Investor Sentiment and Market Predictions

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, has historically been a significant event influencing investor sentiment and market price. Understanding past behavior and considering various influencing factors is crucial for navigating the anticipated 2025 halving.

Investor Behavior Around Previous Halvings, Bitcoin 2025 Halving Date

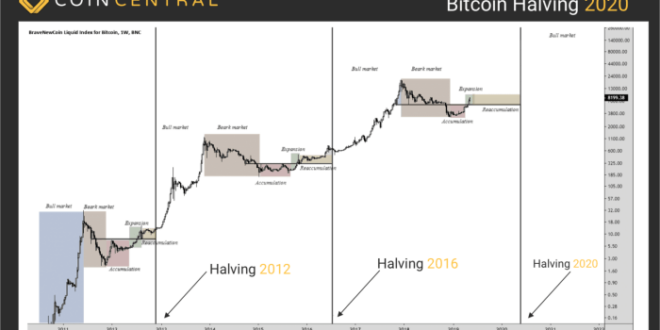

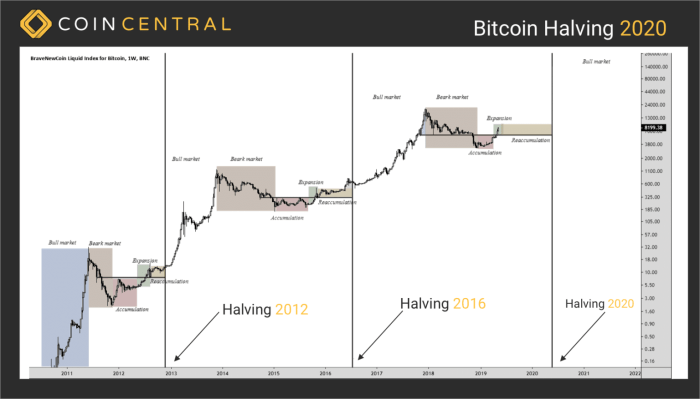

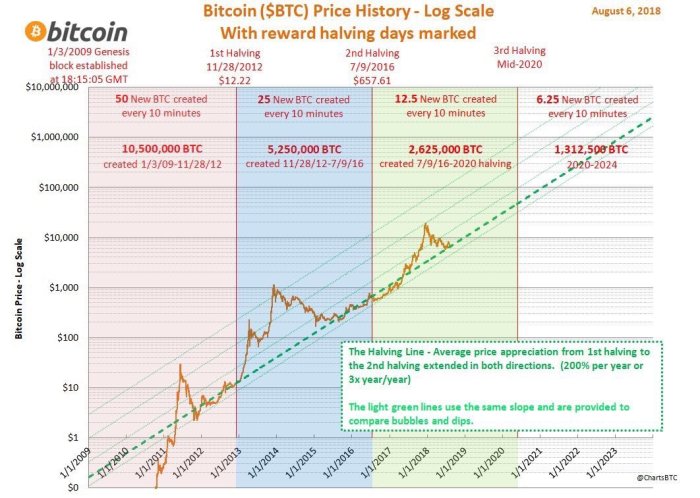

Leading up to previous halvings, investor sentiment often exhibits a mix of anticipation and uncertainty. A “buy the dip” mentality frequently prevails, with investors anticipating a price surge following the event. However, this is not always the case. The period immediately following a halving has seen both substantial price increases and periods of consolidation or even minor price declines, depending on the broader macroeconomic environment and other market factors. For example, the 2012 halving was followed by a period of significant price growth, while the 2016 halving saw a more gradual increase, ultimately culminating in a substantial bull market. The 2020 halving saw a period of consolidation before a significant bull run. These varied responses highlight the complexity of predicting market behavior solely based on the halving event.

Factors Influencing Investor Sentiment in 2025

Several factors beyond the halving itself could significantly impact investor sentiment in 2025. The overall macroeconomic climate, including inflation rates, interest rates set by central banks, and global economic growth, will play a major role. Regulatory developments concerning cryptocurrency, particularly in major jurisdictions like the US and EU, will also heavily influence investor confidence. Technological advancements within the Bitcoin ecosystem, such as the adoption of the Lightning Network for faster and cheaper transactions, and the development of new Bitcoin-related applications, will also contribute to investor perception. Finally, the prevailing narrative surrounding Bitcoin, whether positive or negative, in the mainstream media and among financial analysts, will have a substantial effect.

Market Predictions for Bitcoin After the 2025 Halving

Market predictions for Bitcoin’s price after the 2025 halving vary widely. Some analysts predict a significant price surge, mirroring the historical pattern of price increases following previous halvings, potentially reaching prices several times higher than the price at the time of the halving. Others anticipate a more moderate price increase or even a period of consolidation, arguing that the market has become more mature and less susceptible to dramatic price swings driven solely by the halving. These predictions often differ significantly depending on the underlying assumptions about the aforementioned factors, such as the macroeconomic environment and regulatory landscape. For instance, a prediction based on a bullish macroeconomic forecast would likely project a higher price than one based on a pessimistic outlook. The reliability of these predictions depends heavily on the accuracy of their underlying assumptions.

Risks and Opportunities for Investors

The 2025 halving presents both significant risks and opportunities for investors. The potential for substantial price appreciation represents a significant opportunity, but the possibility of a price correction or prolonged period of sideways trading poses a considerable risk. The volatility inherent in the cryptocurrency market, exacerbated by macroeconomic uncertainty and regulatory changes, adds to the risk. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly. A well-defined investment strategy that accounts for various potential outcomes is essential for managing both the risks and the opportunities associated with the 2025 halving.

Evaluating the Reliability of Bitcoin Price Predictions

Evaluating the reliability of Bitcoin price predictions requires a critical assessment of their underlying assumptions and methodology. Predictions based on sound economic models, incorporating relevant macroeconomic factors and historical data, are generally more reliable than those based on speculation or anecdotal evidence. The credibility of the source making the prediction, their track record, and their transparency regarding their methodology are all crucial factors to consider. It’s vital to avoid predictions that rely on overly optimistic or pessimistic assumptions without providing sufficient justification. Comparing predictions from multiple sources, with diverse methodologies and underlying assumptions, provides a more balanced and informed perspective. It is important to remember that no prediction is foolproof, and the cryptocurrency market is inherently volatile.

Technological Advancements and Their Impact

The 2025 Bitcoin halving, reducing the block reward by half, will undoubtedly impact the network. However, concurrent technological advancements may significantly mitigate or even alter the anticipated effects. These innovations promise to reshape the Bitcoin landscape, influencing mining profitability, transaction fees, and overall network efficiency. Understanding these advancements is crucial for predicting the halving’s true impact.

Scalability Solutions and Transaction Fees

The Bitcoin network’s scalability has been a subject of ongoing discussion. High transaction fees and network congestion can deter users, particularly during periods of high activity. Several solutions aim to address this. Layer-2 scaling solutions, such as the Lightning Network, are designed to process transactions off-chain, significantly reducing the load on the main Bitcoin blockchain. Other proposals involve increasing the block size or implementing alternative consensus mechanisms, though these often face debates regarding security and decentralization. The success of these solutions in scaling the network before and after the halving will be crucial in determining their overall effect on transaction costs and user experience. For example, widespread adoption of the Lightning Network could drastically reduce fees for everyday transactions, even if on-chain fees remain relatively high.

The Role of the Lightning Network

The Lightning Network is a layer-2 protocol built on top of the Bitcoin blockchain. It allows for faster and cheaper transactions by conducting them off-chain. Instead of broadcasting every transaction to the entire network, users open payment channels with each other, settling balances only periodically on the main chain. This drastically reduces the load on the Bitcoin blockchain and consequently lowers transaction fees. The anticipated growth and adoption of the Lightning Network leading up to and following the 2025 halving could potentially negate the price pressure associated with reduced block rewards. Successful scaling and wider merchant adoption of the Lightning Network could render the halving’s impact on transaction costs significantly less severe than previously anticipated. For example, widespread Lightning Network usage could allow microtransactions to become feasible, opening up new use cases for Bitcoin.

Innovations in Mining Hardware

The Bitcoin mining landscape is constantly evolving, driven by the pursuit of greater efficiency and profitability. Advancements in mining hardware, such as the development of more energy-efficient ASICs (Application-Specific Integrated Circuits), can significantly impact the mining industry post-halving. More efficient hardware allows miners to operate profitably even with a reduced block reward. Conversely, a lack of significant hardware innovation could lead to a more pronounced shakeout in the mining industry, with less efficient miners forced to exit the market. The competitiveness of the mining market will depend heavily on the pace of technological advancements in this area. For instance, a breakthrough in ASIC technology leading to significantly lower energy consumption could offset the halving’s impact on miner profitability.

Timeline of Significant Technological Advancements

The following timeline illustrates key technological advancements and their potential influence on the 2025 halving:

| Year | Advancement | Anticipated Influence on 2025 Halving |

|---|---|---|

| 2020-Present | Continued development and adoption of the Lightning Network | Mitigation of increased transaction fees |

| 2022-Present | Improvements in ASIC mining hardware efficiency | Increased miner profitability despite reduced block reward |

| 2023-Present | Research and development of alternative scaling solutions (e.g., Taproot upgrades) | Improved network scalability and transaction throughput |

| 2024-2025 | Potential emergence of new consensus mechanisms or significant upgrades to existing ones | Potential alteration of mining dynamics and network security |

Frequently Asked Questions (FAQ) about the Bitcoin 2025 Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone involved in the Bitcoin market, whether as an investor, miner, or simply an observer. This section addresses common questions surrounding the 2025 halving.

The Bitcoin Halving and its Significance

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, when the reward given to Bitcoin miners for verifying transactions is cut in half. Its significance stems from its impact on Bitcoin’s scarcity and its potential influence on price dynamics. The halving is a fundamental part of Bitcoin’s deflationary monetary policy, designed to control inflation and maintain its long-term value.

Expected Date of the Bitcoin 2025 Halving

The precise date of the 2025 halving depends on the block time, which can fluctuate slightly. However, based on historical data and current block generation rates, the event is anticipated to occur sometime in the spring or early summer of 2025. Precise predictions require monitoring the blockchain closely as the date approaches. The community generally anticipates it within a few weeks of the predicted time.

The Halving’s Effect on Bitcoin Supply

The halving directly affects the rate of Bitcoin’s inflation. Before each halving, a fixed number of Bitcoins are added to the circulating supply with each newly mined block. The halving cuts this number in half. This reduction in the rate of new Bitcoin creation contributes to the overall scarcity of the cryptocurrency. This controlled scarcity is a key feature designed to make Bitcoin a potentially valuable store of value. For example, the halving in 2020 reduced the block reward from 12.5 BTC to 6.25 BTC.

Historical Impact of Previous Halvings on Bitcoin’s Price

Historically, Bitcoin’s price has often experienced periods of growth following halving events. The halvings of 2012, 2016, and 2020 were all followed by significant price increases, although the timing and magnitude varied. This correlation is often attributed to the reduced supply of new Bitcoins entering the market, potentially increasing demand and driving up prices. However, it’s crucial to note that other factors also influence Bitcoin’s price, and past performance is not indicative of future results. External market forces, regulatory changes, and overall investor sentiment all play a significant role.

Potential Risks and Rewards of Investing Around the Halving

Investing in Bitcoin around a halving event presents both potential rewards and risks. The reduced supply could lead to increased price appreciation, offering significant returns for early investors. However, the market can be highly volatile, and price movements are unpredictable. There’s a risk of price corrections or even prolonged bear markets, potentially leading to substantial losses. Diversification of investments and a thorough understanding of the risks are essential before making any investment decisions. The 2020 halving, for instance, saw a significant price increase in the following months, but also experienced periods of volatility and price drops before reaching its peak.

Illustrative Table: Halving Dates and Subsequent Price Movements

Analyzing past Bitcoin halvings provides valuable insight into potential price reactions. While past performance is not indicative of future results, examining historical data helps contextualize expectations surrounding the 2025 halving. The following table presents data from the last three halvings, highlighting the price before and after, along with the percentage change. It’s crucial to remember that numerous other factors influence Bitcoin’s price beyond the halving event.

Bitcoin 2025 Halving Date – The data presented below is compiled from reputable cryptocurrency tracking websites and should be considered for informational purposes only. It is important to conduct your own research and consult with financial advisors before making any investment decisions.

Bitcoin Halving Price Data

| Halving Date | Price Before Halving (USD) | Price After Halving (USD) (Approximate Peak) | Percentage Change (%) |

|---|---|---|---|

| July 9, 2016 | $650 | $19,783 | +2966.62% |

| July 11, 2020 | $9,000 | $64,863 | +615.14% |

| May 12, 2024 | $27,000 (approx.) | N/A | N/A |

Note: The “Price After Halving” column represents an approximate peak price reached after the halving event. The actual peak price and timing can vary. The 2024 halving data is incomplete as the post-halving price peak is yet to be determined.

Visual Representation: Bitcoin Halving Cycle: Bitcoin 2025 Halving Date

Understanding the Bitcoin halving cycle requires visualizing the interplay between block rewards, the circulating supply of Bitcoin, and its potential impact on price. A well-designed chart can effectively communicate this complex relationship.

A suitable visual representation would be a combined line and bar chart. The horizontal axis represents time, marked with the dates of each Bitcoin halving event. The vertical axis has two scales: one for Bitcoin’s price (in USD, for example), and another for both the block reward (in Bitcoin) and the circulating supply (in Bitcoin).

Chart Elements and Significance

The chart would feature three distinct data series. The first would be a line graph showing the historical and projected price of Bitcoin. Significant price movements following each halving event would be clearly visible, allowing for observation of trends and potential correlations. The second series would be a bar chart representing the block reward halved at each event. This visually emphasizes the reduction in new Bitcoin entering circulation after each halving. The third series, also a bar chart, would display the cumulative circulating supply of Bitcoin. This illustrates the gradual increase in the total supply, even with the halving events, highlighting the inherent scarcity of Bitcoin. The interaction of these three series – price, block reward, and circulating supply – allows for a comprehensive analysis of the halving’s impact. For example, the chart would clearly show the decrease in block reward coinciding with periods of increased price volatility, potentially demonstrating a correlation between scarcity and price appreciation. Historical data from previous halvings could be used to inform projections of future price movements, though it is crucial to remember that these are predictions, not guarantees. The chart could also incorporate shaded areas to represent periods of significant market events, like bull or bear markets, to further contextualize the price movements relative to the halving events. Such visual aids would offer a powerful tool for understanding the dynamics of the Bitcoin halving cycle and its potential influence on the cryptocurrency’s value.