Adoption and Usage of Bitcoin in 2025

Predicting Bitcoin’s adoption and usage in 2025 requires considering various factors, including economic growth in different regions, evolving regulatory landscapes, and the maturation of Bitcoin’s underlying technology and its integration with other financial systems. While precise figures remain elusive, analyzing current trends allows us to formulate reasonable projections.

Projected Bitcoin Adoption Rates Across Geographical Regions, Bitcoin 2025 Prediction

Several factors influence Bitcoin adoption. Regions with robust internet infrastructure, higher levels of financial inclusion (or exclusion, leading to a search for alternatives), and more liberal regulatory environments are likely to show higher adoption rates. For instance, we might expect continued strong growth in regions like Latin America and Africa, where existing financial systems may be less efficient or accessible. Conversely, regions with stringent regulatory frameworks, such as certain parts of Asia, might exhibit slower adoption, though this could change with evolving regulations. Developed economies like those in North America and Europe might see more measured growth, as Bitcoin competes with established financial institutions. However, this is also contingent upon broader economic factors and the overall stability of traditional markets. Specific numerical projections are difficult, but a scenario of increased adoption in developing nations and more gradual adoption in developed nations seems plausible.

Potential Use Cases for Bitcoin Across Various Sectors

Bitcoin’s potential use cases are expanding beyond simple store-of-value. In finance, Bitcoin could facilitate faster and cheaper cross-border payments, potentially disrupting the traditional SWIFT system. For example, remittances sent by migrant workers could be significantly cheaper and faster using Bitcoin, benefiting both senders and recipients. In supply chain management, Bitcoin could enhance transparency and traceability. Imagine tracking goods from origin to consumer using Bitcoin’s immutable blockchain, reducing counterfeiting and improving accountability. Challenges include scalability limitations of the Bitcoin network and the need for widespread adoption by businesses within these sectors. Furthermore, regulatory uncertainty continues to pose a significant hurdle to broader adoption.

Bitcoin’s Evolving Role in Decentralized Finance (DeFi)

By 2025, Bitcoin’s role in DeFi is expected to become more significant. While Bitcoin itself is not a DeFi protocol, its integration with other cryptocurrencies and blockchain technologies is likely to increase. Wrapped Bitcoin (WBTC), for instance, allows Bitcoin to be used within Ethereum-based DeFi applications, enabling users to leverage Bitcoin’s security and value within the DeFi ecosystem. This integration could lead to new financial products and services built on top of Bitcoin’s underlying blockchain, such as decentralized lending and borrowing platforms using Bitcoin as collateral. However, challenges include maintaining security and interoperability between different blockchain networks, and the ongoing development of suitable protocols and infrastructure to support increased usage.

Anticipated Challenges and Opportunities for Bitcoin Adoption in Different Economic Sectors

The following points Artikel the anticipated challenges and opportunities:

- Finance: Opportunity: Faster, cheaper cross-border payments; Challenge: Regulatory uncertainty, scalability.

- Supply Chain: Opportunity: Increased transparency and traceability; Challenge: Integration with existing systems, technological hurdles.

- Gaming: Opportunity: In-game assets and microtransactions; Challenge: Volatility, regulatory compliance.

- Real Estate: Opportunity: Fractional ownership, faster transactions; Challenge: Legal frameworks, lack of widespread adoption.

- Arts & Collectibles: Opportunity: Secure and transparent ownership verification; Challenge: High transaction fees (potentially mitigated by layer-2 solutions).

Bitcoin and the Global Economy in 2025

Bitcoin’s increasing integration into the global financial system presents both opportunities and challenges. Its inherent volatility and potential for widespread adoption necessitate a careful examination of its potential impact on macroeconomic indicators and the overall structure of global finance by 2025. This analysis will explore Bitcoin’s influence on global markets, its relationship with key economic variables, and the potential transformations it may trigger within the financial system.

Bitcoin Price Volatility and Global Financial Markets

The price volatility of Bitcoin remains a significant concern. Sharp price swings could trigger ripple effects across global financial markets. For instance, a sudden, substantial drop in Bitcoin’s price could lead to margin calls for investors heavily leveraged in cryptocurrency markets, potentially causing a liquidity crisis affecting traditional financial institutions with exposure to these markets. Conversely, a significant price surge could attract massive capital inflows into Bitcoin, potentially diverting investments from other asset classes and influencing interest rates and inflation. The interconnectedness of global markets means that even seemingly isolated events within the cryptocurrency space can have wider ramifications. Consider the 2022 crypto winter: the collapse of several major cryptocurrency exchanges and firms triggered significant sell-offs across various asset classes, highlighting the potential for contagion.

Bitcoin’s Market Capitalization and Macroeconomic Indicators

Bitcoin’s market capitalization, currently a relatively small fraction of global financial assets, could grow significantly by 2025. Its relationship with macroeconomic indicators like inflation and interest rates will likely become more pronounced. For example, if Bitcoin gains wider acceptance as a store of value during periods of high inflation, its price might rise, potentially affecting monetary policy decisions by central banks. Conversely, rising interest rates could make alternative investment options more attractive, potentially dampening Bitcoin’s price appreciation. The correlation (or lack thereof) between Bitcoin’s market capitalization and traditional macroeconomic indicators will be a crucial area of observation in determining its role within the global economy. For instance, we could see a scenario where rising inflation prompts investors to move capital into Bitcoin as a hedge, increasing its market cap while potentially further fueling inflationary pressures.

Bitcoin Adoption and the Global Financial System

Increased Bitcoin adoption could fundamentally alter the structure and operation of the global financial system. The decentralized nature of Bitcoin challenges the centralized control of traditional financial institutions. Wider adoption could lead to greater financial inclusion, particularly in regions with limited access to traditional banking services. However, this decentralized structure also presents regulatory challenges for governments seeking to maintain control and prevent illicit activities. The potential for Bitcoin to disrupt existing financial infrastructure, particularly cross-border payments and remittances, is substantial. Imagine a scenario where a significant portion of international trade settlements are conducted using Bitcoin, bypassing traditional banking systems and reducing transaction costs. This would have significant implications for international trade and capital flows.

Timeline of Key Events Shaping Bitcoin’s Influence

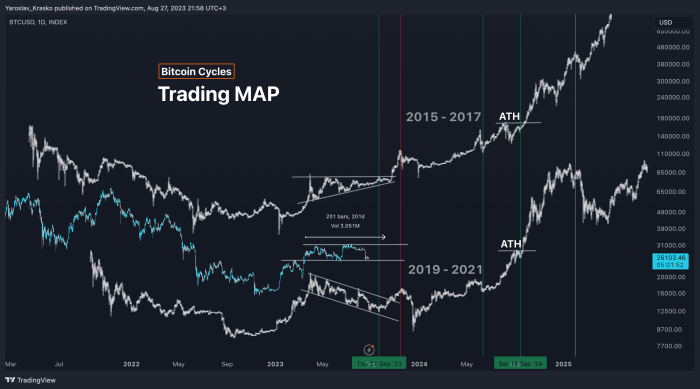

A timeline outlining potential turning points in Bitcoin’s influence on the global economy between now and 2025 might include:

- 2023-2024: Continued regulatory scrutiny and development of regulatory frameworks globally. Potential for increased institutional adoption alongside further price volatility.

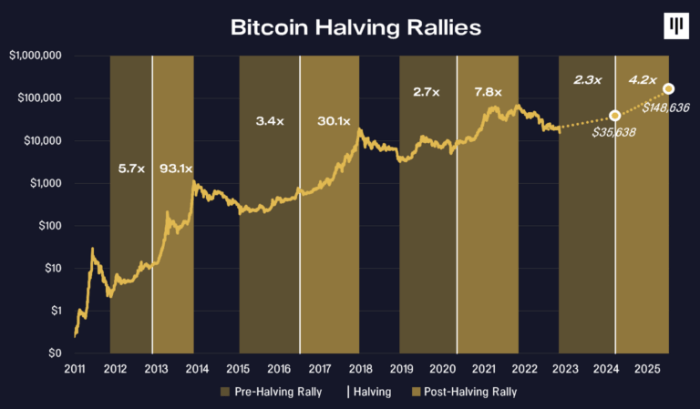

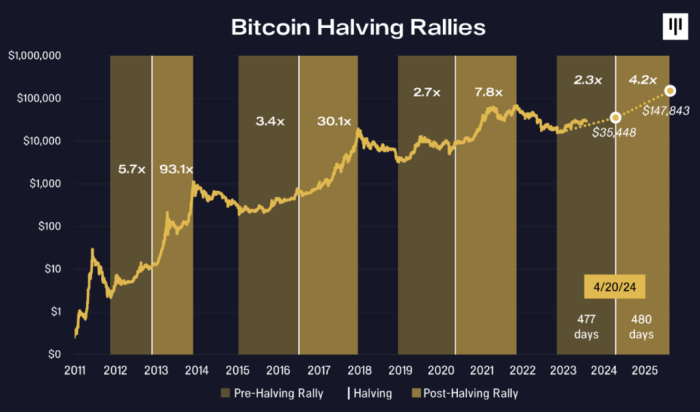

- Mid-2024: Bitcoin halving event, potentially influencing supply and demand dynamics and price.

- 2024-2025: Growing adoption in developing economies, possibly driven by need for alternative financial systems. Increased competition from alternative cryptocurrencies and CBDCs.

- Late 2025: Potential for significant shifts in global macroeconomic conditions influencing Bitcoin’s role as a store of value or investment asset.

These events, among others, could act as turning points, shaping the trajectory of Bitcoin’s influence on the global economy in the coming years. The interplay of technological advancements, regulatory decisions, and macroeconomic factors will ultimately determine the extent of Bitcoin’s impact.

Frequently Asked Questions about Bitcoin in 2025: Bitcoin 2025 Prediction

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and technological advancements, we can formulate informed estimations regarding its widespread adoption, associated risks, technological evolution, and potential long-term implications by 2025. This section addresses some frequently asked questions to provide a clearer perspective.

Bitcoin’s Acceptance as a Payment Method by 2025

The widespread acceptance of Bitcoin as a form of payment by 2025 hinges on several interconnected factors. Increased merchant adoption will be crucial; while some large retailers already accept Bitcoin, broader acceptance across various sectors is needed. This depends on factors such as the reduction of transaction fees and processing times, improved user experience, and the development of robust infrastructure for seamless integration into existing payment systems. Regulatory clarity in different jurisdictions will also play a vital role, as inconsistent or restrictive regulations can hinder adoption. Furthermore, public perception and understanding of Bitcoin’s technology and security are essential. Increased education and awareness campaigns could significantly boost consumer confidence and drive adoption. Finally, the price stability of Bitcoin itself is a key factor; significant price volatility can discourage both merchants and consumers from using it for everyday transactions. For example, if Bitcoin’s price fluctuates wildly, a merchant might be hesitant to accept it as payment due to the risk of losing money on each transaction.

Risks Associated with Investing in Bitcoin by 2025

Investing in Bitcoin carries significant risks, primarily due to its inherent volatility. The price of Bitcoin has historically shown extreme fluctuations, experiencing both dramatic rises and sharp drops. This volatility is driven by a combination of factors, including market sentiment, regulatory announcements, and technological developments. Regulatory uncertainty remains a considerable risk; governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulatory frameworks could significantly impact Bitcoin’s price and usability. Technological disruptions, such as the emergence of competing cryptocurrencies or significant security breaches affecting the Bitcoin network, pose further risks. For example, a major hacking incident could erode investor confidence and lead to a price crash. Finally, the speculative nature of Bitcoin investments means that losses can be substantial, and there is no guarantee of profit. Investing in Bitcoin should only be considered by those who are willing to accept a high degree of risk and are prepared for the possibility of significant losses.

Evolution of Bitcoin’s Technology to Address Current Limitations by 2025

Several technological advancements are likely to address Bitcoin’s current limitations by 2025. Scaling solutions, such as the Lightning Network, aim to increase transaction throughput and reduce fees. The Lightning Network allows for off-chain transactions, which means transactions are processed outside the main Bitcoin blockchain, thus improving speed and scalability. Efforts to reduce energy consumption are also underway. Research into more energy-efficient mining algorithms and hardware is ongoing, aiming to minimize Bitcoin’s environmental impact. Improvements in transaction speed are also anticipated, with ongoing development of faster and more efficient consensus mechanisms. For instance, advancements in hardware and software could lead to faster block generation times and quicker transaction confirmations. These technological improvements are crucial for Bitcoin’s long-term viability and widespread adoption.

Long-Term Implications of Bitcoin’s Success or Failure by 2025

The long-term implications of Bitcoin’s success or failure by 2025 are far-reaching and potentially transformative. If Bitcoin achieves widespread adoption, it could challenge the dominance of traditional financial systems, potentially leading to increased financial inclusion and reduced reliance on intermediaries like banks. A successful Bitcoin could also stimulate innovation in other areas of technology, such as decentralized finance (DeFi) and blockchain applications beyond cryptocurrency. Conversely, if Bitcoin fails to gain significant traction or experiences a major collapse, it could damage investor confidence in cryptocurrencies as a whole and hinder the development of related technologies. This could also reinforce the dominance of traditional financial institutions and potentially stifle innovation in the financial sector. The outcome will significantly impact the global financial landscape and broader societal structures.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the supply of new Bitcoins. For insightful analysis on this crucial event’s market implications, check out this report: Bitcoin Halving:Impact On The Market 2025 Ocean News. Understanding the halving’s effects is vital for any accurate Bitcoin 2025 prediction, as it fundamentally alters the dynamics of the cryptocurrency market.

Predicting Bitcoin’s price in 2025 is challenging, dependent on numerous factors including adoption rates and regulatory changes. A key event influencing these predictions is the Bitcoin halving, significantly impacting the rate of new Bitcoin entering circulation. To understand the potential impact of this event on the 2025 price, it’s crucial to know the exact date; you can find this information by checking this resource: ¿Cuándo Es El Halving De Bitcoin 2025?

. Therefore, the halving’s timing directly informs any serious Bitcoin 2025 prediction.

Predicting Bitcoin’s price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. To understand potential price movements after the halving, it’s crucial to analyze predictions surrounding the Bitcoin Price At Halving 2025 , as this event will likely shape the market’s trajectory heading into 2025 and beyond.

Therefore, understanding the post-halving price is vital for any comprehensive Bitcoin 2025 prediction.

Predicting Bitcoin’s price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. To understand potential price movements after the halving, it’s crucial to analyze predictions surrounding the Bitcoin Price At Halving 2025 , as this event will likely shape the market’s trajectory heading into 2025 and beyond.

Therefore, understanding the post-halving price is vital for any comprehensive Bitcoin 2025 prediction.

Predicting Bitcoin’s price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. To understand potential price movements after the halving, it’s crucial to analyze predictions surrounding the Bitcoin Price At Halving 2025 , as this event will likely shape the market’s trajectory heading into 2025 and beyond.

Therefore, understanding the post-halving price is vital for any comprehensive Bitcoin 2025 prediction.

Predicting Bitcoin’s price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. To understand potential price movements after the halving, it’s crucial to analyze predictions surrounding the Bitcoin Price At Halving 2025 , as this event will likely shape the market’s trajectory heading into 2025 and beyond.

Therefore, understanding the post-halving price is vital for any comprehensive Bitcoin 2025 prediction.