Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. Understanding this mechanism is crucial for grasping Bitcoin’s long-term price dynamics and its deflationary nature.

Bitcoin Halving Mechanism and Impact on Supply

The Bitcoin halving directly affects the block reward miners receive for verifying and adding transactions to the blockchain. Initially, the reward was 50 BTC per block. With each halving, this reward is cut in half. This predictable reduction in the supply of newly minted Bitcoins contributes to Bitcoin’s scarcity and is a key element of its design. The halving doesn’t magically create more demand, but it does reduce the rate of new Bitcoin entering circulation, potentially influencing price due to the interplay of supply and demand.

Historical Impact of Bitcoin Halvings on Price and Market Sentiment

Past Bitcoin halvings have been associated with significant price increases in the months and years following the event. While correlation doesn’t equal causation, the reduced supply often coincides with increased investor interest and speculation, leading to price appreciation. However, it’s important to note that various other market factors, including regulatory changes, technological advancements, and overall economic conditions, also significantly influence Bitcoin’s price. The market sentiment surrounding each halving is often characterized by anticipation and excitement, sometimes leading to speculative bubbles, followed by periods of correction.

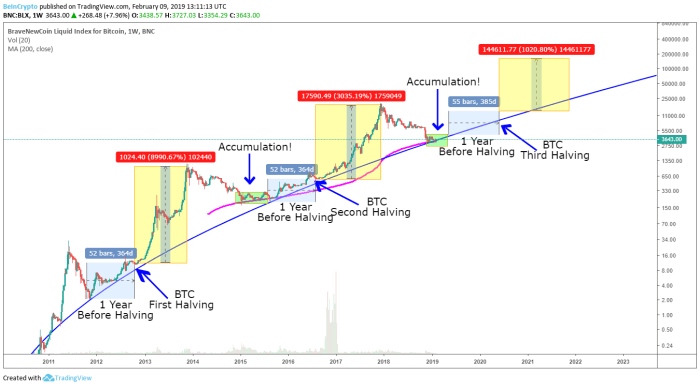

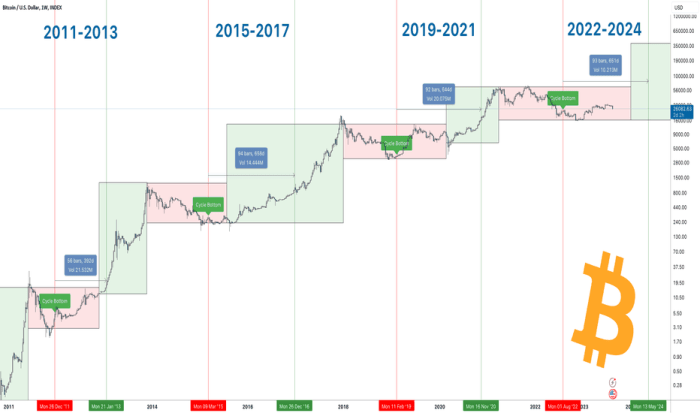

Timeline of Past Bitcoin Halvings and Price Movements

The following table illustrates the dates of past Bitcoin halvings, along with approximate Bitcoin prices before and after the event. Note that these prices are snapshots in time and the actual price movements are far more complex and nuanced.

| Halving Date | Approximate Bitcoin Price (Before) (USD) | Approximate Bitcoin Price (After) (USD) | Key Events/Observations |

|---|---|---|---|

| November 28, 2012 | $13 | ~$100 (within a year) | Relatively low market capitalization, early adoption phase. |

| July 9, 2016 | ~$650 | ~$20,000 (within approximately 3 years) | Increased institutional interest and mainstream media attention. |

| May 11, 2020 | ~$8,700 | ~$65,000 (within approximately a year) | Significant institutional investment and growing adoption. |

Note: These prices are approximate and represent a simplified view of complex market dynamics. The actual price movements are far more complex and influenced by numerous factors beyond the halving itself.

Halving Events and Bitcoin Price: A Visual Representation

Imagine a line graph. The x-axis represents time, showing the dates of the three previous halvings. The y-axis represents the Bitcoin price in USD. Each halving event is marked with a vertical line. The graph would show a general upward trend in Bitcoin’s price over time, with noticeable price increases following each halving event. However, the graph would also demonstrate periods of volatility and price corrections, highlighting the fact that the halving is not the sole determinant of price. The graph would visually demonstrate the correlation, but not causation, between halvings and price increases. The visual representation would emphasize that while halvings often precede price appreciation, other market forces significantly impact the overall price trajectory.

Predicting the 2025 Bitcoin Halving Date

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant event in the cryptocurrency’s lifecycle. Predicting the precise date of the 2025 halving requires understanding the underlying mechanism and acknowledging potential influencing factors. This involves analyzing block generation times and considering various scenarios.

Determining the Halving Date Based on Block Generation Times

The Bitcoin protocol dictates that a new block is added to the blockchain approximately every 10 minutes. Every 210,000 blocks, the reward for miners who validate transactions is halved. Therefore, to predict the halving date, we need to estimate the time it takes to mine 210,000 blocks from the previous halving. While the target is 10 minutes per block, the actual time varies due to several factors. Using the average block time from the previous cycles provides a reasonable initial estimation. However, this is not a perfect prediction, as fluctuations in mining difficulty and hash rate significantly impact the block generation time. For instance, if the average block time consistently exceeds 10 minutes, the halving will be slightly delayed. Conversely, faster-than-average block generation will bring the halving forward.

Factors Affecting the Halving Date

Several factors can influence the exact timing of the Bitcoin halving. The most significant is the mining difficulty adjustment algorithm. This algorithm dynamically adjusts the difficulty of mining new blocks to maintain the approximate 10-minute block generation target. Increased miner participation (higher hash rate) leads to faster block generation and a potential earlier halving, while decreased miner participation (lower hash rate) causes slower block generation and a later halving. Another factor is the potential for unexpected network congestion or disruptions. Significant network issues could temporarily slow down block generation, pushing back the halving date. Finally, the emergence of more efficient mining hardware could also influence the block generation time, affecting the halving date’s precision.

Comparison of Halving Date Prediction Methods

Several methods exist for predicting the halving date. The simplest method uses the average block time from the past to extrapolate the time until the next 210,000 blocks are mined. This approach provides a reasonable estimate but lacks precision due to the inherent variability in block generation times. More sophisticated methods incorporate statistical analysis, considering historical data and attempting to model the fluctuations in mining difficulty and hash rate. These methods aim for greater accuracy but still involve inherent uncertainty given the complexity of the system. Some prediction websites and services use these more sophisticated methods, often providing a range of possible halving dates rather than a single precise prediction.

Potential Scenarios for the 2025 Halving Date, When Is Bitcoin Halving 2025 Date

Considering the factors mentioned above, several scenarios are possible for the 2025 Bitcoin halving. A “baseline” scenario, assuming an average block time close to 10 minutes, might predict a halving date within a relatively narrow window. However, a scenario with significantly increased mining hash rate could result in a slightly earlier halving, while a scenario with reduced hash rate or significant network congestion could lead to a later halving. For example, a sustained period of low Bitcoin price could discourage miners, leading to a slower block generation time and a later halving. Conversely, a surge in Bitcoin’s price could attract more miners, leading to a faster block generation and an earlier halving. The precise date will only be known as the 210,000th block approaches its mining.

Market Expectations and Price Predictions

The 2025 Bitcoin halving is a highly anticipated event within the cryptocurrency market, generating significant speculation regarding its impact on Bitcoin’s price. Market sentiment is generally bullish, with many investors expecting a price surge following the halving, mirroring historical trends. However, the extent of this price increase remains a subject of considerable debate and varying predictions. Several factors, including macroeconomic conditions and regulatory developments, will influence the actual price movement.

Market sentiment surrounding the 2025 halving is largely positive, fueled by the historical correlation between halving events and subsequent price appreciation. This expectation is based on the premise that the reduced supply of newly mined Bitcoin, due to the halving, will increase its scarcity and potentially drive demand, thus increasing its price. However, it’s crucial to remember that past performance is not indicative of future results, and other market forces can significantly influence Bitcoin’s price.

Key Indicators for Predicting Post-Halving Price Behavior

Several key indicators are used to predict Bitcoin’s price behavior following a halving event. These indicators often involve analyzing historical price data, on-chain metrics, and macroeconomic factors. A common approach is to compare the price action before, during, and after previous halvings to identify patterns and extrapolate them to the 2025 event. Other indicators might include the network’s hash rate, the number of active addresses, and the overall sentiment within the crypto community. Analyzing these metrics in conjunction with broader economic trends can provide a more comprehensive picture.

Comparative Analysis of Price Prediction Models

Various price prediction models exist, each employing different methodologies and data sets. Some models rely heavily on historical price data and statistical analysis, attempting to identify recurring patterns and extrapolate them to predict future price movements. Others incorporate on-chain metrics and network activity to gauge the underlying strength and demand for Bitcoin. Finally, some models consider macroeconomic factors, such as inflation rates and regulatory changes, which can significantly influence the cryptocurrency market. The accuracy of these models varies considerably, and none can definitively predict future price movements with complete certainty. For example, a simple model might extrapolate from previous halvings, while a more sophisticated model might integrate machine learning algorithms and incorporate various economic indicators.

Summary of Bitcoin Price Predictions

The following table summarizes price predictions from various sources for Bitcoin post-2025 halving. It’s important to note that these are merely predictions and should not be considered financial advice. The actual price will depend on numerous unpredictable factors.

| Source | Predicted Price (USD) | Methodology | Assumptions |

|---|---|---|---|

| Analyst A | $150,000 | Historical price analysis | Continued adoption, stable macroeconomic conditions |

| Analyst B | $200,000 | On-chain metrics and market sentiment | High demand, limited supply |

| Research Firm X | $100,000 | Econometric model | Moderate growth, potential regulatory headwinds |

The Halving’s Impact on Mining and Network Security

The Bitcoin halving, a programmed event reducing the block reward paid to miners, significantly impacts the profitability of Bitcoin mining and, consequently, the security of the Bitcoin network. Understanding these impacts is crucial for assessing the long-term health and stability of the cryptocurrency.

The halving directly affects miner profitability by reducing their revenue stream. Miners earn Bitcoin by solving complex cryptographic puzzles to validate transactions and add new blocks to the blockchain. With each halving, the amount of Bitcoin awarded for each successfully mined block is cut in half. This means miners receive less Bitcoin for their computational efforts, potentially impacting their operational viability.

Miner Profitability After the Halving

Reduced miner profitability following a halving event can have several consequences for network security. The most significant risk is the potential exodus of less-profitable miners from the network. This reduction in mining power could make the network more vulnerable to 51% attacks, where a malicious actor controls more than half of the network’s hash rate and could potentially manipulate the blockchain. The profitability of mining is directly tied to the price of Bitcoin; a higher Bitcoin price can offset the reduced block reward, maintaining profitability. Conversely, a low Bitcoin price after a halving could trigger a significant decline in mining activity.

Miner Adaptation Strategies

Miners will likely employ various strategies to adapt to the reduced block rewards. These include: increasing mining efficiency through the adoption of more energy-efficient hardware (ASICs), optimizing mining operations to reduce overhead costs, diversifying revenue streams by offering services beyond Bitcoin mining (such as providing hosting or mining pools), and consolidating operations into larger, more efficient mining pools. Successful adaptation will depend on factors like the price of Bitcoin, the cost of electricity, and the availability of advanced mining hardware.

Comparison of Mining Profitability Before and After Halving

The following table illustrates a simplified comparison of mining profitability before and after a halving event. Note that this is a hypothetical example and actual profitability varies significantly based on many factors including the cost of electricity, mining hardware efficiency, and the price of Bitcoin.

| Factor | Before Halving | After Halving |

|---|---|---|

| Block Reward (BTC) | 6.25 BTC | 3.125 BTC |

| Electricity Cost (USD/kWh) | 0.10 USD | 0.10 USD (assumed constant) |

| Hashrate (TH/s) | 100 TH/s | 100 TH/s (assumed constant) |

| Daily Electricity Cost (USD) | 24 USD | 24 USD (assumed constant) |

| Daily Bitcoin Revenue (BTC) | 6.25 BTC | 3.125 BTC |

| Daily Bitcoin Revenue (USD, assuming $30,000 BTC price) | $187,500 | $93,750 |

| Daily Profit (USD) | $187,476 | $93,726 |

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, presents a pivotal moment with potentially profound long-term consequences for Bitcoin’s adoption, value, and influence on the broader cryptocurrency landscape. Understanding these potential impacts requires considering various interconnected factors, including market dynamics, regulatory responses, and technological advancements.

The halving’s impact on Bitcoin’s value is a subject of much debate. Historically, halvings have been followed by periods of price appreciation, although the extent and duration of these increases vary. This is primarily attributed to the decreased supply of new Bitcoin entering the market, potentially increasing scarcity and driving demand. However, other macroeconomic factors and market sentiment significantly influence Bitcoin’s price, making a precise prediction impossible. The 2025 halving’s effect will likely depend on prevailing market conditions, investor confidence, and the overall adoption rate of Bitcoin as a store of value and medium of exchange.

Bitcoin Adoption and Value

The reduced inflation rate resulting from the halving could bolster Bitcoin’s appeal as a deflationary asset, potentially attracting investors seeking to hedge against inflation in traditional markets. Increased scarcity might also encourage long-term holding strategies, further reducing the circulating supply and potentially increasing its value. However, widespread adoption also depends on factors beyond the halving, such as user-friendliness, scalability solutions, and the overall regulatory environment. For example, if institutional adoption accelerates alongside the halving, the price appreciation could be more pronounced than in previous cycles. Conversely, significant regulatory hurdles could dampen the positive effects.

Influence on the Broader Cryptocurrency Market

The 2025 halving is unlikely to be isolated to Bitcoin. Its ripple effects could significantly influence the broader cryptocurrency market. A substantial increase in Bitcoin’s price following the halving might trigger a “Bitcoin-centric” rally, where other cryptocurrencies, particularly those correlated with Bitcoin, experience price increases as well. This could be driven by investor enthusiasm spilling over into the altcoin market, or by investors seeking exposure to the crypto market through alternative assets. Conversely, a less pronounced or negative reaction to the halving could trigger a market downturn, impacting the entire crypto space. For example, the 2012 halving saw a significant price increase, influencing altcoin markets positively.

Regulatory Responses and Market Impact

Government regulations play a crucial role in shaping the cryptocurrency market. The 2025 halving could trigger increased regulatory scrutiny of Bitcoin and other cryptocurrencies. Governments might respond to increased price volatility or potential market manipulation by implementing stricter regulations, potentially impacting the accessibility and adoption of Bitcoin. Conversely, some jurisdictions might embrace Bitcoin’s potential, leading to more favorable regulatory frameworks that could stimulate growth. The regulatory landscape will undoubtedly be a major determinant of the halving’s long-term effects. For example, stricter regulations could limit institutional investment, dampening the positive price effects of the halving.

Potential Long-Term Scenarios Following the 2025 Halving

A timeline illustrating potential long-term scenarios is complex due to the numerous unpredictable factors. However, we can Artikel some plausible scenarios:

| Scenario | Timeline (Years Post-Halving) | Description |

|---|---|---|

| Bullish Scenario | 1-3 years: Significant price appreciation, increased adoption. 3-5 years: Consolidation and maturation of the market. 5+ years: Bitcoin becomes a more established store of value and medium of exchange. | Strong positive market sentiment, favorable regulatory environment, increasing institutional adoption. This scenario resembles the positive market response seen after previous halvings. |

| Neutral Scenario | 1-3 years: Moderate price increase, stable adoption rates. 3-5 years: Market consolidation, limited volatility. 5+ years: Gradual adoption and integration into mainstream finance. | Mixed market sentiment, moderate regulatory changes, slower institutional adoption. This represents a more moderate outcome compared to previous cycles. |

| Bearish Scenario | 1-3 years: Price stagnation or decline, decreased adoption due to regulatory pressure or market events. 3-5 years: Market correction, reduced investor confidence. 5+ years: Slow adoption and integration into mainstream finance. | Negative market sentiment, unfavorable regulatory environment, decreased institutional adoption. This scenario considers potential negative impacts of regulatory pressure or external market events. |

Frequently Asked Questions (FAQ): When Is Bitcoin Halving 2025 Date

This section addresses common queries regarding the Bitcoin halving event, specifically focusing on the anticipated 2025 halving. Understanding these key aspects provides a clearer picture of the potential impacts on the Bitcoin network and its market value.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the block reward miners receive for verifying transactions and adding new blocks to the blockchain. The initial block reward was 50 BTC, and it has been halved three times already, currently standing at 6.25 BTC per block. This mechanism is crucial for Bitcoin’s deflationary nature and long-term scarcity.

Expected Date of the 2025 Bitcoin Halving

While the halving is algorithmically determined, pinpointing the exact date requires considering the time it takes to mine blocks. Block times are not perfectly consistent due to variations in network hash rate. However, based on historical data and current mining difficulty, the 2025 Bitcoin halving is projected to occur sometime in the spring or early summer of 2025. Precise prediction requires monitoring the block creation times leading up to the event.

The Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has experienced significant upward movements following previous halving events. This is attributed to the reduced supply of newly mined Bitcoin, creating a potential scarcity effect. However, it’s crucial to note that other factors, including market sentiment, regulatory changes, and overall economic conditions, also heavily influence price movements. The 2012 and 2016 halvings were followed by substantial price increases, though the timing and magnitude varied. For example, the price surge following the 2016 halving didn’t fully materialize until well into 2017.

Risks and Uncertainties Associated with the Halving

Predicting the precise impact of a halving on Bitcoin’s price is inherently uncertain. While historical data suggests a positive correlation, this is not guaranteed. Unforeseen events, such as a major security breach, a significant regulatory crackdown, or a broader economic downturn, could significantly impact the market regardless of the halving. Moreover, the market’s anticipation of the halving might already be priced into Bitcoin’s value, potentially reducing its immediate impact.

Potential Long-Term Implications of the Halving

The long-term implications of the 2025 halving are multifaceted. The reduced supply of newly minted Bitcoin is expected to contribute to its long-term scarcity and potentially increase its value over time. This could strengthen Bitcoin’s position as a store of value and potentially drive further adoption. However, the long-term effects also depend on factors like technological advancements, competition from other cryptocurrencies, and the overall evolution of the cryptocurrency market. The long-term impact is subject to considerable uncertainty.

Illustrative Examples and Visual Aids

Understanding the Bitcoin halving requires a clear grasp of its mechanics and impact. This section provides illustrative examples and visual aids to enhance comprehension. We will explore a step-by-step example of the halving process, a hypothetical scenario demonstrating its consequences, and a visual representation of Bitcoin’s supply dynamics. Finally, a table summarizes the key characteristics and implications of past halving events.

A Step-by-Step Example of Bitcoin Halving

Let’s imagine a simplified scenario. Suppose Bitcoin’s block reward is currently 6.25 BTC per block. This reward is given to the miner who successfully adds a new block to the blockchain. When the halving occurs, this reward is cut in half, dropping to 3.125 BTC per block. This reduction in the newly created Bitcoin supply is the core mechanism of the halving. This process repeats approximately every four years, reducing the rate at which new Bitcoins enter circulation. This gradual decrease in the issuance rate is a key feature of Bitcoin’s design, intended to control inflation.

Hypothetical Scenario: Impact of the 2025 Halving

Consider a hypothetical scenario where the 2025 halving occurs as predicted, reducing the block reward. Immediately following the halving, we might see a temporary dip in miner profitability, as the revenue per block decreases. This could lead to some miners temporarily shutting down their operations if the price of Bitcoin doesn’t rise to compensate for the reduced reward. However, assuming the demand for Bitcoin remains strong or increases, the reduced supply could drive up the price. This price increase would eventually make mining profitable again, even with the halved reward. This interplay between supply, demand, and miner profitability is crucial to understanding the halving’s impact. The long-term effect could be a gradual increase in Bitcoin’s value, reflecting its scarcity and increasing demand. It is important to note that this is a hypothetical scenario and the actual market reaction could vary significantly.

Bitcoin Supply Dynamics

Imagine a chart showing the cumulative supply of Bitcoin over time. The x-axis represents time (in years), and the y-axis represents the total number of Bitcoins in circulation. The line starts at zero and gradually increases, but the rate of increase slows down with each halving. Each halving event is marked on the chart, visually demonstrating the reduced rate of Bitcoin creation. The chart would clearly show the asymptotic nature of Bitcoin’s supply, approaching but never exceeding the 21 million coin limit. The area under the curve would visually represent the total number of Bitcoins in circulation at any given point in time. The chart would highlight the significant impact of halvings on the rate of Bitcoin supply growth, illustrating how it steadily decreases over time.

Summary of Bitcoin Halving Events

| Halving Event | Date | Block Reward Before Halving | Block Reward After Halving | Approximate Bitcoin Price Before Halving | Approximate Bitcoin Price After Halving (1 year later) | Key Implications |

|---|---|---|---|---|---|---|

| 1st Halving | November 28, 2012 | 50 BTC | 25 BTC | ~$13 | ~$116 | Increased scarcity, price appreciation. |

| 2nd Halving | July 9, 2016 | 25 BTC | 12.5 BTC | ~$650 | ~$2000 | Further scarcity, significant price increase. |

| 3rd Halving | May 11, 2020 | 12.5 BTC | 6.25 BTC | ~$8700 | ~$29000 | Increased network security, substantial price appreciation. |

| 4th Halving (Predicted) | ~April 2024 | 6.25 BTC | 3.125 BTC | (Variable, depends on market conditions) | (Variable, depends on market conditions) | Further scarcity, potential price appreciation; Impact on mining profitability. |

Pinpointing the exact When Is Bitcoin Halving 2025 Date requires careful consideration of the Bitcoin protocol. To fully understand the implications of this event, it’s helpful to first grasp the underlying mechanics; for a clear explanation, refer to this resource on Que Es Halving Bitcoin 2025. Understanding this process helps predict the likely timeframe for the next halving and its potential impact on the Bitcoin price and network.

Therefore, while the precise date remains subject to minor variations, the halving’s significance is undeniable.

Determining the precise date for the next Bitcoin halving is a key question for many investors. Understanding the halving’s impact on Bitcoin’s supply and potential price fluctuations is crucial, and a helpful resource for this is the detailed analysis provided on the website dedicated to Bitcoin Halving 2025 Date. Therefore, researching the projected timeline for the When Is Bitcoin Halving 2025 Date remains important for informed decision-making.

Determining the precise When Is Bitcoin Halving 2025 Date requires careful consideration of the Bitcoin network’s block generation times. To find a definitive answer to this question, you should consult resources dedicated to tracking this event, such as this helpful article: When Is The Bitcoin Halving In 2025. Understanding this date is crucial for anyone interested in Bitcoin’s long-term price predictions and market dynamics related to the When Is Bitcoin Halving 2025 Date.

Determining the precise “When Is Bitcoin Halving 2025 Date” requires careful consideration of the Bitcoin network’s block generation times. To understand the specifics of this event, a helpful resource is the dedicated page detailing Bitcoin Halving Day 2025 , which provides insights into the expected date. Ultimately, pinpointing the exact “When Is Bitcoin Halving 2025 Date” remains dependent on the blockchain’s activity.

Pinpointing the exact Bitcoin halving date in 2025 requires careful consideration of block generation times. To stay updated on the precise timing, refer to this helpful resource: When Is Next Bitcoin Halving 2025. Understanding the projected date for the next halving is crucial for predicting potential market shifts and the impact on Bitcoin’s value in the long term.

Therefore, keeping an eye on the 2025 Bitcoin halving date is vital for informed investment strategies.

Determining the precise When Is Bitcoin Halving 2025 Date requires careful consideration of block generation times. To stay informed about this significant event for Bitcoin’s inflation rate, refer to a reliable resource such as this comprehensive guide on the 2025 Bitcoin Halving Date. Understanding the 2025 Bitcoin Halving Date helps predict future price movements and overall market trends, ultimately answering the question of When Is Bitcoin Halving 2025 Date.