Bitcoin Price Prediction: Bitcoin Price Prediction For 27 January 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential. Its price has swung wildly since its inception, experiencing periods of explosive growth followed by dramatic corrections. Predicting its value, particularly over a timeframe as long as January 27, 2025, presents a significant challenge. While numerous analysts offer forecasts, the inherent unpredictability of the market makes any prediction inherently uncertain. This article aims to explore key factors that could potentially influence Bitcoin’s price on that date, providing a reasoned assessment rather than a definitive forecast.

Bitcoin’s journey began in 2009, emerging from a time of global financial instability. Its decentralized nature and potential to disrupt traditional financial systems quickly attracted attention. Over the years, Bitcoin has evolved from a niche digital asset to a globally recognized store of value, albeit a highly volatile one. Currently, Bitcoin holds a significant market share within the cryptocurrency landscape, although its position is subject to continuous shifts based on technological advancements, regulatory changes, and market sentiment. This analysis will consider several factors that could shape Bitcoin’s trajectory toward January 27, 2025.

Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors could significantly impact Bitcoin’s price by January 27, 2025. These include macroeconomic conditions, regulatory developments, technological advancements within the cryptocurrency space, and overall market sentiment. Understanding the interplay of these elements is crucial for any attempt at informed speculation.

Macroeconomic Conditions and Bitcoin’s Value, Bitcoin Price Prediction For 27 January 2025

Global economic trends, such as inflation rates, interest rate policies, and geopolitical events, can substantially influence Bitcoin’s price. For example, periods of high inflation often see investors seeking alternative assets, potentially driving up demand for Bitcoin as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive compared to traditional, interest-bearing assets. The state of the global economy in 2025 will be a key determinant of Bitcoin’s performance. A strong global economy could lead to decreased demand for Bitcoin as a safe haven asset, whereas a period of economic uncertainty could fuel its rise. Historical examples such as the 2020 COVID-19 pandemic, which saw Bitcoin’s price surge alongside a global economic downturn, illustrate this correlation.

Regulatory Landscape and Bitcoin Adoption

The regulatory environment surrounding cryptocurrencies will play a critical role. Clearer and more consistent regulations could increase institutional investment and mainstream adoption, potentially driving up Bitcoin’s price. Conversely, overly restrictive or unclear regulations could stifle growth and negatively impact its value. The regulatory landscape is constantly evolving, and the actions of governments worldwide will be a major factor in shaping Bitcoin’s future. Consider the contrasting approaches of countries like El Salvador, which adopted Bitcoin as legal tender, and China, which has implemented strict bans on cryptocurrency trading. These differing regulatory approaches highlight the significant impact governmental policies can have on Bitcoin’s price.

Technological Advancements in the Cryptocurrency Sector

Advancements in blockchain technology, the underlying technology of Bitcoin, and the emergence of competing cryptocurrencies could also affect Bitcoin’s price. Improvements in scalability, transaction speed, and energy efficiency could enhance Bitcoin’s appeal and increase its adoption. However, the rise of alternative cryptocurrencies with superior features could potentially divert investment away from Bitcoin. The evolution of the cryptocurrency ecosystem will be a dynamic force shaping the future of Bitcoin. For instance, the development of Layer-2 scaling solutions for Bitcoin could address its limitations in transaction speed and cost, potentially leading to increased adoption and price appreciation.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these influences is crucial for navigating the cryptocurrency market. This section delves into the key macroeconomic, technological, regulatory, and market-driven elements shaping Bitcoin’s price trajectory.

Macroeconomic Factors and Bitcoin Price

Macroeconomic conditions significantly impact Bitcoin’s price. Inflation, interest rates, and recessionary fears all play a role, often influencing investor sentiment and risk appetite. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, while rising interest rates might divert investment capital to higher-yielding assets.

| Macroeconomic Factor | Potential Impact on Bitcoin Price | Example |

|---|---|---|

| Inflation | Positive (as a hedge against inflation); potentially negative if inflation leads to broader economic instability. | High inflation in 2021-2022 saw increased Bitcoin adoption as investors sought inflation hedges. |

| Interest Rates | Negative (as higher rates make holding Bitcoin less attractive compared to yield-bearing assets); potentially positive if higher rates signal a healthier economy. | The Federal Reserve’s interest rate hikes in 2022 led to a decline in Bitcoin’s price as investors moved to bonds. |

| Recessionary Fears | Negative (as investors move to safer assets during economic uncertainty); potentially positive if Bitcoin is seen as a safe haven asset. | The 2008 financial crisis saw a decline in Bitcoin’s price, but subsequent recoveries demonstrated its potential resilience. |

Technological Advancements and Bitcoin’s Utility

Technological advancements constantly improve Bitcoin’s scalability, security, and usability, impacting its price and adoption.

Several key advancements contribute to Bitcoin’s evolution:

- Lightning Network: Enables faster and cheaper transactions, enhancing Bitcoin’s usability for everyday payments.

- Taproot Upgrade: Improves transaction privacy and efficiency, making Bitcoin more attractive for both individuals and businesses.

- Layer-2 Solutions: Reduce transaction fees and increase transaction speeds, addressing scalability concerns.

These improvements can lead to increased adoption and, consequently, higher demand and price.

Regulatory Changes and Market Sentiment

Government regulations significantly influence Bitcoin’s price and market sentiment. The regulatory landscape varies considerably across jurisdictions.

| Region | Regulatory Approach | Impact on Bitcoin Price |

|---|---|---|

| United States | Evolving, with ongoing debates on Bitcoin ETFs and broader cryptocurrency regulation. | Uncertainty creates volatility; positive developments (like ETF approvals) can lead to price increases. |

| European Union | Developing a comprehensive regulatory framework (MiCA) aiming to balance innovation and consumer protection. | Increased regulatory clarity could attract institutional investment and stabilize the market. |

| China | Highly restrictive, with a ban on cryptocurrency trading and mining. | Negative impact on price due to reduced market participation from a significant player. |

Institutional Adoption and Bitcoin’s Price

Increased institutional adoption of Bitcoin boosts its legitimacy and price. Corporations and investment funds holding Bitcoin signal confidence in its long-term value.

Examples include MicroStrategy’s significant Bitcoin holdings and Tesla’s previous investment, although Tesla later sold a portion of its holdings. These actions, though sometimes volatile in their immediate market impact, demonstrate a growing acceptance of Bitcoin as an asset class.

Market Sentiment and Price Volatility

Market sentiment, driven by news events, social media trends, and FUD (fear, uncertainty, and doubt) cycles, heavily influences Bitcoin’s price volatility.

For example, a sudden negative news report about a major cryptocurrency exchange experiencing a security breach could trigger a sell-off, leading to a sharp price drop. Conversely, positive news, like the approval of a Bitcoin ETF, could lead to a significant price surge.

Bitcoin’s Supply and Demand Dynamics

Bitcoin’s price is fundamentally determined by supply and demand. The fixed supply of 21 million Bitcoins creates scarcity, while demand is driven by factors discussed above.

The Bitcoin halving, an event that reduces the rate of new Bitcoin creation, is often associated with price increases due to reduced supply.

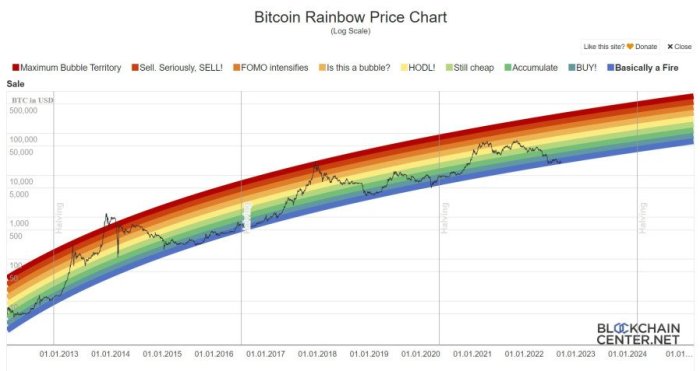

Illustrative Chart (Description): A chart would show a historical Bitcoin price graph with halving events marked. The chart would demonstrate a general upward trend in the price after each halving event, though the price doesn’t always immediately increase after a halving, and other factors can influence the price. The price increase is attributed to the reduced supply of newly minted Bitcoin impacting the supply-demand equilibrium.

Potential Price Scenarios for January 27, 2025

Predicting the price of Bitcoin with certainty is impossible. However, by analyzing current market trends, technological advancements, and regulatory developments, we can construct plausible price scenarios for January 27, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, with a neutral scenario bridging the gap.

Bitcoin Price Scenarios: January 27, 2025

The following table Artikels three distinct price scenarios for Bitcoin on January 27, 2025, each with its supporting factors and underlying assumptions. It’s crucial to remember that these are speculative projections, and the actual price could fall outside these ranges.

| Scenario | Price Range (USD) | Supporting Factors |

|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread institutional adoption, positive regulatory developments globally, continued technological innovation (e.g., Lightning Network scalability improvements), sustained macroeconomic uncertainty driving investors towards Bitcoin as a safe haven asset. Increased demand from emerging markets. |

| Neutral | $50,000 – $100,000 | A period of consolidation following previous price volatility. Moderate institutional adoption. Regulatory uncertainty persists in some key markets. Technological advancements continue but at a slower pace. Macroeconomic conditions are relatively stable, neither significantly bullish nor bearish for Bitcoin. |

| Bearish | $20,000 – $40,000 | Significant regulatory crackdowns globally leading to decreased institutional investment. A major security breach impacting Bitcoin’s network or a significant negative event affecting public trust. A prolonged period of macroeconomic stability leading to reduced demand for alternative assets. Competition from other cryptocurrencies or innovative financial technologies. |

Underlying Assumptions and Factors

The bullish scenario assumes a confluence of positive factors, mirroring the growth experienced in previous bull runs, but on a potentially larger scale. This requires not only continued technological development but also widespread acceptance by both institutional and retail investors, along with favorable regulatory environments. The success of the Lightning Network in scaling Bitcoin transactions would be a key driver. Conversely, the bearish scenario hinges on negative events that could erode investor confidence and lead to a significant price correction. This could include regulatory setbacks, security vulnerabilities, or a broader economic downturn. The neutral scenario represents a more moderate outcome, where neither extremely positive nor extremely negative events dominate the market. This scenario suggests a period of consolidation and sideways trading, allowing the market to absorb previous price movements and adjust to new realities.

Comparison and Contrast of Scenarios

The key difference between these scenarios lies in the degree of institutional adoption, regulatory clarity, and macroeconomic conditions. A significant turning point could be a major regulatory decision from a key jurisdiction like the US or the EU. A positive regulatory framework could fuel a bullish run, while a negative one could trigger a bearish trend. Similarly, a major technological breakthrough, such as a significant improvement in Bitcoin’s scalability or the widespread adoption of a second-layer solution, could act as a catalyst for a bullish market. Conversely, a major security incident or a prolonged period of economic uncertainty could lead to a bearish market. The neutral scenario serves as a baseline, suggesting that the market could consolidate and stabilize before experiencing a more pronounced bullish or bearish trend. The actual price will likely depend on the interplay of these various factors.

Risks and Uncertainties

Predicting the price of Bitcoin, or any cryptocurrency for that matter, over a period as long as four years is inherently risky. Numerous factors, both foreseeable and unforeseen, can significantly impact its value, making any prediction inherently uncertain. While various models attempt to forecast future prices, their limitations must be acknowledged. This section Artikels the key risks and uncertainties associated with long-term Bitcoin price predictions, emphasizing the importance of responsible investment strategies.

The cryptocurrency market is notoriously volatile, susceptible to dramatic price swings driven by a complex interplay of factors. These fluctuations can be amplified by the relatively small size of the market compared to traditional asset classes, making it more prone to manipulation and speculative bubbles. Furthermore, the lack of robust regulatory frameworks across different jurisdictions adds another layer of complexity and uncertainty.

Key Risks and Uncertainties in Bitcoin Price Prediction

Long-term Bitcoin price predictions face considerable challenges due to the inherent volatility of the cryptocurrency market and the influence of external factors. Regulatory changes, technological advancements, and macroeconomic conditions can all significantly impact Bitcoin’s price. For example, a sudden, unexpected crackdown on cryptocurrency trading in a major global economy could trigger a sharp price decline. Conversely, widespread adoption by institutional investors could drive a substantial price increase. The lack of a clear correlation between Bitcoin’s price and traditional economic indicators further complicates accurate forecasting.

Black Swan Events

Predicting “black swan” events – highly improbable but potentially high-impact occurrences – is impossible. However, considering their potential influence is crucial. Examples of such events include: a major security breach compromising the Bitcoin network, a significant regulatory shift leading to a complete ban on Bitcoin in multiple countries, or a sudden and unforeseen technological disruption rendering Bitcoin obsolete. These events, while unlikely, could dramatically alter the Bitcoin landscape and significantly affect its price. The 2008 global financial crisis serves as a stark reminder of the potential for unforeseen events to dramatically reshape financial markets.

Limitations of Price Prediction Models

Various models, from technical analysis to fundamental valuation approaches, attempt to predict Bitcoin’s price. However, these models rely on historical data and assumptions that may not hold true in the future. Bitcoin’s relatively short history limits the reliability of historical data-driven models. Furthermore, the influence of unpredictable factors, such as social media sentiment and regulatory actions, makes it challenging to accurately incorporate all relevant variables into these models. Over-reliance on any single model for long-term predictions is therefore ill-advised.

Importance of Diversification and Risk Management

Given the inherent risks and uncertainties associated with Bitcoin, diversification and robust risk management are essential components of any investment strategy. Diversifying investments across different asset classes, including stocks, bonds, and real estate, can help mitigate the impact of potential losses in the Bitcoin market. Setting clear investment goals, defining acceptable risk levels, and establishing stop-loss orders are vital for managing risk effectively. Investors should only allocate capital they are prepared to lose entirely, understanding that the Bitcoin market is highly speculative.

Disclaimer and Conclusion

It is crucial to understand that predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is exceptionally volatile and influenced by a multitude of interconnected factors, many of which are unpredictable. Any price prediction, including the ones discussed in this analysis, should be viewed with extreme caution and should not be considered financial advice. Investing in Bitcoin carries significant risk, and you could lose some or all of your investment. This analysis aims to provide insights based on current trends and market analysis, but it does not guarantee future performance.

This analysis explored potential Bitcoin price scenarios for January 27th, 2025, considering various factors impacting its value. We examined historical price trends, technological advancements, regulatory developments, macroeconomic conditions, and investor sentiment. Different potential price scenarios were presented, ranging from optimistic to pessimistic outlooks, highlighting the significant uncertainty involved. The analysis also underscored the importance of understanding the risks associated with Bitcoin investment.

Key Findings and Insights

The following points summarize the key findings and insights from our analysis:

- Bitcoin’s price is highly volatile and subject to significant fluctuations.

- Several factors, including technological advancements, regulatory changes, macroeconomic conditions, and investor sentiment, influence Bitcoin’s price.

- Predicting Bitcoin’s price with certainty is impossible due to the inherent volatility and complexity of the cryptocurrency market.

- Various potential price scenarios for January 27th, 2025, were presented, ranging from a significantly higher price to a lower price than the current value, depending on the interplay of the influencing factors.

- Investing in Bitcoin involves substantial risk, and investors should be prepared for potential losses.

FAQ

This section addresses frequently asked questions regarding Bitcoin price predictions for January 27, 2025. Understanding the factors influencing Bitcoin’s price and the inherent risks is crucial for informed investment decisions.

Major Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely shape Bitcoin’s price in 2025. These include macroeconomic conditions (e.g., inflation rates, global economic growth), regulatory developments (e.g., government policies on cryptocurrencies), technological advancements (e.g., scaling solutions, new applications), and market sentiment (e.g., investor confidence, media coverage). The interplay of these factors makes accurate prediction extremely challenging. For example, a period of high inflation could drive demand for Bitcoin as a hedge against inflation, pushing the price upwards. Conversely, stricter regulations could dampen investor enthusiasm and lower the price.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently difficult, bordering on impossible. Bitcoin’s price is highly volatile and susceptible to unpredictable events. Unlike traditional assets with established valuation models, Bitcoin’s value is largely driven by speculative demand and market sentiment. Past price movements offer limited predictive power due to the constantly evolving landscape of regulatory changes, technological advancements, and overall market dynamics. Attempts to predict future prices should be viewed with extreme caution. For example, predictions made in 2017 about Bitcoin’s price in 2020 proved drastically inaccurate due to unforeseen market corrections and regulatory changes.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. The most prominent is its extreme volatility. Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Other risks include regulatory uncertainty, security breaches (e.g., exchange hacks), and the potential for complete market collapse. Furthermore, Bitcoin’s decentralized nature means there is no central authority to protect investors from fraud or market manipulation. The high volatility makes it unsuitable for risk-averse investors. For example, the Bitcoin price crash of 2022 demonstrated the potential for significant and rapid losses.

Considerations Before Investing in Bitcoin

Before investing in Bitcoin, investors should carefully assess their risk tolerance, investment goals, and financial situation. It’s crucial to only invest what you can afford to lose. Thorough research into Bitcoin’s technology, market dynamics, and associated risks is essential. Diversification of your investment portfolio is strongly recommended to mitigate the risks associated with Bitcoin’s volatility. Consulting with a qualified financial advisor can provide personalized guidance based on your individual circumstances. Furthermore, understanding the complexities of cryptocurrency wallets and secure storage practices is crucial to minimize the risk of theft or loss.

Bitcoin Price Prediction For 27 January 2025 – Predicting the Bitcoin price for January 27th, 2025, is inherently speculative, but considering the upcoming halving, it’s a crucial factor. Many analysts base their forecasts on the impact of this event, referencing models like the one detailed in the Plan B Bitcoin Halving 2025 Prediction to understand potential price movements. Ultimately, the Bitcoin price on that date will depend on various market forces beyond any single prediction.

Predicting the Bitcoin price for January 27th, 2025, is inherently speculative, but a significant factor to consider is the impact of the upcoming halving. Understanding the potential consequences of this event is crucial for any accurate prediction, which is why researching resources like The Bitcoin Halving 2025 is highly recommended. Ultimately, the halving’s effect on scarcity and potential price increase will heavily influence the Bitcoin price prediction for that date.

Predicting the Bitcoin price for January 27th, 2025, is inherently speculative, but examining broader predictions can offer context. For a glimpse into community sentiment and various forecasts for the entire year, you might find the discussions on Bitcoin 2025 Prediction Reddit helpful. Returning to the specific date, however, requires acknowledging that numerous factors could influence Bitcoin’s value by then.

Accurately predicting the Bitcoin price for January 27, 2025, is challenging, but a key factor to consider is the upcoming Bitcoin Halving. Understanding the potential impact requires examining the projected date of this event, which you can find detailed information on at Bitcoin Halving 2025 Date Prediction. This halving’s influence on Bitcoin’s scarcity and subsequent price movements will significantly affect the prediction for January 27, 2025.

Predicting the Bitcoin price for January 27th, 2025, is inherently challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the historical correlation between Bitcoin halvings and subsequent price increases is crucial; for insightful analysis on this, check out the comprehensive resource on the Prossimo Halving Bitcoin 2025. This information will help refine any price prediction model for January 2025, considering the anticipated scarcity effect of the reduced block reward.

Predicting the Bitcoin price for January 27th, 2025, requires considering various factors, including market trends and technological advancements. To gain a broader perspective on potential price movements, examining longer-term predictions is helpful; for instance, you might find the insights in this Bitcoin May 2025 Price Prediction article valuable. Ultimately, any Bitcoin price prediction, whether for January 2025 or May 2025, remains speculative and depends on numerous unpredictable influences.

Predicting the Bitcoin price for January 27th, 2025, is challenging, involving numerous market factors. To effectively reach potential investors interested in this prediction, a robust marketing strategy is crucial; consider setting up a targeted Google Ads campaign via a Google Ads Account to maximize your reach. This allows you to refine your audience and focus on those specifically searching for Bitcoin price predictions for that date.

Accurate forecasting remains difficult, but effective advertising can certainly improve visibility.