Regulatory Landscape and Legal Considerations

The regulatory landscape for cryptocurrencies, including Bitcoin Cash (BCH), is a complex and rapidly evolving area. Governments worldwide are grappling with how to classify and regulate these digital assets, balancing innovation with the need to protect consumers and prevent illicit activities. The lack of a universally consistent approach leads to significant variations in regulatory frameworks across different jurisdictions.

Current Regulatory Environment for Bitcoin Cash

Bitcoin Cash, like other cryptocurrencies, is currently subject to a patchwork of regulations globally. Some countries have explicitly recognized cryptocurrencies as property or commodities, subjecting them to taxation and anti-money laundering (AML) regulations. Others maintain a more cautious approach, lacking specific legislation but still imposing general financial regulations where applicable. For example, businesses facilitating BCH transactions might be required to comply with Know Your Customer (KYC) and AML regulations, regardless of specific BCH legislation. The level of regulatory scrutiny often depends on the nature of the activity; for example, trading platforms face stricter oversight than individual holders. Many jurisdictions lack clear guidelines on issues like security token offerings (STOs) involving BCH, leaving considerable uncertainty for businesses operating in this space.

Potential Future Regulatory Changes Affecting Bitcoin Cash

Future regulatory changes could significantly impact Bitcoin Cash’s trajectory. Increased regulatory clarity could boost mainstream adoption by reducing uncertainty for businesses and investors. However, overly restrictive regulations could stifle innovation and hinder BCH’s growth. Several potential scenarios exist: more comprehensive AML/KYC regulations, the introduction of specific cryptocurrency licensing frameworks, or the establishment of regulatory sandboxes for experimentation with BCH-related technologies. The rise of Central Bank Digital Currencies (CBDCs) could also indirectly influence BCH’s position in the market, potentially creating competition or fostering integration depending on the design and implementation of the CBDCs. Furthermore, international cooperation on cryptocurrency regulation is crucial to prevent regulatory arbitrage and ensure a level playing field for global participants.

Comparative Regulatory Landscape Across Countries

The regulatory landscape for Bitcoin Cash varies considerably across different countries. Some countries, such as El Salvador, have embraced Bitcoin (though not specifically BCH) as legal tender, while others maintain a strict prohibition on cryptocurrency trading or usage. The European Union is developing a comprehensive regulatory framework for crypto assets (MiCA), which will likely impact BCH, though the specifics of its application to BCH remain to be seen. The United States, on the other hand, has a more fragmented approach, with different agencies overseeing different aspects of the cryptocurrency market. This lack of unified regulatory oversight contributes to uncertainty and potential inconsistencies in enforcement. Japan has a relatively mature regulatory framework for cryptocurrencies, including licensing requirements for exchanges, which provides a model for other jurisdictions to consider.

Potential Regulatory Scenarios and Their Impact on Bitcoin Cash

| Regulatory Scenario | Impact on Bitcoin Cash |

|---|---|

| Strict Prohibition | Significant decline in adoption and trading volume; potential for underground markets. Could lead to a price decrease and reduced development activity. |

| Comprehensive Regulation with Licensing | Increased legitimacy and mainstream adoption; potential for increased price stability and regulated exchanges. Could also lead to higher compliance costs for businesses. |

| Light-touch Regulation (Self-regulation) | Faster innovation and potentially increased adoption, but higher risk of scams and market manipulation. |

| Integration with CBDCs | Potential for interoperability and increased utility, but could also lead to competition if CBDCs become dominant. |

Bitcoin Cash’s Role in the Broader Cryptocurrency Ecosystem: Bitcoin Cash 2025 Prediction

Bitcoin Cash, despite its relatively smaller market capitalization compared to Bitcoin or Ethereum, occupies a unique niche within the broader cryptocurrency ecosystem. Its focus on scalability and low transaction fees positions it differently from other major players, potentially carving out a specific role in the future of digital transactions and decentralized applications. This section will explore Bitcoin Cash’s comparative advantages, its potential within DeFi, its interoperability prospects, and its possible integration with emerging technologies.

Bitcoin Cash’s features and functionality differ significantly from other prominent cryptocurrencies. Unlike Bitcoin, which prioritizes security and decentralization over speed, Bitcoin Cash prioritizes faster transaction speeds and lower fees. Compared to Ethereum, which emphasizes smart contracts and decentralized applications, Bitcoin Cash focuses on being a peer-to-peer electronic cash system. This distinction allows Bitcoin Cash to target a specific user base: those who require rapid, inexpensive transactions, potentially making it attractive for everyday purchases and microtransactions. In contrast, Ethereum’s complexity and higher gas fees make it less suitable for frequent, small transactions.

Bitcoin Cash’s Potential Role in Decentralized Finance (DeFi)

While not as feature-rich as Ethereum for complex DeFi applications, Bitcoin Cash’s low transaction costs and fast processing times could make it a compelling platform for specific DeFi use cases. For instance, stablecoins pegged to Bitcoin Cash could facilitate cheaper and faster transactions within DeFi ecosystems. Furthermore, decentralized exchanges (DEXs) built on the Bitcoin Cash blockchain could offer a faster and more cost-effective alternative to existing platforms. The success of this, however, hinges on the development of a robust DeFi ecosystem specifically tailored to Bitcoin Cash’s capabilities. A successful example would be a DEX that specializes in low-value, high-frequency trading, leveraging Bitcoin Cash’s speed advantage.

Interoperability Between Bitcoin Cash and Other Blockchain Networks

The ability to seamlessly transfer value between different blockchain networks is crucial for the broader adoption of cryptocurrencies. While Bitcoin Cash currently lacks widespread interoperability solutions, future developments could potentially integrate it with other networks through sidechains, atomic swaps, or other interoperability protocols. This would allow users to easily move Bitcoin Cash to and from other blockchains, enhancing its usability and expanding its potential applications. For example, successful implementation of atomic swaps would allow direct, peer-to-peer exchange of Bitcoin Cash for other cryptocurrencies without the need for a centralized exchange.

Bitcoin Cash Integration with the Metaverse and NFTs

The metaverse and NFTs represent significant emerging technological trends. Bitcoin Cash’s low transaction fees could make it a viable option for in-metaverse microtransactions, facilitating purchases of virtual goods and services. Similarly, Bitcoin Cash could be used to facilitate the buying and selling of NFTs, offering a potentially cheaper alternative to other blockchains currently dominating the NFT market. Imagine a metaverse game where users can purchase in-game items using Bitcoin Cash with near-instantaneous transaction confirmations, providing a smooth and efficient user experience. This contrasts with current NFT marketplaces that often experience high gas fees and slow transaction times on other blockchains.

Risks and Challenges

Bitcoin Cash, despite its potential, faces several significant risks and challenges that could hinder its growth and adoption in 2025 and beyond. Understanding these obstacles is crucial for a realistic assessment of its future prospects. These challenges span technical vulnerabilities, competitive pressures, and the ever-evolving regulatory landscape.

Security Vulnerabilities and Their Impact

Security breaches and vulnerabilities pose a substantial threat to Bitcoin Cash. A successful attack, such as a 51% attack (where a single entity controls more than half of the network’s computing power), could lead to double-spending, the reversal of transactions, and a significant loss of confidence in the network. This would negatively impact Bitcoin Cash’s value and discourage adoption. The severity of the impact would depend on the scale and nature of the vulnerability, as well as the speed and effectiveness of the community’s response in patching and mitigating the issue. Historically, successful attacks on other cryptocurrencies have resulted in substantial price drops and eroded user trust. For example, the 2016 DAO hack on the Ethereum network caused significant losses and highlighted the vulnerability of decentralized systems to sophisticated attacks. Robust security protocols and ongoing audits are essential for mitigating this risk.

Scalability Challenges and Solutions

Bitcoin Cash aims to provide faster and cheaper transactions compared to Bitcoin. However, achieving true scalability remains a challenge. Increasing transaction volume without compromising speed or security requires ongoing technological advancements and network upgrades. Failure to address scalability issues could lead to network congestion, higher transaction fees, and slower confirmation times, hindering its competitiveness and user experience. Solutions being explored include implementing layer-2 scaling solutions like the Lightning Network, which enables faster and cheaper off-chain transactions, and improving the underlying consensus mechanism to enhance transaction throughput. The success of these solutions will significantly impact Bitcoin Cash’s ability to handle a growing number of users and transactions.

Competition and Market Dynamics, Bitcoin Cash 2025 Prediction

Bitcoin Cash competes with a large and ever-growing number of cryptocurrencies and blockchain platforms. These competitors offer various features and functionalities, including enhanced scalability, smart contract capabilities, and improved privacy features. The intense competition necessitates continuous innovation and adaptation to remain relevant and attract users. Bitcoin Cash needs to differentiate itself effectively to maintain its market share and avoid being overtaken by more innovative or better-funded projects. The success of competing projects, particularly those with stronger community support or superior technology, could significantly impact Bitcoin Cash’s adoption rate and market capitalization.

Regulatory Uncertainty and Legal Risks

The regulatory landscape for cryptocurrencies is constantly evolving and remains uncertain in many jurisdictions. Changes in regulations could significantly impact Bitcoin Cash’s legality, trading, and adoption. Governments worldwide are increasingly scrutinizing cryptocurrencies, leading to potential restrictions on their use, taxation, or even outright bans. Uncertainty surrounding regulatory frameworks creates risks for investors and businesses operating within the Bitcoin Cash ecosystem. Navigating this evolving regulatory environment requires proactive engagement with regulators and the development of compliance strategies to mitigate potential legal and financial risks. A clear and consistent regulatory framework, however, could potentially increase investor confidence and stimulate wider adoption.

Potential Risks and Mitigation Strategies

The following table summarizes some key risks and potential mitigation strategies:

| Risk | Mitigation Strategy |

|---|---|

| 51% Attack | Strengthening network security, promoting decentralized mining, and implementing robust attack detection mechanisms. |

| Scalability Issues | Implementing layer-2 solutions (e.g., Lightning Network), upgrading the consensus mechanism, and optimizing network infrastructure. |

| Competition from other cryptocurrencies | Continuous innovation, focusing on specific niche applications, and building a strong and active community. |

| Regulatory Uncertainty | Proactive engagement with regulators, developing robust compliance programs, and advocating for clear and consistent regulatory frameworks. |

| Market Volatility | Diversification of investments, risk management strategies, and educating investors about the inherent volatility of cryptocurrencies. |

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin Cash’s potential trajectory in 2025, encompassing its market valuation, competitive landscape, technological hurdles, and prospects for widespread adoption as a payment method. We will explore a range of possibilities, considering both optimistic and pessimistic scenarios, grounded in current trends and technological advancements.

Potential Market Capitalization of Bitcoin Cash in 2025

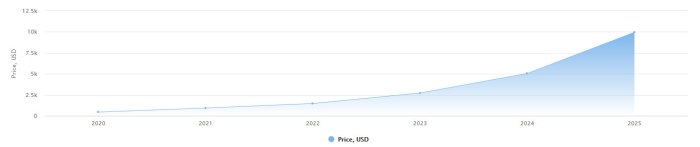

Predicting Bitcoin Cash’s market capitalization in 2025 involves significant uncertainty. However, we can Artikel a range of possibilities based on several factors, including adoption rates, technological improvements, and overall cryptocurrency market conditions. A conservative estimate might place its market cap between $50 billion and $100 billion, assuming moderate growth and continued competition from other cryptocurrencies. A more optimistic scenario, contingent on significant technological advancements and widespread adoption, could see its market cap reach between $200 billion and $500 billion. This higher range is predicated on Bitcoin Cash successfully addressing scalability issues and becoming a dominant player in the payments space, mirroring the growth trajectory of other successful cryptocurrencies like Ethereum, although achieving such levels would require a substantial shift in market sentiment and user adoption. Conversely, a less favorable scenario could see the market cap remain stagnant or even decline if the cryptocurrency market experiences a prolonged bear market or if Bitcoin Cash fails to innovate and adapt to changing market demands.

Bitcoin Cash’s Interaction with Other Cryptocurrencies

Bitcoin Cash’s future is intrinsically linked to the broader cryptocurrency ecosystem. Competition from other cryptocurrencies, particularly those offering similar functionalities or improved technological features, presents a significant challenge. For example, faster transaction speeds and lower fees offered by other cryptocurrencies could hinder Bitcoin Cash’s adoption. However, opportunities for collaboration also exist. Interoperability protocols and cross-chain solutions could enable Bitcoin Cash to integrate with other blockchain networks, enhancing its functionality and accessibility. Joint development efforts and shared infrastructure could lead to synergies, benefiting the entire cryptocurrency ecosystem. The success of Bitcoin Cash will depend on its ability to leverage these opportunities while mitigating competitive pressures.

Technological Hurdles to Wider Adoption

Several technological hurdles impede Bitcoin Cash’s wider adoption. Scalability remains a key challenge; the network needs to handle a significantly higher volume of transactions without compromising speed or security. Improving transaction throughput and reducing confirmation times are crucial for competing with established payment systems. Furthermore, enhancing user experience through simpler interfaces and improved wallet functionalities is vital for attracting a broader user base. Solutions involve implementing layer-2 scaling solutions like Lightning Network, optimizing the consensus mechanism, and developing user-friendly applications and interfaces. Addressing these challenges will be pivotal for Bitcoin Cash to achieve mainstream acceptance.

Likelihood of Bitcoin Cash Becoming a Widely Used Payment Method in 2025

The likelihood of Bitcoin Cash becoming a widely used payment method in 2025 depends on several interconnected factors. These include overcoming technological limitations, achieving greater price stability, and fostering wider merchant acceptance. Increased regulatory clarity and a more positive public perception would also significantly influence adoption rates. While widespread adoption as a primary payment method by 2025 seems ambitious, a significant increase in its use for specific niche applications, such as peer-to-peer transactions or remittances, is more plausible. The success of Bitcoin Cash as a payment method will depend on its ability to offer a compelling value proposition compared to existing payment systems, addressing issues of speed, cost, and security.

Illustrative Example: A Day in 2025 with Bitcoin Cash

Imagine a typical day in 2025, where Bitcoin Cash (BCH) seamlessly integrates into the fabric of daily life, offering a fast, low-cost, and user-friendly alternative to traditional financial systems. Its decentralized nature ensures security and transparency, while its widespread adoption makes it a convenient choice for a multitude of transactions.

This narrative details a day in the life of Sarah, a freelance graphic designer, illustrating how BCH facilitates her various interactions.

Morning Routine and Commuting

Sarah starts her day by checking her BCH balance on her smartphone. She uses a simple, intuitive mobile wallet app that allows her to easily track her funds and make instant payments. Her morning coffee, purchased from a local café that accepts BCH, is automatically deducted from her balance via a QR code scan. Her commute involves a ride-sharing service that also exclusively uses BCH for payment, eliminating the need for credit cards or other intermediaries. The transaction is almost instantaneous, with minimal fees.

Freelance Work and Client Payments

Later in the day, Sarah completes a design project for a client in another country. The client pays her directly in BCH, eliminating the delays and high fees associated with traditional international bank transfers. The speed and low cost of BCH transactions allow her to receive payment almost immediately, streamlining her workflow and improving her cash flow. The transaction details are transparently recorded on the BCH blockchain, providing both Sarah and her client with a verifiable record of the payment.

Online Shopping and Everyday Purchases

During her lunch break, Sarah orders groceries online from a supermarket that accepts BCH. The entire process, from selecting items to completing the payment, is seamless and straightforward. She receives an immediate confirmation of her order, and the delivery is scheduled for later in the afternoon. In the evening, she buys a new pair of headphones from an online retailer that also utilizes BCH, again experiencing the speed and convenience of the cryptocurrency.

Social Interactions and Peer-to-Peer Transfers

In the evening, Sarah meets friends for dinner. To split the bill, she uses a peer-to-peer (P2P) payment app that supports BCH. This allows her to instantly send her share of the bill to her friends, eliminating the hassle of cash or traditional money transfers. The transparency and security of BCH ensure that all transactions are recorded securely and can be easily tracked if needed.

Investing and Savings

Sarah also uses BCH for investing. She has a small portion of her savings invested in BCH, diversifying her portfolio and benefiting from the potential growth of the cryptocurrency. She monitors her investments through her mobile wallet app, easily tracking the value of her holdings. The decentralized nature of BCH provides her with greater control over her investments, reducing reliance on traditional financial institutions.

Bitcoin Cash 2025 Prediction – Predicting Bitcoin Cash’s value in 2025 is challenging, dependent on various market factors. A key influence will undoubtedly be Bitcoin’s own trajectory, particularly the impact of its next halving. To understand the timing of this crucial event, it’s helpful to consult resources like this article on Kapan Bitcoin Halving 2025. This information can then be used to better inform projections about Bitcoin Cash’s potential performance in 2025, given their intertwined market dynamics.