Baby Bitcoin Price Prediction 2025

The cryptocurrency market is notoriously volatile, a rollercoaster ride of exhilarating highs and terrifying lows. While Bitcoin remains the dominant player, the cryptosphere is teeming with alternative coins, each with its own unique story and potential. Among these is Baby Bitcoin (BBTC), a token that has garnered attention due to its association with the king of cryptocurrencies and its speculative appeal. This article aims to explore potential price predictions for Baby Bitcoin in 2025, analyzing various factors that could influence its trajectory.

Baby Bitcoin (BBTC) is an altcoin, often described as a “meme coin,” loosely tied to Bitcoin. Its origins are less clear-cut than many established cryptocurrencies, and its value is primarily driven by market sentiment and speculation rather than a specific underlying technology or utility. Unlike Bitcoin, which is a decentralized digital currency with its own blockchain, BBTC often operates on other established blockchain networks. This relationship to Bitcoin, however, is the main driver of its market interest, making it susceptible to Bitcoin’s price movements. Understanding this dynamic is crucial for any price prediction.

Factors Influencing Baby Bitcoin’s Price in 2025

Several factors could significantly impact Baby Bitcoin’s price by 2025. These include the overall cryptocurrency market trend, the adoption of Bitcoin and other cryptocurrencies, regulatory changes globally, and the specific development and community activity surrounding BBTC itself. For example, a bullish market for Bitcoin could positively influence BBTC, while increased regulatory scrutiny could lead to price drops. Conversely, a successful marketing campaign or the development of a unique use case for BBTC could drive significant price increases. Predicting the interplay of these factors is complex and inherently uncertain.

Potential Price Scenarios for Baby Bitcoin in 2025

Predicting the price of any cryptocurrency, especially one as volatile as BBTC, is inherently speculative. However, we can explore potential scenarios based on different market conditions. For example, if the overall cryptocurrency market experiences significant growth and Bitcoin reaches new all-time highs, BBTC might see a considerable price increase, perhaps exceeding its current value by a significant margin. This scenario would require a confluence of positive factors, including widespread adoption, positive regulatory developments, and a robust BBTC community.

Conversely, a bearish market for Bitcoin or increased regulatory pressure could lead to a decrease in BBTC’s price. This scenario would be more likely if the broader crypto market experiences a downturn or if negative news surrounding BBTC or the cryptocurrency market in general emerges. A realistic price prediction must consider both positive and negative scenarios, acknowledging the inherent uncertainties. It’s important to remember that past performance is not indicative of future results. While analyzing historical price movements can be helpful, it’s crucial to consider the many unpredictable factors that could influence the future price of BBTC. Even within specific scenarios, significant price fluctuations are highly probable.

Factors Influencing Baby Bitcoin’s Price

Predicting the price of Baby Bitcoin (BBTC) is complex, relying on a confluence of factors that intertwine and influence each other. Understanding these influences is crucial for anyone interested in navigating the volatile world of cryptocurrency investments. While past performance doesn’t guarantee future results, analyzing these key drivers offers valuable insight into potential price movements.

Bitcoin’s Price Impact on Baby Bitcoin

Baby Bitcoin, being a token often pegged or related to Bitcoin (BTC), experiences a strong correlation with its parent cryptocurrency. A significant increase in Bitcoin’s price often translates to a positive impact on BBTC’s value, and vice versa. This correlation is driven by investor sentiment and market dynamics. When Bitcoin performs well, investors tend to become more optimistic about the entire cryptocurrency market, including altcoins like BBTC. Conversely, a downturn in Bitcoin’s price can lead to a sell-off across the board, impacting BBTC negatively. The degree of correlation can vary depending on market conditions and the specific relationship between BTC and BBTC. For instance, a strong positive correlation might be observed during periods of general market bullishness, while a weaker correlation or even a negative correlation could occur during periods of market uncertainty or specific negative news affecting BBTC.

Market Sentiment and Cryptocurrency Market Trends

The overall sentiment within the cryptocurrency market significantly impacts BBTC’s price. Positive news, technological advancements, and regulatory clarity can boost investor confidence, leading to increased demand and higher prices for BBTC. Conversely, negative news, regulatory uncertainty, or market crashes can trigger sell-offs and price declines. Broader cryptocurrency market trends also play a crucial role. For example, a general bull market across the crypto space will likely see BBTC’s price appreciate, while a bear market would likely result in a price drop. The extent of this influence depends on factors like the overall market capitalization of BBTC and its perceived risk compared to other cryptocurrencies.

Technological Advancements and Adoption Rates

Technological developments within the Baby Bitcoin ecosystem, such as improved scalability, enhanced security features, or the integration of new functionalities, can positively influence its price. Increased adoption rates, measured by the number of users, transactions, and overall network activity, also contribute to price appreciation. Wider acceptance by businesses and institutions further strengthens the value proposition of BBTC, attracting more investors and driving up demand. For example, the development of a decentralized application (dApp) built on the BBTC blockchain could stimulate demand and increase its value. Conversely, a lack of innovation or security vulnerabilities could negatively affect the price.

Regulatory Changes and Government Policies

Government regulations and policies significantly impact the cryptocurrency market, including BBTC. Favorable regulatory frameworks can foster investor confidence and attract institutional investment, leading to higher prices. Conversely, stringent regulations or outright bans can severely dampen investor enthusiasm and cause price drops. The regulatory landscape is constantly evolving, and its impact on BBTC’s price is difficult to predict with certainty. Different jurisdictions have different regulatory approaches, and these differences can lead to price fluctuations depending on where the majority of trading occurs. For instance, a country implementing clear and supportive regulations for cryptocurrencies could lead to increased trading volume and potentially higher prices for BBTC.

Impact of Major Events (e.g., Halving)

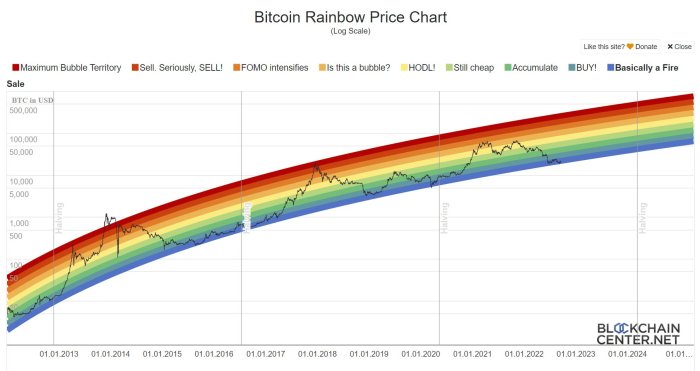

Major events within the Bitcoin ecosystem, such as halving events (reducing the rate of new Bitcoin creation), can indirectly affect BBTC’s price. Halving events are typically considered deflationary, potentially leading to increased scarcity and price appreciation for Bitcoin. This positive sentiment can then spill over into the broader cryptocurrency market, including BBTC. However, the impact of such events can be complex and depends on other concurrent market factors. For example, a halving event might not have a significant impact on BBTC if the overall market sentiment is bearish. Other significant events, like successful upgrades to the Bitcoin network or significant partnerships, could also affect BBTC positively.

Baby Bitcoin Price Performance Compared to Other Cryptocurrencies

The following table offers a simplified comparison of hypothetical price performance. Note that this is illustrative and does not represent actual historical data. Real-world data should be consulted from reputable sources for accurate comparisons.

| Year | Baby Bitcoin (BBTC) | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

| 2020 | $0.01 | $10,000 | $300 |

| 2021 | $0.10 | $60,000 | $4,000 |

| 2022 | $0.05 | $20,000 | $1,500 |

| 2023 (Projected) | $0.08 | $30,000 | $2,500 |

Baby Bitcoin Price Prediction Models

Predicting the price of any cryptocurrency, including Baby Bitcoin, is inherently complex and uncertain. However, various models attempt to forecast future prices by analyzing historical data and market factors. These models, while not guarantees, can offer potential insights into future price movements. We will explore two common approaches: technical analysis and fundamental analysis.

Technical Analysis of Baby Bitcoin’s Price in 2025

Technical analysis focuses on interpreting price charts and trading volume to identify patterns and predict future price movements. This approach doesn’t consider fundamental factors like the underlying technology or market sentiment. For Baby Bitcoin, a common technical indicator like the moving average convergence divergence (MACD) could be used. Assuming a bullish trend indicated by the MACD, and considering historical price volatility, a simplified model might project a price range. For example, if Baby Bitcoin’s price shows a consistent upward trend in 2024, extrapolating this trend, while acknowledging potential corrections, could suggest a price range between $0.005 and $0.015 by 2025. This prediction, however, relies heavily on the continuation of the bullish trend and ignores potential external shocks affecting the cryptocurrency market. The methodology assumes past price movements are indicative of future movements, a simplification often challenged in volatile markets.

Fundamental Analysis of Baby Bitcoin’s Price in 2025

Fundamental analysis assesses the intrinsic value of an asset based on underlying factors. For Baby Bitcoin, this would involve considering factors like adoption rate, technological advancements, regulatory changes, and overall market conditions. If Baby Bitcoin experiences significant adoption within decentralized applications (dApps) or integrates with other established cryptocurrencies, its value could increase. Conversely, negative news regarding regulatory scrutiny or technological vulnerabilities could significantly impact its price. Considering a scenario of moderate adoption and a stable regulatory environment, a fundamental analysis might suggest a price range of $0.002 to $0.008 by 2025. This range reflects the uncertainty inherent in predicting market adoption and technological developments. This prediction is based on a multitude of factors, each with its own degree of uncertainty.

Comparison of Technical and Fundamental Analysis Results

Comparing the results, we see a potential overlap in the price ranges predicted by technical and fundamental analysis. Both models suggest a possible price range for Baby Bitcoin in 2025, albeit with different methodologies and underlying assumptions. The technical analysis, based on extrapolation of past price trends, suggests a potentially higher price range than the fundamental analysis, which relies on a broader range of factors influencing the asset’s intrinsic value. The discrepancy highlights the inherent limitations of each approach.

Limitations and Uncertainties in Price Prediction Models

Cryptocurrency markets are highly volatile and susceptible to unexpected events. Both technical and fundamental analyses have limitations. Technical analysis can be unreliable in highly volatile markets where past price trends don’t always predict future movements. Fundamental analysis, while considering important factors, struggles to accurately quantify the impact of future technological advancements, regulatory changes, or unexpected market events. Therefore, any price prediction should be treated as a potential outcome, not a definitive forecast. External factors like macroeconomic conditions, regulatory changes, and overall market sentiment significantly influence cryptocurrency prices, adding to the uncertainty. These models should be viewed as tools to inform investment decisions, not guarantees of future price performance.

Potential Scenarios for Baby Bitcoin in 2025

Predicting the price of any cryptocurrency, especially one as volatile as Baby Bitcoin, is inherently speculative. However, by considering various market factors and historical trends, we can Artikel potential scenarios for its price in 2025. These scenarios are not predictions, but rather illustrative possibilities based on different sets of assumptions.

Bullish Scenario: Baby Bitcoin Price Surge in 2025, Baby Bitcoin Price Prediction 2025

A bullish scenario for Baby Bitcoin in 2025 hinges on several positive factors converging. Widespread adoption of Baby Bitcoin within a specific niche market, coupled with positive regulatory developments and a general resurgence in the cryptocurrency market, could drive significant price appreciation. Imagine a scenario where a major corporation integrates Baby Bitcoin into its payment system, or a significant DeFi protocol chooses to leverage Baby Bitcoin’s unique properties. This increased demand, combined with a limited supply, could lead to a substantial price increase. For example, if Bitcoin itself experiences a significant price rally, Baby Bitcoin, as a related asset, might see a proportionally larger increase due to its smaller market capitalization and higher volatility. This could result in a price exceeding $10, potentially reaching values significantly higher, depending on the magnitude of these positive developments.

Bearish Scenario: Baby Bitcoin Price Decline in 2025

Conversely, a bearish scenario would involve a confluence of negative factors. A prolonged cryptocurrency bear market, negative regulatory actions targeting Baby Bitcoin specifically, or a significant security breach impacting user confidence could all contribute to a price decline. Furthermore, the emergence of a superior competing cryptocurrency with similar functionality but greater efficiency or wider adoption could divert investment away from Baby Bitcoin. If the broader cryptocurrency market experiences a significant downturn, similar to the 2018 bear market, Baby Bitcoin, given its high volatility, could see a much more dramatic price drop, potentially falling below its current price or even significantly lower, depending on the severity of the downturn and negative factors affecting its market.

Neutral Scenario: Baby Bitcoin Price Stagnation in 2025

A neutral scenario suggests that Baby Bitcoin’s price will remain relatively stable throughout 2025, neither experiencing significant gains nor substantial losses. This scenario would likely involve a period of market consolidation, with limited bullish or bearish catalysts. This could be characterized by a lack of significant technological advancements, regulatory clarity, or major market events directly impacting Baby Bitcoin. The price might fluctuate within a relatively narrow range, mirroring the overall stability (or lack thereof) of the broader cryptocurrency market. The price could remain within a certain range, for example, between $0.50 and $2, depending on the overall market conditions and lack of major catalysts.

Illustrative Chart: Baby Bitcoin Price Scenarios in 2025

The following chart illustrates the three scenarios. The x-axis represents time (in months, starting from January 2025), and the y-axis represents the price of Baby Bitcoin in USD.

The Bullish scenario is represented by an upward-sloping curve, starting at a hypothetical price of $0.75 in January 2025 and steadily increasing to over $10 by December 2025. The Bearish scenario is depicted by a downward-sloping curve, starting at the same point and gradually decreasing to below $0.25 by December 2025. The Neutral scenario is a relatively flat line, fluctuating slightly around an average price of $1 throughout the year. Key data points would include the starting price in January, the highest and lowest points for each scenario in December, and any significant price fluctuations throughout the year, reflecting the impact of potential news events or market trends. The chart would clearly label each curve (Bullish, Bearish, Neutral) and provide a legend explaining the axes. This visual representation would offer a clear comparison of the three possible price trajectories for Baby Bitcoin in 2025.

Risks and Considerations: Baby Bitcoin Price Prediction 2025

Investing in Baby Bitcoin, like any cryptocurrency, carries inherent risks. The volatile nature of the cryptocurrency market means significant price fluctuations are common, potentially leading to substantial losses. Understanding these risks and mitigating them through informed decision-making is crucial for responsible investment.

Market Volatility and Price Fluctuations

The cryptocurrency market is known for its extreme volatility. Baby Bitcoin’s price can experience sharp and unpredictable swings, influenced by factors such as regulatory changes, market sentiment, technological developments, and overall macroeconomic conditions. For example, a negative news story about a major cryptocurrency exchange could trigger a market-wide sell-off, impacting Baby Bitcoin’s price regardless of its own fundamentals. Investors should be prepared for potentially significant losses and only invest capital they can afford to lose.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving globally. Changes in regulations, whether favorable or unfavorable, can significantly impact the price and trading volume of Baby Bitcoin. Uncertainty around future regulations creates a risk that needs to be considered. For instance, a government ban on cryptocurrency trading could drastically reduce Baby Bitcoin’s value. Staying informed about regulatory developments is essential for navigating this risk.

Security Risks

Cryptocurrency exchanges and wallets are potential targets for hacking and theft. Losing access to your Baby Bitcoin holdings due to a security breach could result in significant financial losses. Utilizing reputable and secure exchanges and employing strong security practices, such as two-factor authentication, are crucial for mitigating this risk. Examples of past high-profile exchange hacks highlight the importance of robust security measures.

Diversification in a Cryptocurrency Portfolio

Diversification is a fundamental principle of risk management in any investment portfolio, including one containing cryptocurrencies. Holding a variety of cryptocurrencies, rather than concentrating solely on Baby Bitcoin, reduces the impact of any single asset’s price decline on your overall portfolio value. A diversified portfolio spreads risk, limiting potential losses if one cryptocurrency underperforms. For example, holding a mix of Bitcoin, Ethereum, and Baby Bitcoin could provide a more stable investment strategy compared to investing only in Baby Bitcoin.

Responsible Investing in Cryptocurrencies

Responsible investing in cryptocurrencies involves thorough research, understanding your risk tolerance, and only investing what you can afford to lose. Avoid making investment decisions based on hype or FOMO (fear of missing out). Instead, focus on fundamental analysis, considering factors such as the project’s technology, team, and community. Seek advice from qualified financial advisors if needed, and never invest more than you can comfortably lose.

Resources for Further Research and Learning

Numerous resources are available for learning more about Baby Bitcoin and cryptocurrency investing in general. Reputable cryptocurrency news websites, educational platforms, and blockchain analysis tools provide valuable insights and data. It’s crucial to critically evaluate information from various sources before making investment decisions. Furthermore, engaging with online communities and forums dedicated to Baby Bitcoin can offer additional perspectives, but always be cautious of biased or misleading information.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Baby Bitcoin, clarifying its nature, differences from Bitcoin, investment potential, trading venues, and associated risks. Understanding these aspects is crucial for making informed investment decisions.

What is Baby Bitcoin?

Baby Bitcoin (often represented with a ticker symbol like BABYBTC) is an altcoin, or alternative cryptocurrency, inspired by Bitcoin. It typically aims to offer a more accessible and potentially less expensive entry point into the cryptocurrency market compared to Bitcoin itself. While sharing some similarities with Bitcoin in its underlying blockchain technology, Baby Bitcoin often has different functionalities, tokenomics, and overall market capitalization. It’s important to note that the specific features of Baby Bitcoin can vary depending on the particular project.

How does Baby Bitcoin differ from Bitcoin?

Baby Bitcoin and Bitcoin are distinct cryptocurrencies with key differences. Bitcoin is the original and most established cryptocurrency, boasting a large market capitalization and widespread adoption. Baby Bitcoin, being a newer altcoin, typically has a much smaller market cap and lower trading volume. They may also differ in their technological underpinnings, such as the consensus mechanism used to validate transactions (e.g., Proof-of-Work or Proof-of-Stake) and the specific features implemented in their respective blockchains. Furthermore, Bitcoin’s scarcity (limited to 21 million coins) contrasts with Baby Bitcoin, which may have a different, potentially larger, total supply. Finally, Bitcoin’s brand recognition and established history contribute to its greater perceived stability, although both are subject to significant price volatility.

Is Baby Bitcoin a good investment?

Whether Baby Bitcoin is a “good” investment depends entirely on individual risk tolerance and investment goals. Like any cryptocurrency, Baby Bitcoin carries significant risk due to its inherent volatility. The price can fluctuate dramatically in short periods, leading to substantial gains or losses. Potential rewards could include significant price appreciation if the project gains traction and adoption. However, the risk of losing the entire investment is also high. Thorough research, understanding your risk tolerance, and diversifying your investment portfolio are essential before considering any investment in Baby Bitcoin or any other cryptocurrency. Past performance is not indicative of future results. Consider consulting a financial advisor before making any investment decisions.

Where can I buy Baby Bitcoin?

Baby Bitcoin, like other cryptocurrencies, can be traded on various cryptocurrency exchanges. However, the availability of BABYBTC varies across platforms. Reputable exchanges often have robust security measures and regulatory compliance. It’s crucial to choose a regulated and secure exchange before initiating any transactions. Always verify the legitimacy and security of the exchange before depositing funds or trading any cryptocurrency. Research and due diligence are paramount to mitigate risks. (Note: Specific exchange listings for Baby Bitcoin may change over time, so independent verification is essential.)

What are the potential risks of investing in Baby Bitcoin?

Investing in Baby Bitcoin involves several significant risks. High volatility is a primary concern; its price can experience substantial swings, leading to rapid gains or losses. Market manipulation is another risk, as smaller cryptocurrencies can be more susceptible to price manipulation by large investors. Regulatory uncertainty is also a factor, as the regulatory landscape for cryptocurrencies is still evolving globally. Technological risks, such as security breaches or coding vulnerabilities, can also negatively impact the value of Baby Bitcoin. Furthermore, the project itself may fail to achieve its goals or maintain development, resulting in a significant loss of investment. Finally, the lack of widespread adoption and limited liquidity compared to Bitcoin present further risks.