Different Price Prediction Scenarios for 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. While no one can definitively say what the price will be, analyzing various potential scenarios offers valuable insight into the possible range of outcomes. The following explores three distinct scenarios – bullish, bearish, and neutral – for Bitcoin’s price in 2025, outlining the key factors that could contribute to each.

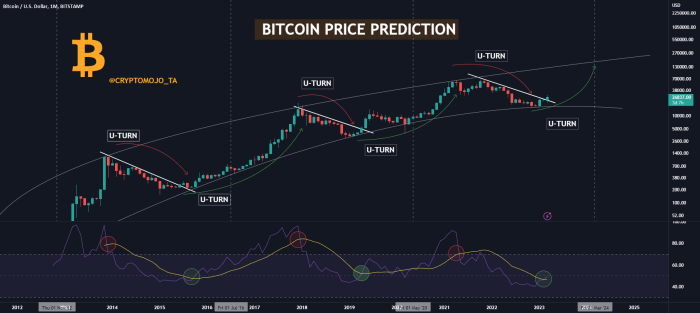

Bullish Scenario: Bitcoin Price Surge

This scenario envisions a significant price increase for Bitcoin by 2025, potentially reaching prices exceeding $100,000 or even higher. This optimistic outlook is predicated on several key factors. Widespread adoption by institutional investors, driven by increased regulatory clarity and a growing understanding of Bitcoin’s potential as a store of value and hedge against inflation, could fuel substantial demand. Technological advancements, such as the development of the Lightning Network improving transaction speeds and reducing fees, would enhance Bitcoin’s usability and attract a broader user base. Furthermore, continued macroeconomic uncertainty and a flight to safety could drive investors towards Bitcoin as a safe haven asset, pushing prices higher. The success of Bitcoin’s Taproot upgrade, enhancing privacy and smart contract capabilities, could also contribute to increased adoption and price appreciation. This scenario mirrors the rapid price growth experienced in previous bull markets, albeit potentially at a more mature and sustainable pace.

Bearish Scenario: Bitcoin Price Decline

Conversely, a bearish scenario anticipates a decline in Bitcoin’s price by 2025, possibly falling below current levels or even significantly lower. This pessimistic outlook hinges on several potential factors. Increased regulatory scrutiny and restrictive policies in major economies could stifle adoption and negatively impact investor sentiment. A prolonged cryptocurrency winter, characterized by low trading volumes and reduced investor interest, could depress prices. The emergence of competing cryptocurrencies with superior technology or more compelling use cases could divert investment away from Bitcoin. Furthermore, a global economic downturn or a major security breach affecting the Bitcoin network could severely undermine confidence and trigger a significant price correction. This scenario, while less optimistic, reflects the inherent volatility of the cryptocurrency market and the potential for significant price fluctuations.

Neutral Scenario: Bitcoin Price Consolidation

A neutral scenario suggests that Bitcoin’s price will consolidate around its current levels or experience moderate fluctuations by 2025. This scenario assumes a balance between bullish and bearish factors. While there might be periods of growth and decline, the overall trend would be relatively flat. This outcome is plausible if the market experiences a period of uncertainty and consolidation, with neither significant bullish nor bearish catalysts dominating. Regulatory clarity could remain elusive, adoption could proceed at a moderate pace, and technological advancements might not be disruptive enough to cause dramatic price swings. This scenario highlights the possibility of a less volatile market, where Bitcoin’s price stabilizes and establishes a new baseline for future growth.

Summary of Price Prediction Scenarios

| Scenario | Projected Price Range (USD) | Key Supporting Factors | Real-World Example/Analogue |

|---|---|---|---|

| Bullish | >$100,000 | Increased institutional adoption, regulatory clarity, technological advancements, macroeconomic uncertainty | Similar to Bitcoin’s price surge in 2020-2021, though potentially at a more sustainable pace. |

| Bearish | <$10,000 (or significantly lower) | Increased regulatory scrutiny, prolonged crypto winter, competing cryptocurrencies, global economic downturn | The 2018 crypto bear market, which saw Bitcoin’s price fall by over 80%. |

| Neutral | ~$20,000 – $40,000 (moderate fluctuations) | Balanced bullish and bearish factors, moderate adoption, lack of significant disruptive events | Similar to periods of sideways trading in Bitcoin’s history, where price consolidates before a significant move. |

Risks and Uncertainties in Bitcoin Price Prediction

Predicting the price of Bitcoin in 2025, or any future date, is inherently fraught with uncertainty. While various models attempt to forecast price movements based on historical data and current market trends, these models are ultimately limited by the volatile nature of cryptocurrencies and the unpredictable influence of external factors. The inherent complexity of the cryptocurrency market makes accurate long-term predictions exceptionally challenging.

The inherent volatility of Bitcoin is a primary source of uncertainty. Unlike traditional assets, Bitcoin’s price can experience dramatic swings in short periods, driven by factors ranging from regulatory announcements and market sentiment to technological developments and macroeconomic conditions. These fluctuations make it difficult to establish reliable trends and extrapolate them into the future with any degree of confidence. For instance, the price of Bitcoin has seen periods of explosive growth followed by sharp corrections, making it nearly impossible to predict the trajectory of its future price with certainty. Predictive models often struggle to account for these sudden and significant shifts.

Limitations of Price Prediction Models

Price prediction models, whether they rely on technical analysis, fundamental analysis, or machine learning algorithms, are subject to several limitations. These models often assume a degree of market rationality and predictability that doesn’t always hold true in the highly speculative cryptocurrency market. Furthermore, many models are based on historical data, which may not accurately reflect future market conditions. The emergence of unforeseen events, technological disruptions, or shifts in regulatory frameworks can render these models ineffective. For example, a model trained on data from the period before the 2017 Bitcoin bull run would likely have failed to accurately predict the subsequent price crash. The lack of truly reliable historical data to train models upon further complicates matters.

Potential Black Swan Events

The possibility of unforeseen events, often referred to as “black swan” events, presents a significant risk to any Bitcoin price prediction. These are highly improbable events with potentially catastrophic consequences that are difficult or impossible to predict. Examples include a major security breach compromising the Bitcoin network, a widespread regulatory crackdown that severely restricts Bitcoin’s use, or a significant technological advancement rendering Bitcoin obsolete. The impact of such events on Bitcoin’s price would likely be severe and immediate, potentially leading to a sharp and sustained decline. Imagine, for instance, the impact of a successful 51% attack on the Bitcoin network; the resulting loss of trust could devastate the price.

Challenges in Predicting Long-Term Adoption Rate

The long-term price of Bitcoin is heavily dependent on its adoption rate. Wider adoption by individuals, businesses, and institutions would likely drive price appreciation, while slower-than-expected adoption could lead to stagnation or decline. Accurately predicting long-term adoption is extremely challenging, as it depends on numerous factors, including technological advancements, regulatory developments, and evolving public perception. Factors such as the emergence of competing cryptocurrencies, improvements in transaction speed and scalability, and the development of user-friendly applications all influence adoption rates, making prediction highly uncertain. For example, the successful development of a Layer-2 scaling solution could dramatically increase Bitcoin’s transaction throughput, leading to increased adoption and a potential price surge. Conversely, failure to address scalability issues could hinder adoption and limit price growth.

Investing in Bitcoin

Investing in Bitcoin presents a unique opportunity, but it’s crucial to understand the inherent risks and rewards before committing any capital. The decentralized nature and volatility of Bitcoin offer both significant potential for profit and substantial potential for loss. A thorough understanding of investment strategies and risk mitigation techniques is paramount.

Bitcoin’s price is notoriously volatile, influenced by factors ranging from regulatory changes and technological advancements to market sentiment and macroeconomic conditions. While past performance isn’t indicative of future results, analyzing historical trends can provide some context. For example, Bitcoin experienced significant price surges in 2017 and 2021, followed by sharp corrections. This volatility underscores the need for careful consideration and a well-defined investment strategy.

Risk and Reward Assessment

Investing in Bitcoin involves a significant level of risk. The cryptocurrency market is known for its extreme price swings, and Bitcoin is no exception. Investors could experience substantial losses if the price drops unexpectedly. However, the potential rewards can be equally significant. If Bitcoin’s price increases, investors can realize substantial profits. A balanced approach requires careful consideration of both the potential gains and the potential losses. The level of risk tolerance varies from individual to individual and should be carefully evaluated before making any investment decisions. For example, an investor with a higher risk tolerance might be more comfortable with a larger Bitcoin allocation in their portfolio compared to a more risk-averse investor.

Investment Strategies

Several investment strategies exist for Bitcoin, each with its own risk profile.

Long-Term Holding (HODLing)

This strategy involves buying Bitcoin and holding it for an extended period, typically years, regardless of short-term price fluctuations. The core principle is to ride out the market volatility, aiming to benefit from potential long-term price appreciation. The risk is tied to the potential for significant price drops during the holding period, but the potential rewards can be substantial if the price appreciates significantly over time. This strategy is suitable for investors with a high risk tolerance and a long-term investment horizon.

Short-Term Trading

This strategy involves frequent buying and selling of Bitcoin based on short-term price movements. Traders attempt to profit from price fluctuations by buying low and selling high. This strategy requires significant market knowledge, technical analysis skills, and a high level of risk tolerance. The potential for quick profits is higher, but so is the risk of significant losses if market predictions are inaccurate. For instance, a trader might attempt to profit from a short-term price increase predicted by technical indicators, but if the price unexpectedly drops, they could incur losses.

Diversification Strategies, Bitcoin Coin Price Prediction 2025

Diversification is a crucial risk mitigation strategy for any investment portfolio, and Bitcoin is no exception. It involves spreading investments across different asset classes to reduce the overall risk. For example, an investor might allocate a portion of their portfolio to Bitcoin while diversifying into other assets such as stocks, bonds, and real estate. This approach helps to reduce the impact of any single investment’s underperformance on the overall portfolio value. A diversified portfolio can help to cushion the impact of Bitcoin’s volatility, limiting potential losses if the cryptocurrency’s price declines. For example, if Bitcoin experiences a significant price drop, the losses might be offset by gains in other asset classes within the diversified portfolio.

Frequently Asked Questions (FAQs): Bitcoin Coin Price Prediction 2025

This section addresses some common questions regarding Bitcoin’s price prediction for 2025 and its overall investment viability. Understanding the inherent uncertainties is crucial before making any investment decisions.

Bitcoin’s Most Likely Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging due to its volatile nature and susceptibility to various market forces. While numerous prediction models exist, ranging from extremely bullish to cautiously bearish, none offer definitive answers. Some analysts project prices well into the six-figure range, fueled by increasing adoption and limited supply. Others, however, point to potential regulatory hurdles or market corrections that could significantly dampen growth. A realistic assessment would acknowledge a wide range of possibilities, with the actual price likely falling somewhere between these extremes, depending on macroeconomic factors, technological advancements, and regulatory developments. For example, a scenario involving widespread institutional adoption and positive regulatory changes could lead to significantly higher prices than a scenario characterized by increased regulatory scrutiny and a general economic downturn.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. On the one hand, its limited supply, growing adoption as a store of value, and decentralized nature are compelling arguments for long-term growth. Historically, Bitcoin has demonstrated significant price appreciation over time, although with substantial volatility. On the other hand, the inherent risks associated with cryptocurrency investments, including price fluctuations, regulatory uncertainty, and security vulnerabilities, cannot be ignored. Therefore, a long-term Bitcoin investment strategy should be carefully considered, taking into account individual risk tolerance and overall portfolio diversification. A diversified portfolio, incorporating both traditional assets and alternative investments like Bitcoin, can help mitigate risk and potentially enhance long-term returns.

Protecting Against Bitcoin Price Volatility

Mitigating the risks associated with Bitcoin’s price volatility requires a strategic approach. Dollar-cost averaging (DCA) is a popular strategy where investors invest a fixed amount of money at regular intervals, regardless of the price. This reduces the impact of buying high and selling low. Diversification is equally important; spreading investments across different asset classes, including stocks, bonds, and other cryptocurrencies, helps to reduce overall portfolio risk. Furthermore, only investing capital that one can afford to lose is crucial. Avoid using borrowed money or funds essential for daily living to invest in Bitcoin.

Biggest Threats to Bitcoin’s Future

Several factors could pose significant threats to Bitcoin’s future. Regulatory uncertainty remains a major concern, with governments worldwide grappling with how to regulate cryptocurrencies. Stringent regulations could stifle innovation and adoption, impacting Bitcoin’s price. Technological disruptions, such as the emergence of more efficient or scalable cryptocurrencies, could also challenge Bitcoin’s dominance. Finally, competition from other cryptocurrencies, each offering unique features and functionalities, could erode Bitcoin’s market share. These are all potential risks that investors need to carefully consider.