Frequently Asked Questions about the 2025 Bitcoin Halving: When Is Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this mechanism is crucial for anyone interested in Bitcoin’s long-term prospects. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

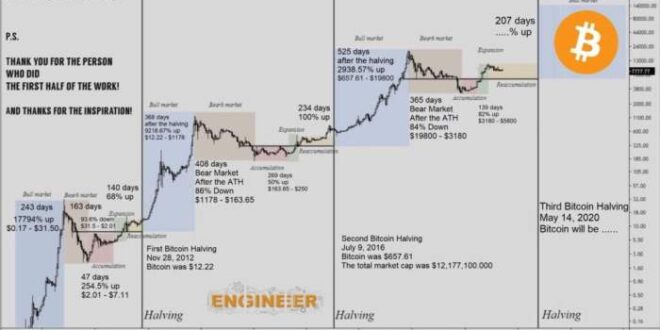

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This process is hardcoded into Bitcoin’s protocol, ensuring a predictable and controlled inflation rate. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled reduction in new Bitcoin creation is a key element of Bitcoin’s deflationary design.

Expected Date of the 2025 Bitcoin Halving

Predicting the exact date of the 2025 halving requires monitoring the block generation time. While theoretically occurring every four years, the actual time varies slightly due to fluctuations in mining difficulty. Based on current block generation times, the 2025 halving is anticipated to occur sometime in the first half of the year, potentially around April or May. However, this remains an estimate, and the precise date will be confirmed only as the halving approaches.

Impact of the Halving on Bitcoin Supply

The halving directly impacts Bitcoin’s inflation rate. By reducing the rate of new Bitcoin creation, it decreases the supply entering the market. This reduced supply, coupled with continued demand, is theoretically expected to increase scarcity and potentially drive up the price. The halving acts as a built-in deflationary mechanism, gradually reducing the rate of inflation over time. This is a key difference from traditional fiat currencies which can experience uncontrolled inflation.

Will the 2025 Halving Guarantee a Price Increase?

While past halvings have often been followed by periods of price appreciation, the 2025 halving does not guarantee a price increase. The price of Bitcoin is influenced by numerous factors beyond the halving, including macroeconomic conditions, regulatory changes, technological advancements, market sentiment, and overall adoption rates. For example, the 2020 halving was followed by a significant price surge, but various other factors contributed to this increase. The price action following a halving is complex and influenced by the interplay of various market forces. Therefore, it’s crucial to understand that a price increase is not a certain outcome, despite the halving’s impact on supply.

Beyond the Halving

The 2025 Bitcoin halving is a significant event, but it’s crucial to understand that it’s just one piece of a much larger puzzle. Bitcoin’s future trajectory will depend on a complex interplay of technological advancements, regulatory landscapes, and evolving market dynamics. Looking beyond the immediate impact of the halving allows us to consider the broader implications for this groundbreaking cryptocurrency.

Technological Developments Impacting Bitcoin’s Future

Technological innovation will play a crucial role in shaping Bitcoin’s future. Improvements in scalability solutions, such as the Lightning Network, are vital for handling a larger volume of transactions and reducing fees. Further research into privacy-enhancing technologies, like confidential transactions, could address concerns around transparency and user anonymity. Additionally, advancements in hardware security and energy efficiency are continuously improving the network’s resilience and sustainability. For example, the development of more energy-efficient ASICs (Application-Specific Integrated Circuits) for Bitcoin mining could lessen the environmental impact of the network.

Challenges to Bitcoin Adoption and Growth

Several obstacles hinder Bitcoin’s widespread adoption. Volatility remains a significant concern for many potential investors and users, making it difficult to integrate Bitcoin into everyday transactions. Regulatory uncertainty across different jurisdictions creates challenges for businesses and individuals seeking to use or invest in Bitcoin. Furthermore, the complexity of using Bitcoin, particularly for those unfamiliar with cryptocurrency technology, presents a barrier to entry for a wider audience. The educational gap needs to be addressed through clear and accessible resources. Finally, the ongoing debate surrounding Bitcoin’s environmental impact, due to its energy-intensive mining process, needs careful consideration and innovative solutions.

Bitcoin’s Role in the Broader Financial Landscape

Bitcoin’s position within the broader financial ecosystem is continuously evolving. Its potential as a store of value, an alternative to traditional currencies, and a hedge against inflation is increasingly recognized. However, its integration into mainstream financial systems faces challenges. Many financial institutions are still hesitant to fully embrace Bitcoin due to regulatory uncertainty and concerns about its volatility. Despite these challenges, the growing interest from institutional investors and the development of Bitcoin-related financial products, such as Bitcoin ETFs (Exchange-Traded Funds), suggest a growing level of acceptance within traditional finance. The long-term impact on traditional financial systems remains to be seen, but the integration is likely to be gradual and incremental.

Potential Scenarios for Bitcoin’s Future, When Is Bitcoin Halving 2025

Predicting the future of Bitcoin is inherently speculative, but considering various scenarios offers valuable insights.

The following Artikels potential scenarios, encompassing both optimistic and pessimistic outlooks:

When Is Bitcoin Halving 2025 – Several factors contribute to the uncertainty surrounding Bitcoin’s future. These include technological advancements, regulatory changes, and overall market sentiment. The scenarios presented below represent a range of possibilities, and the actual outcome is likely to be a complex interplay of these factors.

- Optimistic Scenario: Widespread adoption as a global currency, increased institutional investment, and technological advancements leading to greater scalability and efficiency. This scenario could see Bitcoin’s price significantly appreciate, becoming a dominant force in the global financial system.

- Moderate Scenario: Bitcoin becomes a widely accepted store of value and a significant asset class, but it does not fully replace traditional currencies. Regulation and technological advancements lead to increased stability and wider adoption, but at a slower pace than in the optimistic scenario.

- Pessimistic Scenario: Significant regulatory hurdles, technological limitations, or a major security breach could lead to a decline in Bitcoin’s value and adoption. This scenario might involve a loss of investor confidence and a reduction in Bitcoin’s overall market share.