2025 Bitcoin Halving

The 2025 Bitcoin halving, scheduled for sometime in April, represents a significant event in the cryptocurrency’s lifecycle. This event, occurring approximately every four years, reduces the rate at which new Bitcoins are created, effectively decreasing the supply entering the market. This mechanism, embedded within Bitcoin’s code, is designed to control inflation and maintain its scarcity. Understanding its mechanics and potential impact is crucial for navigating the cryptocurrency landscape.

Bitcoin Halving Mechanics and Historical Price Impact, 2025 Halving Bitcoin

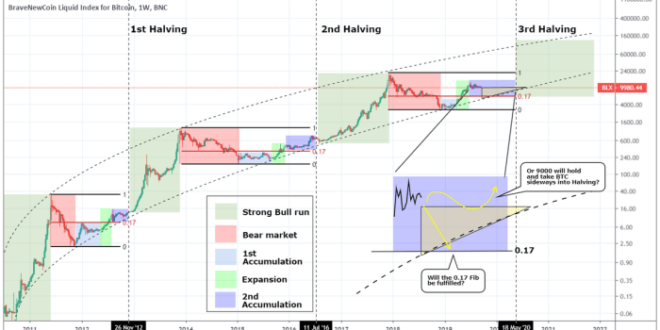

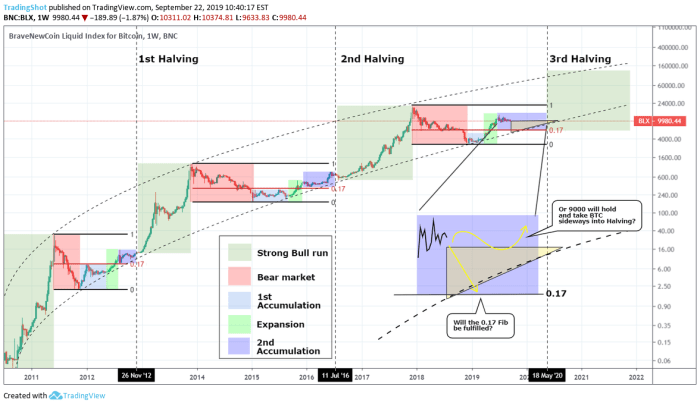

The Bitcoin halving cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding new blocks to the blockchain, in half. Historically, this has led to periods of price appreciation, although the magnitude and duration of these price increases have varied. The first halving in 2012 saw a relatively modest price increase, while the 2016 halving preceded a substantial bull market. The 2020 halving also resulted in significant price appreciation, although this was followed by a period of market correction. These historical patterns suggest a potential correlation between halving events and price increases, though it’s crucial to remember that numerous other factors influence Bitcoin’s price. The exact impact of the 2025 halving remains uncertain, influenced by a confluence of economic and market conditions.

Potential Price Scenarios After the 2025 Halving

Several scenarios are possible following the 2025 halving. A bullish scenario anticipates increased demand due to reduced supply, potentially driving the price significantly higher. This would mirror the price surges observed after previous halvings, albeit potentially at a different scale depending on prevailing market sentiment and macroeconomic conditions. A neutral scenario suggests that the price may experience moderate growth or remain relatively stable, with the halving’s impact offset by other market forces. A bearish scenario considers the possibility of a price decline, potentially driven by factors like a broader economic downturn or negative regulatory developments. The actual outcome will likely depend on the interplay of these various forces. For example, a strong macroeconomic environment could mitigate the impact of reduced supply, while a weak environment could exacerbate it.

Comparison with Previous Halving Events

While each halving event shares the commonality of reducing the block reward, the market conditions surrounding each have differed significantly. The 2012 halving occurred during Bitcoin’s early stages, with relatively low adoption and market capitalization. The 2016 halving occurred during a period of growing institutional interest and mainstream awareness. The 2020 halving coincided with the beginning of the DeFi boom and increased global uncertainty related to the pandemic. The 2025 halving will occur in a market shaped by evolving regulatory landscapes, increasing institutional adoption, and continued macroeconomic volatility. This highlights the importance of considering the unique context of each halving event when making predictions.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation, recessionary pressures, and geopolitical events, will significantly influence Bitcoin’s price trajectory leading up to and following the 2025 halving. High inflation, for instance, might drive investors towards Bitcoin as a hedge against inflation, boosting its price. Conversely, a recession could lead to risk-averse behavior, potentially depressing Bitcoin’s price, as investors may sell assets to secure cash. Global geopolitical instability could also introduce volatility into the market, making price prediction even more challenging. The interplay between these macroeconomic factors and the halving event will determine the ultimate impact on Bitcoin’s price. For instance, a global recession coupled with increased regulatory scrutiny could negate the bullish effects typically associated with a halving.

Timeline of Key Events

A simplified timeline could include:

- Q4 2024 – Q1 2025: Increasing anticipation of the halving, potentially leading to price increases based on speculative trading.

- April 2025: Bitcoin halving event occurs.

- Q2 2025 – Q4 2025: Initial market reaction to the halving. Potential price increase or consolidation depending on market sentiment and macroeconomic conditions.

- 2026 Onwards: Long-term price trajectory influenced by the halving’s impact and prevailing market dynamics. The reduced inflation rate resulting from the halving may contribute to long-term price stability.

Note that this is a highly simplified representation, and the actual timeline and price fluctuations may differ significantly. The price movements depicted here are hypothetical and should not be considered financial advice.

Bitcoin Mining After the 2025 Halving: 2025 Halving Bitcoin

The 2025 Bitcoin halving, reducing the block reward miners receive by half, will significantly impact the Bitcoin mining ecosystem. This event will trigger a cascade of effects, influencing profitability, mining hardware, energy consumption, decentralization, and the strategies employed by miners to maintain operations. Understanding these potential changes is crucial for assessing the future of Bitcoin’s security and sustainability.

Impact on Mining Profitability and Hash Rate

The halving directly reduces the primary revenue stream for Bitcoin miners. With fewer newly minted Bitcoins awarded per block, miners’ profitability hinges on the Bitcoin price remaining sufficiently high to offset the reduced reward. If the price doesn’t rise proportionally, many less profitable miners will be forced to shut down, leading to a decrease in the overall network hash rate. This drop in hash rate could temporarily weaken the network’s security, making it potentially more vulnerable to attacks. Historically, Bitcoin price has often increased following halvings, but this is not guaranteed. For example, the 2016 halving saw a period of relatively flat pricing before a significant price surge later on.

Changes in Mining Hardware and Techniques

To remain profitable in the post-halving environment, miners will likely adopt more energy-efficient mining hardware and refine their mining techniques. This could involve upgrading to the latest generation of ASICs (Application-Specific Integrated Circuits), which offer improved hashing power per watt. Additionally, miners may optimize their operations by improving cooling systems, leveraging renewable energy sources, or employing more sophisticated mining pool strategies to maximize efficiency and share resources. The development of new, more efficient ASICs is a continuous process, driven by the constant competition within the mining industry. We might see a shift towards even more specialized hardware designed to maximize performance within the constraints of the reduced block reward.

Energy Consumption and Environmental Impact

Bitcoin mining consumes a considerable amount of energy. The halving, by potentially reducing the number of active miners, could lead to a decrease in overall energy consumption. However, this effect is not guaranteed. The introduction of more energy-efficient hardware could offset any reduction in the number of miners, potentially leading to a stable or even slightly increasing energy footprint. The environmental impact depends heavily on the energy sources used by miners. A shift towards renewable energy sources, such as solar or hydroelectric power, could mitigate the negative environmental consequences. Conversely, reliance on fossil fuels would exacerbate the issue. The environmental impact of Bitcoin mining is a complex and ongoing debate.

Impact on Decentralization of Bitcoin Mining

The halving could impact the decentralization of Bitcoin mining. Smaller, less efficient mining operations may be forced to shut down due to reduced profitability, potentially concentrating mining power in the hands of larger, more well-funded entities. This could lead to a less geographically diverse and potentially more centralized mining landscape. However, the development of more energy-efficient hardware could allow smaller miners to compete more effectively. Furthermore, the emergence of new mining pools or the adoption of alternative mining strategies might help to maintain a degree of decentralization. The balance between centralization and decentralization after the halving remains a subject of ongoing discussion and analysis.

Miner Adaptation Strategies

Miners will need to employ various strategies to adapt to the reduced profitability. These strategies might include: diversifying revenue streams by offering other services alongside mining, such as hosting or providing cloud mining services; improving operational efficiency to reduce costs; focusing on renewable energy sources to lower electricity expenses; and forming larger mining pools to share resources and reduce individual risk. Some miners might also choose to temporarily suspend operations until the Bitcoin price increases or more efficient hardware becomes available. The success of these strategies will largely depend on individual circumstances and the overall market conditions.

Investor Sentiment and Market Speculation

The 2025 Bitcoin halving is a significant event anticipated to impact investor sentiment and trigger considerable market speculation. The reduced supply of newly mined Bitcoin, coupled with existing demand, is expected to influence price movements, creating both opportunities and risks for investors. Understanding the prevailing sentiment, potential manipulations, and key indicators is crucial for navigating this period.

Investor Sentiment Surrounding the 2025 Halving

Prevailing investor sentiment leading up to the 2025 halving is a complex interplay of optimism, skepticism, and fear. Historically, halvings have preceded periods of significant price appreciation, fueling bullish expectations. However, macroeconomic factors, regulatory uncertainty, and general market volatility can temper this optimism. Many investors believe the halving will act as a significant catalyst for price increases, while others remain cautious, citing potential for market manipulation and unforeseen external events. This divergence in opinion creates a dynamic and potentially volatile market environment.

Potential Market Manipulations and Price Volatility

The period surrounding the halving is often characterized by increased price volatility, potentially exacerbated by market manipulation. Large holders, or “whales,” may strategically accumulate Bitcoin before the halving, driving up prices, and then sell off their holdings afterward, leading to a price correction. This type of manipulation is difficult to definitively prove but is a concern among investors. Furthermore, coordinated efforts to spread misinformation or create artificial demand can also influence price movements. The 2012 and 2016 halvings saw periods of both significant price increases and subsequent corrections, illustrating the potential for volatility.

Key Indicators for Assessing Bitcoin’s Value Post-Halving

Investors utilize various metrics to assess Bitcoin’s value after the halving. These include on-chain metrics such as the Miner Revenue, which is expected to decrease post-halving, and the difficulty adjustment, which reflects the computational power securing the network. The price-to-mining-cost ratio provides insights into the profitability of mining and can influence the overall market sentiment. Off-chain factors, such as adoption rates by institutions and governments, and the overall macroeconomic environment, also play a significant role in determining Bitcoin’s long-term value.

Influence of Social Media and News Coverage on Investor Sentiment

Social media platforms and traditional news outlets significantly influence investor sentiment regarding the halving. Positive news coverage and social media hype can amplify bullish sentiment, driving up prices. Conversely, negative news or FUD (fear, uncertainty, and doubt) can trigger sell-offs. Analyzing the sentiment expressed on social media, using tools that track mentions and sentiment scores, can provide insights into the overall market mood. However, it’s important to be aware that social media can be easily manipulated and doesn’t always reflect accurate market information.

Comparison of Different Investment Strategies

Investors employ various strategies in anticipation of the halving. Some adopt a “buy and hold” strategy, believing in Bitcoin’s long-term value regardless of short-term fluctuations. Others employ dollar-cost averaging (DCA), investing a fixed amount regularly to mitigate risk. More sophisticated strategies involve technical analysis, identifying potential support and resistance levels, and utilizing derivatives like futures and options to hedge against risk or amplify potential gains. The optimal strategy depends on an investor’s risk tolerance, time horizon, and understanding of the market. For example, a risk-averse investor with a long-term horizon might favor DCA, while a more aggressive investor might leverage futures contracts to speculate on price movements.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, presents a pivotal moment with potentially profound long-term consequences for Bitcoin’s adoption, technological development, market position, and regulatory environment. Understanding these implications is crucial for investors, developers, and regulators alike.

Bitcoin’s adoption and market position will likely be significantly impacted. Historically, halvings have preceded periods of increased price volatility and, in some cases, substantial price appreciation. This is primarily attributed to the decreased supply of newly minted Bitcoin, potentially increasing its scarcity value and driving demand. However, the impact on adoption is less direct. While a price increase could boost interest and attract new users, broader adoption hinges on factors like usability, regulatory clarity, and the development of user-friendly applications. A more likely scenario is a gradual increase in adoption, fueled by continued technological advancements and growing institutional acceptance.

Bitcoin’s Technological Advancement

The halving’s impact on Bitcoin’s technological development is less immediate but potentially transformative. The reduced block reward necessitates miners to focus on efficiency and scalability solutions. This could accelerate the development and adoption of more energy-efficient mining hardware and software, as well as innovations aimed at improving transaction throughput and reducing fees. For instance, the development of the Lightning Network, a second-layer scaling solution, is likely to gain further momentum as miners seek to maximize their revenue in a lower-reward environment. The pressure to optimize mining operations could also drive innovation in renewable energy sources for Bitcoin mining, leading to a more sustainable ecosystem.

Bitcoin’s Long-Term Prospects Compared to Other Cryptocurrencies

The halving’s impact on Bitcoin’s position relative to other cryptocurrencies is complex. While Bitcoin’s established network effect and brand recognition provide a significant advantage, competing cryptocurrencies with faster transaction speeds, lower fees, or innovative functionalities could attract investors and users. However, Bitcoin’s inherent scarcity, established security, and strong community support continue to serve as powerful differentiators. The long-term success will depend on Bitcoin’s ability to adapt and innovate while maintaining its core principles of decentralization and security. Altcoins might experience short-term gains from the volatility surrounding the halving, but Bitcoin’s long-term value proposition remains strong. Ethereum, for example, with its smart contract capabilities, presents a different value proposition and is not directly comparable.

Regulatory Landscape Changes

The 2025 halving is unlikely to directly trigger significant regulatory changes, but it could indirectly influence the regulatory landscape. Increased price volatility following the halving might prompt regulatory bodies to intensify their scrutiny of the cryptocurrency market, potentially leading to stricter regulations on trading, taxation, or anti-money laundering measures. Conversely, the growing institutional adoption of Bitcoin could also encourage regulators to develop more nuanced and supportive frameworks, aiming to balance innovation with risk mitigation. The regulatory environment will likely remain dynamic, with jurisdictions adopting diverse approaches based on their economic and political contexts. The example of the European Union’s Markets in Crypto-Assets (MiCA) regulation demonstrates the evolving landscape.

A Potential Scenario for the Bitcoin Ecosystem

In the years following the 2025 halving, a plausible scenario involves a combination of factors. Increased price volatility in the short term could be followed by a period of consolidation, with price finding a new equilibrium. The demand for Bitcoin could continue to grow, driven by institutional adoption and increasing awareness among retail investors. Technological advancements, particularly in scaling solutions like the Lightning Network, could improve the user experience and broaden adoption. Regulations could become more defined, creating a more stable and predictable environment for businesses operating in the Bitcoin ecosystem. This scenario, however, is not guaranteed and depends on various interconnected factors, including global macroeconomic conditions, technological breakthroughs, and regulatory developments. A contrasting scenario could involve a prolonged period of price stagnation or even decline, should negative macroeconomic factors prevail.