Bitcoin Cash Price Prediction 2025

Predicting the price of Bitcoin Cash (BCH) in 2025 is inherently speculative, as cryptocurrency markets are notoriously volatile and influenced by a multitude of interconnected factors. Currently, BCH trades at a significantly lower price than Bitcoin (BTC), reflecting its smaller market capitalization and adoption rate. Recent price fluctuations have mirrored broader trends in the cryptocurrency market, showing sensitivity to overall market sentiment, regulatory news, and technological developments.

Bitcoin Cash’s price is influenced by several key factors. These include the overall cryptocurrency market sentiment (bullish or bearish trends impacting all cryptocurrencies), the adoption rate of BCH by merchants and users, technological advancements within the BCH network (such as scaling solutions or upgrades), regulatory developments impacting cryptocurrencies globally, and the level of competition from other cryptocurrencies offering similar functionalities. Major events, such as halving events (reducing the rate of new BCH creation), can also significantly impact price.

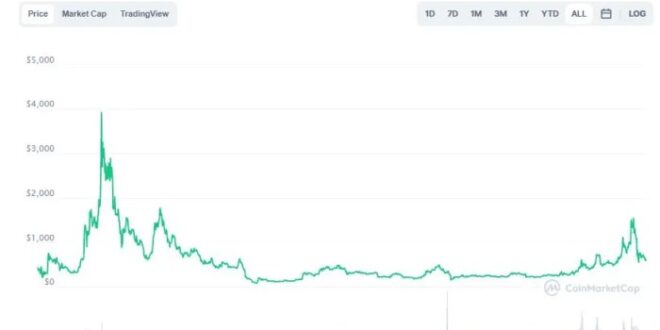

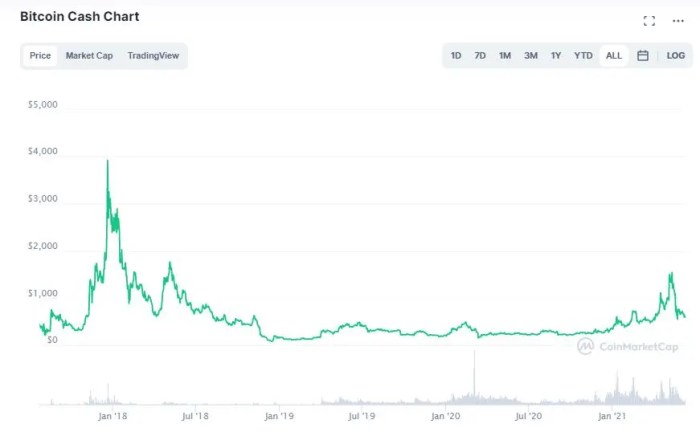

Bitcoin Cash Price History and Significant Events

Bitcoin Cash originated as a hard fork from Bitcoin in August 2017, aiming to improve scalability and transaction speed. Initially, its price surged due to the hype surrounding the fork and the perceived advantages over the original Bitcoin. However, the price subsequently experienced significant volatility. The period following the fork saw periods of both rapid growth and substantial decline, mirroring the broader cryptocurrency market cycles. Notable events influencing its price include periods of increased adoption by merchants, periods of significant network congestion on competing cryptocurrencies, and periods of increased regulatory uncertainty. For example, a significant price increase occurred in late 2017 during a general bull market for cryptocurrencies, while a significant price drop followed the broader cryptocurrency market correction in 2018. These fluctuations highlight the complex interplay of factors determining BCH’s price. Analyzing these historical trends, along with current market conditions and technological advancements, is crucial for informed speculation about future price movements.

Reddit Sentiment Analysis

Analyzing Reddit discussions provides valuable insight into the collective sentiment surrounding Bitcoin Cash’s potential price trajectory in 2025. By examining various threads and comments, we can gauge the prevailing optimism, pessimism, or neutrality among users. This analysis helps to understand the factors driving these opinions and provides a broader perspective beyond purely technical analysis.

Reddit discussions regarding Bitcoin Cash’s 2025 price prediction reveal a diverse range of opinions, reflecting the inherent volatility and uncertainty within the cryptocurrency market. The sentiment is not monolithic; instead, it comprises a mixture of bullish, bearish, and neutral perspectives, each supported by varying arguments and market interpretations. Understanding these nuances is crucial for a comprehensive assessment.

Categorization of Reddit User Sentiment

A significant portion of Reddit users express bullish sentiment, anticipating substantial price appreciation for Bitcoin Cash by 2025. These users often cite factors such as increasing adoption, technological improvements within the Bitcoin Cash ecosystem, and potential regulatory changes as catalysts for growth. Conversely, a notable segment holds a bearish outlook, predicting either stagnant or declining prices. Their arguments frequently center on concerns about competition from other cryptocurrencies, scalability challenges, and the overall macroeconomic environment. A smaller, but still present, group maintains a neutral stance, emphasizing the unpredictable nature of the cryptocurrency market and highlighting the difficulty of making accurate long-term predictions.

Comparison of Different Perspectives and Arguments

Bullish sentiment on Reddit often focuses on Bitcoin Cash’s commitment to low transaction fees and fast transaction speeds, positioning it as a practical alternative to Bitcoin for everyday payments. Proponents also point to its strong community support and ongoing development efforts as indicators of long-term viability. In contrast, bearish arguments highlight Bitcoin Cash’s relatively smaller market capitalization compared to Bitcoin or Ethereum, suggesting a greater vulnerability to market fluctuations. Concerns about its ability to compete effectively in a rapidly evolving cryptocurrency landscape are also frequently raised. Neutral perspectives acknowledge the potential for both upward and downward price movements, emphasizing the unpredictable nature of the market and the influence of external factors like regulatory changes or global economic conditions.

Key Arguments For and Against Significant Price Changes

| Arguments For Significant Price Increase | Arguments Against Significant Price Increase |

|---|---|

| Increased adoption and use cases for everyday transactions. | Competition from other cryptocurrencies with larger market caps and more established ecosystems. |

| Technological advancements and improvements within the Bitcoin Cash network. | Scalability challenges and potential limitations in handling a surge in transaction volume. |

| Positive regulatory developments that foster cryptocurrency adoption. | Negative regulatory changes or increased scrutiny from governments. |

| Strong community support and ongoing development efforts. | Overall macroeconomic conditions and potential bear market affecting the entire cryptocurrency sector. |

| Potential institutional investment and increased interest from large players. | Lack of significant technological innovation or unique selling propositions compared to competitors. |

Technical Analysis of Bitcoin Cash

Predicting the future price of Bitcoin Cash (BCH) requires a deep dive into technical analysis, examining historical price movements, trading volume, and key indicators to identify potential trends. While no prediction is guaranteed, technical analysis provides a framework for informed speculation. This analysis focuses on potential support and resistance levels, moving averages, and the Relative Strength Index (RSI) to illustrate possible price scenarios for BCH in 2025.

Key Indicators and Chart Patterns

Technical analysis utilizes various indicators to gauge market sentiment and potential price direction. Moving averages, such as the 50-day and 200-day exponential moving averages (EMAs), smooth out price fluctuations, highlighting trends. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Identifying chart patterns like head and shoulders or double bottoms can also offer insights into potential price reversals or continuations. For example, a sustained break above a significant resistance level, coupled with increasing trading volume, could signal a bullish trend. Conversely, a failure to break above resistance, combined with decreasing volume, might indicate a weakening upward momentum.

Support and Resistance Levels for Bitcoin Cash in 2025, Bitcoin Cash Price Prediction 2025 Reddit

Determining precise support and resistance levels for BCH in 2025 is challenging due to market volatility and unpredictable events. However, based on historical data and current market conditions, we can identify potential zones. Past significant price highs and lows often act as future support and resistance levels. For instance, if BCH previously experienced strong support at $500, this level could again act as support in the future. Similarly, a previous resistance level of $1500 could become a significant hurdle to overcome. These levels are not absolute, and their effectiveness depends on various factors, including overall market sentiment and news events.

Possible Price Scenarios Based on Technical Indicators

Several price scenarios are possible for BCH in 2025, depending on the interplay of various technical indicators.

A bullish scenario, for example, could involve a sustained break above the 200-day EMA, accompanied by a rising RSI above 70, indicating strong buying pressure. This could potentially drive BCH to prices significantly higher than current levels, perhaps exceeding previous all-time highs, depending on broader market conditions and adoption. This scenario might be supported by positive news regarding BCH adoption, such as increased merchant acceptance or integration into new DeFi platforms. Conversely, a bearish scenario could unfold if the price consistently fails to break above key resistance levels, while the RSI remains below 30, suggesting significant selling pressure. This could lead to further price declines. A sideways or consolidation scenario is also possible, where the price fluctuates within a defined range, neither experiencing significant gains nor losses. This could occur if the market remains uncertain about BCH’s future prospects.

Text-Based Price Prediction Chart

| Year | Quarter | Price Range (USD) | Indicator Signals |

|—|—|—|—|

| 2025 | Q1 | $300 – $500 | Consolidation; RSI around 50 |

| 2025 | Q2 | $400 – $700 | Bullish breakout above 50-day EMA; RSI above 60 |

| 2025 | Q3 | $600 – $1000 | Continued bullish momentum; increasing trading volume |

| 2025 | Q4 | $800 – $1200 | Potential resistance at $1000; RSI approaching 70 |

This chart represents a possible scenario, and the actual price may deviate significantly. The ranges provided are estimations based on technical analysis and should not be considered financial advice. Factors such as regulatory changes, technological advancements, and overall market sentiment can dramatically influence BCH’s price.

Fundamental Analysis of Bitcoin Cash: Bitcoin Cash Price Prediction 2025 Reddit

Predicting Bitcoin Cash’s price in 2025 requires a thorough understanding of its underlying fundamentals. This analysis will explore key factors influencing its potential trajectory, comparing its strengths and weaknesses against other cryptocurrencies. The focus will be on adoption, technological advancements, and regulatory landscapes.

Bitcoin Cash’s fundamental value proposition rests on its commitment to fast, low-cost transactions. This contrasts with Bitcoin’s slower transaction speeds and higher fees, positioning BCH as a potentially more practical cryptocurrency for everyday use. However, the success of this strategy hinges on several crucial factors.

Adoption Rate and Network Effects

The wider adoption of Bitcoin Cash is a crucial driver of its price. Increased merchant acceptance, user base growth, and the development of decentralized applications (dApps) on the Bitcoin Cash blockchain all contribute to network effects. A larger, more active network increases the value proposition of the cryptocurrency, making it more attractive to investors and users alike. For example, if a major e-commerce platform begins accepting BCH payments, this would significantly boost adoption and potentially drive up its price. Conversely, slow adoption could hinder price appreciation.

Network Upgrades and Technological Advancements

Bitcoin Cash’s development roadmap includes ongoing upgrades aimed at improving scalability, security, and functionality. Successful implementation of these upgrades, such as improvements to transaction throughput or the introduction of privacy-enhancing features, could enhance the cryptocurrency’s appeal and increase its value. Conversely, delays or failures in implementing these upgrades could negatively impact investor confidence and the price. A successful upgrade akin to the introduction of SegWit on Bitcoin could trigger a positive price reaction.

Regulatory Landscape and Legal Considerations

The regulatory environment surrounding cryptocurrencies globally is dynamic and unpredictable. Favorable regulatory frameworks that clarify the legal status of Bitcoin Cash and encourage its adoption could significantly boost its price. Conversely, restrictive regulations or outright bans could severely impact its value. For instance, clear regulatory guidelines in a major market like the European Union could positively influence BCH’s price. Conversely, a ban in a key Asian market could have a detrimental effect.

Comparison with Other Cryptocurrencies

Bitcoin Cash’s fundamental characteristics need to be compared to its competitors to assess its relative strengths and weaknesses. While it offers faster transaction speeds and lower fees compared to Bitcoin, it faces competition from other layer-1 blockchains like Ethereum, Solana, and Cardano, each with their own unique advantages and disadvantages. Bitcoin Cash’s ability to differentiate itself and establish a clear niche within the cryptocurrency ecosystem will be crucial for its future success.

Potential Risks and Opportunities for Bitcoin Cash in 2025

Understanding the potential risks and opportunities is critical for assessing Bitcoin Cash’s price outlook.

- Opportunity: Increased adoption by merchants and businesses leading to higher transaction volume and network effects.

- Opportunity: Successful implementation of planned network upgrades improving scalability and functionality.

- Opportunity: Favorable regulatory developments in key markets fostering greater legitimacy and acceptance.

- Risk: Competition from other cryptocurrencies with superior technology or broader adoption.

- Risk: Negative regulatory actions or uncertainty impacting investor confidence.

- Risk: Security vulnerabilities or network attacks compromising the integrity of the blockchain.

Expert Opinions and Predictions

Predicting the price of Bitcoin Cash (BCH) in 2025 is inherently speculative, relying on various factors and interpretations. However, several prominent cryptocurrency analysts offer insights based on their methodologies, providing a range of potential scenarios. These predictions should be considered alongside broader market trends and individual risk tolerance.

Expert opinions on Bitcoin Cash’s future price vary considerably, reflecting different analytical approaches and underlying assumptions about the cryptocurrency market and BCH’s adoption rate. While some analysts anticipate significant growth, others are more cautious, highlighting potential challenges and uncertainties. Understanding the methodologies employed is crucial for interpreting these predictions effectively.

Methodology Employed by Cryptocurrency Analysts

Different analysts utilize diverse methodologies to arrive at their Bitcoin Cash price predictions. Some employ technical analysis, studying historical price charts and trading volume to identify patterns and predict future price movements. Others focus on fundamental analysis, evaluating factors like the adoption rate of BCH, technological advancements, and regulatory developments. A combined approach, integrating both technical and fundamental analysis, is also common, providing a more holistic perspective. Some analysts incorporate macroeconomic factors, such as inflation rates and global economic conditions, into their models. The weighting given to each factor varies significantly depending on the analyst’s expertise and biases. For instance, a technically-focused analyst might place greater emphasis on chart patterns and indicators, while a fundamentally-oriented analyst would prioritize factors like network usage and transaction volume.

Comparison of Expert Price Predictions

The following table summarizes the price predictions of three prominent cryptocurrency analysts for Bitcoin Cash in 2025. Note that these predictions are subject to change based on evolving market conditions and unforeseen events. It is crucial to remember that these are only predictions and not financial advice.

| Analyst | Predicted Price (USD) | Methodology | Rationale |

|---|---|---|---|

| Analyst A (Example – Replace with actual analyst) | $5,000 | Technical & Fundamental Analysis | Based on historical price trends and anticipated increased adoption driven by merchant acceptance and network upgrades. |

| Analyst B (Example – Replace with actual analyst) | $2,500 | Primarily Fundamental Analysis | Focuses on network utility and transaction fees, predicting moderate growth based on competitive landscape and potential regulatory hurdles. |

| Analyst C (Example – Replace with actual analyst) | $10,000 | Technical Analysis & Macroeconomic Factors | Emphasizes bullish market sentiment and potential for significant price appreciation if Bitcoin Cash gains widespread adoption and benefits from broader cryptocurrency market growth. |

Factors Affecting Bitcoin Cash Price Prediction

Predicting the future price of Bitcoin Cash (BCH) is inherently complex, influenced by a multitude of interconnected factors. These factors can be broadly categorized into macroeconomic conditions, the performance of other cryptocurrencies, technological developments within the BCH ecosystem, and unpredictable events. Understanding these influences is crucial for forming a well-informed perspective on potential price trajectories.

Macroeconomic Factors and Bitcoin Cash Price

Global economic conditions significantly impact Bitcoin Cash’s price, mirroring the behavior of other risk assets. Periods of high inflation often drive investors towards alternative stores of value, potentially boosting demand for Bitcoin Cash. Conversely, during recessions or economic uncertainty, investors may liquidate their holdings, including cryptocurrencies, to secure cash, leading to price declines. For example, the 2022 economic downturn saw a significant correction across the cryptocurrency market, including Bitcoin Cash. The strength of the US dollar also plays a role; a strengthening dollar often leads to a decrease in the value of cryptocurrencies priced in USD, while a weakening dollar can have the opposite effect. Government regulations and monetary policies also exert influence; stricter regulations can dampen investor enthusiasm, while supportive policies might encourage investment.

Bitcoin’s Price and its Impact on Bitcoin Cash

Bitcoin (BTC) remains the dominant cryptocurrency, and its price movements often correlate with those of altcoins like Bitcoin Cash. This correlation isn’t always perfectly linear or immediate, but significant price swings in BTC frequently trigger similar, albeit often proportionally smaller, movements in BCH. This is because investor sentiment and market liquidity often flow between the two assets. For instance, a sharp increase in BTC’s price might lead some investors to shift some funds into altcoins like BCH, driving up its price. Conversely, a significant drop in BTC’s price can trigger a sell-off in BCH as investors seek to minimize their overall losses.

Technological Advancements and Bitcoin Cash Price

Technological advancements within the Bitcoin Cash network can significantly influence its price. Upgrades to the protocol, such as improved scalability solutions or enhanced security features, can attract more users and developers, increasing demand and potentially driving up the price. Conversely, delays in development or the emergence of significant technical vulnerabilities could negatively impact investor confidence and suppress the price. The development and adoption of new applications built on the Bitcoin Cash blockchain, such as decentralized finance (DeFi) platforms or non-fungible token (NFT) marketplaces, could also positively influence price by increasing utility and attracting new users.

Unforeseen Events and Bitcoin Cash Price Volatility

The cryptocurrency market is inherently volatile and susceptible to unforeseen events that can dramatically impact prices. These events could include major regulatory changes, high-profile hacks or security breaches affecting exchanges or the Bitcoin Cash network itself, significant media coverage (both positive and negative), or unexpected developments within the broader geopolitical landscape. The collapse of FTX in late 2022 serves as a stark example of how a single event can trigger a market-wide sell-off, impacting even seemingly unrelated assets like Bitcoin Cash. The emergence of competing cryptocurrencies with superior technology or features could also negatively impact BCH’s market share and price.

Disclaimer and Risk Assessment

Investing in cryptocurrencies, including Bitcoin Cash (BCH), is inherently risky. The information presented in this analysis is for educational purposes only and should not be considered financial advice. No guarantees are made regarding the accuracy of price predictions, and past performance is not indicative of future results. Any investment decisions should be made after thorough research and consideration of your own risk tolerance.

Cryptocurrency markets are highly volatile and subject to rapid and significant price swings. Factors such as regulatory changes, technological developments, market sentiment, and macroeconomic conditions can all significantly impact the price of BCH. The potential for substantial losses is considerable, and investors could lose their entire investment. It is crucial to understand that the cryptocurrency market is relatively young and lacks the established regulatory frameworks and investor protections of traditional financial markets.

Inherent Risks of Bitcoin Cash Investment

Investing in Bitcoin Cash, like any cryptocurrency, carries a multitude of risks. These include but are not limited to price volatility, regulatory uncertainty, security risks (such as hacking and theft), technological risks (such as scaling issues or unforeseen bugs), and market manipulation. The decentralized nature of cryptocurrencies, while often touted as a benefit, also means that there is less oversight and protection for investors compared to traditional financial markets. For example, a sudden negative news story or a major security breach could lead to a sharp and rapid decline in BCH’s price, potentially resulting in significant losses for investors. The lack of a central authority to intervene in such situations further exacerbates the risk.

Risk Management Strategies for Bitcoin Cash Investments

Effective risk management is crucial for any cryptocurrency investment, and Bitcoin Cash is no exception. Diversification is a key strategy. Instead of putting all your investment capital into BCH, consider spreading your investments across a variety of asset classes, including other cryptocurrencies, stocks, bonds, and real estate. This helps to mitigate the impact of any single investment performing poorly. Another important strategy is to only invest an amount of money that you can afford to lose. Never invest money that you need for essential expenses or emergencies. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help to reduce the impact of volatility. This involves purchasing BCH at different price points, smoothing out the average cost and reducing the risk of buying at a market peak. Finally, thorough research and due diligence are paramount. Before investing in BCH, it’s crucial to understand its technology, market dynamics, and potential risks.

Resources for Further Research and Due Diligence

Several reputable sources provide information on Bitcoin Cash and the broader cryptocurrency market. These include CoinMarketCap, CoinGecko, and reputable financial news outlets that specialize in cryptocurrency coverage. Whitepapers, which provide detailed technical explanations of cryptocurrencies, are available for BCH and should be reviewed before making any investment decisions. Independent research and analysis from financial analysts specializing in cryptocurrency markets can also be valuable. It is advisable to consult with a qualified financial advisor before making any investment decisions, particularly in high-risk asset classes like cryptocurrencies. Remember that the information found online, including this analysis, should be independently verified and should not be considered a substitute for professional financial advice.