Bitcoin Cash Halving 2025

The Bitcoin Cash halving, scheduled for sometime in 2025, is a significant event in the cryptocurrency’s lifecycle. This event, programmed into the Bitcoin Cash protocol, will reduce the rate at which new BCH is created, effectively cutting the miner reward in half. This mechanism is designed to control inflation and maintain the long-term value of the cryptocurrency.

Bitcoin Cash halvings occur approximately every four years, mirroring the halving schedule of its predecessor, Bitcoin. The precise date of the 2025 halving depends on the block time, but it’s anticipated to be around the middle of the year. This halving will have a considerable impact on the Bitcoin Cash ecosystem, potentially affecting both its price and network activity.

Bitcoin Cash Halving Mechanics

The Bitcoin Cash halving reduces the block reward paid to miners for successfully verifying and adding transactions to the blockchain. Before the halving, miners receive a certain number of BCH for each block they mine. After the halving, this reward is halved. This reduction in newly minted coins decreases the rate of inflation within the Bitcoin Cash network. This mechanism is intended to mimic the scarcity of traditional precious metals like gold, thereby potentially increasing the value of BCH over time.

Historical Impact of Previous Bitcoin Cash Halvings

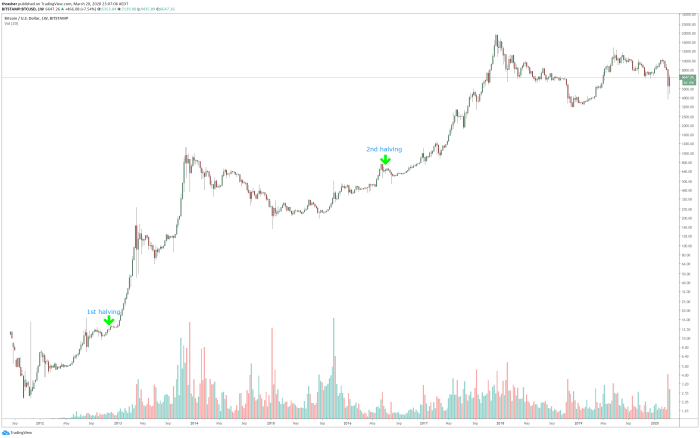

The previous Bitcoin Cash halvings have shown varied impacts on price and network activity. While there’s no guaranteed correlation between halvings and price increases, historical data suggests a general trend of price appreciation following halvings, albeit often followed by periods of volatility. The first halving resulted in a short-term price surge, followed by a period of consolidation. The second halving saw a similar pattern, though the market conditions at the time influenced the overall impact. Network activity, measured by metrics like transaction volume and hash rate, has generally shown an increase following halvings, indicating a heightened level of interest and participation within the ecosystem. However, it’s important to note that external factors such as broader market trends and regulatory changes also play a crucial role in shaping the overall outcome.

Comparison of the 2025 Halving with Previous Halvings

The 2025 halving shares similarities with previous halvings in its core mechanism – the reduction of the block reward. However, key differences exist. The overall market sentiment and the broader cryptocurrency landscape will significantly influence the outcome of the 2025 halving. Previous halvings occurred in different market contexts; the 2025 halving will take place against the backdrop of evolving regulatory frameworks, increasing institutional adoption (or lack thereof) within the cryptocurrency market, and potentially different macroeconomic conditions. Furthermore, technological advancements and the competitive landscape within the cryptocurrency space will play a role in determining the ultimate impact of the 2025 halving on Bitcoin Cash. The degree to which these factors influence price and network activity remains to be seen, making it difficult to predict the precise consequences with certainty. Analyzing previous halvings provides valuable insight, but doesn’t offer a definitive prediction for 2025.

Price Predictions and Market Sentiment

Predicting the price of Bitcoin Cash (BCH) after the 2025 halving is inherently speculative, relying on various models and interpretations of market behavior. While no model is perfectly accurate, analyzing different approaches and considering macroeconomic factors offers a more nuanced perspective. The halving itself, reducing the rate of new BCH creation, is generally viewed as a bullish factor, but other forces will significantly influence the final outcome.

Bitcoin Cash Price Prediction Models

Several models attempt to forecast BCH’s price. Stock-to-flow models, for instance, relate the scarcity of an asset to its price, suggesting a potential price increase post-halving due to the reduced supply. However, these models often oversimplify market dynamics, neglecting factors like adoption rate, regulatory changes, and overall market sentiment. Other models incorporate technical indicators, analyzing historical price patterns and trading volume to predict future price movements. These models, while potentially useful, are not always reliable and should be considered alongside other information. Finally, some analysts use fundamental analysis, evaluating factors like BCH’s utility, development activity, and network security to estimate its long-term value. The success of any of these models is highly dependent on the accuracy of the input data and the underlying assumptions. For example, a stock-to-flow model might predict a price surge based on historical halving cycles of Bitcoin, but it might not fully account for differences in market conditions or the specific characteristics of Bitcoin Cash.

Macroeconomic Factors Influencing Bitcoin Cash Price

Macroeconomic conditions significantly impact cryptocurrency prices, including BCH. Factors like inflation, interest rates, and global economic growth influence investor sentiment and risk appetite. High inflation, for example, might drive investors towards alternative assets like cryptocurrencies, potentially boosting BCH’s price. Conversely, rising interest rates could reduce investment in riskier assets, potentially leading to a price decline. Geopolitical events and regulatory changes also play a role. A positive regulatory environment in a major market could significantly increase BCH adoption and its price. Conversely, negative regulatory news could lead to a price drop. For example, increased regulatory scrutiny in a major market could negatively impact investor confidence and thus the price.

Market Sentiment Regarding the 2025 Halving

Prevailing market sentiment regarding the 2025 halving is mixed. While the halving itself is often viewed as a bullish catalyst due to reduced supply, concerns remain about the overall cryptocurrency market conditions and the specific factors influencing BCH’s price. Some analysts remain optimistic, highlighting BCH’s potential for wider adoption and its unique features compared to other cryptocurrencies. Others express caution, citing macroeconomic uncertainties and the potential for competition from other cryptocurrencies. The level of optimism or pessimism is often reflected in trading volumes and price volatility. For example, increased trading volume and price volatility leading up to the halving could indicate high investor interest and anticipation.

Bullish vs. Bearish Price Predictions

| Bullish Predictions | Bearish Predictions |

|---|---|

| Some analysts predict BCH could reach prices significantly higher than its pre-halving value, potentially driven by increased scarcity and growing adoption. Estimates vary widely, with some suggesting prices in the thousands of dollars. This optimism is often based on historical price increases following previous halvings in Bitcoin and the expectation of a similar pattern for Bitcoin Cash. | Other analysts predict a more modest price increase or even a price decline. These predictions often cite macroeconomic headwinds, increased competition from other cryptocurrencies, and the possibility of lower-than-expected adoption rates. These bearish predictions might point to a price range that is only slightly higher or even lower than the pre-halving price. |

Mining and Network Effects

The Bitcoin Cash halving in 2025 will significantly alter the economics of mining and, consequently, the network’s overall health and decentralization. Understanding these effects is crucial for predicting the future trajectory of the Bitcoin Cash ecosystem. The reduced block reward will directly impact miner profitability, potentially leading to shifts in hashrate distribution and network security.

Mining Profitability After the Halving

The halving will cut the block reward in half, directly reducing the revenue miners receive for successfully adding blocks to the blockchain. This decrease will make mining less profitable, particularly for miners operating with less efficient hardware or higher electricity costs. We can expect some miners to become unprofitable and potentially shut down their operations. This impact will vary depending on factors like the Bitcoin Cash price, electricity costs in different regions, and the efficiency of the mining hardware. For example, a miner operating with older ASICs and high electricity costs might become unprofitable, while a miner with newer, more energy-efficient equipment and lower electricity costs could remain profitable, though with reduced margins. This could lead to a consolidation within the mining sector, with larger, more efficient mining operations potentially gaining market share.

Impact on Hashrate and Network Security

The reduced profitability will likely lead to a decrease in the Bitcoin Cash network’s hashrate. The hashrate represents the computational power dedicated to securing the network. A lower hashrate increases the vulnerability of the network to 51% attacks, where a malicious actor could control a majority of the network’s hashing power to manipulate transactions or reverse them. However, the extent of the hashrate decline is difficult to predict precisely. It will depend on how miners respond to the reduced profitability – some might choose to switch to mining other cryptocurrencies, while others might adjust their operations to maintain profitability. The Bitcoin Cash price after the halving will play a crucial role in determining the overall impact. A significant price increase could offset the reduced block reward, potentially mitigating the hashrate decline. Conversely, a price drop could exacerbate the issue, leading to a more substantial decrease in hashrate.

Impact on Decentralization

The halving’s impact on decentralization is complex. While a decline in hashrate could potentially centralize mining power in the hands of larger, more well-funded operations, it’s not a guaranteed outcome. The Bitcoin Cash network’s design, with its relatively low barrier to entry compared to Bitcoin, could help mitigate this effect. Smaller miners could still participate, albeit with reduced profitability. Furthermore, the development of more energy-efficient mining hardware could help offset the impact of the reduced block reward. The overall impact on decentralization will depend on the interplay between these various factors, including the price of Bitcoin Cash, the development of new mining technology, and the responses of miners to the changing economic landscape.

Bitcoin Cash Mining Process: Before and After Halving

The following flowchart illustrates the key differences in the Bitcoin Cash mining process before and after the halving.

The top half represents the mining process before the halving, showing a larger block reward and potentially higher profitability. The bottom half illustrates the process after the halving, with a smaller block reward, potentially impacting profitability and leading to adjustments in mining operations. Note that this is a simplified representation and doesn’t account for all variables affecting mining profitability.

Technological Developments and Upgrades: Bitcoin Cash Halving 2025

The Bitcoin Cash network, while established, continues to evolve. Several technological improvements are either planned or under discussion, potentially impacting the ecosystem significantly around the 2025 halving. These upgrades aim to enhance scalability, security, and overall user experience, potentially driving increased adoption.

The anticipated technological upgrades are not always set in stone and their implementation timelines can be subject to change based on community consensus and developer progress. However, several key areas show promise for advancements that could significantly impact Bitcoin Cash’s future.

Schnorr Signatures

Schnorr signatures offer several advantages over the currently used ECDSA signatures. They are more compact, allowing for smaller transaction sizes and reduced network congestion. This leads to lower transaction fees and faster confirmation times, making Bitcoin Cash more attractive for everyday transactions. Furthermore, Schnorr signatures enable advanced cryptographic techniques, such as signature aggregation, which could further improve efficiency and privacy. The potential impact on the ecosystem is a more streamlined and efficient transaction process, enhancing the user experience and potentially driving broader adoption. A successful implementation could make Bitcoin Cash a more competitive payment option.

Improved Privacy Features

While Bitcoin Cash is already relatively pseudonymous, ongoing development focuses on enhancing privacy features. This could involve exploring privacy-enhancing technologies like Confidential Transactions or similar approaches to obfuscate transaction amounts and sender/receiver identities. The goal is to provide users with a greater level of privacy without compromising the transparency and security of the blockchain. Increased privacy could attract users concerned about data surveillance and contribute to wider adoption, particularly in jurisdictions with strict data protection regulations. The success of these initiatives depends heavily on community acceptance and effective implementation.

Enhanced Scalability Solutions

Scalability remains a crucial aspect of any cryptocurrency’s success. While Bitcoin Cash already utilizes larger block sizes than Bitcoin, further improvements might be explored to handle even greater transaction volumes. This could involve researching and implementing layer-2 scaling solutions, such as sidechains or payment channels, to offload some transaction processing from the main chain. These upgrades could significantly enhance Bitcoin Cash’s capacity to handle a growing number of users and transactions, making it more robust and resilient to network congestion. The improved scalability would allow for faster and cheaper transactions, fostering a more user-friendly experience. This, in turn, could be a significant factor in increased adoption.

Investment Strategies and Risks

Investing in Bitcoin Cash (BCH) involves navigating a complex landscape of potential rewards and significant risks, especially in anticipation of the 2025 halving. The halving event, which reduces the rate of new BCH creation, historically has influenced price movements, although the extent of this impact remains a subject of ongoing debate. Understanding various investment strategies and associated risks is crucial for making informed decisions.

Investment Strategies Based on Risk Tolerance

The optimal investment strategy depends heavily on individual risk tolerance and financial goals. Below, we categorize strategies based on risk appetite, ranging from conservative to aggressive.

- Conservative: Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals (e.g., weekly or monthly), regardless of price fluctuations. DCA mitigates the risk of investing a lump sum at a market peak. For example, an investor might invest $100 per week into BCH, consistently accumulating holdings over time. This minimizes the impact of short-term volatility.

- Moderate: Value Averaging: Similar to DCA, but instead of a fixed dollar amount, a fixed number of BCH is purchased at regular intervals. This strategy increases investment when prices are low and decreases it when prices are high, aiming to average the cost basis over time. Imagine buying 0.1 BCH each week; the dollar amount spent would fluctuate with the BCH price.

- Aggressive: Leveraged Trading: This involves using borrowed funds to amplify potential gains (and losses). Leveraged trading can yield significant returns if the price moves in the desired direction but carries a high risk of substantial losses if the market moves against the investor. This is only suitable for experienced traders with a high risk tolerance and a thorough understanding of the market.

Risks Associated with Bitcoin Cash Investment, Bitcoin Cash Halving 2025

Investing in Bitcoin Cash, like any cryptocurrency, is inherently risky. The following risks are pertinent, both before and after the halving:

- Price Volatility: Cryptocurrency markets are known for their extreme price swings. BCH is no exception, and its price can fluctuate dramatically in short periods, leading to potential significant losses. The halving may influence price, but the direction and magnitude are uncertain. Consider the price volatility of Bitcoin (BTC) around previous halvings as a potential indicator, but remember that BCH has its own market dynamics.

- Regulatory Uncertainty: Government regulations concerning cryptocurrencies are constantly evolving and vary across jurisdictions. Changes in regulations can significantly impact the price and usability of BCH. The lack of clear and consistent global regulatory frameworks presents a considerable risk.

- Technological Risks: Bugs, security vulnerabilities, or successful attacks on the BCH network could lead to significant price drops or even loss of funds. The ongoing development and upgrades to the BCH network aim to mitigate these risks, but they cannot be entirely eliminated.

- Market Sentiment: Investor sentiment and broader market trends significantly influence BCH’s price. Negative news, market crashes, or a general downturn in investor confidence can trigger substantial price declines.

Bitcoin Cash Investment Compared to Other Cryptocurrencies

Comparing BCH investment to other cryptocurrencies in the context of the 2025 halving requires careful consideration of each asset’s unique characteristics. While some cryptocurrencies might also experience halving events, the impact on their price will likely differ based on factors like their market capitalization, adoption rate, and technological features. For instance, comparing BCH to Ethereum (ETH) would involve assessing the differences in their underlying technologies, use cases, and market positions. The potential price movements of each cryptocurrency around its respective halving event are not directly comparable due to these differing characteristics. A thorough understanding of each asset’s fundamentals is crucial before making investment comparisons.

Community and Adoption

The Bitcoin Cash community, while smaller than Bitcoin’s, boasts a dedicated and active following. Many within this community hold strong beliefs in Bitcoin Cash’s philosophy of scalability and its potential as a peer-to-peer electronic cash system. Expectations for the 2025 halving are varied, ranging from optimistic price predictions fueled by the reduced inflation rate to more cautious assessments that emphasize the importance of broader adoption. The success of the halving will largely depend on the community’s ability to effectively communicate its value proposition and attract new users.

The potential for increased adoption of Bitcoin Cash among businesses and consumers post-halving is significant but hinges on several factors. A lower inflation rate could incentivize businesses to hold Bitcoin Cash as a store of value, and the reduced transaction fees could make it a more attractive payment option for consumers. However, widespread adoption requires more than just favorable economic conditions; it necessitates a concerted effort to improve user experience, increase merchant acceptance, and build trust within the broader financial ecosystem. Examples of successful adoption in the past, like the early adoption of credit cards or mobile payment systems, demonstrate the importance of ease of use and widespread merchant participation.

Bitcoin Cash Community Structure and Engagement

The Bitcoin Cash community is decentralized, with various groups and individuals contributing to its development and promotion. Key components include developers working on the core protocol, miners securing the network, businesses accepting Bitcoin Cash, and community members actively promoting its use and engaging in discussions online. Effective communication and coordination between these different groups are crucial for navigating the challenges and opportunities that lie ahead. Successful community-driven projects like the development of user-friendly wallets and educational resources will play a significant role in driving adoption. For instance, the development of a widely used, intuitive mobile wallet could significantly increase accessibility and usage.

Marketing Strategies and Community Building

Effective marketing strategies are essential to increase awareness and adoption of Bitcoin Cash. This involves targeted campaigns focusing on specific demographics and industries, highlighting the unique advantages of Bitcoin Cash compared to other cryptocurrencies. Community engagement is paramount; active participation in online forums, social media, and educational events fosters a sense of community and helps address user concerns. Examples of successful marketing strategies from other cryptocurrency projects, such as focusing on specific use cases or partnerships with businesses, can provide valuable insights. For example, a campaign showcasing Bitcoin Cash’s utility for microtransactions in developing countries could resonate with a large audience.

Merchant Adoption and Business Use Cases

Increased merchant adoption is crucial for the success of Bitcoin Cash. This requires addressing challenges such as price volatility and the need for robust payment processing solutions. Incentivizing businesses to accept Bitcoin Cash through programs, partnerships, and educational initiatives is key. Highlighting successful use cases, such as businesses that have already integrated Bitcoin Cash into their operations, can encourage further adoption. For instance, showcasing the successful integration of Bitcoin Cash into a point-of-sale system in a specific retail sector could provide a compelling case study for other businesses.

Regulatory Landscape and Legal Considerations

The regulatory landscape surrounding Bitcoin Cash (BCH) is complex and varies significantly across different jurisdictions. While not as heavily scrutinized as Bitcoin, BCH’s decentralized nature and use as a medium of exchange mean it’s subject to evolving regulatory frameworks designed to address issues like money laundering, tax evasion, and consumer protection. Understanding this landscape is crucial for investors, businesses, and developers operating within the BCH ecosystem, particularly in the context of the upcoming halving.

The current regulatory approach to BCH is largely fragmented, with many countries taking a wait-and-see approach or focusing on broader cryptocurrency regulations that encompass BCH. Some jurisdictions have implemented specific regulations targeting cryptocurrencies, while others have yet to establish a clear legal framework. This lack of uniform regulation presents both challenges and opportunities for BCH’s future growth.

Bitcoin Cash Regulation by Jurisdiction

The regulatory treatment of Bitcoin Cash differs widely across major economies. For example, the United States treats BCH as property for tax purposes, subjecting transactions to capital gains taxes. Meanwhile, in Japan, BCH is recognized as a cryptocurrency, subject to anti-money laundering (AML) and know-your-customer (KYC) regulations. The European Union is currently developing a comprehensive regulatory framework for cryptocurrencies (MiCA), which will likely have implications for BCH. In contrast, some countries have either explicitly banned or taken a more restrictive stance on cryptocurrencies, potentially impacting BCH’s accessibility and usage within their borders. These varied approaches highlight the need for ongoing monitoring and adaptation within the BCH ecosystem.

Impact of Regulatory Changes on BCH Price and Adoption

Potential regulatory changes can significantly influence BCH’s price and adoption rate. Increased regulatory clarity and a favorable legal framework could boost investor confidence, leading to higher prices and wider adoption. Conversely, stringent regulations, such as outright bans or excessive taxation, could stifle growth and depress prices. For example, if a major jurisdiction were to implement significant restrictions on BCH transactions, it could lead to a decrease in trading volume and a subsequent price drop, mirroring the impact of similar regulations on other cryptocurrencies in the past. Conversely, regulatory clarity providing a more predictable legal environment could encourage institutional investment and broader acceptance of BCH as a payment method.

Potential Legal Challenges and Opportunities Post-Halving

The halving event, by reducing the rate of new BCH issuance, could trigger both legal challenges and opportunities. A potential legal challenge could arise from increased scrutiny of BCH’s energy consumption, particularly if environmental regulations tighten. This could lead to discussions about the sustainability of BCH mining and its potential impact on climate change goals. On the opportunity side, increased scarcity due to the halving might attract more investors seeking assets with potentially appreciating value. This increased interest could lead to legal and regulatory frameworks being shaped around how to best facilitate BCH’s growth while mitigating associated risks, potentially through the development of specific legal instruments for BCH transactions or the creation of dedicated regulatory bodies focusing on cryptocurrencies. The post-halving period will be a critical juncture for navigating the complex legal landscape and capitalizing on emerging opportunities.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the upcoming Bitcoin Cash halving event in 2025, covering its mechanics, potential market impact, and investment considerations. Understanding these aspects is crucial for navigating the evolving landscape of the Bitcoin Cash ecosystem.

Bitcoin Cash Halving Explained

The Bitcoin Cash halving is a programmed event that reduces the rate at which new Bitcoin Cash (BCH) is created. This occurs approximately every four years, and it cuts the block reward – the amount of BCH miners receive for verifying transactions – in half. This mechanism is designed to control inflation and maintain the scarcity of the cryptocurrency. The halving is a core feature of the Bitcoin Cash protocol, inherited from Bitcoin.

Bitcoin Cash Halving Date in 2025

While the exact date depends on the block time and mining difficulty, the Bitcoin Cash halving in 2025 is anticipated to occur around April 2025. This is a projection based on the current block generation time and is subject to minor variations.

Impact of the Halving on Bitcoin Cash Price

Historically, Bitcoin Cash halvings have been followed by periods of increased price volatility. The halving itself doesn’t directly cause price increases, but it can influence market sentiment. The reduced supply of newly minted BCH can lead to increased scarcity, potentially driving up demand and price, especially if overall market conditions are favorable. However, other factors, such as regulatory changes, technological advancements, and overall market trends, also significantly impact the price. For example, the 2020 halving saw a period of price increase followed by a correction, demonstrating the complex interplay of factors at play.

Investment Considerations Before the Halving

Investing in Bitcoin Cash before the halving presents both opportunities and risks. The potential for price appreciation due to increased scarcity is a significant draw. However, the cryptocurrency market is inherently volatile, and the halving’s impact on price is not guaranteed. Investors should conduct thorough research, understand their risk tolerance, and only invest what they can afford to lose. Diversification within a broader investment portfolio is also a crucial risk management strategy. It’s essential to remember that past performance is not indicative of future results.

Long-Term Implications of the Bitcoin Cash Halving

The long-term implications of the Bitcoin Cash halving are multifaceted. The reduced inflation rate may enhance Bitcoin Cash’s value proposition as a store of value. Furthermore, it could potentially incentivize further network development and adoption as miners adapt to the reduced block reward. However, the long-term effects are difficult to predict definitively, as they depend on numerous interconnected factors, including technological advancements, regulatory developments, and overall market sentiment. The success of the halving in achieving its intended goals will depend on various factors, and it is important to monitor the network’s performance and adoption rates in the period following the event.