Frequently Asked Questions (FAQs): Bitcoin 2025 Halving Price Prediction

This section addresses common queries regarding the Bitcoin halving event and its potential impact on the price of Bitcoin in 2025. Understanding these key aspects is crucial for anyone considering Bitcoin as an investment or simply following its development.

Bitcoin Halving Explained, Bitcoin 2025 Halving Price Prediction

The Bitcoin halving is a programmed event in the Bitcoin protocol that occurs approximately every four years. It reduces the rate at which new Bitcoins are created (mined) by 50%. This mechanism, built into the Bitcoin code from its inception, controls the supply of Bitcoin, aiming to maintain its scarcity and long-term value. The halving directly impacts the reward miners receive for verifying transactions and adding new blocks to the blockchain.

The Halving’s Effect on Bitcoin’s Price

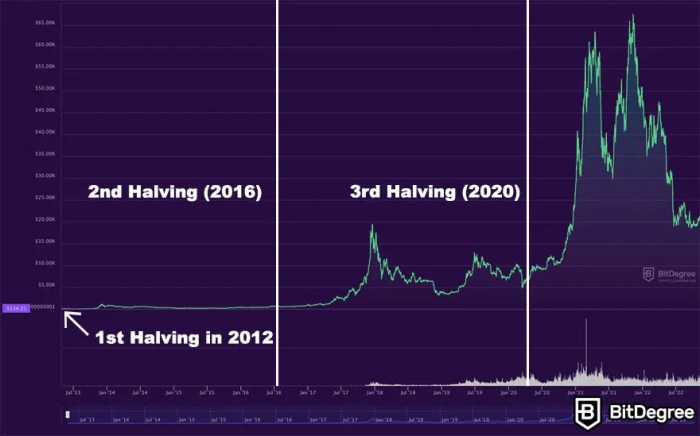

Historically, Bitcoin’s price has tended to increase in the period following a halving event. This is largely attributed to the reduced supply of newly minted Bitcoin. However, it’s crucial to understand that this is not a guaranteed outcome. The relationship between halvings and price is complex and influenced by numerous other market factors. Some analysts believe the anticipation leading up to the halving contributes significantly to price increases, while others argue that the long-term impact is less pronounced than short-term speculation suggests. The 2012 and 2016 halvings were followed by significant price increases, but the market conditions and overall economic climate at the time also played significant roles.

Factors Influencing Bitcoin’s Price in 2025

Beyond the halving, several factors will significantly influence Bitcoin’s price in 2025. These include macroeconomic conditions, such as inflation rates and overall economic growth; regulatory developments worldwide, which can impact the adoption and accessibility of Bitcoin; technological advancements within the Bitcoin network and the broader cryptocurrency space; and finally, the overall sentiment and adoption rate among institutional and retail investors. A global recession, for example, could negatively impact Bitcoin’s price regardless of the halving, while increased regulatory clarity could drive significant adoption.

Investing in Bitcoin Before the 2025 Halving

Investing in Bitcoin, or any cryptocurrency, carries significant risk. While the halving may be a positive catalyst, it’s essential to acknowledge the inherent volatility of the cryptocurrency market. The price of Bitcoin can fluctuate dramatically in short periods, influenced by news events, market sentiment, and technological developments. Before investing, thorough research is crucial, and individuals should only invest what they can afford to lose. Potential rewards can be substantial, but so can the potential losses. It’s advisable to consult with a qualified financial advisor before making any investment decisions.