2025 Bitcoin Halving

The 2025 Bitcoin halving, anticipated to occur around April, marks a significant event in the cryptocurrency’s lifecycle. This predictable reduction in the rate of new Bitcoin creation is a core component of Bitcoin’s deflationary monetary policy, designed to control its supply and potentially influence its value. Understanding the mechanics of this event and its historical impact is crucial for navigating the potential market shifts.

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving event occurs approximately every four years, or every 210,000 blocks mined. During a halving, the reward given to Bitcoin miners for successfully adding a new block to the blockchain is cut in half. This programmed scarcity directly impacts the rate at which new Bitcoins enter circulation. Historically, halving events have been followed by periods of significant price appreciation, although the timing and magnitude of these price increases have varied. This correlation isn’t guaranteed, and other market factors significantly influence Bitcoin’s price. The reduced supply, however, is often cited as a contributing factor to increased demand and, consequently, price increases. The precise mechanics involve a change in the code that governs the block reward, a change implemented automatically as the blockchain progresses.

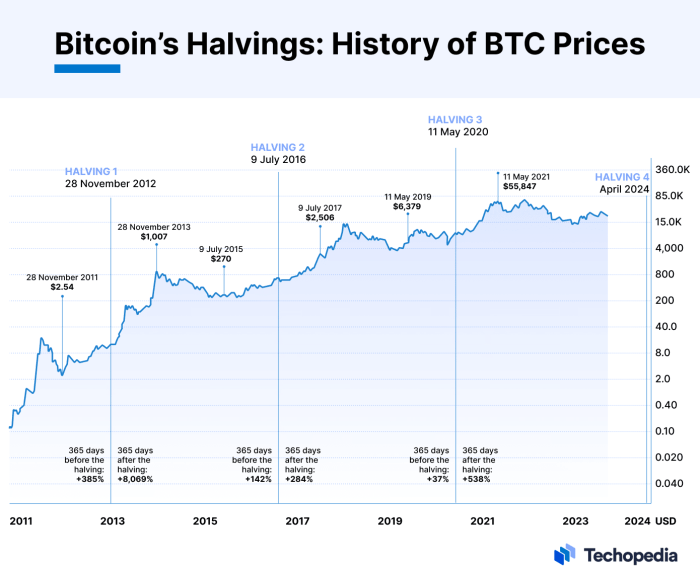

Timeline of Past Halving Events and Subsequent Price Movements

Analyzing past halving events provides valuable insights into potential future scenarios. While past performance is not indicative of future results, examining these trends can help to contextualize expectations.

2025 Bitcoin Halving Event – Below is a table summarizing the past halving events and their subsequent price movements. Note that the price changes listed represent the price movement over a period following the halving, and many factors beyond the halving itself influence the price.

The 2025 Bitcoin Halving Event is a significant milestone for the cryptocurrency, expected to impact its price and mining dynamics. Understanding this event requires researching its potential consequences, and a great resource for this is the detailed analysis available at 2025 Halving Bitcoin. This comprehensive guide will help you prepare for the 2025 Bitcoin Halving Event and its likely effects on the market.

| Date | Block Height (approx.) | Subsequent Price Change (approx. timeframe) | Notes |

|---|---|---|---|

| November 28, 2012 | 210,000 | ~8x increase (over the next 12 months) | Early stage of Bitcoin’s development, smaller market cap. |

| July 9, 2016 | 420,000 | ~10x increase (over the next 2 years) | Growing adoption and increased institutional interest. |

| May 11, 2020 | 630,000 | ~2x increase (over the next 6 months), followed by significant volatility | Increased mainstream awareness and significant institutional investment. |

Predictions from Cryptocurrency Analysts Regarding the 2025 Halving, 2025 Bitcoin Halving Event

Numerous cryptocurrency analysts have offered predictions regarding the 2025 halving’s potential impact. These predictions vary widely, reflecting the inherent uncertainty in the cryptocurrency market. Some analysts, pointing to the historical correlation between halving events and price increases, anticipate a substantial price surge following the 2025 halving. Others caution that macroeconomic factors, regulatory changes, and overall market sentiment will play significant roles in determining the actual price movement. For instance, some analysts compare the current market conditions to those before the 2016 halving, suggesting a potential for a similar pattern of price appreciation, while others highlight the significantly larger market capitalization and regulatory scrutiny as potentially dampening factors. It’s important to approach these predictions with caution and conduct thorough independent research. Predicting cryptocurrency prices with certainty is impossible.

Market Sentiment and Price Predictions: 2025 Bitcoin Halving Event

The 2025 Bitcoin halving event is generating considerable buzz within the cryptocurrency community, leading to a wide range of market sentiment and price predictions. While the halving historically has correlated with price increases due to reduced Bitcoin supply, the current economic climate and regulatory uncertainty introduce significant complexities. Understanding the diverse perspectives and influencing factors is crucial for navigating this period.

The prevailing market sentiment is a mixture of optimism and caution. Bullish sentiment centers around the historical precedent of price appreciation following previous halving events. Conversely, bearish sentiment highlights macroeconomic factors, regulatory risks, and the potential for market manipulation.

Bullish Price Predictions

Many analysts predict a significant price increase for Bitcoin following the 2025 halving. These predictions often cite the halving’s impact on scarcity, arguing that reduced supply will inevitably drive up demand and, consequently, price. For instance, some models project Bitcoin reaching prices exceeding $100,000 or even higher, drawing parallels to the price surges observed after previous halvings. This bullish outlook often stems from a belief in Bitcoin’s long-term value proposition as a decentralized store of value and a hedge against inflation. The expectation is that institutional investors, seeing the reduced supply and increased scarcity, will increase their holdings, further pushing up the price. For example, if institutional adoption continues at its current pace, the demand for Bitcoin could significantly outstrip the reduced supply after the halving.

Bearish Price Predictions

Conversely, bearish predictions highlight potential downsides. These predictions often focus on macroeconomic factors such as inflation, interest rate hikes, and potential recessions. A global economic downturn could significantly impact investor risk appetite, leading to a decrease in Bitcoin’s price, irrespective of the halving. Furthermore, regulatory uncertainty in various jurisdictions poses a significant risk. Stringent regulations or outright bans could negatively impact Bitcoin’s adoption and price. For example, a major regulatory crackdown in a key Bitcoin market could trigger a sharp price correction. The increased scrutiny of cryptocurrency exchanges and the potential for stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations also contribute to the bearish outlook. The argument is that increased regulatory hurdles might stifle the growth and adoption of Bitcoin, negating the positive effects of the halving.

Factors Influencing Bitcoin’s Price

Several factors can significantly influence Bitcoin’s price, both positively and negatively. Positive factors include increased institutional adoption, growing retail investor interest, and positive regulatory developments. Negative factors include macroeconomic headwinds, regulatory crackdowns, and security breaches or hacks impacting exchanges or wallets. The interplay of these factors will ultimately determine Bitcoin’s price trajectory post-halving. For example, a major technological advancement in Bitcoin’s underlying technology, like the implementation of the Lightning Network on a larger scale, could drive positive price action. Conversely, a significant security breach on a major exchange could lead to a sell-off and a drop in price.

Institutional and Retail Investor Influence

Institutional investors, such as hedge funds and investment firms, play a significant role in shaping market sentiment and price movements. Their large-scale investments can create significant upward pressure on Bitcoin’s price. Retail traders, on the other hand, contribute to the market’s volatility through their trading activity. Their collective sentiment can amplify both bullish and bearish trends. The interaction between institutional and retail investors is a key driver of market dynamics. For example, a large institutional buy-in could trigger a positive price reaction, attracting more retail investors and creating a self-reinforcing cycle. Conversely, a significant sell-off by institutional investors could trigger panic selling among retail traders, exacerbating downward pressure.

Mining and Network Security

The 2025 Bitcoin halving will significantly impact Bitcoin mining profitability and, consequently, the network’s security and decentralization. The reduction in block rewards will force miners to adapt, potentially leading to shifts in the mining landscape and influencing the long-term health of the Bitcoin ecosystem.

The halving directly affects miners’ revenue by cutting the Bitcoin reward in half for each successfully mined block. This decrease in profitability necessitates adjustments to remain operational. Miners will need to evaluate their operational costs, including electricity, hardware maintenance, and personnel, and adjust accordingly. This might involve upgrading to more energy-efficient mining hardware, seeking out cheaper electricity sources, or consolidating operations. Some miners may be forced to shut down entirely if they can no longer operate profitably.

Impact on Miners’ Profitability and Responses

The halving’s impact on miner profitability is multifaceted. While the reward is halved, the Bitcoin price could potentially rise due to decreased supply, offsetting some of the revenue loss. However, the extent of this price increase is highly speculative and depends on various market factors. Miners will likely employ several strategies to maintain profitability, including: improving operational efficiency, exploring alternative revenue streams (like transaction fees), consolidating mining pools to reduce overhead, or targeting regions with lower electricity costs. Historically, halvings have been followed by periods of both increased and decreased mining difficulty, reflecting the dynamic interplay between miner profitability and network hash rate. The outcome in 2025 remains uncertain.

Halving’s Effect on Network Security and Decentralization

The halving’s impact on network security is complex. While reduced miner profitability might lead to some miners exiting the network, the increased scarcity of Bitcoin could incentivize others to remain or even enter the market. A decrease in the number of miners could, in theory, reduce the network’s security by making it more vulnerable to 51% attacks. However, a price increase post-halving could counter this effect, maintaining or even increasing the overall hash rate. Decentralization, while often correlated with hash rate distribution, is also affected by the geographic concentration of mining operations. A decrease in the number of smaller miners could lead to increased centralization in the hands of larger, more well-funded operations.

Potential for Increased Hash Rate Centralization

The halving could exacerbate the trend toward hash rate centralization. Larger mining operations, with their economies of scale and access to cheaper resources, are better positioned to withstand the reduced profitability. This may lead to a consolidation of mining power among a smaller number of entities, potentially threatening the decentralization of the Bitcoin network. The geographic concentration of mining could also increase, raising concerns about regulatory risks and potential vulnerabilities to single points of failure. For example, if a significant portion of the hash rate is located in a region with restrictive regulations, a crackdown could disproportionately affect the network’s security.

Relationship Between Mining Rewards, Hash Rate, and Network Security

Imagine a graph with three lines representing mining rewards, hash rate, and network security. The mining reward line shows a step-like decrease at each halving event. The hash rate line generally follows the reward line, but with some lag and volatility. Initially, the hash rate might drop slightly as less profitable miners exit, but if the Bitcoin price rises, the hash rate could recover or even increase. The network security line, representing the network’s resistance to attacks, closely mirrors the hash rate line. A higher hash rate generally corresponds to higher network security, while a lower hash rate increases the risk of attacks. The graph illustrates the interconnectedness of these three factors and the potential for temporary disruptions following a halving, with the long-term outcome depending on the interplay between Bitcoin’s price and the miners’ adaptations.

The 2025 Bitcoin Halving Event is a significant milestone for the cryptocurrency, expected to reduce the rate of new Bitcoin entering circulation. Determining the precise date is crucial for investors, and you can find out exactly when this will occur by checking this helpful resource: When Is The Bitcoin Halving In 2025. Understanding this date allows for better preparation and strategic planning around the 2025 Bitcoin Halving Event and its potential market impact.

The 2025 Bitcoin Halving Event is a significant milestone for the cryptocurrency, expected to impact its price and overall market dynamics. Understanding the historical context is crucial, and a deep dive into the Bitcoin Halving Cycle 2025 provides valuable insight. This understanding helps in better predicting the potential effects of the 2025 Halving Event on the future of Bitcoin.

The 2025 Bitcoin Halving Event is a significant milestone for the cryptocurrency, anticipated to impact its price and overall market dynamics. Precisely pinpointing the date requires careful consideration of block generation times, and for that information, you can check the detailed analysis on the Bitcoin Halving 2025 Date website. Understanding this date is crucial for anyone interested in the future trajectory of the 2025 Bitcoin Halving Event and its potential consequences.

The 2025 Bitcoin Halving Event is a significant milestone for the cryptocurrency, expected to impact its price and mining dynamics considerably. Understanding the precise timing of this event is crucial for investors and miners alike, and you can find detailed information on the exact date by checking out this resource on Bitcoin Halving Time 2025. This knowledge will help you better prepare for the potential market fluctuations surrounding the 2025 Bitcoin Halving Event.

The 2025 Bitcoin Halving Event is a significant occurrence in the cryptocurrency world, anticipated to impact Bitcoin’s price and mining dynamics. A key question surrounding this event is, naturally, the precise timing; to find out, check this resource: When Is The 2025 Bitcoin Halving?. Understanding the date is crucial for investors and miners alike as they prepare for the reduced block rewards that follow the halving.

The 2025 Bitcoin Halving Event promises to be a defining moment for the future of Bitcoin.