Bitcoin Halving in April 2025

The Bitcoin halving, scheduled for April 2025, is a significant event in the cryptocurrency’s lifecycle. This event, programmed into Bitcoin’s code, reduces the rate at which new Bitcoins are created, impacting the overall supply and potentially influencing its price. Understanding the mechanics and historical context of this halving is crucial for navigating the anticipated market fluctuations.

Bitcoin Halving Mechanics and Historical Impact

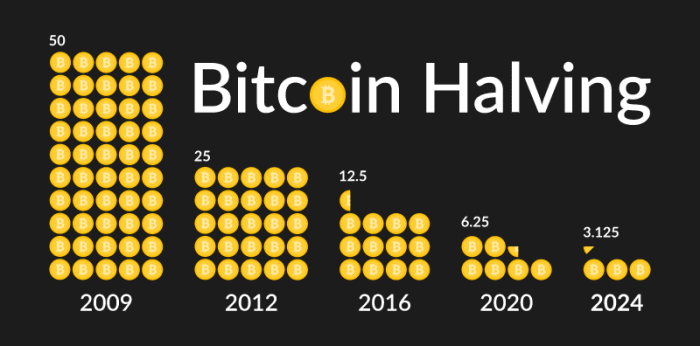

The Bitcoin halving mechanism is designed to control inflation. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This reduces the rate of new Bitcoin entering circulation. Historically, previous halvings have been followed by periods of significant price appreciation, although the timeframes and magnitudes have varied. The 2012 halving saw a gradual price increase, while the 2016 halving led to a more pronounced bull run, and the 2020 halving also resulted in substantial price growth, albeit with periods of volatility. However, it’s crucial to remember that correlation does not equal causation, and other market factors significantly influence Bitcoin’s price.

Supply Reduction from the 2025 Halving

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate of new Bitcoin creation. This reduced supply, coupled with continued demand, is expected to exert upward pressure on the price. The overall effect on price will depend on various factors, including overall market sentiment, regulatory developments, and macroeconomic conditions. Similar to past halvings, the 2025 event will introduce a period of reduced supply, which is expected to contribute to price increases.

Potential Short-Term and Long-Term Price Volatility

The short-term effects of the 2025 halving are likely to be characterized by increased price volatility. Anticipation of the event often leads to speculative trading, resulting in price swings. The actual impact on price might not be immediately apparent, with some potential for a period of consolidation before a significant price movement. Long-term, however, the reduced supply is expected to contribute to a gradual increase in Bitcoin’s value, assuming continued demand. The extent of this increase will depend on several factors, including adoption rates, technological advancements, and overall economic conditions. The 2012, 2016, and 2020 halvings all demonstrate this pattern of short-term volatility followed by longer-term price appreciation.

Comparison with Previous Halving Events

While previous halvings have generally been followed by periods of price appreciation, the extent and timing of these increases have varied considerably. The 2012 halving resulted in a more gradual price increase, while the 2016 and 2020 halvings were followed by more pronounced bull markets. However, it’s important to note that other factors, such as increased institutional adoption, technological improvements, and macroeconomic conditions, have also played a significant role in shaping Bitcoin’s price trajectory. Therefore, directly comparing the 2025 halving to past events requires careful consideration of the broader market context. The 2025 halving will likely present unique challenges and opportunities, influenced by the evolving global economic and regulatory landscape.

Market Predictions and Price Speculation

Predicting Bitcoin’s price, especially around a halving event, is inherently speculative. Numerous analysts and commentators offer diverse forecasts, influenced by a complex interplay of economic factors, technological developments, and regulatory landscapes. While no one can definitively predict the future price of Bitcoin, examining the range of predictions and their underlying rationales offers valuable insight into the market sentiment and potential scenarios.

The upcoming 2025 Bitcoin halving is a significant event expected to reduce the rate of new Bitcoin entering circulation. This scarcity, historically, has been associated with price increases. However, the magnitude of this price increase is highly debated, and several factors contribute to the uncertainty.

Factors Influencing Bitcoin Price Predictions

Several key factors contribute to the varying predictions surrounding Bitcoin’s price following the 2025 halving. Macroeconomic conditions, such as inflation rates, interest rate policies, and global economic growth, play a crucial role. A period of high inflation, for example, might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, a strong dollar and rising interest rates could divert investment away from riskier assets like Bitcoin. Technological advancements, such as the development of layer-2 scaling solutions or significant improvements in Bitcoin’s infrastructure, could also impact its price positively by enhancing usability and transaction efficiency. Finally, regulatory clarity or uncertainty significantly influences investor confidence and market participation. Stringent regulations could suppress price growth, while favorable regulations could attract institutional investment and drive prices upwards.

Price Scenario Breakdown

Analysts propose a wide range of price predictions for Bitcoin post-halving. Some optimistic predictions foresee Bitcoin reaching prices exceeding $100,000 or even higher, based on historical trends and the anticipated impact of reduced supply. These predictions often incorporate assumptions about increased institutional adoption, mainstream acceptance, and continued demand from retail investors. Conversely, more conservative predictions suggest a more moderate price increase, perhaps in the range of $50,000 to $75,000, factoring in potential macroeconomic headwinds and regulatory risks. Pessimistic scenarios, while less common, might even project a price decline or stagnation, should negative macroeconomic events or significant regulatory setbacks occur. For example, a major global recession could significantly impact investor sentiment, leading to a decrease in Bitcoin’s price regardless of the halving. It is important to note that these scenarios are not mutually exclusive, and the actual price movement could fall anywhere within this broad range or even outside it.

Impact of Regulatory Changes

Regulatory developments worldwide significantly impact Bitcoin’s price. A clear and favorable regulatory framework in major markets could legitimize Bitcoin as an asset class, encouraging institutional investment and potentially driving substantial price increases. Examples include countries establishing clear guidelines for Bitcoin taxation and custody, or creating regulatory sandboxes for Bitcoin-related businesses. Conversely, stricter regulations, including outright bans or overly burdensome compliance requirements, could negatively impact Bitcoin’s price by reducing accessibility and investor confidence. The contrasting regulatory approaches of different countries further contribute to price volatility. For instance, a country’s decision to adopt a more permissive stance toward Bitcoin could lead to a temporary price surge, while a crackdown in another major market could cause a price correction. The overall regulatory landscape is a dynamic factor that constantly influences Bitcoin’s market behavior.

Mining and the Halving’s Impact

The Bitcoin halving in April 2025 will significantly impact Bitcoin miners, altering their profitability and necessitating strategic adjustments to maintain operational viability. The reduction in block rewards, the primary income source for miners, will force a recalibration of their operations and potentially reshape the network’s decentralization.

The halving cuts the Bitcoin block reward in half, directly impacting miners’ revenue. This decrease will make mining less profitable, potentially leading to some miners becoming unprofitable and ceasing operations. The magnitude of this impact will depend on several factors, including the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. For instance, if the Bitcoin price remains relatively stagnant or declines post-halving, the profitability squeeze will be even more pronounced. Conversely, a substantial price increase could offset the reduced block reward, maintaining or even enhancing profitability for many miners.

Miner Profitability and Operational Changes

The reduced block reward necessitates miners to reassess their operational strategies. This could involve several actions, such as increasing mining efficiency through hardware upgrades or transitioning to more cost-effective energy sources. Miners might also explore alternative revenue streams, such as transaction fees, which become proportionally more significant with a reduced block reward. Some less efficient or higher-cost miners may be forced to shut down, leading to a consolidation of the mining landscape. A historical example can be observed following previous halvings, where less efficient miners exited the market, leading to increased network hashrate concentration among larger, more efficient operations. This dynamic highlights the constant pressure on miners to optimize their operations for profitability.

Mining Hardware Upgrades and Strategic Adjustments

To maintain profitability in the face of reduced block rewards, many miners will likely invest in more energy-efficient and powerful mining hardware. This could involve adopting the latest generation of ASICs (Application-Specific Integrated Circuits) designed for optimal Bitcoin mining performance. Furthermore, miners might shift their operations to regions with lower electricity costs, potentially leading to geographical shifts in mining activity. This could involve moving mining operations from regions with high electricity prices to areas with renewable energy sources, like hydropower or geothermal energy. This adaptation showcases the industry’s dynamic response to economic pressures.

Decentralization and the Halving

The halving’s effect on decentralization is complex and multifaceted. While it could lead to a consolidation of mining power among larger, more efficient operations, potentially reducing the number of miners, it could also incentivize innovation and the development of more efficient and sustainable mining practices. The long-term impact on decentralization will depend on the balance between these competing forces. For example, if smaller miners are forced out, leading to a dominance of a few large mining pools, it could be argued that decentralization is negatively affected. However, if technological advancements lead to more distributed mining operations, it could have the opposite effect.

Challenges Faced by Miners and Their Responses

Miners face several challenges following a halving, including reduced profitability, increased competition, and the need for significant capital investment in new hardware. To overcome these hurdles, miners may need to explore diverse strategies such as forming larger mining pools to share resources and reduce operational costs, diversifying their revenue streams beyond block rewards, and securing access to cheaper energy sources. Furthermore, the increasing regulatory scrutiny in certain jurisdictions could pose an additional challenge, forcing miners to adapt to comply with evolving regulations. The ability of miners to navigate these challenges will be critical to their continued participation in the Bitcoin network and the overall health of the ecosystem.

Investor Sentiment and Market Behavior

Investor sentiment surrounding Bitcoin halving events is a complex interplay of anticipation, speculation, and market forces. Historically, the period leading up to a halving often sees a build-up of bullish sentiment, fueled by the expectation of reduced supply and potential price appreciation. However, the post-halving period can be more unpredictable, with sentiment shifting based on various factors including overall market conditions and the actual price action following the event.

The typical investor behavior leading up to a Bitcoin halving is characterized by increased trading volume and price volatility. Many investors view the halving as a significant bullish catalyst, leading to accumulation of Bitcoin in anticipation of future price increases. This increased demand can push prices higher, creating a self-fulfilling prophecy. Conversely, some investors might take profits before the halving, anticipating a potential price correction afterward. After the halving, the market behavior often depends on whether the price meets or exceeds investor expectations. Positive price action generally reinforces bullish sentiment, while a lackluster performance can lead to disappointment and selling pressure.

Historical Trends in Investor Sentiment

Analyzing historical data from the previous Bitcoin halvings reveals interesting trends in investor sentiment. The halving in 2012 saw a relatively subdued market reaction, with a gradual price increase following the event. The 2016 halving, however, was followed by a significant bull run, leading to a substantial price surge. The 2020 halving also saw a considerable price increase, though the trajectory was more complex and involved periods of both growth and correction. These differing outcomes highlight the impact of broader macroeconomic factors and overall market conditions on the effectiveness of the halving as a price catalyst. While a halving creates a predictable reduction in supply, the resulting market reaction is far from guaranteed.

Potential for Increased or Decreased Market Volatility

The period surrounding a Bitcoin halving is typically associated with heightened market volatility. The increased uncertainty and anticipation leading up to the event often translate into larger price swings. This is exacerbated by the inherent volatility of the cryptocurrency market itself. After the halving, the volatility can either continue or subside, depending on the market’s response to the actual price action. A sharp price increase might lead to a period of consolidation, while a lack of significant price movement could trigger further uncertainty and potentially more volatility. The 2020 halving, for example, was followed by a period of significant price increases, but also involved considerable price fluctuations along the way.

Strategic Investor Positioning

Investors can employ several strategies in anticipation of the 2025 Bitcoin halving. A common approach is to accumulate Bitcoin gradually in the months leading up to the event, averaging into positions to mitigate the risk of buying at a price peak. Dollar-cost averaging, for example, involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy reduces the impact of short-term price fluctuations. Another strategy involves employing technical analysis to identify potential support and resistance levels, allowing investors to potentially profit from price swings. However, it is crucial to remember that no strategy guarantees success in the volatile cryptocurrency market. Diversification, risk management, and a long-term investment horizon are vital considerations for navigating the complexities of the Bitcoin market.

Long-Term Implications and Future Outlook

The 2025 Bitcoin halving is a significant event with potentially far-reaching consequences for the cryptocurrency’s long-term trajectory. While predicting the future with certainty is impossible, analyzing historical trends and current market dynamics allows for informed speculation on Bitcoin’s future adoption, market dominance, and vulnerability to disruptive forces. The halving’s impact will unfold over several years, shaping the cryptocurrency landscape in ways we can only begin to anticipate.

The reduced supply of newly mined Bitcoin, coupled with sustained or increased demand, is expected to exert upward pressure on the price. This, in turn, could catalyze further adoption by both individual investors and institutional players. However, the extent of this impact depends on several interconnected factors, including macroeconomic conditions, regulatory developments, and the emergence of competing technologies.

Bitcoin’s Continued Market Dominance

Maintaining its position as the leading cryptocurrency hinges on several key factors. Bitcoin’s first-mover advantage, established network effect, and robust security protocol provide a strong foundation. However, the emergence of faster, more scalable, or more environmentally friendly alternatives poses a challenge. The ability of Bitcoin to adapt and evolve, perhaps through layer-2 solutions or improvements to its underlying technology, will be crucial in determining its continued dominance. For example, the Lightning Network’s potential to address scalability issues is a significant factor in Bitcoin’s ability to compete with faster cryptocurrencies. If the Lightning Network gains widespread adoption, it could significantly enhance Bitcoin’s transaction speed and efficiency, thus bolstering its market position.

Potential Disruptive Technologies and Trends

Several technologies and trends could significantly impact Bitcoin’s future. Quantum computing, while still in its nascent stages, presents a theoretical threat to Bitcoin’s cryptographic security. The development of more energy-efficient consensus mechanisms, such as proof-of-stake, could also challenge Bitcoin’s dominance, especially if environmental concerns continue to gain traction. Furthermore, central bank digital currencies (CBDCs) could compete with Bitcoin as a store of value and a medium of exchange, depending on their design and adoption rate. The regulatory landscape, particularly in major economies, will play a crucial role in shaping the future of Bitcoin and its competitors. A globally harmonized and supportive regulatory framework could foster growth and mainstream adoption, while inconsistent or overly restrictive regulations could hinder its progress.

Post-Halving Timeline and Milestones

The years following the 2025 halving are likely to witness a series of significant events and milestones. A gradual increase in Bitcoin’s price is a widely anticipated outcome, although the pace and extent of this increase remain uncertain. We can anticipate increased institutional investment, potentially driven by the scarcity premium associated with the reduced supply. Further regulatory clarity in various jurisdictions is also expected, though the specifics of these regulations will significantly influence market behavior. The development and adoption of layer-2 scaling solutions, like the Lightning Network, will likely accelerate, aiming to improve Bitcoin’s transaction speed and scalability. Finally, the continued evolution of the Bitcoin ecosystem, including the development of new applications and services built on the Bitcoin blockchain, will be critical to its long-term success. A hypothetical timeline could envision significant price appreciation within the first 12-18 months post-halving, followed by a period of consolidation and further technological development. The long-term trajectory, however, is heavily dependent on the aforementioned factors and remains subject to considerable uncertainty.

Frequently Asked Questions (FAQs): Bitcoin April 2025 Halving

This section addresses common queries regarding the Bitcoin halving event expected in April 2025, focusing on its mechanics, historical impact, and potential future implications for investors. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market.

The Bitcoin Halving and its Significance

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. Its significance lies in its direct impact on Bitcoin’s scarcity. As the supply of newly mined Bitcoin decreases, its value may increase due to the principles of supply and demand, assuming demand remains consistent or increases. This controlled inflation mechanism is a key feature of Bitcoin’s design, intended to mimic the scarcity of precious metals like gold.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following previous halving events. The 2012 and 2016 halvings were followed by significant price rallies, although the timeframes and magnitudes varied. However, it’s crucial to remember that correlation doesn’t equal causation. Other market factors, such as regulatory changes, technological advancements, and overall economic conditions, also significantly influence Bitcoin’s price. Therefore, while past performance suggests a potential positive impact, it’s not a guaranteed outcome. The 2020 halving, for example, saw a price increase, but the timing and extent differed from previous cycles.

Expected Date of the Next Bitcoin Halving, Bitcoin April 2025 Halving

The next Bitcoin halving is anticipated to occur in April 2025. This prediction is based on the consistent block generation time and the known halving interval of approximately four years. Block explorers and dedicated Bitcoin tracking websites provide real-time data on block mining progress, allowing for accurate estimations of the halving date. Minor variations are possible depending on the actual mining rate, but April 2025 remains the strongly supported consensus.

Potential Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, particularly around a halving event, carries inherent risks. Market volatility is a significant concern; prices can fluctuate dramatically in short periods. The anticipation surrounding the halving often leads to increased speculation, creating a bubble-like effect where prices can become detached from underlying fundamentals. Furthermore, regulatory uncertainty remains a global challenge for cryptocurrencies. Changes in governmental regulations can significantly impact Bitcoin’s price and accessibility. Investors should carefully assess their risk tolerance and diversify their portfolios to mitigate potential losses.