Bitcoin Crypto Price Prediction 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential for immense returns. Its price has swung wildly, experiencing periods of explosive growth followed by sharp corrections, leaving investors and analysts constantly seeking to understand its future trajectory. Predicting the price of any asset, especially one as volatile as Bitcoin, is inherently challenging, but the interest in long-term price forecasts remains high, driven by both the potential for significant gains and the inherent risks involved.

Several key factors influence Bitcoin’s price. These include the overall adoption rate by businesses and individuals, regulatory developments across various jurisdictions, technological advancements within the Bitcoin network itself, macroeconomic conditions like inflation and interest rates, and the ever-present sentiment and speculation within the cryptocurrency market. Understanding the interplay of these factors is crucial for any attempt at forecasting Bitcoin’s price.

Factors Influencing Bitcoin Price Predictions for 2025

Predicting Bitcoin’s price in 2025 necessitates considering a complex interplay of factors. While precise prediction is impossible, analyzing these influences helps to construct potential price scenarios. For instance, widespread institutional adoption could significantly drive up demand, potentially leading to higher prices. Conversely, increased regulatory scrutiny or a major security breach could negatively impact investor confidence and depress the price. The rate of technological innovation within the Bitcoin ecosystem, such as the development of the Lightning Network for faster and cheaper transactions, also plays a vital role. Macroeconomic conditions, such as global inflation or a potential recession, can also significantly influence investor behavior and thus Bitcoin’s price. Finally, market sentiment, driven by news events, social media trends, and overall investor confidence, exerts a powerful and often unpredictable influence.

Potential Price Scenarios for Bitcoin in 2025

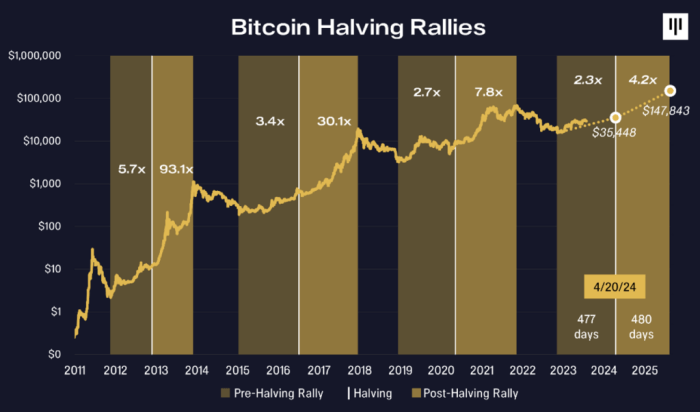

Given the inherent volatility and the numerous unpredictable factors, several price scenarios for Bitcoin in 2025 are plausible. A bullish scenario, fueled by widespread adoption, positive regulatory developments, and continued technological innovation, could see Bitcoin’s price reaching significantly higher levels than its current value. For example, some analysts have speculated about prices exceeding $100,000 or even higher, based on extrapolations of past growth and projected adoption rates. This scenario, however, assumes continued positive market sentiment and a lack of major negative events.

A more conservative scenario anticipates more moderate growth, reflecting a more cautious outlook on widespread adoption and potential regulatory headwinds. In this scenario, Bitcoin’s price might still experience growth but at a slower pace, perhaps reaching levels in the tens of thousands of dollars by 2025. This scenario takes into account the possibility of market corrections and the challenges of mass adoption.

A bearish scenario, though less likely according to some analysts, acknowledges the possibility of negative events such as a major security flaw, widespread regulatory crackdowns, or a significant loss of investor confidence. This scenario could result in a lower price than the current value, potentially reflecting a prolonged period of market uncertainty. This would require a confluence of negative factors impacting both the technology and investor sentiment. Historical examples of market crashes, such as the dot-com bubble burst or the 2008 financial crisis, illustrate the potential for significant price declines in assets, even those with strong underlying fundamentals. However, the resilience of Bitcoin through previous market downturns suggests it might recover from even a substantial price correction.

Factors Influencing Bitcoin’s Price

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of factors. These factors, ranging from global economic conditions to technological advancements and regulatory landscapes, significantly influence investor sentiment and, consequently, the price of Bitcoin. Understanding these dynamics is crucial for navigating the volatile cryptocurrency market.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions exert a considerable influence on Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and price. Conversely, rising interest rates, often employed to combat inflation, can divert investment away from riskier assets like Bitcoin towards higher-yielding bonds, potentially leading to price declines. Global economic growth, or the lack thereof, also plays a significant role. Periods of strong economic growth might see investors allocate more capital to traditional markets, reducing Bitcoin’s appeal, while economic uncertainty could increase its perceived value as a safe haven asset. The 2022 bear market, for instance, was partially attributed to rising interest rates and fears of a global recession.

Technological Advancements and Bitcoin’s Price

Technological developments within the Bitcoin ecosystem can significantly impact its price. The adoption of the Lightning Network, a layer-2 scaling solution, could improve transaction speeds and reduce fees, making Bitcoin more user-friendly and potentially increasing its adoption. Other scalability solutions aim to address Bitcoin’s inherent limitations in processing transactions, leading to faster and cheaper transactions, which could positively impact its price. Conversely, failures or security vulnerabilities in these technologies could negatively impact investor confidence and price. Successful implementation of significant upgrades, such as the Taproot upgrade, which enhanced privacy and smart contract capabilities, has historically shown positive correlation with price appreciation.

Regulatory Changes and Bitcoin’s Price

Government regulations and institutional adoption play a crucial role in shaping Bitcoin’s price trajectory. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency exchanges and taxation, can foster greater institutional investment and wider adoption, leading to price increases. Conversely, restrictive regulations or outright bans can negatively impact investor confidence and price. The increasing institutional adoption, witnessed through the investment of companies like MicroStrategy and Tesla, has demonstrably influenced Bitcoin’s price, albeit with periods of both significant gains and corrections. The regulatory landscape varies significantly across countries, with some showing greater openness and others maintaining a cautious or restrictive approach.

Market Sentiment and Bitcoin’s Price

Market sentiment, encompassing investor confidence and media coverage, profoundly impacts Bitcoin’s price. Positive media coverage, coupled with strong investor confidence, can fuel price rallies, while negative news or periods of uncertainty can trigger sharp price drops. Social media plays a significant role in shaping public perception, and events such as Elon Musk’s tweets about Bitcoin have had noticeable, albeit sometimes short-lived, impacts on its price. Fear, uncertainty, and doubt (FUD) can create significant downward pressure, whereas positive news and anticipation of future growth can drive significant upward momentum. This is exemplified by the dramatic price swings frequently observed in the Bitcoin market.

| Macroeconomic Factors | Technological Advancements | Regulatory Changes | Market Sentiment |

|---|---|---|---|

| Inflation, interest rates, global economic growth significantly influence Bitcoin’s role as a hedge against inflation or a risk asset. | Lightning Network adoption and scalability solutions can enhance usability and transaction efficiency, potentially boosting adoption and price. | Favorable regulations encourage institutional investment and broader adoption, while restrictive measures can dampen investor enthusiasm. | Positive media coverage and strong investor confidence fuel price rallies; negative news and uncertainty can trigger sharp declines. |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. However, by considering various market forces and historical trends, we can construct plausible scenarios to illustrate potential price ranges. These scenarios are not predictions but rather explorations of possible outcomes based on different assumptions about the future.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a significantly bullish market for Bitcoin by 2025, potentially driven by widespread institutional adoption, positive regulatory developments, and continued technological advancements within the crypto space. Imagine a world where Bitcoin is increasingly integrated into traditional financial systems, with major corporations holding significant Bitcoin reserves and offering Bitcoin-related services. Increased regulatory clarity, particularly in major economies like the US, could further boost investor confidence. Furthermore, successful scaling solutions and the development of new use cases for Bitcoin could fuel significant price appreciation.

This bullish outcome assumes a positive global economic climate, sustained technological innovation, and continued institutional investment. We might see a scenario similar to the 2020-2021 bull run, but on a larger scale, with significant price increases driven by a confluence of positive factors. Imagine a chart showing a steep upward trajectory, exceeding previous all-time highs significantly, perhaps reaching a price in the range of $200,000 to $300,000 or even higher, depending on the speed and extent of adoption. This would be fueled by a narrative of Bitcoin as a safe-haven asset, a hedge against inflation, and a store of value, attracting both retail and institutional investors.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

In a neutral scenario, Bitcoin’s price in 2025 would likely remain within a range, neither experiencing a dramatic surge nor a significant crash. This outcome assumes a period of consolidation, where the market absorbs the previous bull and bear cycles, and the focus shifts to the long-term utility and adoption of Bitcoin. Regulatory uncertainty might persist, preventing a major price breakout, but the market wouldn’t experience a major downturn either. Technological developments would continue, but their impact on price might be less dramatic than in a bullish scenario.

Imagine a price chart showing relatively flat growth with some minor fluctuations, staying within a range, perhaps between $50,000 and $100,000. This range represents a period of maturation and stabilization for the Bitcoin market, similar to the consolidation phases seen in the history of other asset classes. This scenario hinges on a relatively stable global economic environment and a cautious approach from both retail and institutional investors. The narrative would shift from rapid growth to steady adoption and integration into the existing financial system.

Bearish Scenario: Bitcoin Experiences a Significant Correction, Bitcoin Crypto Price Prediction 2025

This scenario Artikels a potential downturn in the Bitcoin market by 2025. Several factors could contribute to this, including a global economic recession, increased regulatory scrutiny leading to stricter rules or even bans in certain jurisdictions, or a major security breach compromising the integrity of the Bitcoin network. A significant loss of investor confidence, fueled by negative news or market sentiment, could trigger a substantial price correction.

Visualize a chart depicting a sharp decline from current levels, possibly mirroring the bear market of 2018-2019. In this bearish scenario, the price could fall to levels significantly below current prices, perhaps to the range of $20,000 to $30,000, or even lower, depending on the severity of the negative factors at play. This would be a scenario where the narrative around Bitcoin shifts from a store of value to a risky asset, impacting investor sentiment and leading to a significant sell-off. This scenario relies on significant negative events impacting the global economy or the cryptocurrency market specifically.