin’s success. This inherent bullishness can lead to overly optimistic price projections. Conversely, financial experts often need to account for various risk factors, including market volatility, regulatory hurdles, and the potential for technological disruption, leading to more cautious predictions. Furthermore, the lack of transparency in Reddit’s predictive methodologies, coupled with the absence of accountability, contrasts sharply with the rigorous and documented analysis of professional forecasters. The anonymous nature of many Reddit predictions further contributes to the lack of reliability. Experts, on the other hand, are generally associated with reputable institutions, subjecting their forecasts to scrutiny and peer review.

Reliability and Validity of Predictions

The reliability and validity of both Reddit-based predictions and expert opinions are debatable. Reddit predictions, lacking a formal framework and rigorous analysis, are generally less reliable. While they might offer a glimpse into public sentiment, they should not be considered accurate forecasts. Expert opinions, while more methodologically sound, are still subject to inherent uncertainties and limitations. Even the most sophisticated models cannot perfectly predict future market behavior. Therefore, both sources should be treated with caution, with the understanding that all predictions, regardless of source, carry a significant degree of uncertainty. For example, the prediction of the 2008 financial crisis, while showing signs beforehand, was not accurately predicted by many financial experts, showcasing the inherent limitations in forecasting, especially in complex systems like financial markets. Similarly, the meteoric rise of Bitcoin in 2017 caught many experts off guard, highlighting the unpredictable nature of the cryptocurrency market.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin, especially with a long-term horizon like 2030, presents a complex interplay of substantial risks and potentially significant rewards. Understanding both sides of this equation is crucial for any investor considering allocating capital to this volatile asset. The following sections detail the key considerations.

Bitcoin Investment Risks

Bitcoin’s price volatility is legendary. While it has demonstrated impressive growth periods, it’s equally prone to dramatic and rapid declines. Holding Bitcoin for the long term mitigates some of this risk through dollar-cost averaging and weathering short-term fluctuations, but the inherent unpredictability remains a significant concern. Beyond price volatility, regulatory uncertainty poses a substantial risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulatory landscapes could significantly impact Bitcoin’s value and usability. Furthermore, the security of Bitcoin exchanges and wallets is paramount. While security measures are constantly improving, the risk of hacking, theft, or loss of private keys remains a very real threat, potentially resulting in complete loss of investment. Finally, the inherent technological risks associated with the Bitcoin blockchain itself, such as scaling limitations and potential for unforeseen vulnerabilities, also contribute to the overall risk profile.

Bitcoin Investment Opportunities

Despite the risks, Bitcoin presents compelling opportunities for long-term investors. Its decentralized nature and limited supply (21 million coins) create a potential for scarcity-driven price appreciation. As adoption grows globally, particularly in emerging markets with limited access to traditional financial systems, the demand for Bitcoin could increase substantially. Furthermore, the potential for Bitcoin to become a widely accepted form of payment and a store of value could lead to substantial returns. The growth of the DeFi (Decentralized Finance) ecosystem built on blockchain technology also offers indirect opportunities for Bitcoin holders through staking, lending, and other innovative financial instruments. The potential for Bitcoin to become a significant component of a diversified investment portfolio further enhances its appeal.

Risk and Reward Summary Table

| Risk/Reward | Description | Likelihood (Subjective Assessment) | Mitigation Strategy (For Risks) |

|---|---|---|---|

| Price Volatility | Significant and unpredictable price swings. | High | Dollar-cost averaging, diversification, long-term investment horizon. |

| Regulatory Uncertainty | Changes in government regulations could negatively impact Bitcoin’s value and usability. | Medium | Stay informed about regulatory developments, consider geographically diversified holdings. |

| Security Risks | Hacking, theft, or loss of private keys. | Medium | Use reputable exchanges and wallets, secure your private keys offline, enable two-factor authentication. |

| Technological Risks | Potential for unforeseen vulnerabilities or scaling limitations within the Bitcoin blockchain. | Low | Monitor blockchain development and upgrades, diversify across different cryptocurrencies if desired. |

| Scarcity and Adoption | Limited supply and increasing global adoption could drive price appreciation. | High | N/A (Reward) |

| DeFi Opportunities | Participation in the decentralized finance ecosystem offers additional investment avenues. | Medium | N/A (Reward) |

Illustrative Scenarios for Bitcoin’s Price in 2030

Predicting Bitcoin’s price in 2030 is inherently speculative, but by considering various macroeconomic factors and technological advancements, we can construct plausible scenarios. These scenarios are not exhaustive, and the actual price could fall outside these ranges. They are intended to illustrate the potential impact of different market conditions.

Bullish Scenario: Bitcoin at $500,000

This scenario assumes widespread global adoption of Bitcoin as a store of value and a medium of exchange. Several factors contribute to this outcome. Firstly, a significant increase in institutional investment, driven by regulatory clarity and a growing understanding of Bitcoin’s decentralized nature, would fuel price growth. Secondly, continued technological advancements, such as the Lightning Network’s improved scalability, would address current transaction limitations and enhance usability. Thirdly, macroeconomic instability, potentially triggered by inflation or geopolitical events, could drive investors towards Bitcoin as a safe haven asset, further increasing demand. Imagine a world where major corporations hold substantial Bitcoin reserves, and everyday transactions are facilitated through Bitcoin-based payment systems. This widespread acceptance and increased utility would propel Bitcoin’s price to $500,000 or more by 2030. The price surge would likely be gradual, with periods of consolidation interspersed with sharp price increases driven by positive news and events.

Bearish Scenario: Bitcoin at $10,000

This scenario paints a picture of significantly less optimistic market conditions. A major regulatory crackdown on cryptocurrencies, resulting in stricter regulations and limitations on trading, could severely dampen Bitcoin’s growth. This could be accompanied by a general loss of investor confidence, potentially triggered by a major security breach or a series of high-profile scams involving Bitcoin. Furthermore, the emergence of a superior competing cryptocurrency with more efficient technology or a more compelling use case could divert investment away from Bitcoin. In this scenario, the overall market sentiment would be negative, leading to a sustained period of low prices. The price could potentially plummet and remain stagnated around $10,000, reflecting a lack of widespread adoption and trust. The decline would likely be gradual, punctuated by periods of panic selling driven by negative news and regulatory uncertainty.

Neutral Scenario: Bitcoin at $100,000

This scenario represents a more balanced outlook, where Bitcoin experiences moderate growth but doesn’t reach the extreme highs or lows of the bullish or bearish scenarios. It assumes a degree of regulatory acceptance alongside ongoing technological improvements. While institutional adoption would be present, it wouldn’t be as widespread as in the bullish scenario. Similarly, the overall market sentiment would be relatively stable, with periods of both growth and correction. This scenario reflects a more cautious and less volatile market, with Bitcoin establishing itself as a recognized asset class but not achieving the level of widespread adoption envisioned in the bullish scenario. The price would gradually increase to around $100,000 by 2030, reflecting a balance between positive and negative influences. The price movement would be characterized by more gradual increases and decreases, with less dramatic price swings.

Frequently Asked Questions about Bitcoin’s Future Value: What Will Bitcoin Be Worth In 2030 Reddit

Understanding the potential future value of Bitcoin involves navigating a complex landscape of technological advancements, regulatory changes, and market sentiment. This section addresses some of the most frequently asked questions surrounding Bitcoin’s price trajectory in 2030 and beyond.

Common Arguments for High Bitcoin Prices by 2030

Bullish arguments for Bitcoin’s price appreciation by 2030 often center on its potential as a store of value, a hedge against inflation, and a growing adoption rate. Proponents point to Bitcoin’s limited supply of 21 million coins, arguing that increasing demand in a finite supply will inevitably drive up the price. They also highlight its decentralized nature, making it resistant to government control and manipulation, further bolstering its appeal as a safe haven asset. The increasing adoption by institutional investors and the growth of the Bitcoin ecosystem, including decentralized finance (DeFi) applications and Lightning Network improvements for faster and cheaper transactions, are also cited as positive factors. For example, the growing acceptance of Bitcoin as a payment method by major companies could significantly boost demand. Finally, the ongoing narrative surrounding Bitcoin as “digital gold” contributes to its perceived value and attracts investors seeking alternative assets.

Main Concerns about Bitcoin’s Long-Term Viability

Bearish arguments focus on the volatility of Bitcoin’s price, the potential for regulatory crackdowns, and the emergence of competing cryptocurrencies. The inherent volatility of Bitcoin, characterized by significant price swings, poses a significant risk for investors. Government regulations, varying widely across jurisdictions, could severely impact Bitcoin’s accessibility and adoption. Furthermore, the emergence of newer cryptocurrencies with improved technology or features could potentially diminish Bitcoin’s market dominance. Security concerns, such as the risk of hacks and theft from exchanges or individual wallets, also represent a significant challenge. Finally, the environmental impact of Bitcoin mining, particularly its energy consumption, remains a point of contention and could lead to stricter regulations or public pressure against its use. For example, China’s ban on Bitcoin mining significantly impacted its price and mining activity.

Assessing the Credibility of Bitcoin Price Predictions, What Will Bitcoin Be Worth In 2030 Reddit

Evaluating the credibility of Bitcoin price predictions requires a critical approach. Consider the source’s expertise and potential biases. Predictions from reputable financial analysts or researchers with a proven track record are generally more reliable than those from anonymous online sources or individuals with a vested interest in promoting Bitcoin. The methodology used to arrive at the prediction should be transparent and well-documented. Look for predictions that consider a range of factors, rather than relying on a single metric or assumption. Beware of predictions that rely on overly optimistic or unrealistic scenarios. For example, a prediction based solely on increasing adoption without considering regulatory risks would likely be less credible. Finally, remember that all predictions are inherently uncertain; treat them as informed speculation, not guarantees.

Factors to Consider Before Investing in Bitcoin

Before investing in Bitcoin, carefully consider your risk tolerance, investment goals, and financial situation. Bitcoin is a highly volatile asset, and you could lose a significant portion of your investment. Only invest what you can afford to lose. Thoroughly research Bitcoin and understand its underlying technology, risks, and potential rewards. Diversify your investment portfolio to mitigate risk. Don’t invest based solely on hype or speculation. Securely store your Bitcoin using a reputable wallet and follow best practices for cybersecurity. Consult with a qualified financial advisor before making any investment decisions. Understanding the tax implications of Bitcoin investments is also crucial, as regulations vary across jurisdictions.

What Will Bitcoin Be Worth In 2030 Reddit – Predicting Bitcoin’s value in 2030 is a popular Reddit topic, with wildly varying opinions. To get a sense of potential future price movements, it’s helpful to examine shorter-term predictions; understanding the anticipated Btc Price Prediction 2025 Bull Run could offer clues about Bitcoin’s trajectory towards 2030. Ultimately, however, the 2030 price remains highly speculative and dependent on numerous unpredictable factors.

Discussions on Reddit about Bitcoin’s 2030 value are highly speculative, naturally. However, to gain some perspective, it’s helpful to examine shorter-term predictions. A useful resource for this is the Bitcoin Price Prediction 2025 Chart, available here: Bitcoin Price Prediction 2025 Chart. Analyzing these nearer-term forecasts can offer some insight into the potential trajectory, informing – though not definitively predicting – Bitcoin’s value by 2030.

Predicting Bitcoin’s value in 2030 is a popular Reddit discussion, with wildly varying opinions. To get a sense of potential trajectory, it’s helpful to consider shorter-term forecasts; understanding the projected value in the near future provides a foundation for longer-term speculation. For example, checking resources like this forecast for the Bitcoin Price 2025 Aud can help contextualize the longer-term discussions about what Bitcoin will be worth in 2030 on Reddit.

Predicting Bitcoin’s value in 2030 is a popular Reddit discussion, with wildly varying opinions. To get a sense of shorter-term projections, it’s helpful to consider intermediate milestones; for example, understanding potential price points in 2025 can offer valuable context. Check out this insightful analysis on What Price Bitcoin 2025 to inform your longer-term predictions regarding Bitcoin’s 2030 value.

Ultimately, the 2030 price remains highly speculative, depending on numerous factors.

Discussions on Reddit regarding Bitcoin’s 2030 value are highly speculative, often referencing shorter-term predictions to extrapolate. For a glimpse into potential near-term growth, consider Cathie Wood’s outlook, detailed in this analysis: Bitcoin Price Prediction 2025 Cathie Wood. While her 2025 prediction doesn’t directly answer the 2030 question, it provides a valuable data point for those pondering Bitcoin’s long-term trajectory on Reddit and elsewhere.