2025 Bitcoin Halving

The 2025 Bitcoin halving, anticipated to occur in April, marks a significant event in the cryptocurrency’s lifecycle. This event, programmed into Bitcoin’s code, will reduce the rate at which new Bitcoins are created, impacting supply and potentially influencing price. Understanding the mechanics of this halving and its historical precedent is crucial for navigating the evolving market landscape.

Bitcoin Halving Mechanics and Historical Impact

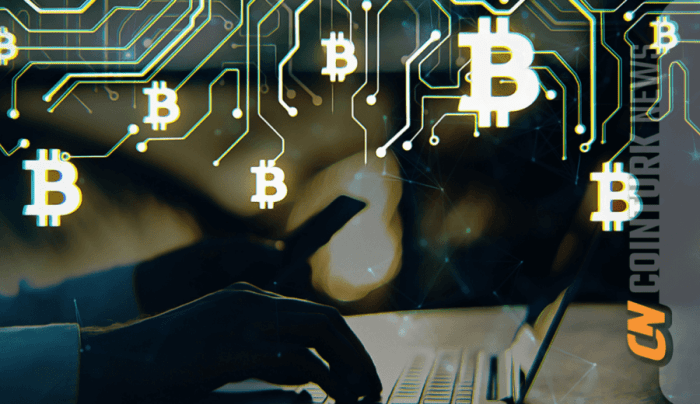

The Bitcoin halving is a programmed reduction in the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain. Every 210,000 blocks mined (approximately every four years), the block reward is halved. This mechanism, designed by Bitcoin’s creator Satoshi Nakamoto, controls inflation and ensures the scarcity of Bitcoin. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The first halving in 2012 saw a gradual price increase, while the 2016 halving preceded a substantial bull run, and the 2020 halving also led to a notable price surge, albeit followed by a correction. The relationship between halving events and price movements is complex and influenced by numerous market factors.

Anticipated Effects on Supply and Demand, 2025 Bitcoin Halving Chart

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in the rate of new Bitcoin creation will decrease the supply entering the market. Simultaneously, assuming demand remains relatively constant or increases, this reduced supply could exert upward pressure on the price. The principle of supply and demand suggests that when supply is limited and demand is high, prices tend to rise. However, the actual price movement will depend on a multitude of factors beyond the halving itself.

Factors Influencing Bitcoin Price

Numerous factors beyond the halving itself will influence Bitcoin’s price leading up to and following the 2025 event. These include macroeconomic conditions (like inflation, interest rates, and overall economic growth), regulatory developments, technological advancements within the Bitcoin ecosystem, adoption rates by institutional and retail investors, and prevailing market sentiment. For instance, a global recession could negatively impact Bitcoin’s price regardless of the halving, while positive regulatory developments in major economies could boost its appeal and price. Similarly, technological innovations like the Lightning Network could increase Bitcoin’s usability and thus demand.

Comparison of Previous Halving Cycles and 2025 Projections

| Halving Year | Pre-Halving Price (USD) | Post-Halving Price (USD) | Market Cap Change (%) |

|---|---|---|---|

| 2012 | ~ $12 | ~ $1000 (approx. 1 year after) | +8200% (approx. 1 year after) |

| 2016 | ~ $650 | ~ $20,000 (approx. 2 years after) | +2900% (approx. 2 years after) |

| 2020 | ~ $9,000 | ~ $65,000 (approx. 1 year after) | +620% (approx. 1 year after) |

| 2025 (Projected) | (Variable, depending on market conditions) | (Variable, highly dependent on multiple factors, including those listed above) | (Variable, significant increase possible but not guaranteed) |

Analyzing Historical Bitcoin Halving Charts

Analyzing historical Bitcoin halving charts offers valuable insights into potential price movements surrounding future halving events. While past performance doesn’t guarantee future results, identifying recurring patterns and understanding market conditions can inform investment strategies. This analysis focuses on the price behavior in the months leading up to and following the previous halving events.

2025 Bitcoin Halving Chart – Examining the price action around previous Bitcoin halvings reveals a complex interplay of factors influencing the cryptocurrency’s value. The halving itself, a programmed reduction in the rate of Bitcoin creation, acts as a significant catalyst, but the overall market sentiment, macroeconomic conditions, and technological advancements all play crucial roles. A thorough analysis requires comparing and contrasting these diverse influences across different halving cycles.

Understanding the 2025 Bitcoin Halving Chart requires considering the impact of reduced Bitcoin issuance. For a deeper dive into the mechanics and predicted consequences, you should check out this comprehensive resource on Halving Bitcoin 2025 , which offers valuable insights. Returning to the chart, we can then better interpret the projected price movements and market volatility post-halving.

Price Movements Surrounding Previous Halvings

The three previous Bitcoin halvings (2012, 2016, and 2020) each exhibited distinct price trajectories before and after the event. The 2012 halving saw a gradual price increase in the months leading up to the event, followed by a significant surge in the subsequent year. The 2016 halving saw a period of relative price stability before a substantial rally began several months after the halving. The 2020 halving presented a different picture, with a significant price increase preceding the event, followed by a period of consolidation and a later, more pronounced bull run. These variations highlight the importance of considering broader market forces beyond the halving itself.

Comparison of Market Conditions Before and After Halvings

Before each halving, market sentiment varied. Sometimes, anticipation of the halving fueled price increases, while at other times, broader market uncertainty or bearish trends dominated. After the halvings, the price movements were similarly diverse. While some halvings were immediately followed by significant price rallies, others saw periods of consolidation before substantial price appreciation. Factors such as regulatory changes, technological advancements, and overall investor confidence played a significant role in shaping the post-halving price action.

Recurring Patterns and Anomalies in Historical Data

While no two halving cycles are identical, several recurring patterns emerge. A period of price increase often precedes the halving, driven by anticipation. However, the magnitude and duration of this increase vary considerably. Post-halving, a significant price increase often occurs, though the timing and intensity of this rally differ significantly across halving events. A key anomaly is the variation in the length of time it takes for the price to react significantly after the halving. This suggests that factors beyond the halving itself significantly impact the subsequent price trajectory.

Visual Representation of Historical Bitcoin Halving Price Performance

A line graph would effectively illustrate the historical price performance of Bitcoin around halving events. The x-axis would represent time, spanning several months before and after each halving event. The y-axis would represent the Bitcoin price in USD. Each halving event would be marked with a vertical dashed line. Different colored lines could represent the price trajectory for each halving cycle. Data points would be plotted for daily or weekly closing prices. This visualization would clearly show the price fluctuations surrounding each halving, allowing for a direct comparison of the price movements across different cycles. Key price highs and lows could be highlighted with different symbols or annotations to emphasize significant price changes. A legend would clearly identify each halving cycle’s corresponding line.

Predicting Bitcoin’s Price After the 2025 Halving: 2025 Bitcoin Halving Chart

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors influence Bitcoin’s price, making accurate forecasting extremely challenging. While historical data provides some insights, the cryptocurrency market is inherently volatile and susceptible to unforeseen events. Therefore, any price prediction should be viewed with a healthy dose of skepticism.

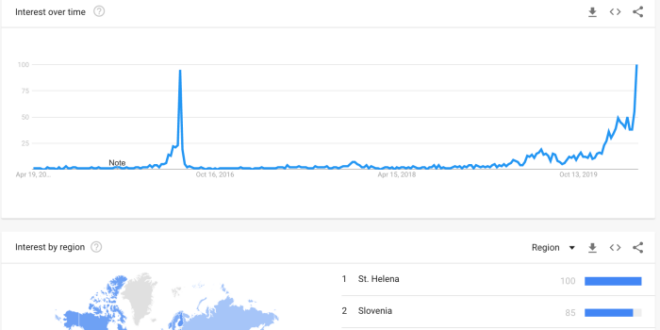

Numerous models and methodologies attempt to forecast Bitcoin’s price following halving events. These range from simple statistical analyses of historical price movements after previous halvings to sophisticated quantitative models incorporating macroeconomic indicators, on-chain metrics, and even sentiment analysis from social media. Some models focus solely on the reduction in Bitcoin’s inflation rate, while others integrate broader market trends and technological developments. The accuracy of these models varies greatly, and past performance is not necessarily indicative of future results.

Model Limitations and Inaccuracies

The inherent limitations of price prediction models stem from the unpredictable nature of the cryptocurrency market. These models often struggle to account for external factors such as regulatory changes, macroeconomic shocks, major technological advancements (or setbacks), and the influence of large institutional investors or whales. Overreliance on historical data can be misleading, as past price movements may not reflect future behavior, especially in a rapidly evolving market. For instance, a model that accurately predicted price increases after previous halvings might fail to account for a sudden market crash caused by a significant regulatory event. Moreover, the very act of predicting price movements can influence market behavior, creating a self-fulfilling prophecy or, conversely, leading to unexpected deviations.

Analyst Predictions and Divergent Views

Analysts and experts offer a wide range of predictions for Bitcoin’s price after the 2025 halving. Some analysts, employing bullish models, project substantial price increases, potentially exceeding previous all-time highs. Their arguments often center on the reduced supply of Bitcoin, increased institutional adoption, and growing global demand. Others offer more conservative, neutral predictions, highlighting the inherent volatility of the market and the potential for unexpected downturns. Bearish predictions, meanwhile, cite potential regulatory risks, macroeconomic instability, or competition from alternative cryptocurrencies as reasons for a less optimistic outlook. For example, one analyst might predict a price of $150,000 based on a stock-to-flow model, while another might forecast a more modest increase to $75,000, citing potential market saturation. The disparity in these predictions underscores the difficulty of accurate forecasting.

Price Trajectory Scenarios

Considering the various perspectives, we can Artikel several potential price scenarios for Bitcoin after the 2025 halving:

A bullish scenario could see a significant price surge, driven by reduced inflation and increased demand. This could lead to prices well above previous highs, potentially reaching several hundred thousand dollars per Bitcoin. This scenario assumes sustained institutional adoption, positive regulatory developments, and continued growth in the overall cryptocurrency market.

A bearish scenario, on the other hand, might involve a prolonged period of price stagnation or even a decline. This could result from negative regulatory actions, a broader cryptocurrency market downturn, or a significant technological disruption. In this scenario, the price might remain relatively flat or even decrease despite the halving event.

A neutral scenario anticipates a moderate price increase, reflecting the impact of reduced inflation but also acknowledging the inherent market volatility. This scenario suggests a gradual upward trend, potentially reaching a new all-time high but without the dramatic price increases predicted in a bullish scenario. The actual price movement might fall somewhere between the bullish and bearish extremes, depending on the interplay of various market forces.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic conditions, regulatory landscapes, and market sentiment. While the 2025 halving is a significant event, its impact will be intertwined with these broader forces, potentially amplifying or dampening its effect on price. Understanding these factors is crucial for navigating the uncertainties of the cryptocurrency market.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price, often acting as a leading indicator of investor behavior. Global economic stability, inflation rates, and monetary policies all play a crucial role. For instance, periods of high inflation might drive investors towards Bitcoin as a hedge against currency devaluation, while rising interest rates could divert capital away from riskier assets like cryptocurrencies.

- Inflation: High inflation could increase Bitcoin’s appeal as a store of value, potentially driving up its price. The historical correlation between high inflation and Bitcoin price increases, though not perfectly linear, offers some support for this view. For example, the inflationary pressures of 2021 were partially reflected in Bitcoin’s price surge.

- Interest Rates: Increased interest rates generally reduce the attractiveness of riskier assets, potentially leading to a decrease in Bitcoin’s price as investors shift to higher-yield, lower-risk investments. The Federal Reserve’s interest rate hikes in 2022 are a recent example of this dynamic.

- Global Economic Growth: Strong global economic growth can positively influence Bitcoin’s price, as investors are more likely to allocate capital to riskier assets during periods of economic expansion. Conversely, a recessionary environment might lead to decreased investment in Bitcoin.

Regulatory Changes and Government Policies

Government regulations and policies significantly shape the cryptocurrency landscape. Favorable regulations can boost investor confidence and increase institutional adoption, potentially driving up Bitcoin’s price. Conversely, restrictive measures can dampen investor enthusiasm and lead to price declines.

- Favorable Regulations: Clear regulatory frameworks that provide legal certainty for cryptocurrency transactions can attract institutional investors and increase mainstream adoption, positively impacting Bitcoin’s price. Examples include countries developing specific cryptocurrency regulations.

- Restrictive Regulations: Conversely, bans, heavy taxation, or overly stringent regulations can create uncertainty and discourage investment, potentially suppressing Bitcoin’s price. China’s crackdown on cryptocurrency mining in 2021 serves as a notable example.

Institutional Adoption and Mainstream Media Coverage

The involvement of institutional investors and the narrative presented by mainstream media heavily influence Bitcoin’s price. Increased institutional adoption signals a growing acceptance of Bitcoin as a legitimate asset class, while positive media coverage can increase public awareness and drive demand.

- Institutional Adoption: Large financial institutions investing in Bitcoin legitimizes the asset class and increases its liquidity, potentially leading to price appreciation. The entry of companies like MicroStrategy into the Bitcoin market illustrates this influence.

- Mainstream Media Coverage: Positive media coverage can generate broader public interest and increase demand, leading to price increases. Conversely, negative media portrayals can fuel uncertainty and lead to price drops. The impact of prominent media outlets’ coverage on Bitcoin’s price is undeniable.

Analyzing the 2025 Bitcoin Halving Chart requires understanding the event’s impact on Bitcoin’s price and mining dynamics. A key date to consider is the precise Bitcoin Halving 2025 Day, which you can find detailed information on at Bitcoin Halving 2025 Day. This date is crucial for interpreting the chart’s predictions and forecasting potential market movements following the halving event in the 2025 Bitcoin Halving Chart.

Understanding the 2025 Bitcoin Halving Chart requires knowing the precise date of the halving event. To accurately interpret the chart’s implications, you first need to determine when exactly the next halving will occur; you can find that information by checking this helpful resource: When Is Bitcoin Halving 2025?. Once you have that date, you can effectively analyze the 2025 Bitcoin Halving Chart and its potential market effects.

Analyzing the 2025 Bitcoin Halving Chart requires understanding the precise timing of the event. To stay informed about the rapidly approaching halving, check out this helpful resource: Bitcoin Halving 2025 Countdown Clock. This clock provides a real-time countdown, allowing you to better interpret the implications of the halving on the 2025 Bitcoin Halving Chart and its potential market effects.

Analyzing the 2025 Bitcoin Halving Chart requires understanding the anticipated impact on price. To gain further insight into potential price fluctuations, it’s helpful to consult resources dedicated to predicting the effects, such as this analysis of Halving Bitcoin 2025 Precio. Ultimately, the 2025 Bitcoin Halving Chart’s interpretation depends heavily on these price projections and market sentiment.

Analyzing the 2025 Bitcoin Halving Chart is crucial for understanding the potential impact on the cryptocurrency’s value. Understanding this chart becomes even more important when considering future price movements; for insightful predictions, check out this resource on Bitcoin Price Prediction After 2025 Halving. Ultimately, the 2025 Bitcoin Halving Chart serves as a foundational element for any serious price projection analysis.