Bitcoin Bull Run 2024

Bitcoin’s price history is characterized by periods of intense growth (bull runs) followed by significant corrections (bear markets). These cycles, while unpredictable in their exact timing and magnitude, often exhibit similar patterns and contributing factors. Understanding these historical trends can provide valuable context for analyzing potential future bull runs, such as the anticipated 2024 event.

The primary drivers of Bitcoin bull runs are typically a confluence of factors, including increased institutional adoption, positive regulatory developments, technological advancements within the Bitcoin ecosystem, macroeconomic events impacting investor sentiment, and, crucially, the narrative surrounding Bitcoin’s scarcity and its potential as a hedge against inflation or geopolitical instability. Each bull run builds upon previous cycles, accumulating more widespread awareness and acceptance.

Factors Contributing to Bitcoin Bull Runs

Several key elements typically converge to fuel a Bitcoin bull run. Increased institutional investment, for example, brings substantial capital into the market, pushing prices higher. Positive regulatory clarity, or even the absence of overly restrictive measures, can significantly boost investor confidence. Technological upgrades, such as the implementation of the Lightning Network for faster and cheaper transactions, improve Bitcoin’s usability and attract new users. Finally, macroeconomic factors, such as high inflation or uncertainty in traditional financial markets, can drive investors towards Bitcoin as a perceived safe haven or alternative asset.

Timeline of Events Leading to Potential 2024 Bull Run

A simplified timeline illustrating significant events leading up to the anticipated 2024 bull run could be structured as follows:

Bitcoin Bull Run 2024 – The 2022 bear market, triggered by various factors including macroeconomic conditions and the collapse of several prominent crypto projects, significantly impacted Bitcoin’s price. This period, however, is often viewed as a necessary correction within the broader cyclical pattern. The subsequent period of relative price stability and consolidation, coupled with ongoing development and adoption, has set the stage for a potential resurgence.

| Year | Event | Impact |

|---|---|---|

| 2022 | Crypto winter, significant price correction | Price decline, market consolidation |

| 2023 | Increased regulatory scrutiny, but also some positive developments in certain jurisdictions; growing institutional interest | Mixed impact, but growing institutional adoption helps to mitigate negative effects of regulatory uncertainty. |

| 2024 | Bitcoin halving event | Reduced supply of newly mined Bitcoin, historically associated with increased price appreciation |

The Bitcoin halving, scheduled for 2024, is a significant event that historically has preceded bull runs. The halving reduces the rate at which new Bitcoins are created, thus potentially increasing scarcity and driving up demand.

Predicting the 2024 Bitcoin Bull Run

Predicting the future price of Bitcoin, or any asset for that matter, is inherently speculative. However, by analyzing historical trends, understanding market forces, and considering the opinions of prominent analysts, we can formulate informed hypotheses about the potential trajectory of Bitcoin’s price in 2024. The upcoming halving event, coupled with potential shifts in macroeconomic conditions and regulatory landscapes, are key factors influencing these predictions.

Bitcoin Price Predictions for 2024: A Comparison

Various analysts and forecasting platforms offer diverse price predictions for Bitcoin in 2024. These predictions often vary significantly, reflecting the inherent uncertainty in the cryptocurrency market and the different methodologies employed. Some analysts utilize technical analysis, focusing on chart patterns and historical price movements to predict future trends. Others incorporate fundamental analysis, examining factors like adoption rates, network security, and regulatory developments. Still others utilize complex quantitative models that attempt to factor in a wide range of variables. For example, some predictions suggest a price range between $100,000 and $200,000, while others are far more conservative, projecting prices in the tens of thousands. The divergence highlights the significant uncertainty surrounding future price movements. The lack of a universally accepted model for predicting cryptocurrency prices further contributes to this variability.

Prominent Analyst Insights and Rationale

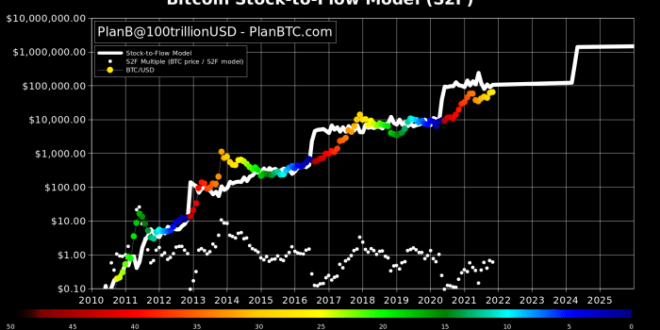

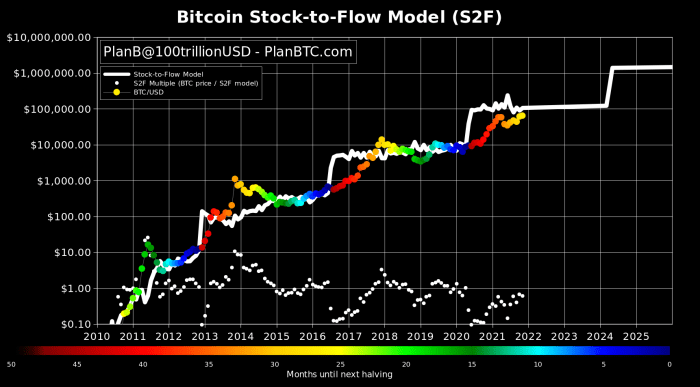

PlanB, a well-known on-chain analyst, has historically used stock-to-flow models to predict Bitcoin’s price. While his previous predictions haven’t always been perfectly accurate, his models continue to be closely followed within the crypto community. His rationale often centers around the scarcity of Bitcoin and the impact of halving events on its supply. Conversely, other analysts, such as those at CoinMetrics, might emphasize factors such as network activity, transaction volume, and the overall macroeconomic environment in their predictions. Their analyses often incorporate a broader range of data points, leading to potentially more nuanced, though less precise, forecasts. The differences in analytical approaches underscore the complexity of predicting Bitcoin’s price and the importance of considering multiple perspectives.

Potential Catalysts for a 2024 Bull Run

Several factors could act as catalysts for a Bitcoin bull run in 2024. The most frequently cited is the Bitcoin halving, scheduled for sometime in April 2024. This event reduces the rate at which new Bitcoins are created, potentially increasing scarcity and driving up demand. Past halving events have historically been followed by significant price increases, although the timing and magnitude of these increases have varied. Beyond the halving, positive regulatory developments, such as the clarification of regulatory frameworks in major jurisdictions, could boost investor confidence and lead to increased institutional investment. Finally, macroeconomic factors, such as inflation or geopolitical instability, could also play a significant role. If traditional assets underperform, Bitcoin could potentially benefit from its perceived status as a safe haven asset. The interplay of these factors makes predicting the precise nature and timing of a bull run a complex challenge.

Factors Influencing Bitcoin’s Price in 2024

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic factors, investor sentiment, technological advancements, and regulatory changes. While no one can definitively state the price, understanding these influencing factors provides a framework for informed speculation.

Macroeconomic Conditions and Bitcoin’s Price

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, often prompting central banks to raise interest rates, can initially drive investors towards Bitcoin as a hedge against inflation. However, rising interest rates increase the opportunity cost of holding Bitcoin, which doesn’t generate yield like interest-bearing accounts. A recessionary environment could lead to decreased risk appetite, potentially causing a sell-off in risk assets like Bitcoin. Conversely, a period of economic stability or unexpectedly low inflation could boost investor confidence and increase demand for Bitcoin. For example, the 2020-2021 bull run coincided with increased money printing and low interest rates, creating a favorable environment for risk assets.

Institutional Investment and Adoption

The growing involvement of institutional investors, such as hedge funds and corporations, is a crucial driver of Bitcoin’s price. Larger investments bring increased liquidity and credibility to the market. Grayscale Bitcoin Trust, for instance, holds a significant amount of Bitcoin, impacting supply and demand dynamics. Increased institutional adoption can also lead to greater regulatory clarity and acceptance, fostering a more stable and mature market. This, in turn, can attract more mainstream investors, further driving price appreciation.

Technological Advancements and Network Upgrades

Technological advancements and network upgrades play a significant role in Bitcoin’s long-term value proposition. Successful implementations of scaling solutions, such as the Lightning Network, could enhance Bitcoin’s usability and transaction speed, potentially increasing its adoption and driving price growth. Conversely, significant security breaches or unforeseen technical challenges could negatively impact investor confidence and the price. The development of new applications built on the Bitcoin blockchain, such as decentralized finance (DeFi) applications, also contribute to the overall ecosystem’s growth and appeal, influencing the price indirectly.

Impact of Various Factors on Bitcoin’s Price

| Factor | Positive Impact | Negative Impact | Example/Real-Life Case |

|---|---|---|---|

| Macroeconomic Conditions (Inflation/Interest Rates/Recession) | High inflation drives investors to Bitcoin as a hedge; low interest rates reduce the opportunity cost of holding Bitcoin. | High interest rates increase the opportunity cost; recessionary environments decrease risk appetite. | The 2020-2021 bull run coincided with increased money printing and low interest rates. The 2022 bear market partially reflected rising interest rates and economic uncertainty. |

| Institutional Investment & Adoption | Increased liquidity, credibility, and regulatory clarity attract mainstream investors. | Lack of institutional adoption limits market growth and price appreciation. | Grayscale Bitcoin Trust’s holdings significantly impact market dynamics. Increased corporate Bitcoin adoption signals growing acceptance. |

| Technological Advancements & Network Upgrades | Improved scalability, usability, and security enhance adoption and attract investors. | Security breaches or technical failures erode investor confidence. | Successful implementation of the Lightning Network could significantly improve transaction speed. A major network outage could cause a price drop. |

Risks and Challenges Associated with a 2024 Bull Run

A Bitcoin bull run, while potentially lucrative, carries significant risks. The rapid price appreciation characteristic of such periods can create an environment ripe for manipulation, regulatory crackdowns, and ultimately, a sharp correction. Understanding these inherent dangers is crucial for navigating the market successfully.

Market manipulation, regulatory uncertainty, and security vulnerabilities represent significant threats to investors during a bull run. The potential for a subsequent market crash following a period of rapid growth is also a major concern. Effective risk mitigation strategies are therefore essential for protecting capital.

Market Manipulation, Bitcoin Bull Run 2024

The decentralized nature of Bitcoin doesn’t eliminate the risk of market manipulation. Large holders, or “whales,” can exert considerable influence on price through coordinated buying and selling. This can lead to artificial price inflation during a bull run, followed by a sharp decline when these actors decide to liquidate their holdings. The 2017 Bitcoin bubble, for example, saw significant price spikes driven by speculation and potentially manipulative activities, ultimately leading to a devastating crash. Sophisticated trading strategies employing algorithms and high-frequency trading further exacerbate this risk.

Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies. A sudden shift in regulatory landscape, such as increased restrictions on trading or taxation, could trigger a significant market downturn. The uncertainty surrounding regulatory frameworks contributes to market volatility and makes it difficult to predict long-term price trends. Different jurisdictions may adopt varying approaches, creating further complexity and risk. For example, a sudden ban on Bitcoin trading in a major market could negatively impact global prices.

Security Vulnerabilities

Bitcoin’s security relies on its cryptographic infrastructure and the robustness of exchanges and wallets. Security breaches, hacks, and exploits targeting exchanges or individual wallets can lead to significant losses for investors. The theft of large sums of Bitcoin can negatively impact market confidence and trigger price corrections. Mt. Gox, a once-dominant Bitcoin exchange, famously suffered a major security breach in 2014, resulting in the loss of millions of dollars worth of Bitcoin and a significant decline in market price.

Potential for a Market Correction or Crash

Bull runs are inherently unsustainable. The rapid price increases often attract speculative investment, creating a bubble. When investor sentiment shifts or a triggering event occurs, this bubble can burst, leading to a sharp and often prolonged price correction. The 2017-2018 Bitcoin bear market, following a significant bull run, serves as a prime example of this phenomenon. The longer and steeper the bull run, the greater the potential for a subsequent, more severe correction.

Strategies for Mitigating Risk

Diversification is a key risk mitigation strategy. Avoid investing your entire portfolio in Bitcoin. Allocate funds across different asset classes to reduce overall portfolio volatility. Dollar-cost averaging, a strategy involving investing fixed amounts of money at regular intervals, can help mitigate the risk of buying high during a bull run. Finally, thorough due diligence and a clear understanding of the risks associated with Bitcoin investment are essential. Setting stop-loss orders can help limit potential losses if the market turns against you.

Investment Strategies for a Potential Bull Run

Navigating a Bitcoin bull run requires a strategic approach, balancing potential gains with inherent risks. Understanding various investment strategies and implementing robust risk management are crucial for successful participation. The following Artikels several approaches and considerations for investors of varying risk tolerances.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak. For example, an investor might commit $100 per week to Bitcoin, buying more when the price is low and fewer when the price is high. Over time, this strategy aims to reduce the average cost per Bitcoin, potentially leading to higher returns if the overall market trend is upward. This strategy is particularly suitable for long-term investors with a lower risk tolerance.

Swing Trading

Swing trading focuses on capturing short-to-medium-term price movements. Traders identify potential entry and exit points based on technical analysis, aiming to profit from price swings within a specific timeframe, often ranging from a few days to several weeks. Successful swing trading requires a good understanding of chart patterns, indicators, and market sentiment. For instance, a swing trader might buy Bitcoin when it shows a strong support level and sell when it reaches a predetermined resistance level. This strategy carries higher risk than DCA due to its shorter time horizons and reliance on precise market timing.

Long-Term Holding (HODLing)

Long-term holding, often referred to as “HODLing” within the cryptocurrency community, involves buying and holding Bitcoin for an extended period, typically years, regardless of short-term price volatility. This strategy is based on the belief in Bitcoin’s long-term value proposition and potential for significant growth. The longer the holding period, the less impact short-term price fluctuations have on the overall return. This strategy minimizes the need for constant monitoring and trading, but requires significant patience and confidence in Bitcoin’s future. Consider the example of someone who bought Bitcoin in 2010 and held it until 2021; they would have experienced significant gains despite market corrections.

Diversification to Minimize Risk

Diversification is a cornerstone of responsible investing. Instead of allocating all capital to Bitcoin, investors should consider diversifying across other asset classes, including stocks, bonds, real estate, and other cryptocurrencies. This reduces the overall portfolio risk, as losses in one asset class may be offset by gains in another. A well-diversified portfolio can withstand market volatility more effectively than one heavily concentrated in a single asset. For example, an investor might allocate 5% of their portfolio to Bitcoin, 15% to other cryptocurrencies, 40% to stocks, and 40% to bonds. The specific allocation will depend on individual risk tolerance and investment goals.

Risk Management and Responsible Investing

Responsible investing necessitates a clear understanding of risk tolerance and investment goals. Before investing in Bitcoin or any other cryptocurrency, investors should carefully assess their risk appetite and only invest an amount they can afford to lose. Setting stop-loss orders can help limit potential losses during market downturns. Thorough research and due diligence are essential before making any investment decisions. Furthermore, investors should be wary of scams and fraudulent investment schemes, and avoid making emotional decisions based on hype or market speculation. Only invest what you can afford to lose and never invest borrowed money.

Bitcoin’s Long-Term Outlook Beyond 2024

Bitcoin’s future beyond 2024 is a subject of much speculation, but its underlying technology and growing adoption suggest a significant role in the evolving global financial landscape. While short-term price volatility remains a characteristic of the cryptocurrency market, the long-term potential of Bitcoin as both a store of value and a medium of exchange is increasingly recognized by investors and financial institutions alike.

The continued development and adoption of Bitcoin hinge on several key factors, including technological advancements, regulatory clarity, and increasing institutional investment. Its decentralized nature and inherent scarcity, governed by its fixed supply of 21 million coins, are fundamental attributes that contribute to its perceived value proposition.

Bitcoin as a Store of Value

Bitcoin’s potential as a store of value is closely tied to its scarcity and its perceived resistance to inflation. Unlike fiat currencies, which can be subject to inflationary pressures through government printing, Bitcoin’s fixed supply creates a deflationary model. This has led many to view Bitcoin as a hedge against inflation, a safe haven asset similar to gold. The historical correlation between Bitcoin’s price and periods of high inflation in traditional markets further supports this argument. For example, during periods of economic uncertainty and rising inflation, Bitcoin has often seen increased demand, driving its price upwards. This suggests a growing recognition of Bitcoin’s potential to preserve purchasing power in volatile economic environments.

Bitcoin as a Medium of Exchange

While Bitcoin’s adoption as a widespread medium of exchange is still in its early stages, its increasing use in cross-border transactions and payments demonstrates its growing potential in this area. The speed and lower transaction fees associated with Bitcoin compared to traditional banking systems make it an attractive alternative, particularly for international transfers. The development of the Lightning Network, a second-layer scaling solution, is further improving Bitcoin’s transaction speed and efficiency, addressing one of the key limitations to its widespread adoption as a daily payment method. The increasing number of merchants accepting Bitcoin as payment also signals a gradual shift in consumer behavior and acceptance.

Bitcoin’s Role in the Evolving Financial Landscape

Bitcoin’s impact on the financial landscape extends beyond its use as a store of value or medium of exchange. Its underlying blockchain technology has broader applications in various sectors, including supply chain management, digital identity verification, and decentralized finance (DeFi). The transparency and immutability of the blockchain offer potential solutions to existing inefficiencies and security vulnerabilities in traditional systems. Furthermore, the emergence of decentralized autonomous organizations (DAOs) built on blockchain technology demonstrates the potential for a more democratized and transparent governance model. The increasing integration of Bitcoin and blockchain technology into established financial systems suggests a future where these technologies play a significant role in shaping the financial world.

Bitcoin’s Potential Impact on the Global Economy

The long-term impact of Bitcoin on the global economy is difficult to predict with certainty. However, its potential to disrupt traditional financial systems and empower individuals through greater financial inclusion is undeniable. The increased accessibility of financial services through Bitcoin, particularly in underserved regions, could have profound economic and social consequences. Furthermore, the development of innovative financial products and services built on Bitcoin’s blockchain technology could lead to significant economic growth and innovation. While challenges remain, including regulatory uncertainty and the need for increased technological scalability, the potential for Bitcoin to reshape the global financial system is significant.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin bull runs, providing clarity on their nature, duration, prediction, and investment strategies. Understanding these aspects is crucial for navigating the volatile cryptocurrency market.

Bitcoin Bull Run Definition

A Bitcoin bull run refers to a sustained period of significant price appreciation in the Bitcoin market. It’s characterized by a rapid and substantial increase in Bitcoin’s value, often fueled by a confluence of factors including increased investor demand, positive media coverage, technological advancements, and regulatory developments. This upward trend is typically accompanied by high trading volume and significant market capitalization growth. Unlike shorter-term price fluctuations, a bull run signifies a broader shift in market sentiment, marked by sustained upward momentum. For example, the 2017 bull run saw Bitcoin’s price surge from under $1,000 to nearly $20,000, a dramatic increase reflecting widespread enthusiasm and investment.

Bitcoin Bull Run Duration

The duration of Bitcoin bull runs has varied considerably. The 2011 bull run lasted approximately one year, while the 2017 run extended for several months. The 2021 bull run lasted around a year. Several factors influence the duration, including the speed of adoption, regulatory changes, macroeconomic conditions, and the emergence of competing cryptocurrencies. A prolonged bull run might be indicative of sustained investor confidence and robust technological developments, while a shorter run could signal a more speculative market driven by rapid price increases and subsequent corrections. Predicting the precise duration of a future bull run remains challenging due to the inherent volatility of the cryptocurrency market.

Signs of an Impending Bitcoin Bull Run

Several indicators can suggest an upcoming bull run. These include increasing on-chain activity (e.g., higher transaction volumes, increased network hash rate), positive sentiment among investors and analysts, significant institutional investment, and favorable regulatory developments. A decrease in Bitcoin’s volatility after a prolonged period of sideways trading can also precede a bull run. Furthermore, macroeconomic factors like inflation or economic uncertainty can drive investors towards Bitcoin as a hedge against inflation, thereby fueling a bull run. Observing these factors collectively provides a more comprehensive picture of the market’s potential trajectory.

Investing in Bitcoin Before a Potential Bull Run

Investing in Bitcoin before a potential bull run presents both opportunities and risks. Early investment allows for potentially higher returns if the bull run materializes. However, it also carries the risk of losses if the price doesn’t increase as anticipated. Investing during the early stages of a bull run involves higher risk but potentially higher rewards, while investing later offers lower risk but potentially lower returns. A diversified investment strategy, coupled with thorough research and risk assessment, is crucial for mitigating potential losses and maximizing potential gains. Careful consideration of personal risk tolerance is paramount.

Protecting Bitcoin Investments During a Bull Run

Protecting Bitcoin investments during a bull run requires a proactive approach to risk management. Diversification across different asset classes, including traditional investments, can help mitigate losses if the Bitcoin market experiences a correction. Employing strategies like dollar-cost averaging (DCA) can help reduce the impact of volatility. Furthermore, securing your Bitcoin using robust security measures, such as hardware wallets and strong passwords, is crucial to protect against theft or loss. Regularly reviewing your investment strategy and adjusting it based on market conditions can help to navigate the volatile nature of a bull run effectively.

Illustrative Example: Bitcoin Price Chart

This section presents a hypothetical Bitcoin price chart depicting a potential bull run in 2024. The chart is designed to illustrate key price movements, trends, and support and resistance levels, providing a visual representation of a possible market scenario. While not a prediction, it helps contextualize the discussion of potential bull run dynamics.

The chart would span the period from early 2024 to late 2024, showcasing a significant price increase.

Hypothetical Bitcoin Price Chart: 2024 Bull Run

The chart begins in January 2024 at approximately $20,000, reflecting a potential post-bear market price. A gradual upward trend begins in the spring, driven by positive market sentiment and potentially fueled by regulatory clarity or institutional adoption. This initial phase shows a relatively steady incline, reaching approximately $25,000 by April. The line representing the Bitcoin price would show a consistent, although not perfectly linear, upward trajectory during this period. A minor correction around $24,000 would serve as a short-term support level, indicating temporary consolidation before the next upward surge.

The summer months see a more significant price increase, propelled by increased trading volume and positive news events. By July, the price might reach $35,000, establishing a new resistance level. This upward movement would be depicted by a steeper incline on the chart. A short period of sideways trading around this resistance level would be visible, representing a pause in the upward momentum before the final push. This period would highlight the volatility typical of bull runs.

The final leg of the bull run would start in August, showing a rapid ascent to $50,000 by October. This surge would be depicted as a sharp upward spike on the chart, reflecting a strong buying pressure. The $40,000 level would act as a strong support level during this phase. The chart’s final section would show a slight pullback from $50,000, perhaps settling around $45,000 by December, showcasing the potential for profit-taking at the peak of the bull run. The overall trend, however, would be decisively upward, showcasing a significant price increase throughout the year. Support levels would be clearly visible at $24,000 and $40,000, while resistance levels would be apparent at $25,000 and $35,000. The chart’s visual style would be clean and easy to interpret, using a clear line graph to illustrate price movements over time, with support and resistance levels marked with horizontal lines and shaded areas to highlight these key price points. The X-axis would represent time (months of 2024), and the Y-axis would represent the Bitcoin price in USD.