Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and significantly impacts the supply and demand dynamics of the cryptocurrency. Understanding the mechanics and historical impact of this event is crucial for navigating the potential market fluctuations surrounding the April 2025 halving.

Bitcoin Halving Mechanics and Historical Impact

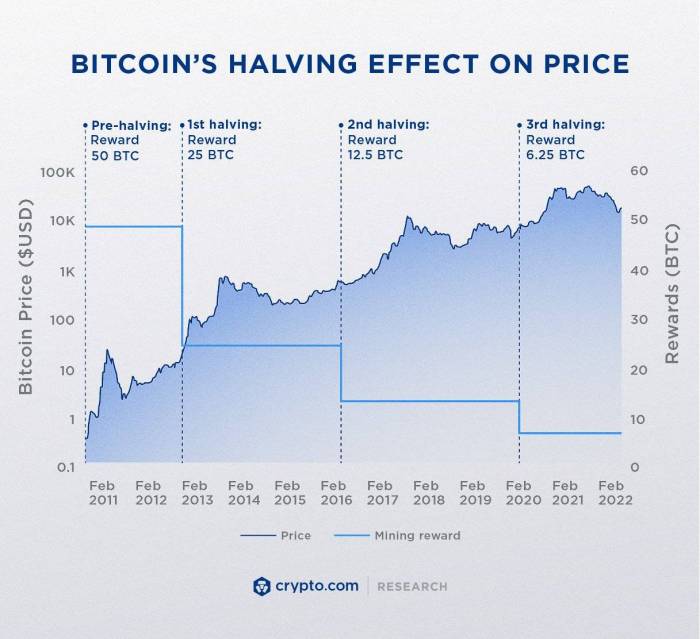

The Bitcoin halving mechanism is designed to control inflation. Every halving cuts the block reward – the amount of Bitcoin awarded to miners for successfully adding a block of transactions to the blockchain – in half. Initially, the block reward was 50 BTC. After the first halving in November 2012, it dropped to 25 BTC, then 12.5 BTC in July 2016, and currently stands at 6.25 BTC. Historically, halvings have been followed by periods of increased Bitcoin price appreciation, though the extent and duration of these price increases have varied. This correlation isn’t guaranteed, and other market factors significantly influence Bitcoin’s price. The halving itself doesn’t directly cause price increases, but it creates a predictable scarcity that can influence market sentiment.

Anticipated Effects of the April 2025 Halving on Supply and Demand

The April 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in new Bitcoin entering circulation is expected to tighten the supply, potentially increasing demand if the overall market sentiment remains positive or even neutral. The scarcity of newly mined Bitcoin could lead to upward price pressure, especially if demand remains strong or increases. However, it’s important to remember that numerous factors beyond the halving – macroeconomic conditions, regulatory changes, technological advancements, and overall market sentiment – will significantly influence the actual price movement. The 2012 and 2016 halvings were followed by significant price increases, but the market conditions then were quite different from what we expect in 2025.

Potential Consequences for Bitcoin Miners Following the Halving

The halving directly impacts Bitcoin miners’ profitability. With a reduced block reward, miners’ revenue per block decreases. This could lead to several consequences: some less profitable miners might be forced to shut down operations, increasing the hashrate concentration amongst larger mining operations. Others might adapt by increasing efficiency, improving their mining hardware, or seeking cheaper energy sources. The overall effect on the network’s security could be a decrease in the hashrate in the short term, followed by a period of consolidation and potential increase as miners adapt. The long-term impact will depend on the interplay of various factors, including Bitcoin’s price, energy costs, and technological advancements in mining hardware.

Timeline of Past Bitcoin Halvings and Market Trends

| Halving Date | Block Reward (BTC) | Approximate Bitcoin Price Before Halving (USD) | Approximate Bitcoin Price 1 Year After Halving (USD) | Market Trends |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC to 25 BTC | ~13 USD | ~100 USD | Significant price increase following the halving, though it took some time to manifest fully. |

| July 9, 2016 | 25 BTC to 12.5 BTC | ~650 USD | ~2000 USD | A substantial price increase occurred after the halving, but the market experienced some volatility before reaching its peak. |

| May 11, 2020 | 12.5 BTC to 6.25 BTC | ~8700 USD | ~10,000 USD (initially) then a significant bull run to ~$64,000 in 2021 | A rapid price increase followed the halving, leading to a major bull market. This is notable as the increase was not immediate but happened over time. |

Market Predictions and Price Speculation

The Bitcoin halving in April 2025 is a significant event expected to impact the cryptocurrency’s price. Numerous analysts and commentators have offered diverse predictions, ranging from wildly optimistic to cautiously pessimistic. Understanding these predictions and the factors driving them is crucial for navigating the potentially volatile market leading up to and following the halving.

Predicting Bitcoin’s price is inherently challenging due to the cryptocurrency’s unique characteristics and susceptibility to various internal and external factors. While historical data from previous halvings provides some insight, the current macroeconomic climate and regulatory landscape add layers of complexity that make definitive predictions impossible.

Diverse Price Predictions for Bitcoin’s Halving

A wide range of price predictions for Bitcoin surrounds the April 2025 halving. Some analysts predict a significant price surge, possibly exceeding $100,000 or even higher, driven by the reduced supply of newly mined Bitcoin. Others, however, forecast a more moderate price increase or even a period of consolidation or decline, citing concerns about macroeconomic headwinds, regulatory uncertainty, or potential technological disruptions. For example, PlanB’s stock-to-flow model, while historically accurate to a degree, has faced criticism for its inability to fully account for external factors impacting Bitcoin’s price. Conversely, more conservative predictions point to a price range closer to $50,000 – $75,000, reflecting a balance between the supply-side impact of the halving and the prevailing market sentiment.

Factors Influencing Bitcoin Price Predictions, April 2025 Bitcoin Halving

Several key factors influence these varied predictions. Macroeconomic conditions, such as inflation rates, interest rate hikes, and global recessionary fears, significantly impact investor appetite for risk assets like Bitcoin. Regulatory developments, particularly in major jurisdictions like the US, play a crucial role, as clearer regulatory frameworks could attract institutional investment, while harsh regulations could stifle growth. Technological advancements, including the development of layer-2 scaling solutions and improvements in Bitcoin’s infrastructure, could also positively influence Bitcoin’s price by enhancing its usability and efficiency.

Potential Price Scenarios for Bitcoin

Three broad scenarios are possible: a bullish scenario, characterized by a substantial price increase following the halving; a bearish scenario, where the price remains relatively stagnant or even declines due to negative external factors; and a neutral scenario, where the price experiences moderate growth or sideways movement, reflecting a balance between bullish and bearish forces. The bullish scenario is fueled by the anticipation of reduced Bitcoin supply, potentially leading to increased scarcity and higher demand. The bearish scenario considers the potential for a continued crypto winter or a negative regulatory environment. The neutral scenario acknowledges the inherent volatility of the cryptocurrency market and the difficulty in predicting its precise trajectory.

Investor Sentiment and Speculation

Investor sentiment and speculation are powerful forces shaping Bitcoin’s price. Periods of strong positive sentiment, fueled by media hype or positive regulatory news, can drive significant price increases. Conversely, negative sentiment, often triggered by market crashes, regulatory crackdowns, or negative news coverage, can lead to sharp price declines. Speculation, driven by the anticipation of future price movements, can amplify both bullish and bearish trends, leading to periods of extreme volatility. The level of institutional adoption and the overall macroeconomic climate also significantly influence investor sentiment and speculative activity, thereby influencing Bitcoin’s price trajectory.

Mining and Network Security

The Bitcoin halving, occurring in April 2025, significantly impacts the economics of Bitcoin mining and, consequently, the security of the network. This event, which cuts the block reward in half, alters the profitability of mining operations and potentially influences the distribution of mining power across the network.

The halving directly affects miner profitability by reducing their income from block rewards. With fewer bitcoins awarded for each block successfully mined, miners must rely more heavily on transaction fees to remain profitable. This reduction in revenue can lead to miners shutting down less efficient operations, potentially impacting the overall hash rate and network security. A lower hash rate makes the network more vulnerable to 51% attacks, where a malicious actor could control a majority of the network’s computing power to manipulate the blockchain. The extent of this impact depends on several factors, including the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. For example, if the Bitcoin price remains high following the halving, miners might still find it profitable to operate even with reduced block rewards. Conversely, a significant price drop could force many miners offline, potentially compromising network security.

Impact on Network Centralization and Decentralization

The halving’s effect on the centralization or decentralization of Bitcoin mining is complex and uncertain. A drop in profitability could lead to smaller, less efficient miners exiting the market, leaving the network dominated by larger, more established mining operations. This would increase centralization, concentrating mining power in fewer hands and potentially raising concerns about network control. However, the halving could also spur innovation and efficiency improvements within the mining industry. Miners may adopt more energy-efficient hardware and explore new mining strategies to maintain profitability, potentially leading to a more decentralized network in the long run. The outcome will depend on the interplay between economic forces, technological advancements, and regulatory changes. For instance, the implementation of new, more efficient mining ASICs could offset the reduced block reward and allow smaller miners to compete more effectively.

Miner Adaptation Strategies

To adapt to the reduced block rewards, miners may employ several strategies. These include upgrading to more energy-efficient mining hardware, optimizing their operations to reduce costs, diversifying their revenue streams by engaging in activities like staking or providing other blockchain services, and forming mining pools to share resources and costs. The choice of strategy will depend on individual circumstances, technological capabilities, and market conditions. For example, some miners might invest in next-generation ASICs to maintain their hash rate despite the lower reward, while others might consolidate their operations to achieve economies of scale. A successful adaptation requires a combination of technological innovation and effective risk management.

Bitcoin Mining Energy Consumption Before and After Halving

The halving’s direct impact on Bitcoin’s energy consumption is not straightforward. While a reduction in the number of active miners due to lower profitability could theoretically lead to lower energy consumption, this is not guaranteed. The overall energy consumption will depend on the miners who remain active, their hardware efficiency, and the price of Bitcoin. If the price remains high, and miners upgrade to more efficient equipment, the overall energy consumption might not decrease significantly, or might even increase due to the adoption of newer, more powerful (but potentially more energy-intensive) hardware. Furthermore, the energy mix used by miners (e.g., renewable versus fossil fuels) will also play a role in determining the environmental impact. Historically, the energy consumption of Bitcoin mining has fluctuated based on factors like Bitcoin’s price, regulatory changes, and technological advancements, making accurate predictions difficult. A comparison before and after the halving would require careful analysis of these multiple variables and access to reliable data on mining operations.

Impact on Bitcoin’s Ecosystem

The Bitcoin halving in April 2025, reducing the block reward for miners by half, will undeniably ripple through Bitcoin’s ecosystem, impacting its development, adoption, and relationship with other markets. The decreased miner revenue will force adaptations across the board, potentially accelerating innovation and reshaping the landscape of Bitcoin-related services.

The halving’s effect on the ecosystem is multifaceted and complex, influencing everything from the adoption of scaling solutions to the overall market sentiment and investment strategies. The changes will not be uniform; some sectors will benefit while others face challenges. Understanding these potential impacts is crucial for navigating the post-halving landscape.

Impact on Bitcoin-Related Technologies and Services

The reduced block reward will likely increase the importance of transaction fees as a source of miner revenue. This could incentivize the development and adoption of technologies that optimize transaction fees, such as improved wallet software, fee estimation tools, and more efficient transaction batching techniques. Furthermore, services focused on providing better on-chain analytics and data visualization to help users manage their transaction fees effectively will likely see increased demand. For example, a service that analyzes network congestion and predicts optimal times to send transactions could become highly valuable. This shift in miner incentives could also lead to greater focus on layer-2 solutions like the Lightning Network.

Impact on the Lightning Network and Other Second-Layer Scaling Solutions

The halving could act as a catalyst for the wider adoption of the Lightning Network and other second-layer scaling solutions. With reduced block subsidies, miners will increasingly rely on transaction fees, making on-chain transactions more expensive. This economic pressure will drive users towards faster, cheaper, and more scalable solutions like the Lightning Network, which allows for off-chain transactions. The increased usage could, in turn, lead to further development and improvement of Lightning Network infrastructure, including increased node density and improved user experience. This could be similar to the growth of mobile payment systems as transaction costs and friction associated with traditional banking increased.

Impact on the Cryptocurrency Market and Traditional Financial Markets

The halving’s impact on the broader cryptocurrency market is difficult to predict with certainty, but it’s likely to cause significant volatility. Historically, halvings have been followed by periods of both price appreciation and correction. The anticipation surrounding the event can lead to speculative trading activity, driving price fluctuations. The effect on traditional financial markets is likely to be indirect, primarily through the influence on investor sentiment and overall market dynamics. A significant price increase in Bitcoin could spill over into other cryptocurrencies, while a sharp decline might negatively affect the perception of the entire digital asset class. The 2016 halving, for example, was followed by a significant bull run, albeit with subsequent corrections.

Changes in Bitcoin Use Cases

The halving could subtly shift the use cases for Bitcoin. As on-chain transaction costs potentially increase, Bitcoin might become less attractive for frequent, small-value transactions. Instead, it could solidify its position as a store of value and a medium for larger, more significant transactions. This could lead to an increase in the use of Bitcoin for long-term investment, institutional adoption, and cross-border payments, where its security and decentralized nature are particularly valuable. We could see a reduction in its use for daily purchases, favoring other cryptocurrencies with lower transaction fees for such applications.

Investor Strategies and Risk Assessment: April 2025 Bitcoin Halving

The Bitcoin halving in April 2025 is a significant event expected to impact the cryptocurrency’s price and market dynamics. Understanding various investment strategies and thoroughly assessing the inherent risks is crucial for investors navigating this period of potential volatility. This section Artikels potential approaches, risk mitigation techniques, and a comparison of investment vehicles.

Bitcoin Investment Strategies in Anticipation of the Halving

Several strategies can be employed by investors anticipating the Bitcoin halving. These strategies range from conservative approaches to more aggressive ones, each carrying its own set of risks and potential rewards. A well-informed investor will consider their risk tolerance and financial goals before implementing any strategy.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak. For example, an investor might invest $100 per week, consistently adding to their Bitcoin holdings over time. This approach reduces the impact of short-term volatility.

- Value Averaging: This strategy aims to acquire a set amount of Bitcoin over time, adjusting the investment amount to maintain a consistent growth rate. It involves purchasing more Bitcoin when the price is low and less when the price is high. This requires more active management than DCA. For example, an investor aiming to own 1 Bitcoin might buy more when the price drops and less when it rises, maintaining a consistent purchase schedule to achieve the goal.

- Long-Term Holding (HODLing): This involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. This strategy relies on the belief that Bitcoin’s long-term value will appreciate. It requires patience and a strong conviction in the asset’s future. For instance, an investor might purchase Bitcoin and hold it for 5 years or more, anticipating significant growth over the long term.

Risk Assessment in Bitcoin Investment

Investing in Bitcoin carries substantial risk due to its inherent volatility. The halving, while anticipated to be bullish, doesn’t guarantee price increases. Several factors contribute to the risk:

- Price Volatility: Bitcoin’s price is notoriously volatile, subject to significant swings in short periods. Market sentiment, regulatory changes, and macroeconomic factors can all influence its price dramatically. For example, the price of Bitcoin can fluctuate by thousands of dollars in a single day.

- Regulatory Uncertainty: Government regulations regarding cryptocurrencies are still evolving globally. Changes in regulations could negatively impact Bitcoin’s price and accessibility. The lack of a universally accepted regulatory framework adds to the uncertainty.

- Security Risks: Bitcoin exchanges and wallets are potential targets for hacking and theft. Investors need to take appropriate security measures to protect their investments. The loss of private keys can result in the permanent loss of funds.

- Market Manipulation: The relatively smaller market capitalization of Bitcoin compared to traditional assets makes it potentially more susceptible to market manipulation by large players. This can lead to significant price swings that are not necessarily reflective of the underlying value.

Comparison of Bitcoin Investment Vehicles

Investors have various options for gaining exposure to Bitcoin, each with different risk profiles and return potential.

| Investment Vehicle | Description | Risk | Reward Potential |

|---|---|---|---|

| Spot Purchases | Directly buying and holding Bitcoin | High volatility | High potential returns |

| Futures Contracts | Agreements to buy or sell Bitcoin at a future date | High leverage, potential for large losses | High potential returns, hedging opportunities |

| ETFs (Exchange-Traded Funds) | Funds that track the price of Bitcoin | Lower volatility than direct spot purchases, but still subject to market fluctuations | Moderate potential returns, easier access than direct Bitcoin purchases |

Diversifying a Bitcoin Investment Portfolio

Diversification is crucial to mitigate risk. While Bitcoin can be a core holding, spreading investments across different asset classes reduces the impact of any single asset’s underperformance.

- Diversification across asset classes: Include traditional assets like stocks, bonds, and real estate in your portfolio to balance the risk associated with Bitcoin’s volatility. This helps to reduce the overall portfolio risk.

- Diversification within the crypto space: Consider diversifying within the cryptocurrency market itself by investing in other cryptocurrencies or blockchain-related projects. This can reduce the impact of Bitcoin’s price fluctuations on your overall crypto holdings.

- Strategic allocation: Determine an appropriate allocation of your investment portfolio based on your risk tolerance and financial goals. A risk-averse investor might allocate a smaller percentage to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the upcoming Bitcoin halving in April 2025, covering its mechanics, historical impact, and potential future implications for investors and the Bitcoin ecosystem. Understanding these key aspects is crucial for navigating the market leading up to and following this significant event.

The Bitcoin Halving Mechanism

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving adjusts the block reward, which is the amount of Bitcoin awarded to miners for successfully verifying and adding transactions to the blockchain. For example, the reward started at 50 BTC per block, and after each halving, it’s been reduced to 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The next halving will reduce this to 3.125 BTC per block. This controlled inflation mechanism is designed to maintain scarcity and potentially influence the long-term value of Bitcoin.

The Date of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in April 2025. The precise date will depend on the block mining time, which can fluctuate slightly. However, the month of April 2025 is a highly probable timeframe based on current block generation rates.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the periods following previous halvings. This is often attributed to the reduced supply of new Bitcoins entering the market, potentially creating upward pressure on demand. The 2012 and 2016 halvings were followed by significant price increases, although the market conditions and other factors also played crucial roles. It’s important to note that past performance is not indicative of future results, and numerous other factors influence Bitcoin’s price. The 2020 halving, while leading to a price surge later that year, saw a period of relatively flat pricing immediately following the event, highlighting the complexity of price prediction.

Risks and Rewards of Investing Before the Halving

Investing in Bitcoin before a halving presents both significant risks and potential rewards. The potential reward is the possibility of capital appreciation as the price potentially rises following the halving due to decreased supply. However, the risk lies in the volatility of the cryptocurrency market. Bitcoin’s price can experience substantial fluctuations due to various factors, including regulatory changes, market sentiment, and technological developments. Investing before a halving involves increased uncertainty, and investors should carefully consider their risk tolerance and diversify their portfolio accordingly. Similar to investing in any asset, thorough research and a well-defined investment strategy are paramount.

Long-Term Implications of the Halving

The long-term implications of the Bitcoin halving are multifaceted. The reduced inflation rate could contribute to Bitcoin’s perceived value as a store of value, potentially attracting more institutional and individual investors. This increased adoption could, in turn, lead to further price appreciation and wider acceptance of Bitcoin as a legitimate asset class. However, the long-term impact also depends on factors such as technological advancements, regulatory frameworks, and overall macroeconomic conditions. The halving’s impact will likely be gradual, unfolding over time, rather than causing an immediate, dramatic shift.

Illustrative Data Representation

Understanding the impact of Bitcoin halvings on price requires analyzing historical data. While predicting future price movements is inherently speculative, examining past trends offers valuable insights into potential market reactions. The following table provides a concise overview of historical halvings, highlighting the subsequent price changes. Note that correlation doesn’t equal causation; numerous other factors influence Bitcoin’s price.

Historical Bitcoin Halving Data and Subsequent Price Movements

| Halving Date | Block Reward Reduction (BTC) | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) |

|---|---|---|---|

| November 28, 2012 | 50 BTC to 25 BTC | ~ $12 | ~ $100 |

| July 9, 2016 | 25 BTC to 12.5 BTC | ~ $650 | ~ $4,000+ |

| May 11, 2020 | 12.5 BTC to 6.25 BTC | ~ $9,000 | ~ $9,000 (Varied significantly throughout the year) |

The April 2025 Bitcoin Halving is a significant event for the cryptocurrency market, anticipated to impact Bitcoin’s price and mining dynamics. Understanding the specifics of this halving requires careful analysis, and a great resource for this is the detailed information available at Bitcoin Halving 2025 Daye. This site provides valuable insights that can help you prepare for the potential consequences of the April 2025 Bitcoin Halving.

The April 2025 Bitcoin Halving is a significant event for the cryptocurrency market, impacting the rate of new Bitcoin creation. Understanding the precise timing is crucial for investors, and you can find detailed information on this at Bitcoin Halving Time 2025. This resource provides a comprehensive overview, helping you prepare for the effects of the April 2025 Bitcoin Halving on the overall market.

The April 2025 Bitcoin halving is a significant event for the cryptocurrency market, expected to reduce the rate of new Bitcoin creation. To understand the precise timing of this reduction, you might find it helpful to check out this resource on When Is The Next Bitcoin Halving 2025 which offers detailed information. Ultimately, the April 2025 halving will likely impact Bitcoin’s price and overall market dynamics in the coming months and years.

The April 2025 Bitcoin Halving is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. To understand the precise timing of this event, it’s helpful to consult resources dedicated to tracking the halving schedule, such as this informative page: When Is The Bitcoin Halving In 2025. Ultimately, the April 2025 Bitcoin Halving will be a pivotal moment shaping the future trajectory of Bitcoin.

The April 2025 Bitcoin Halving is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. Precisely pinpointing the date requires careful consideration of block times, and for the most accurate information, you should consult a reliable resource such as this website on the Date For Bitcoin Halving 2025. Understanding the exact date of the halving allows for better preparation and informed speculation regarding its market consequences in April 2025.

The April 2025 Bitcoin Halving is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. Precisely pinpointing the date requires careful consideration of block times, and for the most accurate information, you should consult a reliable resource such as this website on the Date For Bitcoin Halving 2025. Understanding the exact date of the halving allows for better preparation and informed speculation regarding its market consequences in April 2025.