Understanding Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin.

Bitcoin’s halving mechanism directly impacts the supply of new bitcoins entering circulation. Every halving cuts the block reward, the amount of bitcoin miners receive for successfully adding a block to the blockchain, in half. This controlled reduction in supply is a core tenet of Bitcoin’s deflationary model. The initial block reward was 50 BTC, and it has been halved three times already, currently standing at 6.25 BTC per block.

Historical Impact of Bitcoin Halvings

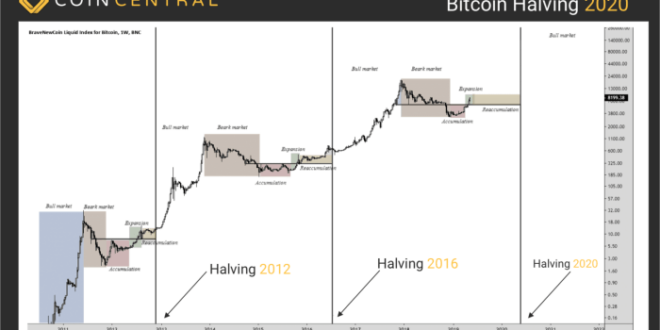

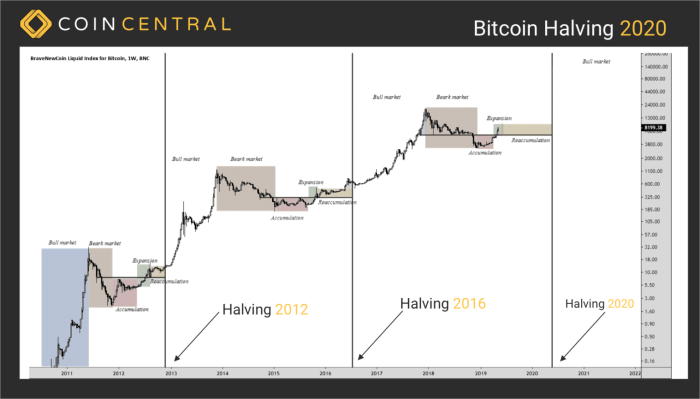

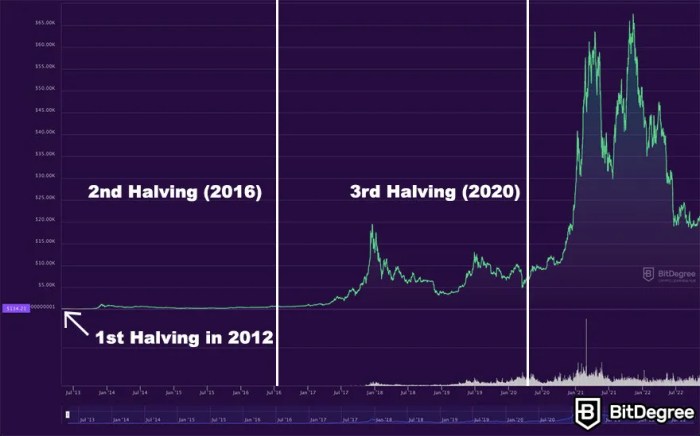

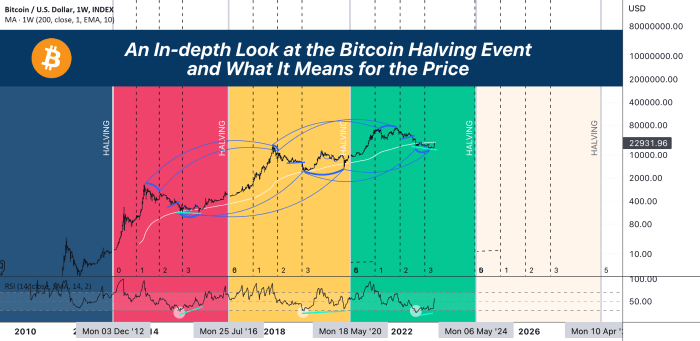

The three previous Bitcoin halvings have demonstrably influenced both the price and market sentiment surrounding Bitcoin. While correlation doesn’t equal causation, the periods following each halving have generally witnessed significant price increases. This is often attributed to the decreased supply of newly mined Bitcoin, increasing scarcity and potentially driving up demand. However, other macroeconomic factors and market speculation also play a substantial role. The periods leading up to each halving have often seen periods of increased volatility and speculation, as investors anticipate the event’s potential impact.

Comparison of Anticipated 2025 Halving Effects

Predicting the exact impact of the 2025 halving is challenging, as various factors influence Bitcoin’s price. However, we can compare it to previous halvings to glean some insights. The 2012 and 2016 halvings were followed by significant bull runs, though the timing and magnitude varied. The 2020 halving also led to a price increase, but the subsequent market behavior was more complex, influenced by factors like the COVID-19 pandemic and overall macroeconomic conditions. The 2025 halving is anticipated to follow a similar pattern, potentially leading to increased price volatility and a subsequent bull market, but this is not guaranteed and depends heavily on broader economic and regulatory factors. The key difference compared to previous halvings may be the increased maturity and regulatory scrutiny of the cryptocurrency market.

Timeline of Past Bitcoin Halvings

The following timeline illustrates key events surrounding previous Bitcoin halvings:

| Date | Block Height (approx.) | Block Reward (BTC) | Price Before/After (USD, approximate) |

|---|---|---|---|

| November 28, 2012 | 210,000 | 25 BTC → 12.5 BTC | ~$13 / ~$1000 (approx. 1 year after) |

| July 9, 2016 | 420,000 | 12.5 BTC → 6.25 BTC | ~$650 / ~$20,000 (approx. 2 years after) |

| May 11, 2020 | 630,000 | 6.25 BTC → 6.25 BTC | ~$9,000 / ~$60,000 (approx. 1 year after) |

Predicting the 2025 Bitcoin Halving Date: When Is The Next Bitcoin Halving 2025

Predicting the exact date of the 2025 Bitcoin halving requires understanding the underlying mechanism of Bitcoin’s block reward reduction and considering potential influencing factors. The halving occurs approximately every four years, when the reward miners receive for validating transactions is cut in half. While seemingly straightforward, several variables can affect the precise timing.

Factors Affecting the Halving Date

The Bitcoin halving is triggered when a specific number of blocks are mined. This number is currently set at 210,000 blocks per halving cycle. The time it takes to mine these blocks depends on the overall computational power (hashrate) dedicated to the Bitcoin network. A higher hashrate leads to faster block generation, potentially accelerating the halving, while a lower hashrate would delay it. Other factors, such as network congestion and potential changes in mining difficulty adjustments, also play a role. Unexpected events, like significant changes in the price of Bitcoin or large-scale regulatory actions impacting mining operations, could indirectly influence the hashrate and, consequently, the halving date.

Precise Date Prediction Based on Current Block Generation Times

Based on the average block generation time as of October 26, 2023, and assuming a consistent hashrate, a precise prediction is challenging. However, extrapolating from current data, a reasonable estimate would place the 2025 halving sometime in the spring or early summer of 2025. This is, however, a very rough estimate, and significant variations are possible.

Implications of a Delayed or Accelerated Halving

A delayed halving, resulting from a lower hashrate, might lead to a more gradual increase in Bitcoin’s scarcity and potentially dampen the immediate price surge anticipated around the halving event. Conversely, an accelerated halving, due to a higher hashrate, could amplify the market excitement and potentially lead to a more pronounced price reaction. Market expectations are heavily influenced by the anticipated scarcity created by the halving. A deviation from the predicted timeline could impact investor sentiment and trading strategies.

Expert Opinions and Predictions

Several cryptocurrency analysts and experts offer predictions regarding the 2025 halving. These predictions often vary based on different methodologies and assumptions regarding future hashrate trends. For example, some analysts use historical data and extrapolate based on past halving cycles, while others incorporate more complex models that account for various economic and technological factors. The consensus, however, generally points towards a halving occurring within the timeframe mentioned above. It’s important to note that these predictions are not guarantees and should be considered with caution.

Prediction Methods: Strengths and Weaknesses

Predicting the Bitcoin halving date involves several approaches, each with its own strengths and weaknesses:

- Extrapolation from Average Block Times: This method uses the average block generation time to estimate the time until the next 210,000 blocks are mined. Strength: Simple and straightforward. Weakness: Highly sensitive to fluctuations in hashrate and doesn’t account for potential network changes.

- Statistical Modeling: This involves using statistical models to predict future hashrate based on historical data. Strength: Considers historical trends and potentially incorporates other relevant factors. Weakness: Accuracy depends heavily on the model’s complexity and the quality of the input data; past performance is not necessarily indicative of future results.

- Expert Opinion: Predictions based on the insights of cryptocurrency analysts and experts. Strength: Leverages knowledge and experience in the field. Weakness: Subjective and can be influenced by biases or incomplete information.

Market Impact and Price Predictions

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically has preceded periods of significant price volatility. Understanding the potential market impact and attempting to predict the price trajectory following the 2025 halving requires careful consideration of several intertwined factors. While no one can definitively predict the future price of Bitcoin, analyzing past trends, current market sentiment, and economic conditions can offer insights into potential scenarios.

Short-Term and Long-Term Price Effects

The halving’s immediate effect is often a reduction in the supply of newly minted Bitcoin. This decreased supply, coupled with sustained or increased demand, can theoretically drive the price upward. However, the short-term impact can be unpredictable, influenced by various market forces. The long-term effect is generally considered more positive, as the reduced inflation rate of Bitcoin could increase its perceived value as a store of value and a hedge against inflation in traditional markets. Historically, the price has seen significant increases in the months and years following previous halvings, though the timing and magnitude of these increases have varied. For example, the 2012 halving was followed by a gradual price increase, while the 2016 halving led to a more dramatic rise, culminating in the 2017 bull market. The 2020 halving also saw a significant price increase in the following year.

Catalysts Influencing Bitcoin’s Price

Several factors beyond the halving itself can significantly influence Bitcoin’s price. These include macroeconomic conditions (e.g., inflation rates, interest rate hikes), regulatory developments (e.g., government policies regarding cryptocurrencies), technological advancements (e.g., scaling solutions, new applications), and overall market sentiment (e.g., investor confidence, media coverage). For example, a global recession could increase demand for Bitcoin as a safe haven asset, while increased regulatory scrutiny might dampen investor enthusiasm. Conversely, positive news about Bitcoin adoption by large institutions or the successful launch of a significant upgrade to the Bitcoin network could trigger a price surge. The interplay of these factors makes predicting the precise impact of the halving challenging.

Comparison of Price Prediction Models

Various models attempt to predict Bitcoin’s price, each with its own set of assumptions and limitations. Some models rely on historical price data and technical analysis, identifying patterns and trends to extrapolate future price movements. Others incorporate fundamental analysis, focusing on factors like supply and demand, network growth, and adoption rates. Quantitative models may use algorithms to analyze vast amounts of data, while qualitative models incorporate expert opinions and market sentiment. These models often diverge significantly in their predictions, highlighting the inherent uncertainty in forecasting cryptocurrency prices. For instance, some models might predict a price surge to $100,000 or more following the 2025 halving, while others might suggest a more modest increase or even a temporary price dip.

Supply and Demand Dynamics

The halving directly impacts the supply side of the Bitcoin equation. The reduced issuance rate of new coins makes Bitcoin inherently deflationary. This deflationary pressure, in theory, should increase the value of Bitcoin, particularly if demand remains strong or increases. However, demand is equally crucial. If demand weakens or stagnates, the price may not rise as significantly, despite the reduced supply. The interplay between supply and demand determines the equilibrium price. For example, a surge in institutional investment or widespread adoption could significantly increase demand, amplifying the price impact of the halving.

Hypothetical Price Trajectory, When Is The Next Bitcoin Halving 2025

Consider a scenario where the 2025 halving occurs in the context of a relatively stable macroeconomic environment with continued institutional adoption and growing mainstream acceptance of Bitcoin. In this optimistic scenario, the price might experience a gradual increase in the months leading up to the halving, driven by anticipation. Following the halving, the price could see a more substantial rally, potentially reaching $100,000 within a year or two, driven by the reduced supply and increased demand. However, a pessimistic scenario might involve a global economic downturn or heightened regulatory pressure, potentially leading to a period of price stagnation or even a decline after the halving, before a later recovery. This highlights the uncertainty inherent in price predictions.

Mining and Hashrate Implications

The Bitcoin halving, a programmed event reducing the block reward for miners by half, significantly impacts their profitability and, consequently, the Bitcoin network’s hashrate. Understanding these implications is crucial for assessing the potential short-term and long-term effects on Bitcoin’s price and security.

The halving directly affects miners’ revenue. With fewer newly minted Bitcoins awarded per block, miners’ income decreases unless the price of Bitcoin rises proportionally or mining costs significantly fall. This creates a strong incentive for miners to become more efficient, adopt more advanced mining hardware, and seek out cheaper electricity sources. Those who cannot adapt to the reduced profitability may be forced to shut down their operations, leading to a potential shift in the mining landscape.

Miner Profitability and Incentives

The profitability of Bitcoin mining is determined by the interplay of several factors: the Bitcoin price, the block reward, the difficulty of mining (adjusted to maintain a consistent block time), and the cost of electricity and mining hardware. A halving directly reduces the block reward, putting downward pressure on miner profitability. To maintain profitability after a halving, miners must either see a corresponding increase in the Bitcoin price or reduce their operational costs. This often leads to a period of consolidation in the mining industry, with less efficient miners exiting the market. The remaining miners, however, tend to be more efficient and resilient, leading to a potentially stronger network in the long run. For example, after the 2020 halving, we saw a significant increase in the adoption of more energy-efficient ASICs (Application-Specific Integrated Circuits), demonstrating the industry’s adaptation to reduced profitability.

Hashrate Impact Leading Up To and Following the Halving

The Bitcoin hashrate, representing the total computational power dedicated to securing the network, is directly tied to miner profitability. In the period leading up to a halving, we might see a temporary increase in hashrate as miners try to maximize their profits before the reward reduction. However, after the halving, if the Bitcoin price doesn’t rise sufficiently, a hashrate drop is likely. This is because less profitable miners will be forced to shut down, reducing the overall computational power. The magnitude of this drop varies depending on the Bitcoin price and the cost of mining. The 2016 halving saw a relatively minor hashrate drop, while the 2020 halving experienced a more pronounced, albeit temporary, decrease before a subsequent rebound.

Potential Hashrate Drop and its Consequences for Network Security

A significant hashrate drop poses a risk to the security of the Bitcoin network. A lower hashrate makes it easier for malicious actors to perform a 51% attack, gaining control of the network and potentially reversing transactions. While unlikely, a substantial drop could make the network vulnerable. The resilience of the network in the face of such events depends on the speed of adaptation by remaining miners and the overall market sentiment regarding Bitcoin’s value. A quick price recovery can mitigate the risk by increasing miner profitability and incentivizing new miners to join the network.

Comparison of Hashrate Changes After Previous Halvings

The impact of previous halvings on the hashrate has varied. While each halving has initially resulted in a period of uncertainty and potential hashrate reduction, the network has historically shown resilience. The hashrate typically recovers and often surpasses previous highs over time, reflecting the long-term adoption and value proposition of Bitcoin. Analyzing the data from past halvings reveals a pattern of initial decline followed by a significant rebound, demonstrating the adaptability of the Bitcoin mining ecosystem. A detailed analysis would require charting hashrate data against Bitcoin’s price for each halving event.

Bitcoin Price and Hashrate Relationship Around Previous Halvings

A chart illustrating the relationship between Bitcoin’s price and hashrate around previous halving events would show a complex dynamic. The X-axis would represent time, encompassing the period leading up to, during, and after the halving. The Y-axis would have two scales: one for Bitcoin’s price (in USD), and another for the hashrate (in exahashes per second). The chart would show fluctuations in both variables, with the hashrate often lagging behind price movements. We would typically observe a period of increased hashrate before the halving, followed by a potential dip after, often recovering as the Bitcoin price adjusts. The recovery in the hashrate would often be faster if the price increases significantly post-halving. The chart would visually demonstrate the correlation, though not necessarily a direct causation, between Bitcoin’s price and the network’s hashrate. A clear illustration would show the temporary drop in hashrate following the halving and its subsequent recovery, reinforcing the narrative of resilience within the Bitcoin network.