2025 Bitcoin Halving

The 2025 Bitcoin halving, anticipated to occur in the spring, is a significant event in the cryptocurrency’s lifecycle. This event, where the reward for Bitcoin miners is cut in half, historically has preceded periods of substantial price volatility. Analyzing past halvings and considering current market conditions allows for a reasoned projection of potential market impacts.

Bitcoin Price Movement Following the 2025 Halving

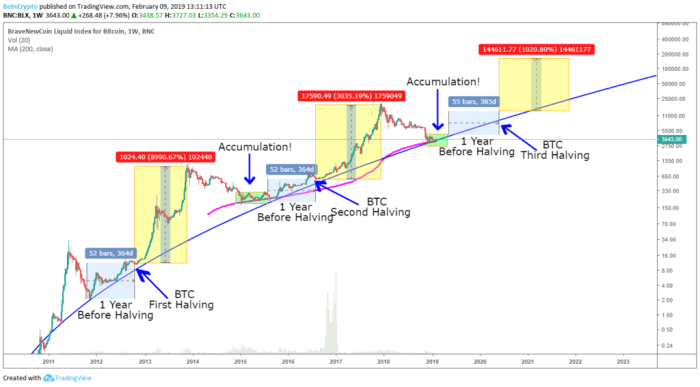

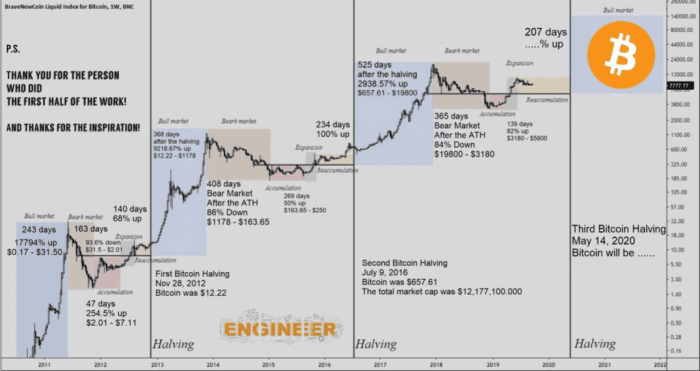

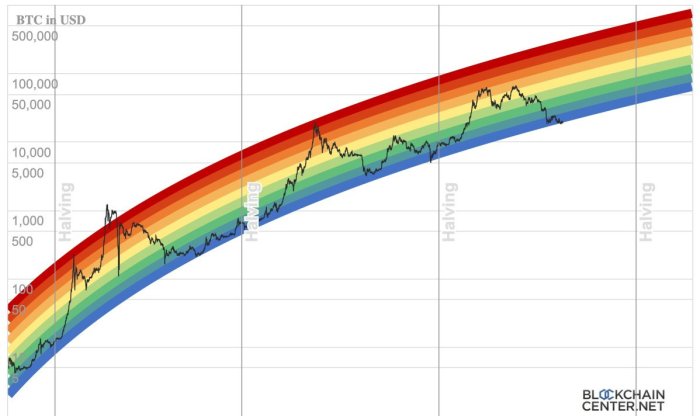

Predicting the precise price movement of Bitcoin following any halving is inherently challenging due to the complex interplay of factors influencing the market. However, historical data provides a useful framework. The previous halvings in 2012, 2016, and 2020 each saw periods of price appreciation following the event, although the timing and magnitude of these increases varied considerably. The 2012 halving was followed by a gradual price increase, while the 2016 halving led to a more dramatic surge, and the 2020 halving resulted in a significant price rally before a subsequent correction. For 2025, several scenarios are possible, ranging from a moderate price increase mirroring the 2012 event to a more pronounced rally similar to 2016 or 2020, albeit influenced by prevailing macroeconomic conditions. A conservative prediction might see a gradual price increase over a period of 12-18 months post-halving, while a more bullish scenario could see a steeper, albeit potentially more volatile, rise. The ultimate price trajectory will depend heavily on factors such as regulatory clarity, institutional adoption, and overall market sentiment.

Impact on Mining Difficulty and Hash Rate

The halving directly impacts Bitcoin miners’ profitability by reducing their block rewards. This typically leads to an increase in mining difficulty as miners compete for the reduced rewards. The network’s hash rate – a measure of its computational power – may initially see a dip as less profitable miners exit the network. However, historically, the hash rate has recovered and often exceeded previous levels as the price of Bitcoin increases, attracting new miners and incentivizing existing ones to remain active. The 2025 halving is likely to follow a similar pattern, with a potential temporary dip in hash rate followed by a recovery and growth as Bitcoin’s price potentially rises. The exact extent of these changes will depend on the price of Bitcoin and the cost of energy for miners.

Comparative Analysis of Previous Halving Events, 2025 Bitcoin Halving Prediction

| Halving Year | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) | Price Change Percentage | Notes |

|---|---|---|---|---|

| 2012 | $12 | $13 | +8% | Gradual price increase |

| 2016 | $650 | $900 | +38% | Significant price surge |

| 2020 | $9000 | $29000 | +222% | Significant price rally followed by correction |

It’s crucial to remember that these figures represent past performance and are not indicative of future results. The 2025 halving will likely unfold within a very different macroeconomic environment than those of previous halvings.

Influence of Macroeconomic Factors

Global economic conditions, including inflation rates, interest rate policies, and geopolitical events, significantly influence Bitcoin’s price. The lead-up to the 2025 halving will likely see Bitcoin’s price impacted by prevailing macroeconomic trends. For instance, persistent inflation might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, aggressive interest rate hikes by central banks could reduce investor appetite for riskier assets like Bitcoin, potentially suppressing its price. Geopolitical instability could also impact Bitcoin’s price, potentially driving investors towards its perceived safe-haven qualities. The interplay of these macroeconomic factors will significantly shape the market environment surrounding the 2025 halving and influence its ultimate impact on Bitcoin’s price.

Halving’s Influence on Bitcoin Supply and Demand

The Bitcoin halving, a programmed event occurring approximately every four years, significantly impacts the cryptocurrency’s supply and, consequently, its price. This reduction in the rate of new Bitcoin entering circulation interacts with existing demand to create potentially volatile market conditions. Understanding this interplay is crucial for navigating the cryptocurrency landscape.

The Bitcoin halving mechanism reduces the reward miners receive for validating transactions on the blockchain. Before the first halving, miners received 50 BTC per block. After each halving, this reward is cut in half. This means that the rate at which new Bitcoin is added to the circulating supply decreases, creating a controlled scarcity. This controlled deflationary characteristic is a core element of Bitcoin’s design and is intended to mimic the properties of precious metals like gold.

Impact of Reduced Supply on Price

A decrease in the supply of Bitcoin, all else being equal, should increase its price. This is a fundamental principle of economics: when demand remains constant or increases while supply decreases, the price rises to balance the market. However, the actual price movement is complex and influenced by numerous factors beyond just supply. Market sentiment, regulatory changes, technological advancements, and macroeconomic conditions all play a significant role. For instance, the 2012 halving saw a relatively gradual price increase, while the 2016 halving led to a more pronounced price surge. The 2020 halving, occurring amidst a global pandemic and increased institutional interest, resulted in a substantial price increase, demonstrating the influence of external factors.

Comparison of Previous Halvings

Analyzing previous halvings provides valuable insights. The first halving in 2012 saw the block reward decrease from 50 BTC to 25 BTC. While the price did increase following this event, the rise was gradual and less dramatic compared to subsequent halvings. The 2016 halving, which reduced the reward to 12.5 BTC, witnessed a more significant price increase over a longer period. The 2020 halving, resulting in a 6.25 BTC block reward, saw a rapid and substantial price surge, but also subsequent periods of correction. Comparing these events highlights the interplay of the halving’s impact on supply with other market forces.

Projected Supply and Demand Curves Post-2025 Halving

A simplified model can illustrate the projected changes. Imagine a supply curve that shifts to the left after the 2025 halving, reflecting the reduced rate of new Bitcoin entering circulation. Simultaneously, the demand curve could shift to the right if investor confidence and adoption continue to grow. The intersection of these curves determines the equilibrium price. If the demand curve shifts more significantly than the supply curve, a substantial price increase is likely. However, if demand growth is less pronounced, the price increase could be more moderate or even experience periods of consolidation or decline due to various market forces beyond just supply and demand. This model is a simplification, as real-world dynamics are far more complex. For example, a significant influx of new investors could drastically alter the demand curve, while unexpected regulatory changes could impact both supply and demand. Past halvings demonstrate the difficulty of accurately predicting the precise price movements.

Miner Behavior and Hash Rate Post-Halving: 2025 Bitcoin Halving Prediction

The Bitcoin halving, a programmed event reducing the block reward miners receive, significantly impacts their profitability and consequently, the network’s hash rate. Understanding miner behavior post-halving is crucial for predicting Bitcoin’s price and network security. The 2025 halving will likely trigger various responses from miners, leading to potential scenarios for the network’s overall health.

The halving directly cuts the Bitcoin reward miners receive for successfully adding blocks to the blockchain in half. This immediately reduces their revenue stream. Miners assess their profitability based on the block reward, transaction fees, and the cost of electricity and equipment. A halving necessitates miners to re-evaluate their operational efficiency and potentially adjust their strategies to maintain profitability. Some miners may choose to upgrade their equipment to improve efficiency, others may consolidate operations, and some may shut down entirely if their operational costs exceed their revenue.

Miner Profitability and Responses to the Halving

The profitability of Bitcoin mining is a delicate balance between the revenue generated from block rewards and transaction fees, and the operational costs including electricity, hardware maintenance, and infrastructure. The 2025 halving will likely cause a period of reduced profitability for many miners. This could lead to several responses: Some larger, more efficient mining operations may weather the storm by optimizing their energy consumption and potentially consolidating with other operations to benefit from economies of scale. Smaller, less efficient miners, however, may find it increasingly difficult to operate profitably and could be forced to shut down, leading to a reduction in the network’s overall hash rate. This could also lead to increased consolidation within the mining industry, with larger players acquiring the assets of smaller, less profitable operations. The price of Bitcoin itself will play a significant role; a price increase post-halving could offset the reduced block reward and maintain profitability for many miners.

Potential Scenarios for Bitcoin Hash Rate

Following the 2025 halving, several scenarios are plausible regarding the Bitcoin network’s hash rate. A temporary decline is highly probable as less profitable miners cease operations. However, the extent of this decline will depend on several factors including the Bitcoin price, the efficiency of existing mining operations, and the availability of cheaper energy sources. Historically, the hash rate has generally recovered after previous halvings, sometimes exceeding pre-halving levels. This recovery is often attributed to the entrance of new, more efficient miners, and the anticipation of future price increases. A sustained increase in Bitcoin’s price post-halving could significantly boost profitability, attracting new miners and offsetting the initial decline. Conversely, a prolonged period of low Bitcoin prices could lead to a more prolonged and significant drop in hash rate, potentially impacting the network’s security.

The Role of Mining Pools

Mining pools play a crucial role in maintaining the stability of the Bitcoin network. They aggregate the computing power of numerous individual miners, increasing their chances of successfully mining a block and earning the reward. Following a halving, the reduced profitability could lead to increased consolidation within mining pools, with smaller pools merging to increase their efficiency and competitiveness. Larger, more established pools are likely to be better positioned to weather the reduced profitability, potentially gaining market share. The concentration of hash rate within fewer pools could raise concerns about centralization, although this risk is mitigated by the decentralized nature of the Bitcoin protocol itself. The ability of large mining pools to adapt and maintain operations post-halving will be a key factor in maintaining the network’s overall security and stability.

Impact on Different Miner Types

The 2025 halving will differentially impact large-scale and small-scale miners. Large-scale operations, with their economies of scale and access to cheaper energy, are better positioned to withstand the reduced profitability. They can leverage their existing infrastructure and potentially upgrade their equipment to further enhance efficiency. In contrast, small-scale miners, often operating with less efficient hardware and higher energy costs, will likely face greater challenges. Many may find it unsustainable to continue operating profitably, leading to their exit from the market. This disparity could lead to a further consolidation of the mining industry, with larger players dominating the landscape. The 2012 and 2016 halvings provide examples of this trend, with a significant increase in the market share of larger mining operations following each event. This concentration of mining power, while potentially raising centralization concerns, also arguably enhances network security through improved efficiency and resilience.

2025 Bitcoin Halving Prediction – Predicting the Bitcoin price after the 2025 halving is a complex endeavor, relying heavily on various market factors. To gain a clearer understanding of the historical data surrounding previous halvings and their impact, it’s beneficial to consult resources like Halving Bitcoin 2025 Data. Analyzing this data allows for a more informed prediction of potential price movements following the 2025 halving event.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous factors beyond the reduced block reward. To gain a clearer understanding of potential price movements, analyzing resources dedicated to this specific topic is crucial. For detailed predictions and market analysis, check out this comprehensive report on Bitcoin Halving 2025 Price Prediction.

Ultimately, the 2025 Bitcoin halving’s impact remains a subject of ongoing discussion and speculation within the crypto community.

Predicting the market impact of the 2025 Bitcoin halving is a complex undertaking, with many analysts offering diverse opinions. A key aspect of this prediction hinges on knowing the precise date of the event; to find out, check this helpful resource: When Is Next Bitcoin Halving 2025. Understanding the timing is crucial for accurately forecasting the potential price fluctuations and overall market behavior following the 2025 Bitcoin halving.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, with various analysts offering diverse opinions. Understanding the impact of this event requires considering the halving’s effect on Bitcoin’s supply, which inevitably leads to discussions about the next halving. For a detailed look at what to expect after 2025, you might find this resource helpful: Next Bitcoin Halving After 2025.

Ultimately, the 2025 halving’s influence will be determined by a confluence of factors, making accurate prediction challenging.

Predictions for the 2025 Bitcoin halving are varied, with some anticipating a significant price increase due to reduced supply. To fully understand the implications, it’s helpful to review the fundamentals; a good resource for this is Que Es El Halving Bitcoin 2025 , which clearly explains the halving mechanism. Understanding this mechanism is crucial for informed speculation on the 2025 Bitcoin Halving Prediction and its potential market impact.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous factors beyond the reduced block reward. Understanding the historical impact of previous halvings is crucial for informed speculation, and a key resource for this is exploring the potential price movements; you can find insightful analysis on this topic at Bitcoin Price Next Halving 2025.

Ultimately, the 2025 Bitcoin Halving Prediction remains a subject of ongoing debate and analysis within the cryptocurrency community.