Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025, significantly impacting the cryptocurrency’s supply and potentially its price. This event reduces the rate at which new Bitcoins are created, decreasing the inflation rate of the Bitcoin network. Understanding the mechanics of this event and its historical context is crucial for predicting its future influence.

Bitcoin Halving Mechanics and Historical Price Impact

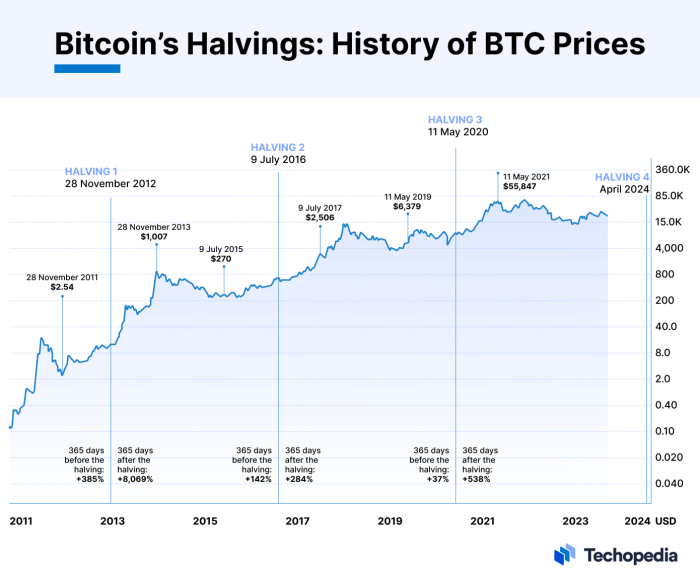

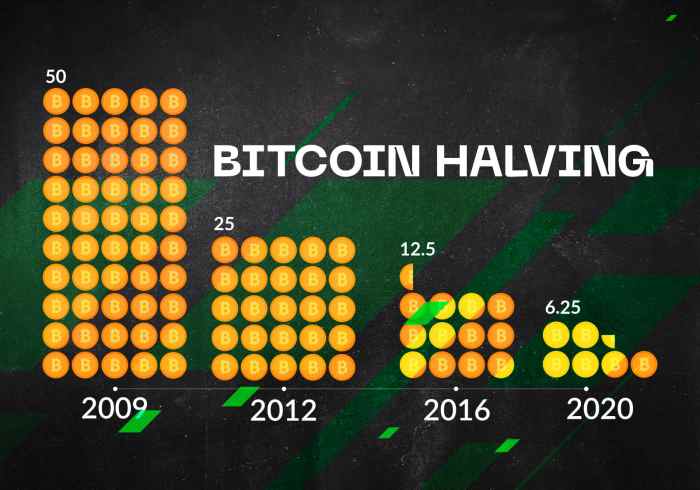

The Bitcoin halving occurs approximately every four years, halving the reward miners receive for validating transactions and adding new blocks to the blockchain. This reward, initially 50 BTC per block, has been halved three times already, currently standing at 6.25 BTC. Historically, halving events have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The first halving in 2012 saw a gradual price increase, while the second in 2016 and third in 2020 led to more pronounced bull runs, albeit with subsequent corrections. The exact relationship between halving events and price movements remains a subject of debate, with various factors influencing the market beyond the halving itself.

Potential Price Scenarios Following the 2025 Halving, What Time Is Bitcoin Halving 2025

Predicting Bitcoin’s price after the 2025 halving is inherently speculative. A bullish scenario suggests that the reduced supply, combined with sustained or increased demand, could drive the price significantly higher. This could be fueled by factors like increased institutional adoption, growing mainstream awareness, and further technological advancements. Conversely, a bearish scenario considers the possibility of a price correction or stagnation. This could be influenced by macroeconomic factors, regulatory uncertainty, or competition from other cryptocurrencies. The actual outcome will likely depend on the interplay of various market forces. For example, the 2020 halving was followed by a significant price surge, reaching an all-time high in late 2021, but this was preceded by a period of relatively low prices and was followed by a considerable price drop.

Comparison of the 2025 Halving with Previous Events

While past halving events offer valuable insights, it’s important to acknowledge the differences in market conditions. The 2012 halving occurred in a relatively nascent market with limited institutional participation. The 2016 and 2020 halvings saw increasing institutional interest and broader public awareness. The 2025 halving will likely take place in a market that is even more mature, regulated (to varying degrees globally), and competitive. Therefore, direct comparisons might not accurately predict the outcome. While past halvings have generally been followed by bullish periods, the magnitude and duration of these periods have differed significantly.

Factors Influencing Bitcoin’s Price Before and After the 2025 Halving

Numerous factors can influence Bitcoin’s price leading up to and following the 2025 halving. These factors are interconnected and their impact is difficult to isolate. A comparative analysis across previous halving cycles is insightful.

| Factor | 2012 Halving | 2016 Halving | 2020 Halving | Expected 2025 Halving |

|---|---|---|---|---|

| Macroeconomic Conditions | Relatively stable global economy | Slow global economic growth | Global pandemic and economic uncertainty | Uncertain; potential inflation or recession |

| Regulatory Landscape | Limited regulation | Increasing regulatory scrutiny in some jurisdictions | Growing regulatory frameworks globally | Further regulatory developments anticipated |

| Institutional Adoption | Minimal institutional involvement | Early signs of institutional interest | Significant increase in institutional investment | Continued and potentially accelerated institutional adoption |

| Technological Advancements | Early stages of blockchain technology | Maturing technology with scaling solutions emerging | Development of layer-2 solutions and DeFi | Further innovations in scalability and usability expected |

Impact on Bitcoin Mining and the Network: What Time Is Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners, significantly impacts the Bitcoin mining industry and the network’s overall health. The 2025 halving will likely trigger a period of adjustment and consolidation within the mining sector, influencing profitability, operational strategies, and ultimately, the network’s security and decentralization.

The halving directly affects the profitability of Bitcoin mining operations by reducing the primary revenue stream for miners. With fewer newly minted bitcoins awarded per block, miners’ income is cut in half. This necessitates a recalibration of their operational costs, including electricity expenses, hardware maintenance, and labor. Miners with higher operational costs, particularly those relying on older, less-efficient mining equipment, might find it increasingly challenging to remain profitable.

Miner Adaptation Strategies

Facing reduced block rewards, miners will likely adopt several strategies to maintain profitability. These include:

* Increased Mining Efficiency: Upgrading to more energy-efficient ASICs (Application-Specific Integrated Circuits) is crucial. This involves investing in newer generation hardware that boasts higher hash rates per unit of energy consumed.

* Optimization of Operational Costs: Miners will explore avenues to reduce expenses, such as negotiating lower electricity rates, consolidating operations to leverage economies of scale, and optimizing cooling systems.

* Diversification of Revenue Streams: Some miners might diversify their revenue streams by offering services beyond Bitcoin mining, such as hosting nodes for other cryptocurrencies or providing cloud mining services.

* Geographic Relocation: Miners may relocate their operations to regions with lower electricity costs and more favorable regulatory environments. This could lead to shifts in the geographic distribution of mining power.

Energy Consumption Before and After Halving

The energy consumption of Bitcoin mining is a frequently debated topic. While a precise before-and-after comparison for the 2025 halving is impossible to predict with certainty, we can analyze trends. It’s important to remember that energy consumption is not solely determined by the halving; hash rate, miner efficiency, and the price of Bitcoin all play significant roles.

- Before Halving (Hypothetical): Assume a hypothetical scenario where the network hash rate remains constant. In this case, the energy consumption would likely remain relatively stable, even with the reduced block reward. Miners would simply need to maintain their profitability by adjusting other factors, such as operational costs.

- After Halving (Hypothetical): If the price of Bitcoin remains stable or increases, miners might continue operating at a similar scale. This would mean energy consumption would stay relatively constant. However, a significant price drop could lead to a decrease in mining activity and a consequent reduction in energy consumption.

- Long-Term Trend: Regardless of the immediate impact, a long-term trend toward increased mining efficiency is likely. This is driven by continuous technological advancements in ASIC design, leading to potentially lower overall energy consumption per Bitcoin mined over time, even with an increasing hash rate.

Impact on Network Decentralization and Security

The halving’s impact on the decentralization and security of the Bitcoin network is complex. While a decrease in mining profitability could lead to some smaller miners exiting the market, it could also incentivize the consolidation of mining operations into larger, more efficient entities.

This consolidation could potentially lead to a less decentralized network, with fewer, larger mining pools controlling a larger percentage of the hash rate. However, it’s also possible that the increased efficiency and lower energy costs from technological advancements will offset this effect, allowing smaller, more geographically diverse miners to continue participating. The overall security of the network, measured by its hash rate, is likely to remain robust as long as the Bitcoin price remains sufficiently high to incentivize mining activity. A significant drop in the Bitcoin price, however, could lead to a reduction in the network’s hash rate and thus its security.