Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant occurrence in the cryptocurrency’s lifecycle. Scheduled for 2025, this halving will undoubtedly impact Bitcoin’s price and overall market sentiment, although predicting the exact extent of this impact remains a challenge. Understanding the historical context and considering various macroeconomic factors are crucial to forming informed expectations.

Historical Impact of Previous Bitcoin Halvings

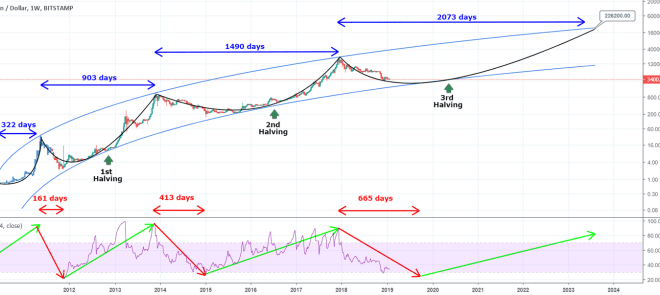

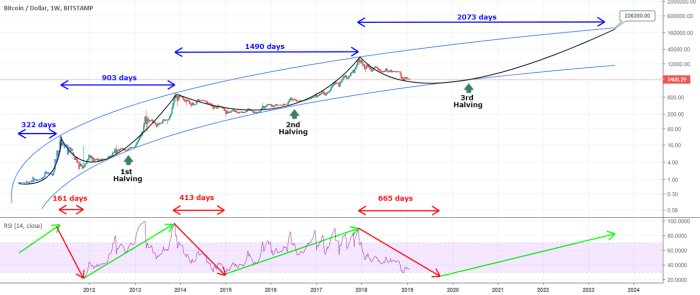

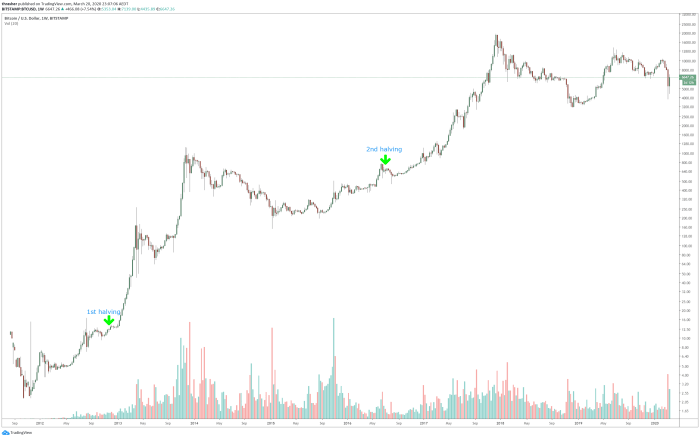

Previous Bitcoin halvings have generally been followed by periods of increased price appreciation, although the timing and magnitude of these price increases have varied. The first halving in 2012 saw a gradual price increase in the following year. The second halving in 2016 was followed by a significant bull run, culminating in the 2017 peak. The third halving in 2020 was also followed by a substantial price surge, reaching an all-time high in late 2021. However, it’s important to note that other factors, including broader market trends and technological developments, also contributed to these price movements. The relationship between halvings and price is not deterministic but rather correlational.

Potential Price Movements Post-2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, but we can explore potential scenarios. A bullish scenario could see a significant price increase driven by increased scarcity and renewed investor interest. This could be similar to the bull runs following previous halvings, potentially leading to prices exceeding previous all-time highs. A bearish scenario, however, could see subdued price action or even a price decline, if broader macroeconomic conditions remain unfavorable or if investor sentiment turns negative. A neutral scenario might see a modest price increase, reflecting the impact of the halving but tempered by other market forces. The actual outcome will likely be a complex interplay of these factors. For example, a scenario mirroring the 2012 halving might see a more gradual price increase over an extended period, while a scenario similar to 2016 or 2020 might involve a more dramatic and rapid price surge.

Influence of Macroeconomic Factors

Macroeconomic factors such as inflation, recessionary pressures, and geopolitical instability significantly influence Bitcoin’s price. High inflation could drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. Conversely, a recession could lead to risk-averse behavior, potentially depressing Bitcoin’s price. Geopolitical events, such as wars or significant political shifts, can also introduce volatility and uncertainty, affecting investor sentiment and Bitcoin’s price. For example, the 2022 war in Ukraine caused significant market volatility across various asset classes, including Bitcoin. The impact of these factors on Bitcoin’s price post-2025 halving will depend on their specific nature and severity.

Comparison of the 2025 Halving with Previous Halvings

The 2025 halving shares similarities with previous halvings in that it will reduce the rate of Bitcoin creation, potentially influencing scarcity and price. However, key differences exist. The Bitcoin ecosystem is far more mature and widely adopted now than in 2012, 2016, or even 2020. Regulatory scrutiny is also significantly higher. The level of institutional investment is considerably greater than in previous cycles. These factors could influence the market’s response to the halving differently than in the past. The overall market capitalization and the degree of Bitcoin’s integration into the global financial system are also substantially larger than in previous cycles, implying a different scale of impact.

Mining and the 2025 Halving

The Bitcoin halving, occurring approximately every four years, is a significant event that reduces the block reward miners receive for validating transactions and adding new blocks to the blockchain. The 2025 halving will cut this reward in half, creating a ripple effect across the Bitcoin mining ecosystem. Understanding the mechanics of mining and its relationship to the halving is crucial for comprehending the potential consequences.

Bitcoin mining involves solving complex cryptographic puzzles using specialized hardware. Miners compete to solve these puzzles first, and the winner adds the next block to the blockchain, receiving the block reward. This reward, currently 6.25 BTC, is the primary source of revenue for miners, alongside transaction fees. The halving directly impacts miner profitability by reducing this primary income stream. A decrease in the block reward means miners must generate more revenue from transaction fees to remain profitable, or face the prospect of operating at a loss.

Miner Profitability and the Halving

The halving directly affects miner profitability by reducing their primary income source – the block reward. With a smaller reward, miners must either increase their hashing power to secure a higher percentage of block rewards or rely more heavily on transaction fees. The profitability of mining is a complex calculation that depends on several factors including electricity costs, hardware costs (including initial investment and maintenance), and the Bitcoin price. A lower block reward increases the sensitivity of miner profitability to fluctuations in the Bitcoin price and the cost of electricity. For example, if the Bitcoin price remains relatively stable post-halving, miners with higher electricity costs might become unprofitable and be forced to shut down their operations.

Impact on Hash Rate and Network Security

The halving’s effect on the hash rate—a measure of the total computational power dedicated to securing the Bitcoin network—is a subject of ongoing debate. Some argue that a reduced block reward will lead to a decrease in the hash rate as less profitable miners exit the market. A lower hash rate could potentially increase the vulnerability of the network to 51% attacks, where a malicious actor controls a majority of the network’s hash power and can potentially manipulate the blockchain. However, others believe that the Bitcoin price could rise following the halving, offsetting the reduced block reward and maintaining or even increasing the hash rate. The historical precedent suggests a mixed response; some halvings have been followed by a temporary drop in the hash rate, while others have not shown a significant immediate impact.

Miner Adaptation Strategies

Facing reduced block rewards, miners will likely adopt several strategies to maintain profitability. These include: improving operational efficiency to lower electricity costs, consolidating mining operations to leverage economies of scale, upgrading to more energy-efficient hardware, diversifying revenue streams by engaging in other activities such as staking other cryptocurrencies, and focusing on regions with lower electricity costs. Some miners might also choose to temporarily suspend operations until the Bitcoin price increases sufficiently to offset the reduced block reward. The success of these strategies will depend on various market conditions, including the price of Bitcoin and the availability of cheaper, more efficient mining hardware.

Consequences of Reduced Miner Participation

A significant drop in miner participation following the halving could have several consequences. The most immediate concern is the potential reduction in network security, as a lower hash rate makes the network more susceptible to attacks. This could lead to decreased confidence in the network and potentially impact the Bitcoin price. Furthermore, transaction confirmation times might increase as fewer miners are available to process transactions. The long-term impact on the network’s decentralization is also a concern, as a reduction in the number of miners could concentrate mining power in the hands of fewer entities. This could potentially undermine the core principles of Bitcoin’s decentralized nature. Historical data on previous halvings provides some insights but doesn’t offer a precise prediction for the 2025 event, as market conditions and technological advancements can significantly influence the outcome.

Investor Sentiment and Market Predictions

The 2025 Bitcoin halving is a significant event expected to impact investor sentiment and market predictions. The reduced supply of newly mined Bitcoin, coupled with potential increased demand, often leads to price speculation. However, predicting the precise price trajectory remains challenging, with analysts offering a wide range of opinions.

Analyst Opinions on Bitcoin’s Price After the 2025 Halving

Diverse Analyst Predictions

A spectrum of opinions exists regarding Bitcoin’s price post-halving. Some prominent analysts predict substantial price increases, citing the historical correlation between halvings and price surges. Others, however, express caution, pointing to macroeconomic factors and potential regulatory hurdles that could dampen the bullish effects. For instance, PlanB, known for his stock-to-flow model, historically predicted high prices, while other analysts like Michael Saylor have expressed long-term bullish sentiment based on Bitcoin’s scarcity and adoption. Conversely, some analysts highlight the potential for a bear market to continue or for a period of consolidation following the halving, suggesting that the price impact might be less dramatic than some anticipate. These differing views reflect the inherent uncertainty in the cryptocurrency market.

Range of Price Predictions and Their Reasoning

Price predictions vary dramatically. Bullish forecasts often cite the halving’s impact on Bitcoin’s scarcity, suggesting prices could reach six figures or even higher. The reasoning behind these projections usually involves extrapolating from past halving cycles and incorporating factors like increased institutional adoption and growing demand from developing markets. Bearish predictions, on the other hand, emphasize the influence of macroeconomic conditions, such as inflation, interest rates, and potential regulatory crackdowns. These analysts might point to historical instances where Bitcoin’s price didn’t immediately surge after a halving, or they might highlight the possibility of a prolonged period of market uncertainty. For example, a prediction of $100,000 might be based on a model that assumes continued institutional investment and mainstream adoption, while a prediction of $50,000 might incorporate a more conservative outlook on adoption rates and macroeconomic risks.

Potential Catalysts Influencing Investor Sentiment

Several factors could significantly impact investor sentiment. Positive catalysts include increased institutional adoption, successful regulatory clarity in key markets, the development of innovative Bitcoin-related applications, and positive macroeconomic news. Conversely, negative catalysts include regulatory crackdowns, major security breaches affecting exchanges or the Bitcoin network itself, a prolonged economic downturn, or negative news surrounding large Bitcoin holders. For example, a positive regulatory announcement from a major global economy could trigger a significant price increase, while a major security breach could lead to a sharp decline.

Comparative Analysis of Prediction Models and Their Reliability

Various prediction models exist, ranging from simple price extrapolation based on historical data to complex quantitative models incorporating macroeconomic indicators and network metrics. The reliability of these models varies significantly. Models based solely on historical price action often fail to account for unforeseen events and changing market dynamics. More sophisticated models incorporating a wider range of variables offer a potentially more nuanced perspective but still carry inherent uncertainty. The stock-to-flow model, for example, has been both praised and criticized for its accuracy, demonstrating the limitations of even seemingly robust predictive tools. No single model guarantees accurate predictions, highlighting the speculative nature of cryptocurrency market forecasting.

Bitcoin’s Long-Term Prospects After the Halving: Bitcoin After Halving 2025

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation, is a significant event with potentially profound long-term implications for the cryptocurrency’s adoption, market dominance, and overall value. While predicting the future is inherently uncertain, analyzing historical trends, current market dynamics, and potential technological advancements allows us to formulate a reasoned assessment of Bitcoin’s trajectory.

Impact of the Halving on Adoption and Market Dominance

The halving mechanism, programmed into Bitcoin’s code, is designed to control inflation and create scarcity. Historically, halvings have been followed by periods of price appreciation, potentially driving increased adoption as more individuals and institutions perceive Bitcoin as a valuable store of value and a hedge against inflation. Increased adoption could solidify Bitcoin’s position as the leading cryptocurrency and potentially expand its market share relative to altcoins. However, the extent of this impact depends on various factors, including overall macroeconomic conditions, regulatory developments, and the emergence of competing technologies. For example, the 2012 and 2016 halvings were followed by significant price increases, although the market context surrounding those events differed significantly from the current landscape.

The Role of Institutional Investors and Regulatory Developments

Institutional investment in Bitcoin has steadily increased in recent years, with large corporations and financial institutions adding Bitcoin to their balance sheets. Continued institutional adoption is crucial for Bitcoin’s long-term growth and stability, providing liquidity and driving price discovery. Regulatory clarity, however, remains a key factor. Favorable regulatory frameworks in major jurisdictions could significantly boost institutional participation, while restrictive regulations could stifle growth. The contrasting regulatory approaches of countries like El Salvador (embracing Bitcoin as legal tender) and China (banning Bitcoin trading) illustrate the significant impact of government policies on Bitcoin’s trajectory.

Potential Technological Advancements Affecting Bitcoin’s Value Proposition

Technological advancements, both within and outside the Bitcoin ecosystem, could influence Bitcoin’s value proposition. The development of the Lightning Network, for example, aims to improve Bitcoin’s scalability and transaction speed, addressing a common criticism of the original protocol. Furthermore, advancements in layer-2 scaling solutions could further enhance Bitcoin’s usability and efficiency. Conversely, the emergence of new consensus mechanisms or alternative cryptocurrencies with superior technological features could pose a challenge to Bitcoin’s dominance. The success of competing technologies will depend on their ability to offer compelling advantages over Bitcoin’s established network effects and security.

Comparison of Bitcoin’s Long-Term Potential Against Alternative Cryptocurrencies

Bitcoin’s first-mover advantage, established network effects, and robust security are significant strengths. However, alternative cryptocurrencies offer different value propositions, such as faster transaction speeds, lower fees, or enhanced smart contract capabilities. Ethereum, for instance, has gained popularity due to its smart contract functionality, enabling the development of decentralized applications (dApps). However, Bitcoin’s established brand recognition, scarcity, and proven track record as a store of value continue to give it a competitive edge. The long-term dominance of either Bitcoin or altcoins will likely depend on the evolution of the cryptocurrency landscape, technological innovations, and market preferences. A realistic scenario may involve a diversified cryptocurrency market, with Bitcoin maintaining a significant share alongside other specialized cryptocurrencies fulfilling specific niches.

Risks and Uncertainties

Investing in Bitcoin, even after the anticipated positive effects of the 2025 halving, carries inherent risks. While the halving event typically leads to reduced supply and potentially increased price, several factors could negatively impact returns and even lead to significant losses. Understanding these risks is crucial for any investor considering Bitcoin exposure.

Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies. Changes in regulatory frameworks, such as stricter KYC/AML rules, increased taxation, or outright bans, could significantly impact Bitcoin’s price and accessibility. The lack of a universally accepted regulatory approach creates uncertainty for investors, potentially leading to market volatility and decreased investor confidence. For example, a sudden ban on Bitcoin trading in a major market could trigger a significant price drop. Conversely, clear and favorable regulatory frameworks in key jurisdictions could boost investor confidence and market stability.

Market Volatility

Bitcoin’s price is notoriously volatile. Sharp price swings, both upward and downward, are common. These fluctuations can be triggered by various factors, including news events, regulatory changes, market sentiment, and technological developments. The volatility inherent in the cryptocurrency market presents significant risk for investors, particularly those with shorter-term investment horizons. For instance, the 2022 cryptocurrency market crash saw Bitcoin’s price plummet by over 60% from its all-time high. Such drastic declines can lead to substantial financial losses for investors who are not prepared for this level of risk.

Technological Risks

Bitcoin’s underlying technology is constantly evolving. The potential for unforeseen technical issues, such as vulnerabilities in the blockchain or successful attacks on exchanges, poses a significant risk. A major security breach or a successful 51% attack could severely damage investor confidence and negatively impact Bitcoin’s price. Furthermore, the development and adoption of competing cryptocurrencies could also affect Bitcoin’s market dominance and price.

Security Risks

Investors face risks associated with the security of their Bitcoin holdings. Hacking of exchanges, theft of private keys, and phishing scams are all potential threats. Investors need to take appropriate security measures, such as using secure wallets and practicing good cybersecurity hygiene, to mitigate these risks. The high value of Bitcoin makes it a prime target for cybercriminals, highlighting the importance of robust security protocols. High-profile exchange hacks, such as the Mt. Gox incident, demonstrate the potential for significant losses due to security breaches.

Macroeconomic Factors, Bitcoin After Halving 2025

Bitcoin’s price is also influenced by broader macroeconomic factors, such as inflation, interest rates, and economic recessions. These factors can impact investor sentiment and capital flows into the cryptocurrency market. For example, rising interest rates can make alternative investments more attractive, potentially leading to a decline in Bitcoin’s price as investors shift their assets. Conversely, periods of high inflation might increase the appeal of Bitcoin as a hedge against inflation, potentially driving up its price.

Risk Management Strategy

A robust risk management strategy for Bitcoin investment post-halving should incorporate diversification, careful position sizing, and thorough due diligence. Diversifying investments across different asset classes reduces the impact of any single investment’s poor performance. Position sizing, or limiting the amount invested in Bitcoin relative to an investor’s overall portfolio, helps control potential losses. Finally, conducting thorough research and understanding the risks involved is crucial before investing. Regularly reviewing and adjusting the investment strategy based on market conditions and personal risk tolerance is also essential for long-term success.

Bitcoin After Halving 2025 – Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, with many factors influencing its trajectory. To better understand the historical context and potential implications, it’s useful to consult a visual representation of past halvings and their effects; a great resource for this is the Bitcoin Halving Chart 2025. Analyzing this chart can help inform predictions about Bitcoin’s performance in the post-halving period, though of course, no prediction is guaranteed.

Predicting Bitcoin’s behavior after the 2025 halving is a complex undertaking, relying heavily on numerous factors. A key event to consider is the impact of the upcoming halving itself, which is expected to significantly reduce the rate of new Bitcoin entering circulation. For detailed information on this crucial event, please refer to this comprehensive analysis of the Bitcoin April 2025 Halving.

Understanding this halving is vital for any projection of Bitcoin’s price and market dynamics post-April 2025.

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, with many analysts offering diverse perspectives. A key factor in these predictions is, of course, the precise date of the halving itself, which you can find detailed information about on this helpful resource: Fecha Halving Bitcoin 2025. Understanding the timing allows for more accurate modeling of the subsequent supply reduction and its potential impact on Bitcoin’s market value.

Therefore, knowing the halving date is crucial for any serious analysis of Bitcoin’s post-halving trajectory.

Predicting Bitcoin’s price after the 2025 halving is a complex endeavor, dependent on numerous factors. Understanding the mechanics of the halving itself is crucial, however, as it directly impacts the rate of new Bitcoin entering circulation. For a comprehensive explanation of this pivotal event, refer to this insightful resource on Bitcoin Halving In 2025. Following the halving, we can expect a period of market adjustment, with potential price increases driven by reduced supply.

Understanding Bitcoin after the 2025 halving requires careful consideration of the preceding event. To accurately gauge the post-halving market dynamics, it’s crucial to examine predictions for the halving itself; a comprehensive analysis can be found at Bitcoin Halving Prediction 2025. This prediction will help us better understand the potential scarcity and resulting price action in the Bitcoin market following the 2025 halving event.

Analyzing Bitcoin’s performance after the 2025 halving requires understanding the precise timing of the event. To clarify this crucial date, you might find it helpful to consult this resource on When Was Bitcoin Halving In 2025. Knowing the exact date allows for a more accurate prediction of the potential impact on Bitcoin’s price and market dynamics following the reduced block reward.