Bitcoin Halving 2025: When Is The Bitcoin Halving 2025 Prediction

The Bitcoin halving, a pre-programmed event reducing the rate of newly mined Bitcoin by half, is anticipated in 2025. This event has historically been associated with significant price increases, although the extent of this impact remains a subject of ongoing debate within the cryptocurrency community. Understanding the mechanics of the halving and its interaction with broader economic trends is crucial for navigating the potential market volatility surrounding this event.

Bitcoin Halving Mechanics and Historical Impact, When Is The Bitcoin Halving 2025 Prediction

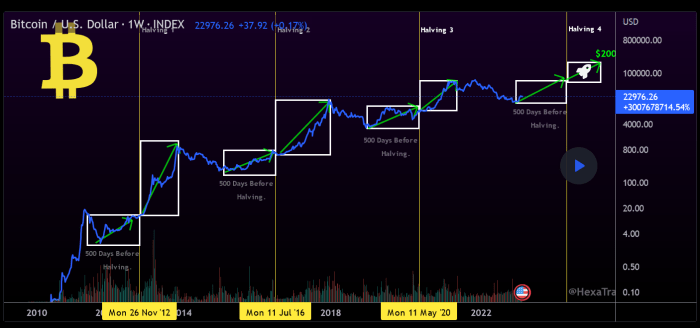

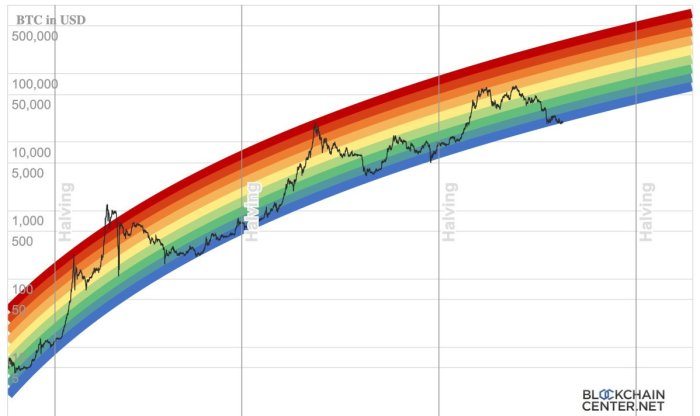

The Bitcoin halving mechanism is a core component of the Bitcoin protocol, designed to control the supply of Bitcoin over time. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This process reduces the rate of Bitcoin inflation, making it a deflationary asset in the long run. Historically, the halvings in 2012, 2016, and 2020 have been followed by periods of significant price appreciation, although the timing and magnitude of these price increases have varied. The 2012 halving saw a gradual price increase over the following year, while the 2016 and 2020 halvings led to more pronounced price rallies, albeit with subsequent corrections. It’s important to note that other factors beyond the halving itself have also influenced Bitcoin’s price during these periods.

Economic Factors Influencing the 2025 Halving

Several macroeconomic factors could influence the price of Bitcoin leading up to and following the 2025 halving. Global inflation rates, central bank monetary policies (particularly interest rate adjustments), and overall global economic conditions will all play a significant role. High inflation, for instance, might drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand. Conversely, rising interest rates could make holding Bitcoin less attractive compared to other, higher-yielding assets. Recessions or significant geopolitical events could also impact investor sentiment and Bitcoin’s price. The strength of the US dollar, a major currency against which Bitcoin is often priced, will also be a key determinant.

Comparison of Previous Halving Cycles and Projections for 2025

While past halvings have shown a correlation with price increases, it’s crucial to avoid assuming a direct causal relationship. The cryptocurrency market has matured significantly since the first halving. The increased institutional involvement, regulatory scrutiny, and overall market sophistication have introduced new dynamics that may affect the price response to the 2025 halving. Predicting the exact price movement is inherently challenging, as numerous factors beyond the halving itself will be at play. However, by analyzing past cycles and considering current economic conditions, analysts can develop informed projections. For example, some analysts might compare the market conditions before the 2016 halving to those of today, identifying similarities and differences to inform their predictions.

Potential for Increased Volatility Around the 2025 Halving

The period surrounding the 2025 halving is likely to be characterized by increased price volatility. As the event approaches, anticipation and speculation can lead to significant price swings, both upwards and downwards. This volatility is driven by the interplay of supply and demand, influenced by investor sentiment and the aforementioned macroeconomic factors. The level of volatility could be amplified by the uncertainty surrounding regulatory developments and the overall macroeconomic climate. Historically, periods of increased volatility have presented both risks and opportunities for investors.

Timeline of Key Events Leading Up To and Following the 2025 Halving

Predicting precise dates is impossible, but a likely timeline could include:

- Increased Market Speculation (2024 Q3 – 2025 Q1): As the halving date approaches, market speculation and anticipation will likely intensify, leading to increased price volatility.

- Bitcoin Halving Event (Likely Spring 2025): The actual halving event, marking the reduction in the block reward.

- Post-Halving Price Adjustment (2025 Q2 – 2026 Q1): The market will likely experience a period of price adjustment following the halving, potentially involving significant price swings.

- Long-Term Price Trend Development (2026 onwards): The long-term price trend will depend on the interplay of numerous factors, including adoption rates, regulatory developments, and macroeconomic conditions.

Predicting the Bitcoin Price After the 2025 Halving

Predicting the price of Bitcoin after any halving event is inherently speculative, but analyzing historical trends, market sentiment, and various prediction models can offer potential scenarios. The 2025 halving, reducing the block reward for miners by half, is expected to significantly impact Bitcoin’s supply and potentially its price. However, numerous other factors contribute to the complexity of accurate prediction.

Price Prediction Models in the Cryptocurrency Market

Several models attempt to forecast Bitcoin’s price. These range from simple technical analysis, relying on chart patterns and indicators like moving averages and relative strength index (RSI), to more complex quantitative models incorporating macroeconomic factors, on-chain metrics, and sentiment analysis. Stock-to-flow models, for instance, attempt to correlate Bitcoin’s scarcity with its price, while other models use machine learning algorithms to analyze vast datasets and identify price trends. Each model carries its own set of assumptions and limitations, impacting the reliability of its predictions. For example, a simple moving average might identify a short-term trend, while a stock-to-flow model attempts to project long-term price based on a limited number of variables.

Bullish and Bearish Price Predictions Post-Halving

Bullish predictions often center on the halving’s impact on scarcity, arguing that reduced supply coupled with sustained or increased demand will drive prices significantly higher. Historical precedent, where previous halvings have been followed by price increases (though not immediately or consistently), fuels this optimism. Bearish predictions, conversely, highlight potential macroeconomic headwinds, regulatory uncertainty, or a general market downturn that could counteract the halving’s effect. They might point to potential selling pressure from miners needing to offload Bitcoin to cover operational costs, or a general loss of investor confidence. The discrepancy between these predictions highlights the inherent uncertainty in the cryptocurrency market. For example, some analysts predict a price surge to $100,000 or more after the halving, while others forecast a relatively muted response or even a price decline.

Factors Shaping Bitcoin Price Predictions

The adoption rate of Bitcoin as a payment method and store of value significantly influences price predictions. Widespread institutional adoption could boost demand and price, while limited adoption might lead to stagnation. Technological advancements, such as the development of the Lightning Network improving transaction speed and scalability, can also influence price positively by increasing usability. Conversely, significant technological setbacks or security vulnerabilities could negatively impact the price. Regulatory changes play a crucial role; favorable regulations in major markets could stimulate investment, while stringent or prohibitive regulations could dampen price growth. The interplay of these factors makes accurate prediction exceptionally challenging.

Hypothetical Price Movement Scenario Post-Halving

In a hypothetical scenario, the months following the 2025 halving could witness an initial period of price consolidation as the market digests the event. A gradual increase might follow, driven by anticipation of increased scarcity. However, this could be punctuated by periods of volatility depending on broader macroeconomic conditions and news events. For example, a sudden surge in inflation or a significant regulatory announcement could trigger price fluctuations. A sustained upward trend might materialize in the later part of 2025 or into 2026, but the rate of increase would depend on the interplay of factors previously discussed. This is just one possibility, and other scenarios, including a significant price decline, are equally plausible.

Comparison of Price Prediction Models

| Model | Assumptions | Projected Outcome (Hypothetical) |

|---|---|---|

| Stock-to-Flow | Bitcoin’s scarcity drives price; historical halving cycles | $150,000 – $250,000 by end of 2026 |

| Technical Analysis (Moving Averages) | Chart patterns and indicators; short-term trends | Variable, dependent on specific indicators; potential short-term gains or losses |

| Macroeconomic Model | Correlation between Bitcoin price and global economic factors (inflation, interest rates) | Dependent on global economic climate; potential for both significant gains or losses |

| On-Chain Analysis | Analysis of network activity, transaction volume, and miner behavior | Moderate price increase, influenced by network activity and adoption |

Factors Influencing Bitcoin Halving Predictions

Predicting the price of Bitcoin after a halving is a complex undertaking, influenced by a multitude of interconnected factors. Analysts employ various models and consider a wide range of data points to arrive at their estimations, but the inherent volatility of the cryptocurrency market makes precise predictions extremely challenging. This section will delve into the key elements shaping these predictions.

Mining Difficulty Adjustments

The Bitcoin network automatically adjusts its mining difficulty every 2016 blocks (approximately every two weeks) to maintain a consistent block generation time of roughly 10 minutes. A higher hash rate leads to a more frequent block creation, triggering a difficulty increase to slow down the process. Conversely, a lower hash rate results in a difficulty decrease. These adjustments directly impact the profitability of mining and, consequently, the supply of newly minted Bitcoin. For example, a significant drop in the Bitcoin price might lead miners to shut down less profitable operations, reducing the network hash rate and subsequently the mining difficulty. This can temporarily ease the pressure on the supply side. However, the long-term effect depends on the price recovering and attracting new miners back into the network.

Network Hash Rate and Miner Behavior

The network hash rate, representing the total computational power dedicated to Bitcoin mining, is a crucial indicator of network security and the overall health of the ecosystem. A higher hash rate signifies a more robust and secure network, potentially boosting investor confidence. Miner behavior, including their decisions on whether to hold or sell newly mined Bitcoin, significantly influences the circulating supply and price. If miners choose to hold (hodl), it can create upward pressure on the price due to reduced selling pressure. Conversely, if miners sell off their newly mined Bitcoin to cover operational costs, it could put downward pressure on the price. The 2021 halving, for example, saw a period of sustained price increases despite miners selling a portion of their newly mined Bitcoin, highlighting the complex interplay of factors.

Institutional Investment and Public Sentiment

The entry of institutional investors into the Bitcoin market can significantly influence its price. Large-scale purchases by firms and hedge funds can inject substantial liquidity and drive up demand, particularly in anticipation of a halving event. Conversely, a negative shift in public sentiment, fueled by regulatory uncertainty or negative news, can trigger sell-offs and depress the price. The influence of Elon Musk’s tweets on Bitcoin’s price serves as a prime example of how public sentiment, even from a single prominent individual, can dramatically impact the market. The level of institutional adoption and public perception leading up to and following the halving are significant predictive factors.

Macroeconomic Events and Regulatory Frameworks

Global macroeconomic events, such as inflation, interest rate changes, and geopolitical instability, can significantly influence Bitcoin’s price. Periods of high inflation, for example, might drive investors towards Bitcoin as a hedge against inflation. Similarly, regulatory developments in various jurisdictions can impact investor confidence and market participation. Stricter regulations could dampen enthusiasm, while favorable regulatory frameworks might attract more investment. The 2022 bear market, influenced by rising interest rates and global economic uncertainty, demonstrates the significant impact of macroeconomic conditions on Bitcoin’s price trajectory.

Understanding the Halving’s Impact on Bitcoin Mining

The Bitcoin halving, a programmed event that reduces the block reward for miners by half, significantly impacts the economics of Bitcoin mining. This event creates a ripple effect throughout the ecosystem, influencing miner profitability, operational strategies, and ultimately, the security of the Bitcoin network. Understanding these impacts is crucial for predicting future Bitcoin price movements and assessing the long-term health of the cryptocurrency.

The halving directly affects miners’ profitability by reducing their income per block mined. Before the halving, miners receive a certain number of Bitcoins for successfully adding a block to the blockchain. After the halving, this reward is halved. To maintain profitability, miners must either increase their efficiency (reducing operational costs per Bitcoin mined) or rely on a higher Bitcoin price to compensate for the reduced block reward. This dynamic creates pressure on miners to adapt and optimize their operations.

Miner Profitability and Operational Strategies After the Halving

The halving forces miners to re-evaluate their operational strategies. Those with higher energy costs or less efficient mining hardware will find their profit margins significantly squeezed. This leads to a crucial decision: adapt or exit. Miners might explore strategies like upgrading to more energy-efficient hardware (ASICs), negotiating lower electricity rates, or diversifying revenue streams (e.g., through mining pools or other cryptocurrencies). Those who fail to adapt face the prospect of operating at a loss, ultimately forcing them to shut down their operations. The 2020 halving, for example, saw a wave of less efficient miners exiting the market, leading to a consolidation of the mining industry.

Consolidation and Exit of Less Efficient Miners

Following a halving, the Bitcoin mining landscape often undergoes a period of consolidation. Less efficient miners, unable to compete with the reduced block reward and increased mining difficulty, are forced to exit the market. This leads to a concentration of mining power in the hands of larger, more efficient operations. This consolidation can have both positive and negative consequences. On the positive side, it can lead to a more resilient and centralized mining network. However, it can also raise concerns about centralization and the potential for manipulation. The 2016 halving also saw a similar trend, with smaller miners struggling to remain profitable.

Consequences of Decreased Mining Activity on Network Security

A significant decrease in mining activity, potentially resulting from the halving, poses a risk to the security of the Bitcoin network. The security of the network relies on the computational power (hashrate) provided by miners. A drop in hashrate could make the network more vulnerable to 51% attacks, where a malicious actor controls more than half of the network’s hashrate and can potentially manipulate the blockchain. While Bitcoin’s robust design makes such attacks extremely costly, a significant reduction in mining activity increases the likelihood of this risk. Therefore, maintaining a healthy level of mining activity is vital for preserving the network’s security.

Comparison of Miner Responses to Previous Halvings

The responses of miners to previous halvings have varied depending on factors such as the prevailing Bitcoin price, the availability of cheaper energy sources, and technological advancements in mining hardware. Generally, we’ve observed a pattern of initial price dips followed by eventual price increases, leading to a rebound in miner profitability. However, the extent of the price increase and the speed of the recovery vary significantly. The 2012 halving, for example, saw a relatively quick price recovery, while the 2016 and 2020 halvings exhibited more complex price patterns. Analyzing these past events provides valuable insights into potential future outcomes.

Relationship Between Bitcoin Price, Mining Difficulty, and Miner Profitability

The following chart illustrates the complex interplay between Bitcoin’s price, mining difficulty, and miner profitability. The chart would visually depict the following relationship: As Bitcoin’s price increases, miner profitability improves, even with increased mining difficulty. Conversely, a decrease in Bitcoin’s price, coupled with increased mining difficulty, directly impacts miner profitability, potentially leading to miners exiting the market. The mining difficulty adjusts automatically to maintain a consistent block time, approximately 10 minutes. This means that if more miners join the network, increasing the hashrate, the difficulty increases to keep the block time stable.

The 2025 Halving and Long-Term Bitcoin Outlook

The 2025 Bitcoin halving presents a pivotal moment, potentially reshaping Bitcoin’s trajectory within the broader financial landscape. Its long-term impact hinges on a complex interplay of technological advancements, regulatory developments, and evolving market sentiment. Understanding these factors is crucial for assessing Bitcoin’s future role, whether as a mainstream asset or a niche investment.

Bitcoin’s Position in the Financial Landscape Post-2025 Halving

The 2025 halving will significantly reduce the rate of new Bitcoin entering circulation. This scarcity, coupled with increasing institutional adoption (as seen with companies like MicroStrategy and Tesla’s previous investments), could drive up demand and price. However, this is not guaranteed. The halving’s effect depends on broader macroeconomic conditions and the overall sentiment towards cryptocurrencies. For example, a global recession might negatively impact investor confidence, regardless of the halving. Conversely, a period of economic stability and increased regulatory clarity could lead to significant price appreciation.

Bitcoin as Mainstream Asset or Niche Investment

Whether Bitcoin becomes a mainstream asset or remains a niche investment depends on several factors. Widespread adoption requires user-friendly interfaces, increased transaction speed, and lower fees. Furthermore, regulatory clarity and acceptance from governments and financial institutions are paramount. Currently, Bitcoin’s volatility and complexity hinder mainstream adoption. However, advancements in layer-2 scaling solutions and the development of more intuitive wallets could potentially bridge this gap. The success of other cryptocurrencies in specific niches (like decentralized finance or non-fungible tokens) also impacts Bitcoin’s potential for broader acceptance. If Bitcoin maintains its position as the leading cryptocurrency and gains greater regulatory approval, its chances of mainstream adoption significantly increase.

The Halving’s Impact on Bitcoin Adoption Rate

The 2025 halving is unlikely to be a singular catalyst for rapid adoption. While scarcity can drive price appreciation, it doesn’t automatically translate to increased user adoption. The halving’s impact on adoption will be indirect, primarily through price increases. Higher prices could attract more institutional investors and potentially drive greater media attention, thus indirectly fostering wider adoption. However, high prices could also make Bitcoin less accessible to the average individual, potentially hindering widespread usage. Therefore, the halving’s effect on adoption is complex and intertwined with other market forces.

Challenges and Opportunities Facing Bitcoin

Bitcoin faces several challenges, including regulatory uncertainty, environmental concerns related to energy consumption, and the ongoing threat of hacks and security breaches. However, opportunities abound. The development of layer-2 scaling solutions aims to address transaction speed and cost issues. Growing institutional interest suggests a shift towards greater legitimacy and acceptance within traditional financial systems. Furthermore, Bitcoin’s decentralized nature and inherent resistance to censorship remain powerful advantages in a world increasingly concerned about privacy and financial freedom.

Potential Scenarios for Bitcoin’s Long-Term Future

The following scenarios illustrate the range of possible outcomes for Bitcoin’s long-term future:

When Is The Bitcoin Halving 2025 Prediction – The context for these scenarios is that they are based on a range of plausible, but not exhaustive, factors influencing Bitcoin’s price and adoption. These are speculative and should not be considered financial advice.

- Optimistic Scenario: Widespread adoption fueled by regulatory clarity, technological advancements (e.g., improved scalability and user experience), and growing institutional investment. Bitcoin becomes a globally recognized store of value and a significant component of diversified investment portfolios, leading to substantial price appreciation.

- Moderate Scenario: Gradual adoption with ongoing regulatory uncertainty and technological challenges. Bitcoin maintains its position as a leading cryptocurrency but faces competition from newer alternatives. Price fluctuates significantly but generally trends upwards over the long term.

- Pessimistic Scenario: Increased regulatory pressure, technological limitations, or a major security breach leading to a significant loss of investor confidence. Bitcoin’s price declines sharply, and its dominance within the cryptocurrency market diminishes considerably. It may become a niche asset with limited mainstream appeal.

Frequently Asked Questions about the 2025 Bitcoin Halving

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, generates considerable interest and speculation. Understanding this event is crucial for anyone involved in or observing the Bitcoin market. This section addresses some common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event within the Bitcoin protocol that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin. The initial reward was 50 BTC per block; subsequent halvings have reduced it to 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled reduction in supply is a core element of Bitcoin’s deflationary nature.

Predicted Date of the 2025 Bitcoin Halving

While the halving is a predictable event based on block generation times, pinpointing the exact date requires considering the average block time, which can fluctuate slightly. Current predictions point towards a halving occurring sometime in the Spring of 2025, likely in April or May. However, minor variations are possible depending on the actual block generation rate leading up to the event. It’s important to remember that this is an estimate, and the precise date will only be known closer to the time. For example, the 2020 halving was initially predicted for May 11th but occurred on May 12th due to variations in block generation times.

Impact of the Halving on Bitcoin Price

Historically, Bitcoin’s price has shown an upward trend following previous halvings. The reduced supply of newly mined Bitcoin, coupled with sustained or increased demand, often leads to price appreciation. However, it’s crucial to note that this is not a guaranteed outcome. Other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by significant price increases, but these increases were not immediate and took several months to fully materialize. The price surge after a halving is often attributed to a combination of reduced supply and increased anticipation from investors.

Risks and Rewards of Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and potential rewards. The potential for price appreciation is a major draw, but the cryptocurrency market is notoriously volatile. Investing before the halving involves the risk of a price correction before the anticipated increase, while investing after could mean missing out on potential gains. Furthermore, market sentiment and external factors can override the anticipated effects of the halving. Diversification and careful risk management are crucial for any investment strategy involving Bitcoin, particularly around major events like the halving. Consider the potential for significant price swings, both positive and negative, before making any investment decisions.

Impact of the Halving on Bitcoin Mining Operations

The halving directly impacts Bitcoin miners’ profitability. With a reduced block reward, miners’ revenue per block decreases. This can lead to several consequences, including an increase in mining difficulty, as miners compete for the reduced rewards, the potential exit of less-efficient miners from the network, and a potential consolidation within the mining industry as larger, more efficient operations gain market share. The long-term effect on the network’s security and decentralization remains a subject of ongoing discussion and analysis. Miners may adjust their operations to remain profitable, potentially by increasing efficiency or seeking alternative revenue streams. For example, some miners might transition to using renewable energy sources to reduce operating costs.

Predicting the exact date of the Bitcoin halving in 2025 is challenging, but various analyses offer potential timelines. To gain a deeper understanding of the factors influencing this prediction, you might find the comprehensive analysis at Bitcoin Halving 2025 Prediction helpful. Ultimately, pinpointing the “when” remains speculative, dependent on the blockchain’s consistent block generation rate.

Predicting the exact date of the 2025 Bitcoin halving remains challenging, though estimations point towards sometime in the spring. Understanding the potential impact on price is crucial, and for insights into that, check out this analysis on Bitcoin Price Prediction After 2025 Halving. Ultimately, the timing of the halving significantly influences the subsequent market behavior, making accurate predictions a complex endeavor.

Predicting the Bitcoin halving in 2025 involves analyzing the blockchain’s transaction history and mining difficulty. To get a clearer picture of potential dates, it’s helpful to consult resources dedicated to tracking this event, such as this informative site on the Halving Bitcoin Date 2025. Ultimately, pinpointing the exact date requires monitoring the network’s activity leading up to the event.

Therefore, while predictions exist, confirming the precise When Is The Bitcoin Halving 2025 Prediction necessitates close observation.

Predicting the exact date of the Bitcoin halving in 2025 remains challenging due to the complexities of the blockchain. However, current estimations suggest the event will likely take place in April. For a more detailed analysis, you can check out this insightful article: Bitcoin Halving Is Expected To Occur In April 2025. Understanding this timeframe is crucial for anyone interested in Bitcoin’s future price movements and market dynamics related to the 2025 halving prediction.

Predicting the exact date of the Bitcoin halving in 2025 is challenging, as it depends on the block generation time. However, to understand the timeframe better, you might find this resource helpful: When Bitcoin Halving 2025. This will give you a clearer picture, allowing for a more informed prediction regarding the When Is The Bitcoin Halving 2025 Prediction.

Predicting the exact date of the Bitcoin halving in 2025 is challenging, as it depends on the block generation time. However, understanding the potential price impact is crucial, and for that, you might find the analysis at Bitcoin 2025 Halving Price Prediction helpful. Ultimately, pinpointing the precise halving date remains a matter of ongoing observation and technical analysis.