Beyond the 2025 Halving: When Was 2025 Bitcoin Halving

The 2025 Bitcoin halving is a significant event, but its impact extends far beyond the immediate aftermath. Understanding the long-term implications for Bitcoin’s adoption, value, and its position within the broader cryptocurrency landscape is crucial for investors and enthusiasts alike. The halving, a core component of Bitcoin’s design, is not a standalone event but rather a piece in a larger puzzle of factors influencing its future.

Bitcoin’s Scarcity Model and the Halving

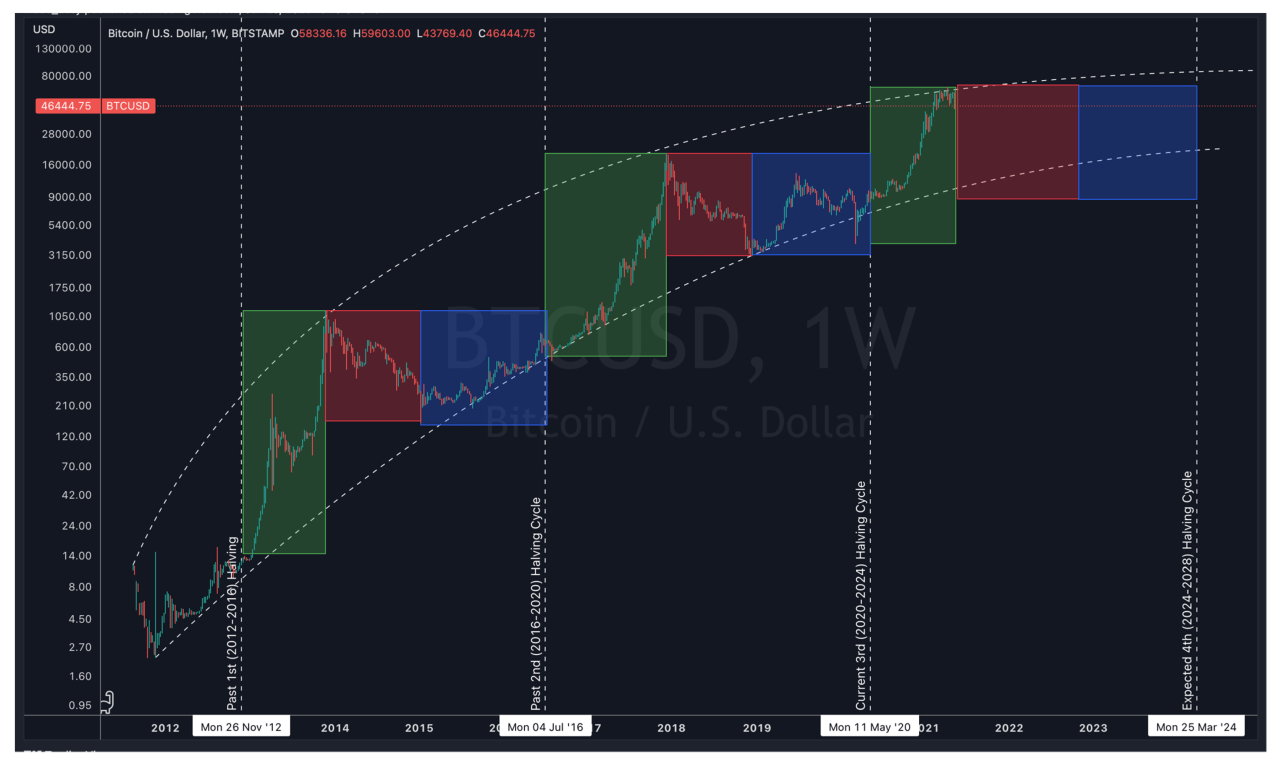

The halving mechanism is intrinsically linked to Bitcoin’s scarcity model. By reducing the rate of new Bitcoin creation every four years, the halving reinforces the inherent scarcity embedded in its limited supply of 21 million coins. This controlled inflation, or rather, deflationary pressure, is designed to mirror the properties of precious metals like gold, which historically have held value due to their rarity. Each halving event further solidifies Bitcoin’s position as a deflationary asset, potentially driving up demand and, consequently, its price over the long term. This scarcity, coupled with increasing adoption and network effects, forms the foundation of Bitcoin’s long-term value proposition.

Comparison with Other Cryptocurrencies, When Was 2025 Bitcoin Halving

Unlike Bitcoin, many other cryptocurrencies employ different mechanisms for managing their supply. Some have a fixed supply, similar to Bitcoin, but without a halving mechanism. Others have an inflationary supply, meaning the total number of coins continues to increase over time. This difference in monetary policy significantly impacts the long-term price dynamics of these assets. For example, Ethereum, while having a deflationary model in place since the Shanghai upgrade, differs from Bitcoin’s predictable halving schedule. The contrasting approaches highlight the unique characteristics of Bitcoin’s halving mechanism and its impact on its perceived value and stability.

Potential Technological Advancements

Technological advancements in areas such as layer-2 scaling solutions (like the Lightning Network), improved wallet security, and enhanced regulatory clarity could significantly influence Bitcoin’s future adoption and price. Layer-2 solutions aim to increase transaction throughput and reduce fees, making Bitcoin more accessible for everyday transactions. Improved security measures could boost investor confidence, while clearer regulatory frameworks could reduce uncertainty and encourage institutional investment. These factors, alongside the halving’s impact on scarcity, create a synergistic effect that could contribute to sustained growth.

Scenario: Halving and Long-Term Price Appreciation

Consider a scenario where Bitcoin adoption continues to grow steadily, fueled by increasing institutional interest and mainstream acceptance. Simultaneously, technological advancements improve the usability and efficiency of the Bitcoin network. The 2025 halving, reducing the rate of new Bitcoin entering circulation, creates a situation where demand outpaces supply. This imbalance, coupled with the aforementioned factors, could lead to a sustained increase in Bitcoin’s price. This is analogous to the historical price appreciation of precious metals, where limited supply and increased demand have consistently driven up value. While predicting precise price movements is impossible, this scenario illustrates how the halving contributes to a favorable environment for long-term price appreciation.

When Was 2025 Bitcoin Halving – Determining the precise date of the 2025 Bitcoin halving requires careful consideration of the blockchain’s schedule. The event is anticipated to occur in April, and for detailed information and analysis on this significant event, you can refer to this comprehensive resource: Bitcoin Halving April 2025. Therefore, based on current projections, the answer to “When was the 2025 Bitcoin Halving?” is April 2025.

Determining the precise date for the 2025 Bitcoin halving requires careful consideration of the blockchain’s block time. To find a definitive answer regarding the exact timing, refer to this comprehensive resource on Bitcoin Halving 2025 Time for a detailed breakdown. Understanding this timing is crucial for predicting potential market impacts related to the 2025 Bitcoin halving event.

Determining the precise date for the 2025 Bitcoin halving requires careful consideration of the blockchain’s block time. To find a definitive answer regarding the exact timing, refer to this comprehensive resource on Bitcoin Halving 2025 Time for a detailed breakdown. Understanding this timing is crucial for predicting potential market impacts related to the 2025 Bitcoin halving event.

Determining the precise date for the 2025 Bitcoin halving requires careful consideration of the blockchain’s block time. To find a definitive answer regarding the exact timing, refer to this comprehensive resource on Bitcoin Halving 2025 Time for a detailed breakdown. Understanding this timing is crucial for predicting potential market impacts related to the 2025 Bitcoin halving event.

Determining the precise date for the 2025 Bitcoin halving requires careful consideration of the blockchain’s block time. To find a definitive answer regarding the exact timing, refer to this comprehensive resource on Bitcoin Halving 2025 Time for a detailed breakdown. Understanding this timing is crucial for predicting potential market impacts related to the 2025 Bitcoin halving event.

Determining the precise date of the 2025 Bitcoin halving requires careful consideration of block times. To clarify the exact timing, a helpful resource is available: When Is The Bitcoin Halving 2025. Using this information, we can then accurately calculate the past event and understand when the 2025 Bitcoin halving actually occurred.