Bitcoin Halving: When Is Bitcoin Halving Date 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin.

Bitcoin Halving Mechanism

The halving mechanism directly impacts the block reward, the amount of Bitcoin miners receive for successfully adding a block of transactions to the blockchain. Initially, the block reward was 50 BTC. Each halving cuts this reward in half. Therefore, after the first halving, it became 25 BTC, then 12.5 BTC, and the next halving will reduce it to 6.25 BTC. This reduction in the rate of new Bitcoin entering circulation directly affects the supply side of the market. While demand may fluctuate, a consistent decrease in supply tends to exert upward pressure on price, assuming demand remains relatively stable or increases.

Historical Impact of Bitcoin Halvings

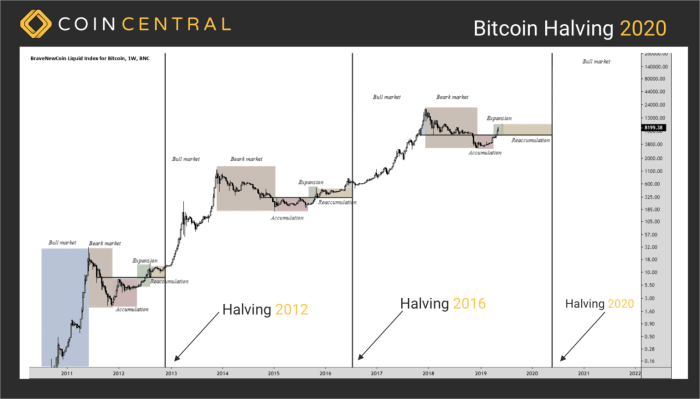

Previous Bitcoin halvings have demonstrated a noticeable impact on price volatility and market sentiment. While not always immediately followed by a sharp price increase, historical data suggests a general upward trend in price following each halving event, albeit often preceded or followed by periods of significant volatility. The first halving in 2012 saw a gradual price increase in the following months. The second halving in 2016 was followed by a period of relative price stability before a significant bull run began. The third halving in 2020 also saw a significant price surge following the event, although market sentiment and other factors undoubtedly played a role in the price movement. These observations highlight the complex interplay between the halving event and broader market dynamics.

Comparison of Past Halvings and Future Predictions

Comparing the effects of past halvings reveals no single, predictable outcome. The timing and magnitude of price changes following each halving have varied significantly, influenced by factors beyond the halving itself, such as regulatory changes, macroeconomic conditions, and overall market sentiment. For example, while the 2020 halving was followed by a substantial price increase, the preceding period had already seen considerable price growth. Therefore, attributing the entire price surge solely to the halving would be an oversimplification. Predicting the outcome of the 2024 halving requires considering these various interconnected factors and acknowledging the inherent uncertainty in the cryptocurrency market. Any prediction should be viewed with caution, acknowledging the potential for significant price fluctuations in either direction.

Past Bitcoin Halving Events

The following table summarizes the dates and impacts of past Bitcoin halvings. Note that “Subsequent Price Changes” represent general trends and not precise, immediate post-halving price movements, as market reactions are complex and occur over time.

| Date | Block Height (approx.) | Halving Impact (Block Reward) | Subsequent Price Changes |

|---|---|---|---|

| November 28, 2012 | 210,000 | 50 BTC to 25 BTC | Gradual price increase over several months |

| July 9, 2016 | 420,000 | 25 BTC to 12.5 BTC | Period of stability followed by a significant bull run |

| May 11, 2020 | 630,000 | 12.5 BTC to 6.25 BTC | Significant price surge following the event |

Predicting the 2025 Bitcoin Halving Date

Predicting the exact date of the 2025 Bitcoin halving requires understanding the core mechanics of Bitcoin’s blockchain and acknowledging the inherent uncertainties involved. While we can make a strong estimate, several factors could influence the final outcome.

Calculating the Expected Block Height

The Bitcoin halving occurs approximately every 210,000 blocks. To predict the block height of the 2025 halving, we need the current block height and the average block time. Assuming a consistent average block time of 10 minutes (which is a simplification, as it fluctuates), we can extrapolate. Let’s assume, for the sake of example, that the current block height at the time of writing is 800,000. The next halving would then occur around block height 1,010,000 (800,000 + 210,000). This is a simplified calculation and the actual block height may differ slightly. The exact block height will be known only as we approach the event.

Factors Influencing Halving Timing

Several factors can influence the precise timing of the halving. Changes in mining difficulty dynamically adjust the rate of block generation to maintain a roughly 10-minute average. If the hashrate (total computational power dedicated to mining) increases significantly, the difficulty also increases, potentially speeding up block creation and slightly advancing the halving date. Conversely, a significant decrease in hashrate would slow down block creation, delaying the halving. Furthermore, unforeseen circumstances, such as significant network congestion or major protocol upgrades, could also impact block generation times and, consequently, the halving date. For example, the 2020 halving was slightly ahead of initial predictions due to increased hashrate.

Uncertainty and Market Speculation

The inherent uncertainty surrounding the precise date of the halving fuels significant market speculation. Traders and investors often anticipate the halving as a bullish event, expecting reduced supply to increase Bitcoin’s price. However, the actual market reaction can be complex and influenced by numerous factors beyond just the halving itself, including macroeconomic conditions, regulatory changes, and overall market sentiment. The uncertainty creates an environment ripe for both price increases and potentially sharp corrections depending on the prevailing market conditions. The 2012 and 2016 halvings were followed by periods of significant price appreciation, but this is not a guaranteed outcome for 2025.

Timeline Leading to the 2025 Halving

The period leading up to the 2025 halving is likely to witness increasing anticipation within the Bitcoin market. We can anticipate:

When Is Bitcoin Halving Date 2025 – Several months before: Increased discussion and analysis of the upcoming halving, with various price predictions and market forecasts emerging.

Determining the precise Bitcoin Halving date for 2025 requires careful consideration of the block reward reduction mechanism. Understanding this process is key to predicting when the next halving will occur, and for more detailed information, you can consult this excellent resource on Bitcoin Halving 2025. Therefore, by analyzing the blockchain’s activity, we can reasonably estimate the When Is Bitcoin Halving Date 2025.

Months before: A gradual increase in Bitcoin’s price as investors position themselves ahead of the anticipated event. This might be accompanied by increased volatility.

Determining the precise Bitcoin Halving Date 2025 requires careful consideration of block times and mining difficulty adjustments. To get a clear understanding of the projected date, you should consult a reliable resource such as this article on When Is Bitcoin Halving 2025 , which provides detailed analysis. This will help you accurately predict the When Is Bitcoin Halving Date 2025 and its potential market impact.

Weeks before: Intensified market activity as the estimated block height approaches, potentially leading to significant price fluctuations.

Predicting the exact Bitcoin halving date in 2025 requires careful analysis of the blockchain’s block generation times. However, once we have that date pinned down, the next big question is always the price. Speculation abounds, and to get a sense of potential price movements, check out this insightful resource on Bitcoin Price At Halving 2025 before forming your own conclusions about the 2025 halving date and its impact.

Ultimately, the precise timing of the halving remains a key factor in price predictions.

Days before: High levels of trading volume and volatility as the exact block height and date become imminent.

Predicting the exact Bitcoin halving date in 2025 requires careful analysis of the blockchain’s block generation times. However, once we have that date pinned down, the next big question is always the price. Speculation abounds, and to get a sense of potential price movements, check out this insightful resource on Bitcoin Price At Halving 2025 before forming your own conclusions about the 2025 halving date and its impact.

Ultimately, the precise timing of the halving remains a key factor in price predictions.

Post-Halving: The market will react to the actual event. The immediate aftermath might see further price movements, but the long-term effects will depend on various market factors beyond the halving itself.

Pinpointing the exact When Is Bitcoin Halving Date 2025 requires careful analysis of the blockchain, but once we know, the next big question is always about the market reaction. Understanding the potential impact on price is crucial, and for insightful predictions, check out this resource on Bitcoin Price After Halving 2025. Ultimately, the date of the 2025 halving will significantly influence Bitcoin’s trajectory in the following years.

Market Impact of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is anticipated to have significant consequences for the cryptocurrency market. The event’s impact stems from the fundamental principle of supply and demand: a decrease in supply, coupled with potentially sustained or increased demand, can exert upward pressure on price. Understanding the multifaceted nature of this impact requires analyzing its effects on price, institutional investment, mining profitability, and overall market sentiment.

Bitcoin Price Influence

The reduced supply of newly mined Bitcoin following the halving is expected to contribute to price appreciation. Historically, Bitcoin’s price has shown a tendency to rise in the periods following previous halvings. This is attributed to the decreased inflation rate and the perception of increasing scarcity among investors. While the magnitude of price increase varies and is influenced by other market factors, the halving acts as a significant catalyst. For instance, the 2012 halving was followed by a substantial price increase, and while the 2016 and 2020 halvings exhibited more complex price trajectories influenced by broader market conditions, they also saw notable price growth in the following months and years. It’s crucial to remember that other factors, such as regulatory changes, macroeconomic conditions, and overall market sentiment, also play a crucial role in determining Bitcoin’s price.

Increased Institutional Investment

The halving event often attracts increased attention from institutional investors. The anticipated scarcity of Bitcoin, combined with its perceived store-of-value characteristics, can make it an attractive asset for diversification within large portfolios. This increased institutional interest can lead to greater liquidity in the market and potentially further fuel price appreciation. Examples of increased institutional involvement following previous halvings include the rise of Bitcoin investment trusts and the growing adoption of Bitcoin by major corporations as a treasury asset. The 2020 halving, for instance, saw a significant influx of institutional investment, contributing to the subsequent price surge.

Impact on Bitcoin Mining Profitability and Network Security

The halving directly impacts Bitcoin miners’ profitability. The reward for successfully mining a block is halved, reducing the income generated from this activity. This can lead to some miners exiting the network if the price of Bitcoin doesn’t rise sufficiently to offset the reduced block reward. However, the halving also strengthens the network’s security. A smaller number of miners, operating more efficiently, can still maintain the network’s overall hash rate, making it more resilient to attacks. The network’s resilience is directly proportional to the total hashing power, and thus, the halving incentivizes miners to become more efficient and consolidate. This contributes to the long-term stability and security of the Bitcoin network.

Comparison of Market Sentiment and Price Movements Before and After Previous Halvings

Analyzing the market sentiment and price movements surrounding previous halvings provides valuable insights. Generally, the period leading up to a halving often witnesses increased speculation and anticipation, sometimes leading to price increases. The period immediately following a halving can be characterized by a period of consolidation, before a longer-term price trend emerges. The price movements post-halving are not uniform, influenced by a complex interplay of market factors. While all halvings have seen an increase in price eventually, the timing and the magnitude of that increase varied. The impact of each halving is also heavily influenced by external factors such as global economic conditions and regulatory changes. A comprehensive comparison of these factors across the previous halvings allows for a more nuanced understanding of the potential outcomes of the 2025 event.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, presents significant long-term implications for the cryptocurrency’s role in the global financial landscape. Understanding these potential effects is crucial for investors, businesses, and policymakers alike. The reduced supply, coupled with anticipated continued demand, could profoundly shape Bitcoin’s future trajectory.

The halving’s impact on Bitcoin’s store-of-value proposition is arguably its most significant long-term consequence. Historically, halvings have been followed by periods of price appreciation, as the scarcity of newly minted Bitcoin increases its perceived value. This is predicated on the fundamental economic principle of supply and demand. However, other factors such as macroeconomic conditions, regulatory changes, and overall market sentiment will significantly influence the actual outcome. A sustained period of price appreciation could further solidify Bitcoin’s position as a hedge against inflation and a safe haven asset, attracting investment from both individual and institutional investors. Conversely, a failure to see substantial price increases could potentially weaken its appeal as a store of value.

Bitcoin’s Role as a Medium of Exchange, When Is Bitcoin Halving Date 2025

The 2025 halving’s effect on Bitcoin’s adoption as a medium of exchange is less straightforward. While increased scarcity might enhance its perceived value, transaction fees remain a significant hurdle. The relatively slow transaction speeds compared to other payment systems, coupled with transaction fees that fluctuate with network congestion, continue to limit widespread adoption for everyday purchases. However, the development of the Lightning Network, a layer-two scaling solution, aims to address these limitations by enabling faster and cheaper transactions. The success of the Lightning Network in achieving widespread adoption will be crucial in determining whether the halving translates into increased usage of Bitcoin as a daily transactional currency. Wider merchant adoption and integration into payment platforms will also be critical factors.

Comparison with Other Cryptocurrencies

Bitcoin’s halving mechanism is unique, although other cryptocurrencies have implemented similar supply control mechanisms. Many altcoins utilize pre-mined coins, a fixed total supply, or inflationary models with varying emission schedules. These approaches differ significantly from Bitcoin’s halving, which gradually reduces the rate of new coin creation over time. The predictability of Bitcoin’s halving schedule is a key differentiator, providing market participants with a clear roadmap for future supply. This predictability contrasts with the often less transparent or more volatile supply mechanisms found in many other cryptocurrencies.

Key Differences and Similarities in Supply Management

The following points highlight the key differences and similarities between Bitcoin’s halving and other approaches to managing cryptocurrency supply:

- Predictability: Bitcoin’s halving is predictable, occurring approximately every four years. Many other cryptocurrencies have less predictable or entirely unpredictable supply schedules.

- Scarcity: Bitcoin’s halving contributes to its inherent scarcity, a key driver of its value proposition. Other cryptocurrencies may have a fixed supply, but the rate at which those coins enter circulation can vary widely.

- Inflationary vs. Deflationary: Bitcoin’s halving mechanism creates a deflationary pressure on its price. Many altcoins operate under inflationary models, where new coins are constantly being created.

- Transparency: The rules governing Bitcoin’s halving are transparent and publicly auditable. Some altcoins may have less transparent supply mechanisms, potentially leading to uncertainty.

- Decentralization: Bitcoin’s halving is governed by its decentralized network, ensuring its immutability. The supply mechanisms of some altcoins might be controlled by a centralized entity or team, raising concerns about potential manipulation.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding the 2025 Bitcoin halving, its impact, and associated risks. Understanding these aspects is crucial for anyone considering Bitcoin investment or involvement in the mining sector.

Expected Date of the 2025 Bitcoin Halving

Pinpointing the exact date of the 2025 Bitcoin halving is challenging due to the decentralized nature of Bitcoin and the variability in block generation times. The halving occurs approximately every four years, when the block reward for miners is cut in half. While the target block time is 10 minutes, this isn’t always consistent. Therefore, estimations rely on projecting the average block time leading up to the event. Current predictions place the 2025 halving sometime in the spring or early summer, but this remains an estimate subject to fluctuation. For example, if block times consistently exceed the 10-minute average, the halving could be slightly delayed. Conversely, faster-than-average block times could bring it forward. Reliable sources, such as blockchain explorers, will provide the most up-to-date information as the halving approaches.

Effect of the Bitcoin Halving on Bitcoin Price

The Bitcoin halving’s impact on price is a complex issue with no guaranteed outcome. Historically, halvings have been followed by periods of price increase. This is because the reduced supply of newly mined Bitcoin can create upward pressure on price, particularly if demand remains consistent or increases. However, it’s crucial to understand that this isn’t a guaranteed causal relationship. Other market factors, such as regulatory changes, overall economic conditions, and investor sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, but this doesn’t guarantee a similar outcome in 2025. The market’s reaction will depend on the interplay of numerous factors beyond just the reduced supply.

Potential Risks of Investing in Bitcoin Before the Halving

Investing in Bitcoin, especially before a halving event, carries significant risk. Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by speculation, news events, and market sentiment. Investing before a halving involves betting on a future price increase, but there’s no certainty this will occur. The price could decline even after a halving, leading to potential losses. Furthermore, the cryptocurrency market is relatively unregulated in many jurisdictions, adding another layer of risk. It’s crucial to only invest what you can afford to lose and to thoroughly research the market before making any decisions. Past performance is not indicative of future results.

Impact of the Halving on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. With a reduced block reward, miners’ income per block is halved. This necessitates adjustments to maintain profitability. Miners might respond by: increasing their mining efficiency through upgrades to their hardware; reducing operational costs; consolidating mining operations; or, in extreme cases, shutting down less profitable operations entirely. The overall impact on the mining industry depends on factors like the price of Bitcoin, the cost of electricity, and the competition within the mining sector. A sustained low Bitcoin price following the halving could lead to a significant shakeout within the mining industry, with less efficient or higher-cost operations forced to cease operations.

Illustrative Example

Visualizing the potential impact of the 2025 Bitcoin halving on price is a complex undertaking, reliant on numerous unpredictable market factors. However, by analyzing past halving cycles and considering current market sentiment, we can create a plausible projection, understanding that this is just one possible scenario. This illustrative example aims to provide a visual representation of potential price movements, not financial advice.

This table presents a simplified projection of Bitcoin’s price behavior around the 2025 halving, based on historical trends and expert analysis. It is crucial to remember that these are projections, and the actual price will depend on a multitude of factors.

Projected Bitcoin Price Changes Around the 2025 Halving

| Time Period | Projected Price (USD) | Rationale |

|---|---|---|

| 6 Months Before Halving | $40,000 | Anticipation of the halving often leads to price increases as investors accumulate Bitcoin. This projection assumes moderate bullish sentiment. |

| During Halving Month | $45,000 – $55,000 | The halving itself is a significant event, often triggering short-term volatility. This range reflects the uncertainty around immediate post-halving price action. |

| 6 Months After Halving | $60,000 – $80,000 | Historically, the period following a halving has seen substantial price increases due to reduced supply. This projection assumes continued positive market sentiment and increased demand. |

| 12 Months After Halving | $70,000 – $100,000 | This projection accounts for the potential for sustained growth based on the reduced inflation rate of newly mined Bitcoin. However, macroeconomic factors could significantly impact this range. |

Disclaimer: This table provides a speculative projection based on historical trends and does not constitute financial advice. The actual price of Bitcoin is subject to significant volatility and can be influenced by numerous factors, including regulatory changes, macroeconomic conditions, and market sentiment. Investing in cryptocurrency carries significant risk, and you should conduct your own research before making any investment decisions.

Format Considerations

Presenting complex financial information like Bitcoin halving predictions requires a format that prioritizes clarity and accessibility for a broad audience, regardless of their prior knowledge of cryptocurrency. Effective design choices will significantly improve comprehension and engagement.

The optimal format should blend concise textual explanations with visually compelling data representations. This approach caters to different learning styles, ensuring that the information resonates with a wider range of readers. The use of charts and graphs is crucial for simplifying complex trends and relationships, making the data more digestible and memorable.

Visual Representation of Data

Charts and graphs are indispensable tools for conveying the potentially intricate dynamics of Bitcoin halving and its market effects. For instance, a line graph could effectively illustrate the historical price movements of Bitcoin around previous halving events, highlighting correlations between halving dates and subsequent price changes. A bar chart could compare the mining reward before and after each halving, clearly showing the reduction in newly minted Bitcoin. Scatter plots could visualize the relationship between Bitcoin’s price and its mining difficulty, offering insights into market behavior. Pie charts can represent the distribution of Bitcoin holdings among different groups (e.g., exchanges, individuals, institutions), providing context for market dynamics. All charts should be clearly labeled with titles, axis labels, and legends, ensuring easy interpretation. Using consistent color schemes and a clean, uncluttered design is crucial for visual appeal and readability.

Effective Use of Formatting Elements

Employing a hierarchical structure with clear headings and subheadings is essential for guiding the reader through the information logically. Main sections, such as “Market Impact of the 2025 Halving” or “Long-Term Implications of the 2025 Halving,” should be clearly designated with

tags. Subsections, such as specific aspects of market impact (e.g., “Price Volatility,” “Miner Revenue”), can be indicated with

tags. Bullet points (

) are effective for summarizing key takeaways or presenting lists of factors influencing Bitcoin’s price. For instance, a list of factors influencing Bitcoin price after a halving could include: increased scarcity, reduced inflation, increased investor interest, and regulatory changes. Numbered lists (

) could be used to present a step-by-step analysis of a specific scenario or prediction. The use of bold text can highlight crucial information or emphasize key findings. White space should be used liberally to avoid overwhelming the reader with dense text blocks. This improves readability and creates a more visually appealing layout.

Illustrative Example: Charting Bitcoin Price Around Previous Halvings

Imagine a line graph showing Bitcoin’s price over a period of several years, encompassing the previous halving events. The x-axis represents time, and the y-axis represents Bitcoin’s price in USD. Each halving date would be clearly marked on the x-axis. The line would visually demonstrate the price movements before, during, and after each halving. A legend could distinguish between different time periods (e.g., pre-halving, post-halving). This visual representation would allow readers to quickly grasp the historical relationship between halving events and Bitcoin’s price performance. This could be further enhanced by adding additional lines representing relevant metrics, such as mining difficulty or trading volume, to provide a richer context for price fluctuations.

Pinpointing the exact When Is Bitcoin Halving Date 2025 requires careful analysis of the blockchain, but once we know, the next big question is always about the market reaction. Understanding the potential impact on price is crucial, and for insightful predictions, check out this resource on Bitcoin Price After Halving 2025. Ultimately, the date of the 2025 halving will significantly influence Bitcoin’s trajectory in the following years.

- ) are effective for summarizing key takeaways or presenting lists of factors influencing Bitcoin’s price. For instance, a list of factors influencing Bitcoin price after a halving could include: increased scarcity, reduced inflation, increased investor interest, and regulatory changes. Numbered lists (

- ) could be used to present a step-by-step analysis of a specific scenario or prediction. The use of bold text can highlight crucial information or emphasize key findings. White space should be used liberally to avoid overwhelming the reader with dense text blocks. This improves readability and creates a more visually appealing layout.

Illustrative Example: Charting Bitcoin Price Around Previous Halvings

Imagine a line graph showing Bitcoin’s price over a period of several years, encompassing the previous halving events. The x-axis represents time, and the y-axis represents Bitcoin’s price in USD. Each halving date would be clearly marked on the x-axis. The line would visually demonstrate the price movements before, during, and after each halving. A legend could distinguish between different time periods (e.g., pre-halving, post-halving). This visual representation would allow readers to quickly grasp the historical relationship between halving events and Bitcoin’s price performance. This could be further enhanced by adding additional lines representing relevant metrics, such as mining difficulty or trading volume, to provide a richer context for price fluctuations.

Pinpointing the exact When Is Bitcoin Halving Date 2025 requires careful analysis of the blockchain, but once we know, the next big question is always about the market reaction. Understanding the potential impact on price is crucial, and for insightful predictions, check out this resource on Bitcoin Price After Halving 2025. Ultimately, the date of the 2025 halving will significantly influence Bitcoin’s trajectory in the following years.