White Bitcoin Price Predictions for 2025

Predicting the price of White Bitcoin (assuming this refers to a hypothetical or lesser-known cryptocurrency) in 2025 is inherently speculative. However, by analyzing various market factors and comparing bullish and bearish scenarios, we can construct potential price trajectories. These predictions are not financial advice and should be considered for informational purposes only.

Market Factors Influencing White Bitcoin’s Price

Several factors will significantly impact White Bitcoin’s price in 2025. These include broader cryptocurrency market trends (e.g., Bitcoin’s price performance, regulatory changes), the adoption rate of White Bitcoin (influenced by its utility and technological advancements), and the overall macroeconomic environment (e.g., inflation, economic growth). For example, a bullish cryptocurrency market, coupled with increasing White Bitcoin adoption and positive macroeconomic conditions, could drive significant price appreciation. Conversely, a bearish market, slow adoption, or negative macroeconomic factors could lead to price stagnation or decline.

Bullish Price Scenario for White Bitcoin in 2025

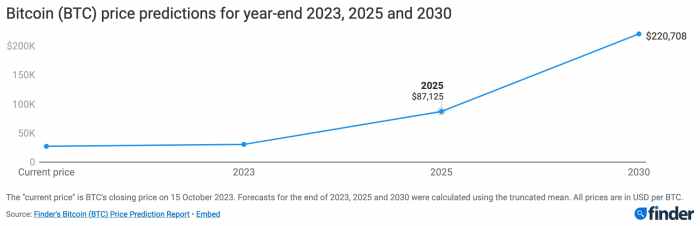

In a bullish scenario, assuming widespread adoption, positive technological developments, and a generally favorable cryptocurrency market, White Bitcoin could see substantial growth. If Bitcoin, for example, reaches $100,000 by 2025, other cryptocurrencies, including White Bitcoin, could experience similar proportional gains, potentially reaching prices in the thousands of dollars, depending on its market capitalization and trading volume. This scenario assumes a high level of investor confidence and significant institutional investment.

Bearish Price Scenario for White Bitcoin in 2025

Conversely, a bearish scenario could see White Bitcoin’s price stagnate or even decline. This could be due to several factors, including a general downturn in the cryptocurrency market, regulatory hurdles hindering adoption, or a lack of significant technological advancements. If the overall cryptocurrency market experiences a prolonged bear market, similar to the 2018-2020 period, White Bitcoin’s price might remain relatively low, potentially even below its current value, depending on its starting price. This would represent a scenario of low investor confidence and a lack of significant market interest.

Potential Price Movement Illustration

Imagine a line graph depicting White Bitcoin’s price over time. The X-axis represents time (from the present to 2025), and the Y-axis represents the price in USD. In a bullish scenario, the line would show a generally upward trend, with occasional dips representing temporary corrections. Key support levels (areas where the price is likely to find support and bounce back) could be visually represented as horizontal lines, while resistance levels (areas where the price faces selling pressure and struggles to break through) would also be shown as horizontal lines. The bullish scenario graph would show the price steadily increasing, potentially with a few minor corrections, reaching a significantly higher price point in 2025. In contrast, a bearish scenario would depict a relatively flat or downward-sloping line, with support levels becoming increasingly important as the price potentially tests lower lows. Resistance levels would act as ceilings, preventing significant price increases. The bearish scenario graph would show a much lower price in 2025 compared to the bullish scenario. The difference between these two scenarios would highlight the significant impact of market sentiment and external factors on White Bitcoin’s price.

Factors Influencing White Bitcoin’s Price in 2025

Predicting the price of any cryptocurrency, including White Bitcoin, is inherently speculative. However, by analyzing several key factors, we can develop a more informed understanding of the potential price movements in 2025. These factors encompass macroeconomic conditions, technological advancements, regulatory landscapes, and overall market sentiment.

Macroeconomic Factors Influencing White Bitcoin’s Price

Global economic conditions significantly influence cryptocurrency markets. Periods of high inflation or economic uncertainty often lead investors to seek alternative assets, including cryptocurrencies, as a hedge against inflation or a store of value. Conversely, periods of economic stability or rising interest rates can shift investment away from riskier assets like cryptocurrencies towards more traditional investments. For example, the 2022 bear market in cryptocurrencies was partly attributed to rising inflation and interest rate hikes by central banks globally. Conversely, periods of economic downturn, like the 2008 financial crisis, can lead to increased interest in decentralized financial systems, potentially boosting cryptocurrency prices.

Technological Advancements and White Bitcoin’s Value

Technological advancements within the White Bitcoin ecosystem itself, such as improvements in scalability, security, and transaction speed, can directly impact its value. The development of new features, applications, or integrations with other blockchain networks could also increase demand and, consequently, price. Conversely, significant technological setbacks or security breaches could negatively affect investor confidence and drive down the price. For instance, the development of layer-2 scaling solutions for Ethereum significantly improved its usability and led to increased adoption and price appreciation.

Regulatory Changes and Their Impact

Government regulations play a crucial role in shaping the cryptocurrency landscape. Clear and favorable regulatory frameworks can increase investor confidence and encourage institutional investment, leading to higher prices. Conversely, restrictive or unclear regulations can stifle growth and negatively impact prices. The regulatory approach taken by different countries toward cryptocurrencies has varied significantly, impacting their respective markets. For example, the relatively favorable regulatory environment in some jurisdictions has led to the growth of significant cryptocurrency exchanges and related businesses.

Adoption Rates and Market Sentiment

The widespread adoption of White Bitcoin by businesses and individuals is a critical driver of price. Increased usage and transaction volume demonstrate growing demand, pushing prices upwards. Conversely, a decrease in adoption can lead to lower prices. Market sentiment, driven by news, social media trends, and overall investor confidence, also plays a significant role. Positive sentiment generally leads to price increases, while negative sentiment can trigger price drops. The rise of Bitcoin, for example, was significantly fueled by increased adoption and positive media coverage.

Comparative Influence of Factors on White Bitcoin’s Price

| Factor | Positive Impact | Negative Impact | Overall Influence |

|---|---|---|---|

| Regulatory Changes | Increased investor confidence, institutional adoption | Uncertainty, restrictions, bans | High |

| Technological Advancements | Improved scalability, security, usability | Security breaches, technological setbacks | High |

| Macroeconomic Conditions | Inflation hedge, safe haven asset during uncertainty | Economic stability, rising interest rates | Medium to High |

| Adoption Rates & Market Sentiment | Increased usage, positive news, investor confidence | Decreased usage, negative news, fear, uncertainty, and doubt (FUD) | High |

Comparing White Bitcoin to Other Cryptocurrencies in 2025

Predicting the relative performance of cryptocurrencies is inherently complex, given the volatile nature of the market and the influence of numerous unpredictable factors. However, by analyzing projected growth trajectories, technological advantages, and market adoption rates, we can attempt a comparative assessment of White Bitcoin against other major cryptocurrencies in 2025. This analysis will focus on identifying potential strengths and weaknesses and exploring possible market share shifts.

Comparing White Bitcoin’s projected price performance to other major cryptocurrencies in 2025 requires considering various scenarios. For instance, if the overall cryptocurrency market experiences significant growth, White Bitcoin, assuming its projected growth rates hold, could outperform less innovative or less widely adopted competitors. Conversely, a bearish market could negatively impact all cryptocurrencies, including White Bitcoin, regardless of its relative strengths. The comparison needs to account for potential macroeconomic factors, regulatory changes, and technological advancements impacting the entire cryptocurrency ecosystem.

White Bitcoin’s Projected Price Performance Relative to Bitcoin and Ethereum

Several forecasting models project Bitcoin and Ethereum to maintain their positions as leading cryptocurrencies in 2025. However, the extent of their dominance could be challenged. If White Bitcoin successfully achieves its projected technological milestones and gains wider adoption, its price appreciation could rival or even surpass that of Bitcoin and Ethereum, particularly if it addresses specific limitations of these existing platforms. For example, if White Bitcoin offers significantly faster transaction speeds and lower fees compared to Bitcoin and Ethereum, it could attract users and investors seeking a more efficient and cost-effective solution, leading to increased demand and price appreciation. Conversely, failure to meet these projections could result in a less impressive performance relative to the established giants.

Strengths and Weaknesses of White Bitcoin Compared to Competitors

White Bitcoin’s potential strengths lie in its [insert specific technological advantages, e.g., scalability, security features, unique consensus mechanism]. These advantages could attract developers and users seeking alternatives to existing platforms. However, its weaknesses might include [insert potential drawbacks, e.g., limited adoption, reliance on specific technologies, lack of established community support]. A direct comparison with competitors like Solana, Cardano, or Polkadot needs to evaluate White Bitcoin’s performance against their strengths and weaknesses in areas like transaction speed, energy efficiency, and smart contract capabilities. For example, if White Bitcoin offers superior scalability compared to Ethereum, it could attract decentralized application (dApp) developers, leading to increased network activity and price appreciation. Conversely, if its security features are less robust than those of Bitcoin, it could face challenges in gaining mainstream adoption.

Potential Market Share Shifts and Their Impact on White Bitcoin’s Price

Market share shifts are influenced by a variety of factors, including technological innovation, regulatory landscape, and overall market sentiment. If White Bitcoin successfully differentiates itself through superior technology and adoption, it could capture a significant market share, leading to substantial price appreciation. However, competition from other cryptocurrencies will be fierce. For instance, if a competitor develops a technology that surpasses White Bitcoin in key areas, this could negatively impact White Bitcoin’s market share and price. A hypothetical example: if a new cryptocurrency emerges with significantly improved privacy features, it could attract users concerned about the privacy aspects of White Bitcoin, thus affecting its market share and consequently, its price.

Investment Strategies for White Bitcoin in 2025

Investing in White Bitcoin in 2025, like any cryptocurrency, presents both opportunities and risks. The potential for high returns is balanced by the inherent volatility of the market. Choosing the right investment strategy depends heavily on your individual risk tolerance and financial goals. A well-defined strategy is crucial for navigating the complexities of the cryptocurrency market and maximizing your potential gains.

Several investment strategies can be employed when considering White Bitcoin in 2025. Each approach carries distinct advantages and disadvantages, and the optimal choice will vary based on individual circumstances. Careful consideration of risk tolerance and investment timeframe is paramount.

Long-Term Holding (Hodling)

Long-term holding, often referred to as “hodling” within the cryptocurrency community, involves buying White Bitcoin and holding it for an extended period, typically several years, regardless of short-term price fluctuations. This strategy aims to capitalize on the potential long-term growth of the cryptocurrency.

The primary advantage of hodling is its simplicity and potential for significant returns if the price of White Bitcoin appreciates substantially over time. This strategy minimizes the impact of short-term market volatility. However, a significant disadvantage is the risk of substantial losses if the price of White Bitcoin declines significantly during the holding period. Liquidity is also a factor; accessing your investment quickly may be challenging. For example, an investor who bought Bitcoin in 2010 and held it until 2021 experienced enormous gains, but those who bought at the peak of the 2021 bull market and held experienced significant losses.

Day Trading

Day trading involves buying and selling White Bitcoin within the same trading day, aiming to profit from short-term price movements. This strategy requires active monitoring of the market and a deep understanding of technical analysis.

Day trading offers the potential for quick profits if market predictions are accurate. The high frequency of trades allows for capitalizing on even small price fluctuations. However, it’s a high-risk strategy. The need for constant market monitoring demands significant time commitment and expertise. Transaction fees can also significantly eat into profits, especially with frequent trading. Furthermore, the high volatility of the cryptocurrency market can lead to substantial losses if trades are not executed precisely. Successful day trading often requires advanced technical analysis skills and a significant tolerance for risk.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money in White Bitcoin at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak.

The main advantage of DCA is its risk reduction. By investing consistently, you avoid the potential for significant losses from investing a lump sum at an unfavorable price point. It’s a relatively passive strategy requiring less frequent market monitoring. However, DCA may result in lower returns compared to lump-sum investing if the price of White Bitcoin rises sharply during the investment period. Also, it doesn’t entirely eliminate risk; a prolonged bear market could still lead to losses. The effectiveness of DCA is demonstrated by numerous investors who have successfully mitigated risk using this approach in various markets.

Comparison of Investment Strategies, White Bitcoin Price 2025

| Strategy | Risk | Time Commitment | Potential Return |

|---|---|---|---|

| Long-Term Holding | High (but potentially mitigated by diversification) | Low | High (potentially) |

| Day Trading | Very High | Very High | High (potentially, but also high potential for loss) |

| Dollar-Cost Averaging | Moderate | Moderate | Moderate |

Risks and Opportunities Associated with White Bitcoin in 2025

Predicting the future of any cryptocurrency, including a hypothetical “White Bitcoin,” is inherently speculative. However, by examining the general risks and opportunities present in the cryptocurrency market, we can extrapolate potential scenarios for White Bitcoin in 2025. Understanding these factors is crucial for any investor considering exposure to this asset.

Investing in cryptocurrencies carries significant risk, and White Bitcoin would be no exception. The volatile nature of the market, coupled with the relatively new and untested nature of many cryptocurrencies, means substantial gains are possible, but equally substantial losses are a real possibility. Conversely, the potential for high returns is a key driver of investment in this space. Let’s examine these aspects more closely.

Potential Risks Associated with White Bitcoin in 2025

The cryptocurrency market is known for its volatility. Price swings can be dramatic and unpredictable, influenced by a variety of factors including regulatory changes, technological advancements, market sentiment, and even social media trends. Investing in White Bitcoin in 2025 would expose investors to these inherent risks. For example, a negative news cycle surrounding cryptocurrencies in general, or specific concerns regarding White Bitcoin’s technology or team, could lead to significant price drops. Furthermore, the lack of regulation in many jurisdictions increases the risk of scams and fraudulent activities. The decentralized nature of cryptocurrencies also means that there is less protection for investors compared to traditional financial markets. Remember the 2018 crypto winter, where Bitcoin lost over 80% of its value? A similar downturn could significantly impact White Bitcoin’s price.

- Market Volatility: The cryptocurrency market is notoriously volatile, with prices subject to rapid and significant fluctuations.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving and can be unpredictable, potentially impacting White Bitcoin’s value and accessibility.

- Security Risks: Cryptocurrency exchanges and wallets are potential targets for hacking and theft, exposing investors to financial losses.

- Technological Risks: Technological advancements and competition from other cryptocurrencies could render White Bitcoin obsolete or less valuable.

- Scams and Fraud: The decentralized nature of the market makes it vulnerable to scams and fraudulent activities, potentially leading to investor losses.

Potential Opportunities Associated with White Bitcoin in 2025

Despite the risks, the potential rewards associated with investing in White Bitcoin in 2025 are significant. If White Bitcoin gains widespread adoption and its underlying technology proves successful, its value could appreciate substantially. This potential for high returns is a major draw for many cryptocurrency investors. Consider the early investors in Bitcoin who saw their investments multiply exponentially. While not guaranteed, similar returns are theoretically possible with White Bitcoin, depending on market conditions and adoption. Furthermore, if White Bitcoin successfully addresses a specific market need or provides a unique technological advantage, it could attract substantial investment and increase its value.

- High Growth Potential: Successful cryptocurrencies can experience exponential growth, offering significant returns to early investors.

- Technological Innovation: White Bitcoin may offer innovative features or technologies that could disrupt existing financial systems or create new markets.

- Diversification: Adding White Bitcoin to a diversified investment portfolio could help reduce overall risk and potentially increase returns.

- Decentralization and Transparency: White Bitcoin’s decentralized nature can offer increased transparency and security compared to traditional financial systems, depending on its implementation.

- Community and Network Effects: A strong community and network effects can drive adoption and increase the value of White Bitcoin.

White Bitcoin’s Technological Aspects and Future Development: White Bitcoin Price 2025

White Bitcoin, a hypothetical cryptocurrency, necessitates a discussion of its theoretical technological underpinnings and potential future trajectory. Understanding its technological basis is crucial for evaluating its price predictions and investment viability. While specifics are absent due to White Bitcoin’s hypothetical nature, we can extrapolate from existing cryptocurrency technologies to illustrate potential developments.

White Bitcoin’s underlying technology could potentially leverage existing blockchain architectures, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS). A PoW system, like Bitcoin’s, relies on miners solving complex computational problems to validate transactions, offering a high degree of security but consuming significant energy. Conversely, a PoS system validates transactions based on a validator’s stake in the network, resulting in lower energy consumption but potentially higher centralization risks. The choice of consensus mechanism would significantly impact White Bitcoin’s scalability, security, and environmental impact. Further, the use of layer-2 scaling solutions, such as Lightning Network or Plasma, could enhance transaction speed and reduce fees, increasing its usability and attractiveness.

Potential Network Upgrades and Their Price Implications

The success of White Bitcoin hinges on its ability to adapt and improve. Upgrades could focus on enhancing transaction throughput, reducing latency, improving security against attacks (such as 51% attacks), and increasing the overall efficiency of the network. For instance, implementing sharding, a technique that divides the blockchain into smaller, more manageable parts, could significantly improve scalability. Successful upgrades would likely boost investor confidence and drive up the price, mirroring the positive price movements seen in Ethereum after successful network upgrades like the transition to PoS. Conversely, failed upgrades or security breaches could severely damage confidence and lead to price drops. The successful implementation of privacy-enhancing technologies, like zero-knowledge proofs, could also attract a broader user base, driving up demand and price.

Technological Innovation and White Bitcoin Adoption

Technological innovation plays a vital role in cryptocurrency adoption. Features like improved user interfaces, the integration of decentralized finance (DeFi) protocols, and the development of user-friendly wallets would all increase accessibility and drive wider adoption. The integration of White Bitcoin into existing financial systems and applications could also significantly boost its value and usability. For example, if White Bitcoin were integrated into payment gateways or used for cross-border transactions, its demand and price would likely increase. Conversely, a lack of technological innovation or failure to adapt to evolving market trends could lead to stagnation and decreased value, as seen with some older cryptocurrencies that have failed to keep pace with technological advancements.

Frequently Asked Questions about White Bitcoin Price in 2025

This section addresses common inquiries regarding White Bitcoin’s price trajectory and investment considerations in 2025. We will explore potential price ranges, associated risks, comparative analysis with other cryptocurrencies, and suitable investment strategies. It’s crucial to remember that all cryptocurrency investments carry inherent risk, and these predictions are speculative in nature.

Potential High and Low Price Range for White Bitcoin in 2025

Predicting the precise price of White Bitcoin in 2025 is inherently challenging due to the volatile nature of the cryptocurrency market. However, a reasoned range can be constructed by considering several factors. A conservative estimate might place the low end of the range around $5000, assuming relatively low adoption and continued market uncertainty. Conversely, a high-end estimate, factoring in significant technological advancements, increased adoption, and positive regulatory developments, could reach as high as $25,000. This range is significantly influenced by broader market trends, technological breakthroughs within White Bitcoin’s ecosystem, and overall investor sentiment. For instance, a major technological upgrade could drive significant price increases, mirroring the impact of Ethereum’s transition to Proof-of-Stake. Conversely, a major security breach or regulatory crackdown could significantly depress the price, similar to the impact of the Mt. Gox collapse on Bitcoin’s price.

Biggest Risks Associated with Investing in White Bitcoin

Investing in White Bitcoin, like any cryptocurrency, involves considerable risk. Market volatility is a primary concern; price fluctuations can be dramatic and unpredictable, leading to significant losses. Regulatory uncertainty poses another substantial risk; changing government regulations could impact White Bitcoin’s legality and accessibility, potentially affecting its value. Technological risks, such as vulnerabilities in the White Bitcoin network or coding errors, could lead to security breaches or system failures, resulting in loss of funds. Finally, the relatively nascent nature of White Bitcoin compared to more established cryptocurrencies means it carries a higher degree of uncertainty regarding its long-term viability and adoption. The risk of complete failure, though unlikely, cannot be entirely discounted.

Comparison of White Bitcoin to Other Cryptocurrencies in Terms of Future Potential

White Bitcoin’s future potential must be considered relative to other cryptocurrencies. Compared to Bitcoin, it might offer higher potential for growth due to its potentially innovative features and younger age. However, Bitcoin’s established market dominance and brand recognition provide it with a significant advantage in terms of stability and investor confidence. Compared to Ethereum, White Bitcoin’s success hinges on its ability to differentiate itself in terms of functionality and utility. If White Bitcoin can establish a strong niche and attract a dedicated user base, it could outperform Ethereum. However, Ethereum’s established DeFi ecosystem and broad developer community provide it with a substantial competitive edge. Ultimately, White Bitcoin’s future potential depends on its ability to deliver on its promises and attract significant adoption.

Suitable Investment Strategies for White Bitcoin

Several investment strategies can be applied to White Bitcoin, each with its own risk/reward profile. A long-term “buy and hold” strategy minimizes trading fees and capitalizes on potential long-term growth, but requires patience and tolerance for short-term volatility. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, mitigates the risk of investing a lump sum at a market peak. Day trading, while potentially lucrative, is highly risky and requires significant expertise and market knowledge. Diversification, spreading investments across multiple cryptocurrencies, helps mitigate overall portfolio risk. The optimal strategy depends on individual risk tolerance, investment goals, and market understanding. For example, a risk-averse investor might prefer dollar-cost averaging, while a more aggressive investor might consider a combination of long-term holding and carefully planned day trading.

White Bitcoin Price 2025 – Predicting the White Bitcoin price in 2025 is challenging, as it depends on various factors including overall market sentiment and technological advancements. Understanding the broader Bitcoin market is key, and a good starting point is examining projections for the end of the year; for instance, check out this forecast for the Bitcoin Price Dec 2025 to gain perspective.

This data can then inform a more nuanced assessment of White Bitcoin’s potential trajectory throughout 2025.

Predicting the White Bitcoin price in 2025 is challenging, given its relatively new status. However, understanding broader Bitcoin trends can offer some insight. A helpful resource for general Bitcoin price predictions is this analysis of Btc Price Prediction 2025 Usd , which can inform estimations for White Bitcoin’s potential trajectory, considering its relationship to the overall market.

Ultimately, White Bitcoin’s 2025 price will depend on various factors including adoption and technological developments.

Predicting the White Bitcoin price in 2025 is challenging, given its relatively new status compared to Bitcoin. However, understanding the broader cryptocurrency market trends is crucial; a helpful resource for this is the analysis provided at Bitcoin Price In 2025 Year. This overall market outlook will significantly influence any projections for White Bitcoin’s value in 2025, considering factors like adoption rates and technological developments.

Predicting the White Bitcoin price in 2025 is challenging, given the cryptocurrency market’s volatility. However, understanding related altcoin predictions can offer some context. For instance, checking out the discussions on Bitcoin Cash Price Prediction 2025 Reddit might provide insights into broader market sentiment. Ultimately, though, the White Bitcoin price in 2025 will depend on various factors, including adoption rates and technological developments.

Predicting the White Bitcoin price in 2025 is challenging, given its relatively new status and limited market data. However, understanding broader Bitcoin price predictions can offer some context. For a reputable outlook on general Bitcoin’s future value, check out this Forbes prediction: Bitcoin Price Usd Prediction 2025 Forbes. Extrapolating from these broader trends might offer a tentative framework for estimating White Bitcoin’s potential value, though significant uncertainty remains.