Bitcoin Price Prediction for 2025: What Will Bitcoin Cost In 2025

Bitcoin, the pioneering cryptocurrency, has experienced a tumultuous journey since its inception in 2009. From a niche digital asset to a globally recognized phenomenon, its price has demonstrated remarkable volatility, swinging wildly from near-zero to record highs and back again. This inherent volatility makes predicting its future price a complex and challenging endeavor. Understanding this history and the forces that drive its price fluctuations is crucial for any attempt at forecasting.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a dynamic interplay of several interconnected factors. Market sentiment, driven by news events, social media trends, and investor confidence, significantly impacts its value. Positive news, such as widespread adoption by major companies or positive regulatory developments, often leads to price increases, while negative news, like security breaches or regulatory crackdowns, can trigger sharp declines. The regulatory landscape surrounding Bitcoin varies considerably across jurisdictions, with some countries embracing it as a legitimate asset class while others maintain a more cautious or even hostile stance. These regulatory shifts can profoundly affect its accessibility and therefore its price. Technological advancements, such as improvements in scalability and transaction speed, can enhance Bitcoin’s functionality and potentially boost its appeal, leading to price appreciation. Finally, macroeconomic conditions, such as inflation, interest rates, and global economic uncertainty, can also influence investor behavior and subsequently Bitcoin’s price. For instance, during periods of high inflation, Bitcoin’s perceived value as a hedge against inflation might drive increased demand.

Challenges in Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s price in 2025, or any future date, is fraught with challenges. The cryptocurrency market is inherently speculative and susceptible to sudden, dramatic shifts. Unlike traditional assets, Bitcoin’s value isn’t directly tied to tangible assets or company earnings. Its price is primarily determined by supply and demand dynamics, which are notoriously difficult to forecast with precision. Furthermore, the influence of unforeseen events – a major security flaw, a significant regulatory change, or a sudden shift in public perception – can render even the most sophisticated models inaccurate. The lack of historical data compared to traditional markets also limits the effectiveness of predictive models. While analysts employ various techniques, including technical analysis and fundamental analysis, these methods are not foolproof and their predictions often vary widely. Consider, for example, the numerous widely publicized price predictions for Bitcoin that have dramatically missed the mark in the past. This highlights the inherent uncertainty involved in attempting to predict its future price.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of factors that interact in unpredictable ways. While no one can definitively state the exact price, understanding these influential elements provides a framework for informed speculation. These factors range from macroeconomic trends to technological advancements and regulatory shifts.

Institutional and Governmental Adoption, What Will Bitcoin Cost In 2025

Widespread adoption by institutions and governments could significantly impact Bitcoin’s price. Increased institutional investment, such as that seen from companies like MicroStrategy and Tesla, signals growing confidence in Bitcoin as a store of value and potential hedge against inflation. Governmental recognition, even limited, can legitimize Bitcoin and boost its appeal to a broader investor base. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, undeniably increased global awareness and, temporarily, its price. Further mainstream acceptance by major financial institutions and regulatory clarity from governments worldwide could drive substantial price appreciation.

Technological Advancements: The Lightning Network

Technological advancements, particularly the maturation of the Lightning Network, are crucial. The Lightning Network is a layer-2 scaling solution designed to improve Bitcoin’s transaction speed and reduce fees. Currently, Bitcoin’s transaction fees can be prohibitive for everyday use. Widespread adoption of the Lightning Network would make Bitcoin transactions faster, cheaper, and more efficient, potentially leading to increased usage and consequently, higher demand and price. Imagine a future where microtransactions are seamlessly facilitated, enabling everyday purchases with Bitcoin, drastically increasing its utility and, by extension, its value.

Bitcoin’s Price Performance Relative to Other Assets

Bitcoin’s price performance will inevitably be compared to other cryptocurrencies and traditional assets. The performance of altcoins, competing cryptocurrencies with potentially superior technology or features, could affect Bitcoin’s market share and price. Similarly, the performance of gold, a traditional safe-haven asset, and other commodities, will influence investor allocation decisions. For example, if gold prices remain stagnant while Bitcoin demonstrates sustained growth, it might attract investors seeking higher returns, driving up Bitcoin’s value. Conversely, a significant bull run in the traditional stock market could divert investment away from Bitcoin.

Global Economic Events and Geopolitical Instability

Global economic events and geopolitical instability are major external factors influencing Bitcoin’s price. Periods of economic uncertainty, inflation, or political turmoil often lead investors to seek alternative assets like Bitcoin, viewed as a hedge against traditional financial systems. For example, during times of high inflation, the limited supply of Bitcoin could make it a more attractive investment compared to fiat currencies experiencing devaluation. Conversely, periods of economic stability might see investors shifting their funds back into traditional markets, potentially impacting Bitcoin’s price negatively.

Regulatory Hurdles

Regulatory hurdles present a significant challenge. Differing regulatory approaches across jurisdictions create uncertainty and can impact investor confidence. Strict regulations could limit Bitcoin’s adoption, potentially suppressing its price. Conversely, clear and consistent regulatory frameworks could foster trust and attract more institutional investment. The ongoing regulatory debates in various countries, ranging from outright bans to embracing Bitcoin as a regulated asset, demonstrate the significant impact of governmental policy on its price trajectory.

Social Media and Public Perception

Social media and public perception play a powerful role. Positive news coverage, endorsements from influential figures, and viral trends on platforms like Twitter can significantly boost Bitcoin’s price. Conversely, negative news, regulatory crackdowns, or high-profile scams can trigger sharp price declines. The influence of social media sentiment is amplified by the inherent volatility of the cryptocurrency market. This highlights the importance of separating factual information from speculative narratives and hype cycles when assessing Bitcoin’s future price.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. While no one can definitively say what Bitcoin will cost in 2025, exploring plausible scenarios based on current trends and potential future developments offers valuable insights. The following Artikels three distinct scenarios: a bullish, a bearish, and a neutral outlook.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a significantly higher Bitcoin price in 2025, driven by widespread adoption, positive regulatory developments, and sustained institutional investment. Several key assumptions underpin this optimistic outlook.

- Widespread Institutional Adoption: Major financial institutions continue to integrate Bitcoin into their portfolios, driving increased demand and price appreciation. This could be fueled by further regulatory clarity and the development of robust institutional-grade custody solutions.

- Positive Regulatory Landscape: Governments globally adopt more favorable regulatory frameworks for cryptocurrencies, reducing uncertainty and encouraging broader participation. Examples of such favorable regulations might include clear tax guidelines and the establishment of licensing frameworks for crypto exchanges.

- Technological Advancements: Significant technological upgrades, such as the successful implementation of the Lightning Network, enhance Bitcoin’s scalability and transaction speed, making it more practical for everyday use. This improved usability could attract a wider range of users.

- Macroeconomic Factors: Global economic instability or inflation could drive investors towards Bitcoin as a safe haven asset, increasing demand and pushing prices upward. This mirrors the behavior observed during periods of economic uncertainty in the past.

In this bullish scenario, Bitcoin could potentially reach prices exceeding $150,000 by 2025, fueled by a combination of these factors.

Bearish Scenario: Bitcoin Faces Significant Challenges

Conversely, a bearish scenario suggests a considerably lower Bitcoin price in 2025. This downturn would likely result from a confluence of negative factors impacting market sentiment and adoption.

- Increased Regulatory Scrutiny: Governments worldwide implement stringent regulations that stifle Bitcoin’s growth, potentially including outright bans or heavy taxation. This could significantly reduce investor interest and liquidity.

- Technological Limitations: Failure to address scalability and transaction speed issues could hinder Bitcoin’s mass adoption, limiting its potential for price appreciation. The persistent issue of high transaction fees could deter users.

- Security Breaches or Hacks: Large-scale security breaches targeting Bitcoin exchanges or wallets could erode investor confidence and trigger a significant price drop. The 2021 Colonial Pipeline ransomware attack serves as a reminder of the potential for cyberattacks to negatively impact cryptocurrency markets.

- Market Manipulation: Significant market manipulation or coordinated sell-offs could trigger a sharp decline in Bitcoin’s price, potentially leading to a prolonged bear market. This highlights the vulnerability of cryptocurrency markets to speculative trading.

Under this bearish scenario, Bitcoin’s price could potentially fall below $20,000 by 2025, reflecting diminished investor confidence and reduced demand.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

This scenario suggests a more moderate price range for Bitcoin in 2025, characterized by periods of consolidation and sideways trading. This outcome would likely result from a balance of positive and negative factors.

- Gradual Institutional Adoption: Institutional investment continues at a steady pace, but not at the rapid rate seen in a bullish scenario. This would lead to a more gradual price increase.

- Mixed Regulatory Developments: Some regions implement favorable regulations, while others maintain a cautious or restrictive approach. This creates a more fragmented and less predictable market.

- Technological Improvements: Incremental technological advancements improve Bitcoin’s functionality, but do not dramatically change its scalability or usability. This results in steady but not explosive growth.

- Stable Macroeconomic Conditions: Global economic conditions remain relatively stable, neither boosting nor hindering Bitcoin’s price significantly. This absence of strong external drivers leads to a period of consolidation.

In a neutral scenario, Bitcoin’s price in 2025 could range between $40,000 and $80,000, reflecting a period of market maturity and stabilization.

Investing in Bitcoin: A Cautious Approach

Investing in Bitcoin, like any other investment, requires a measured and informed approach. The potential for high returns is undeniable, but so is the significant risk involved. Understanding the intricacies of the cryptocurrency market and implementing robust risk management strategies are crucial for navigating this volatile landscape successfully.

Bitcoin’s price is notoriously unpredictable, influenced by a complex interplay of factors ranging from regulatory changes to market sentiment. Therefore, thorough research and due diligence are paramount before committing any capital. This involves understanding not only the technology behind Bitcoin but also the broader economic and geopolitical factors that can impact its value. A clear understanding of your own risk tolerance is also essential.

Risk Mitigation Strategies

Effective risk management is crucial when investing in Bitcoin. Diversification is key; avoid putting all your eggs in one basket. Investing only a portion of your portfolio in Bitcoin, while allocating the rest to more traditional assets, helps to cushion against potential losses. Dollar-cost averaging, a strategy involving investing a fixed amount of money at regular intervals regardless of price fluctuations, can help mitigate the risk associated with market timing. Setting stop-loss orders, which automatically sell your Bitcoin if the price falls below a predetermined level, can limit potential losses. Furthermore, securing your Bitcoin using robust security measures, such as hardware wallets, is essential to protect your investment from theft or loss.

Ethical Considerations in Cryptocurrency Investment

The ethical implications of investing in cryptocurrencies are multifaceted and deserve careful consideration. The environmental impact of Bitcoin mining, due to its high energy consumption, is a significant concern. Investors should research and support environmentally conscious mining practices or consider investing in cryptocurrencies with lower energy footprints. Transparency and traceability are also crucial ethical considerations. Understanding the origins of your Bitcoin and ensuring that your investments are not inadvertently supporting illicit activities are vital ethical responsibilities. Finally, the potential for market manipulation and the lack of robust regulatory frameworks in some jurisdictions present further ethical challenges that investors should be aware of. Responsible investing involves acknowledging and mitigating these concerns.

Frequently Asked Questions (FAQ)

This section addresses some common questions regarding Bitcoin’s price and investment potential. Understanding these factors is crucial for making informed decisions about your investment strategy.

Significant Factors Affecting Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of market forces and external events. Supply and demand dynamics, driven by investor sentiment and trading activity, are primary drivers. Regulatory announcements from governments worldwide, technological advancements within the cryptocurrency space, macroeconomic conditions (like inflation and interest rates), and even major news events can significantly impact Bitcoin’s value. For example, positive regulatory developments in a major economy often lead to price increases, while negative news or a broader economic downturn can trigger sell-offs.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is highly volatile and influenced by unpredictable factors. While analysts may offer projections based on various models and indicators, these are not guarantees. Past performance is not indicative of future results, and unforeseen events can drastically alter price trajectories. Any prediction should be viewed with considerable skepticism. For example, predictions made during periods of high market growth often fail to account for subsequent corrections or crashes.

Bitcoin as a Long-Term Investment

Bitcoin’s long-term investment potential is a subject of ongoing debate. While it has shown remarkable growth since its inception, it also carries substantial risk. The volatility of its price means significant losses are possible. However, proponents argue that its decentralized nature, limited supply, and increasing adoption could lead to long-term appreciation. Investors should carefully weigh their risk tolerance and financial goals before committing to a long-term Bitcoin investment. Consider the example of early Bitcoin adopters who saw immense returns, contrasted with those who invested at peak prices and experienced significant losses.

Resources for Learning About Bitcoin Investing

Several reputable sources offer information on Bitcoin investing. These include educational websites specializing in finance and cryptocurrency, such as CoinDesk and Investopedia. Reputable financial news outlets also provide regular coverage of Bitcoin and the broader cryptocurrency market. Always exercise caution and verify information from multiple sources before making any investment decisions. It is also advisable to seek guidance from a qualified financial advisor before investing in any cryptocurrency, including Bitcoin.

Illustrative Examples

Visual representations can help clarify the potential price trajectories of Bitcoin in 2025. The following descriptions detail hypothetical charts illustrating bullish, bearish, and neutral scenarios, alongside a graph exploring the relationship between Bitcoin’s price and a macroeconomic indicator. Remember, these are illustrative examples and not financial advice.

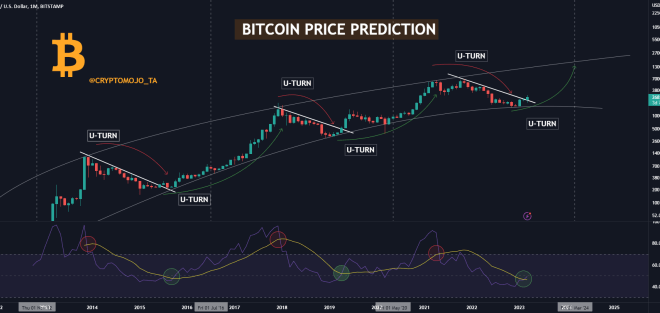

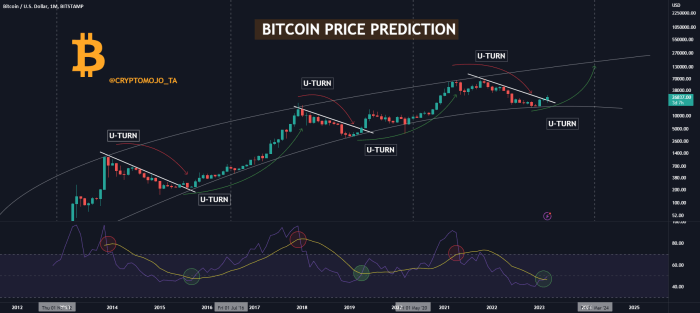

Bitcoin Price Scenarios for 2025

This hypothetical chart depicts three distinct scenarios for Bitcoin’s price in 2025. The x-axis represents time (January to December 2025), and the y-axis represents the Bitcoin price in USD.

The bullish scenario shows a steady upward trend throughout the year, potentially reaching a price of $100,000 by December. This scenario assumes widespread adoption, positive regulatory developments, and continued institutional investment. Key features include a relatively consistent upward slope with minor corrections, strong support levels at approximately $60,000 and $80,000, and resistance levels that are gradually overcome. A significant event like a major technological upgrade or positive regulatory news could trigger a sharp price increase.

The bearish scenario displays a downward trend, potentially dipping below $20,000 by year’s end. This assumes negative regulatory actions, a broader economic downturn, or a significant security breach impacting investor confidence. Key features include a consistent downward slope with occasional brief rallies, strong resistance levels around $30,000 and $40,000, and support levels that are consistently broken. A major negative news event could trigger a sharp price drop.

The neutral scenario shows a relatively flat trajectory with moderate fluctuations around a price of $40,000. This scenario assumes a period of consolidation and sideways movement, with neither significant bullish nor bearish factors dominating the market. Key features include periods of both upward and downward trends of similar magnitude, clear support and resistance levels around $35,000 and $45,000, and a lack of significant price breakthroughs.

Bitcoin Price and Inflation Correlation

This graph illustrates the relationship between Bitcoin’s price and the US inflation rate (as measured by the Consumer Price Index – CPI) over a period encompassing 2025. The x-axis represents time, and the y-axis displays both Bitcoin’s price (in USD) and the CPI (as a percentage change from the previous year).

The graph might show a complex relationship. In periods of high inflation, Bitcoin’s price could potentially rise as investors seek to hedge against inflation. This is based on the idea that Bitcoin’s limited supply could make it a store of value during inflationary periods. Conversely, a sharp increase in inflation might lead to broader economic uncertainty, causing investors to sell off riskier assets, including Bitcoin, resulting in a price decrease. The correlation is not always straightforward and can be influenced by various other market forces. For example, a period of high inflation coupled with positive Bitcoin-specific news (such as widespread adoption by major companies) could lead to a price increase despite the inflationary pressures. Conversely, high inflation coupled with negative news (such as a major security breach) could lead to a price decline. Therefore, a simple positive or negative correlation cannot be definitively assumed. The graph would visually represent this complex interplay, showing periods of positive correlation, negative correlation, and even periods where there is little to no correlation.